#MarketUpdate THREAD

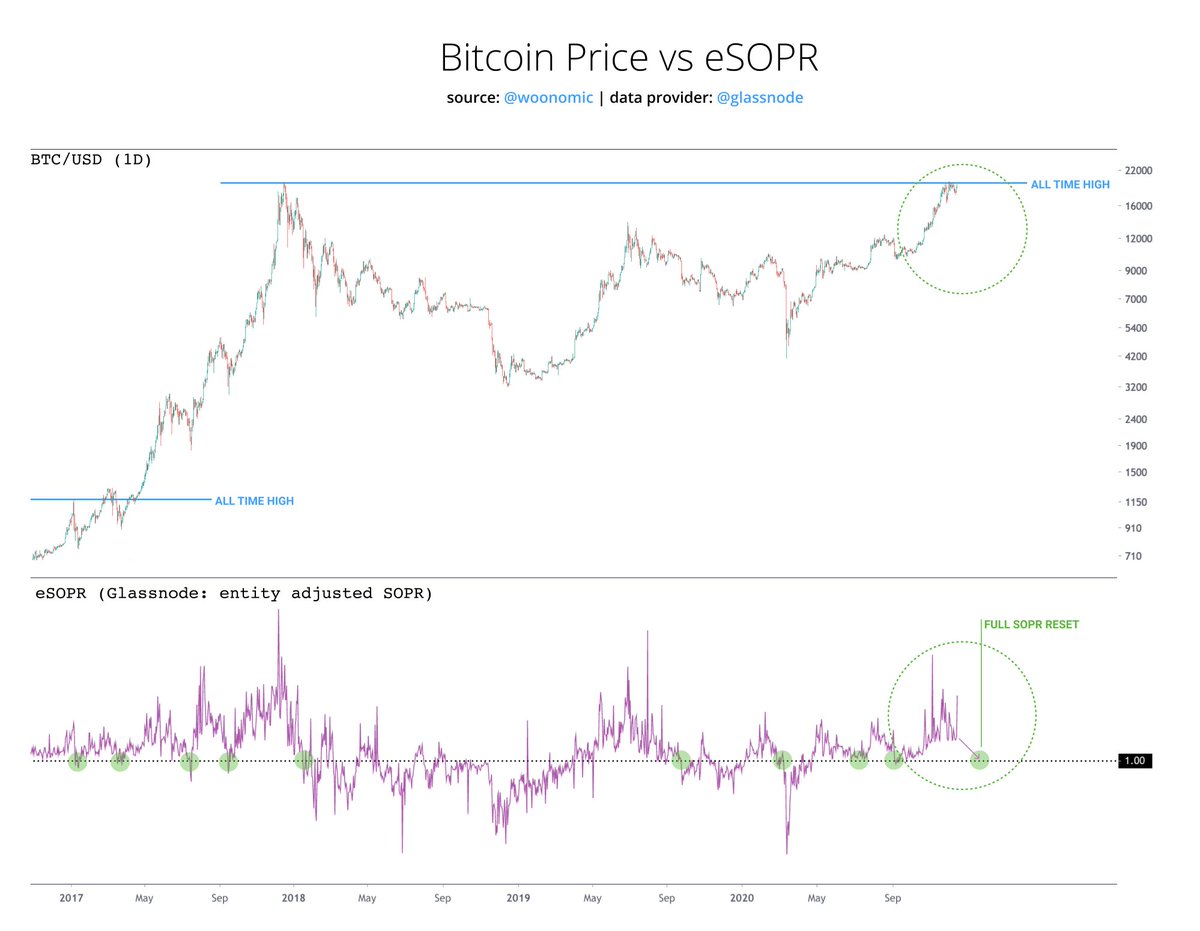

SOPR is the chart I care most about RN.

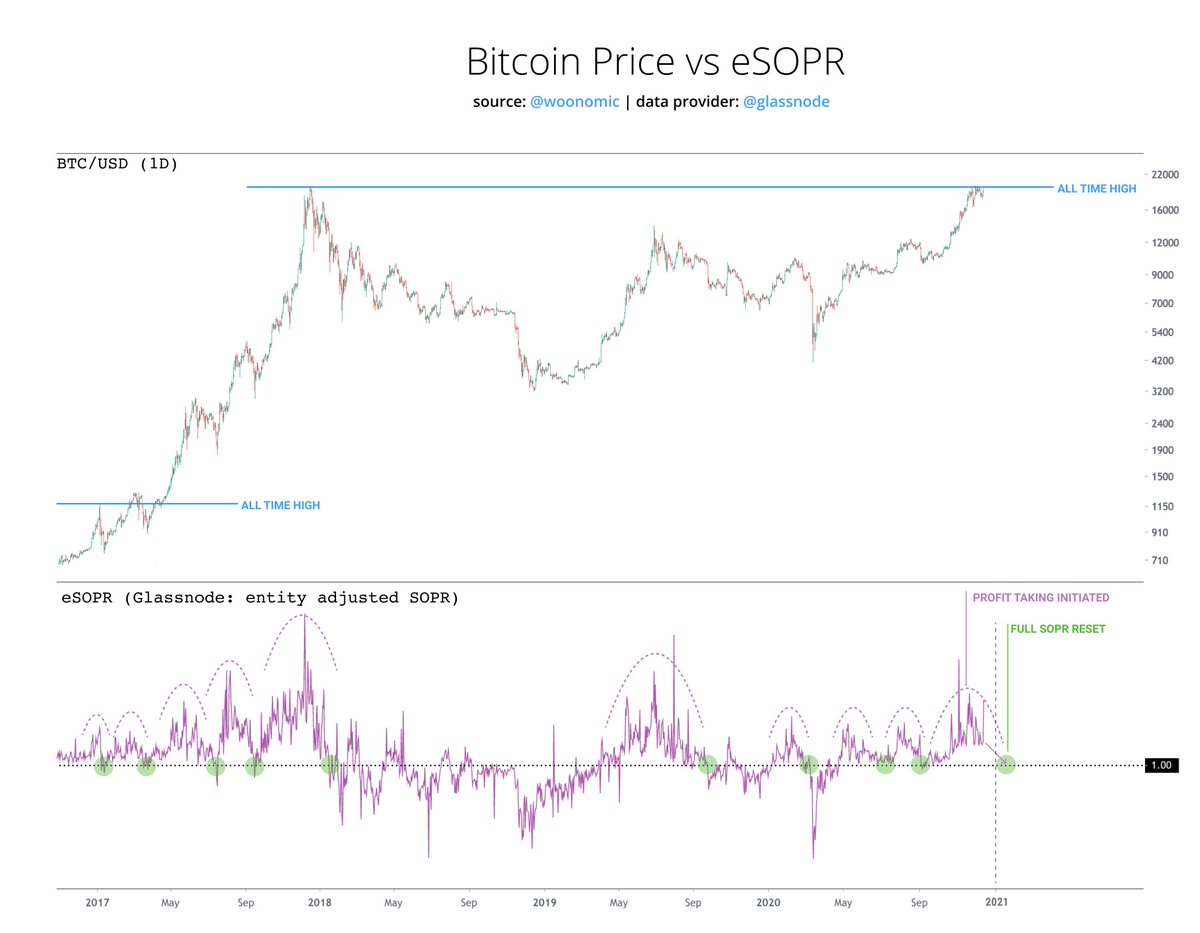

Profit-takers initiated weeks ago, we need to wait until they exhaust before there's full freedom to explore new highs.

It's a waiting game, likely until Jan 2021 for a full reset.

Till then beware of bull traps.

SOPR is the chart I care most about RN.

Profit-takers initiated weeks ago, we need to wait until they exhaust before there's full freedom to explore new highs.

It's a waiting game, likely until Jan 2021 for a full reset.

Till then beware of bull traps.

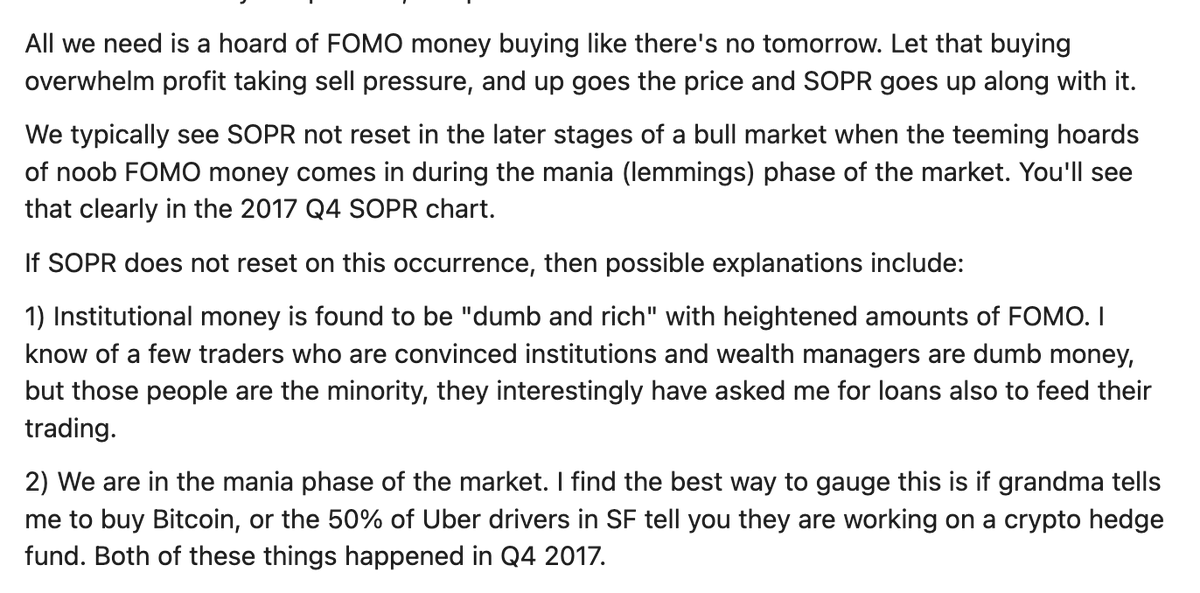

SOPR by @renato_shira is a lie-proof "survey of investors to determine their profit or loss for the coins that transacted in a day". We like to use SOPR because all investors lie about their losses and on-chain guys like smart sounding acronyms.

More details here:

More details here:

Once SOPR starts declining, profit taking begets profit taking. We wait until all investors in profit who are going to sell to complete their sell off, when this happens, coins moving no longer carry profit, SOPR goes to 1.0, and we can move forward. ETA January perhaps.

I've used eSOPR in this analysis which is @glassnode's improvement over the original SOPR by viewing only coins moving between DIFFERENT investors (we do this by forensic clustering addresses together that smell like they belong to the same person).

eSOPR Datasource: @glassnode

eSOPR Datasource: @glassnode

• • •

Missing some Tweet in this thread? You can try to

force a refresh