#stockmarket WE update. Last wk I mentioned to be careful adding new money to the mkt, which was the correct call as we did see weakness. I mentioned watching the $DXY for signals as it did move off the lows. But 20day save on Fri above key lvls for #SPX is bullish for now....

#stockmarket As I've mentioned in previous updates, $ spikes are equity bearish & last wk we did see #DXY move off the lows. Whether this a minor bounce or bigger countertrend move is yet TBD. $DXY bounce from OS RSI now above 14day SMA & day 3 of price flip; needs to be watched.

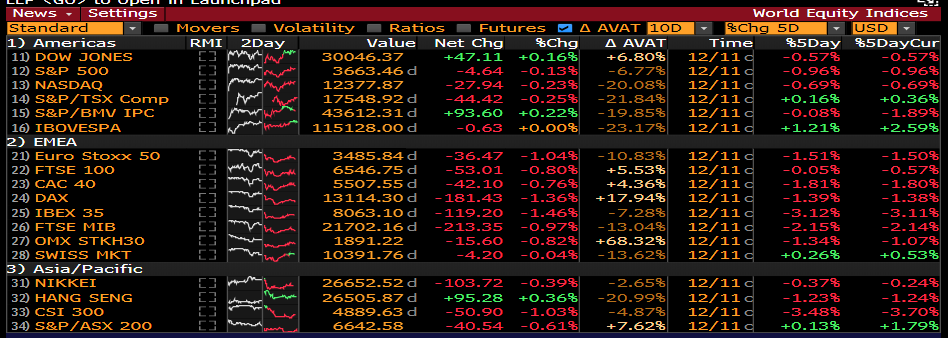

#stockmarket I also discussed in last WE update that key global mkts were also flashing Demark exhaustion signals & something that could hurt US stock performance - see 5 day performance of major indices....

#stockmarket But last weeks weakness did work off some of the overbought nature of the indices in the ST. $SPY $QQQ now back to mid BB. McClellan Osc also back to neutral posture vs extreme overbought....

#stockmarket Despite what felt like a rough week was only an inside week for the #SPX and very close to one for the $QQQ....

#stockmarket Smart Money Index, which has been a cause for concern, is now off the lows, broke the DTL & at an important juncture. Breaking up here would be equity bullish...

#stockmarket and lets not forget the most important chart in all the land. The FED BS keeps making new highs. Tough to be too bearish when this keeps moving up....

#stockmarket Valueline Index is back to pre-covid hi resistance but still has room to ATH's. @ first blush I'd say thats bearish b/c its non-confirming, but given the impact Covid has had on SMB's & certain sectors, the closer we get to normalization the more these recover....

#stockmarket While I think the mkt has some room to the upside, #SPX demark 13 sells are looming (current 10 counts) & were postponed last wk. They could print 2H of the wk again which would require index strength. something to watch for sure...

#stockmarket volatility is also something I've discussed recently , as certain demark signals in various measures of volatility have posted. Vol did come back into the mkt last wk, $VVIX is pot'l signaling more to come. Last Demark 9, here saw the index rise 50% vs up 20% now...

#stockmarket $VIX also post the Demark 13 buy on the weekly now with recent flip up as indicated by the green 1 above the price bar. I keep saying, vol is cheap, not a bad place to buy some protection....

#stockmarket #SPX MACD has now crossed down & the #Nasdaq is approaching. Something to monitor as well as the recent rally is losing momentum....

#stockmarket Lastly, stocks +200 day - something I've talked about previously remains quite elevated, & @ lvls where reversals occur. Now w/ new daily Demark combo 13 sell, and Seq 13 to print this wk, to go along w/ weekly 13 sells. turning down could cause equity dislocation..

#stockmarket concl: still advise some caution as per last WE update, as not much has changed. The mkt is less OB now vs last wk, which is +, defending the 20day & key lvls are bullish, but possible #SPX 13 sells this wk keep me on guard. Until then, cautiously optimistic.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh