1/ as evidenced by the recent corruption of all US systems, from gov't to corporate, securing networks is very difficult to do persistently.

bitcoin is a global telecommunications network that secures financial information.

mining is what keeps it secure.

a short thread!

bitcoin is a global telecommunications network that secures financial information.

mining is what keeps it secure.

a short thread!

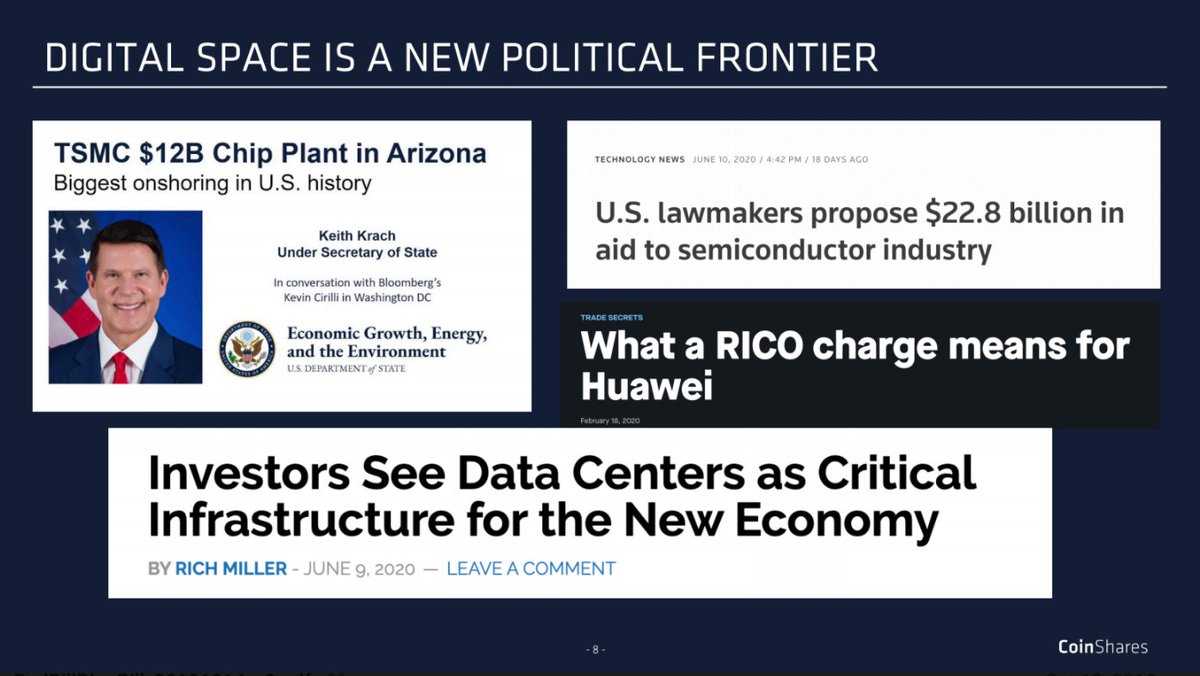

2/ power in our world is changing

the world's largest and most powerful companies used to own, make, and finance physical inputs and things.

not anymore.

today's behemoths own, maintain, and manage digital networks. and they're bigger than most nation-states.

the world's largest and most powerful companies used to own, make, and finance physical inputs and things.

not anymore.

today's behemoths own, maintain, and manage digital networks. and they're bigger than most nation-states.

3/ in the coming decade, we will see a rapid proliferation of digital networks in the energy, compute and connectivity, and capital markets and finance world

as a result, nations will spend trillions of dollars on securing their data and access to global systems and networks

as a result, nations will spend trillions of dollars on securing their data and access to global systems and networks

4/ cyberspace is a brave new world.

as evidenced this week, the US is absolutely unprepared.

there is a massive amount of value that is going to be captured by private corporations and individuals as this new world unfolds. and it's DANGEROUS.

#Bitcoin has entered the chat.

as evidenced this week, the US is absolutely unprepared.

there is a massive amount of value that is going to be captured by private corporations and individuals as this new world unfolds. and it's DANGEROUS.

#Bitcoin has entered the chat.

5/ bitcoin is multiple things - it's a protocol, a network, and an asset.

the bitcoin network has a security measure - the hash rate. and hash rate is correlated to the asset.

as bitcoin becomes more valuable, more compute resources are utilized to secure the network.

the bitcoin network has a security measure - the hash rate. and hash rate is correlated to the asset.

as bitcoin becomes more valuable, more compute resources are utilized to secure the network.

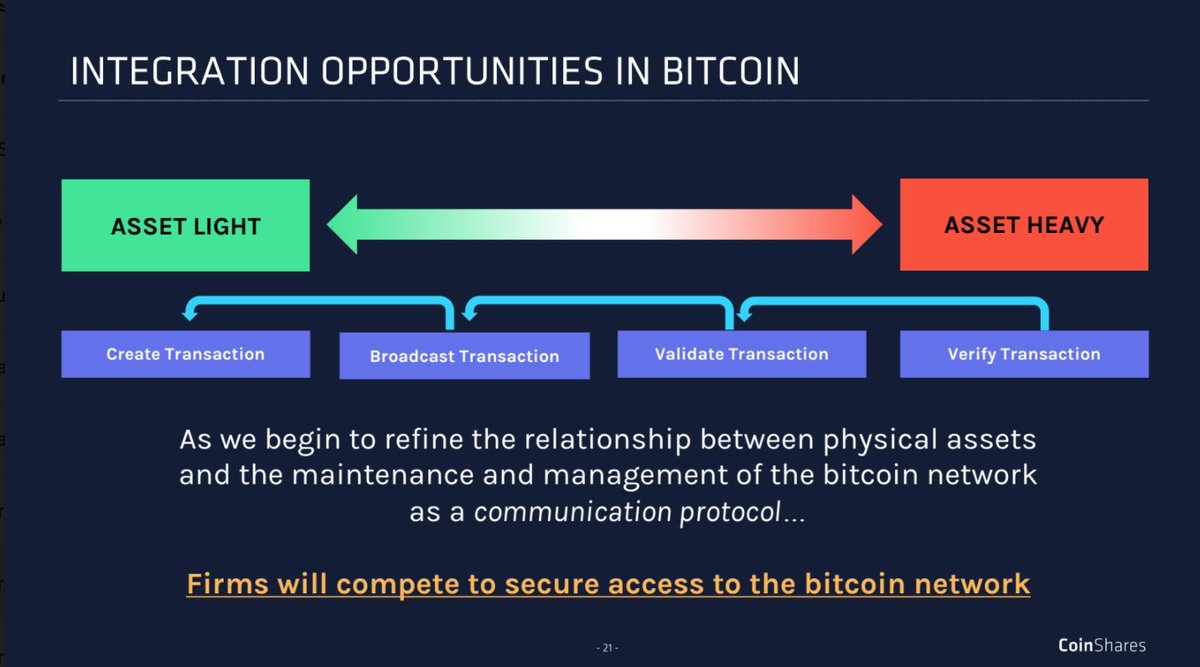

6/ most people don't understand bitcoin mining because they don't understand the bitcoin value chain.

most people will only ever interact with bitcoin by creating a transaction through an intermediary. but the value chain operates as such 👇

most people will only ever interact with bitcoin by creating a transaction through an intermediary. but the value chain operates as such 👇

7/ the value chain needs hardware, not just software. you need silicon and power to fuel the network, just like we do for any other type of compute or connectivity.

investors have historically been dismissive of bitcoin infrastructure - they think its exchanges (lol!)

investors have historically been dismissive of bitcoin infrastructure - they think its exchanges (lol!)

8/ but smart investors understand

if bitcoin is a communication protocol...firms will compete to secure access to the bitcoin network

put another way: if you depend 100% on service providers, your service level and infra risk will mirror that of your service provider.

if bitcoin is a communication protocol...firms will compete to secure access to the bitcoin network

put another way: if you depend 100% on service providers, your service level and infra risk will mirror that of your service provider.

9/ firms who require high levels of service and high levels of security (which is ALL bitcoin firms) need to use service providers who understand the bitcoin value chain and can operate robust infrastructure

$EQIX built a $60B business doing this for cloud compute and peering

$EQIX built a $60B business doing this for cloud compute and peering

10/ however, let's not forget the critical role that innovation plays in evolving the economics of the bitcoin network

technology innovation, business model innovation, and financial innovation are rapidly changing the shape of the mining landscape and the bitcoin value chain!

technology innovation, business model innovation, and financial innovation are rapidly changing the shape of the mining landscape and the bitcoin value chain!

11/ a brief example - oil.

from 1970 - 2010, the world was shaped by the US' drive to secure the oil value chain.

the petro-dollar was a product of this. the military-industrial complex was shaped by it. most importantly, financial markets were built around it.

from 1970 - 2010, the world was shaped by the US' drive to secure the oil value chain.

the petro-dollar was a product of this. the military-industrial complex was shaped by it. most importantly, financial markets were built around it.

12/ let's look at the impact of cyberspace

this decade will be shaped by the US' attempts to, but ultimate failure to secure cyberspace

billions have been spent. trillions will be wasted.

for those who want to secure their own future, #Bitcoin presents an alternative.

this decade will be shaped by the US' attempts to, but ultimate failure to secure cyberspace

billions have been spent. trillions will be wasted.

for those who want to secure their own future, #Bitcoin presents an alternative.

13/ sidebar: if you want to read more about the economics of the internet and new incentive models using crypto - see medium.com/coinshares/the…

14/ ok back to main story

here's how this all plays out. #Bitcoin is the most secure compute network in the world. full stop.

we are re-shaping financial markets.

but it doesn't stop there. #bitcoin will reshape cyberspace and the energy economy.

here's how this all plays out. #Bitcoin is the most secure compute network in the world. full stop.

we are re-shaping financial markets.

but it doesn't stop there. #bitcoin will reshape cyberspace and the energy economy.

15/ #bitcoin started with a simple concept - the separation of money and state.

but in order to implement this effectively, we need to change the function of the state by stripping it of its hegemony through engineering a sovereign revolution.

it's WILD and it BLOWS my MIND.

but in order to implement this effectively, we need to change the function of the state by stripping it of its hegemony through engineering a sovereign revolution.

it's WILD and it BLOWS my MIND.

16/ if you dismiss bitcoin mining, you don't understand how bitcoin works. if you're not trying to get your paws into as many of these 👇 as you can, you're missing the big picture.

your app might be worth billions of dollars.

but without the bitcoin network, it's useless.

your app might be worth billions of dollars.

but without the bitcoin network, it's useless.

17/ by the end of this decade, the economics of the bitcoin value chain will re-shape the world's physical infrastructure and as a result, its power structures - in every sense of the word power.

i, for one, cannot wait.

fin/

i, for one, cannot wait.

fin/

• • •

Missing some Tweet in this thread? You can try to

force a refresh