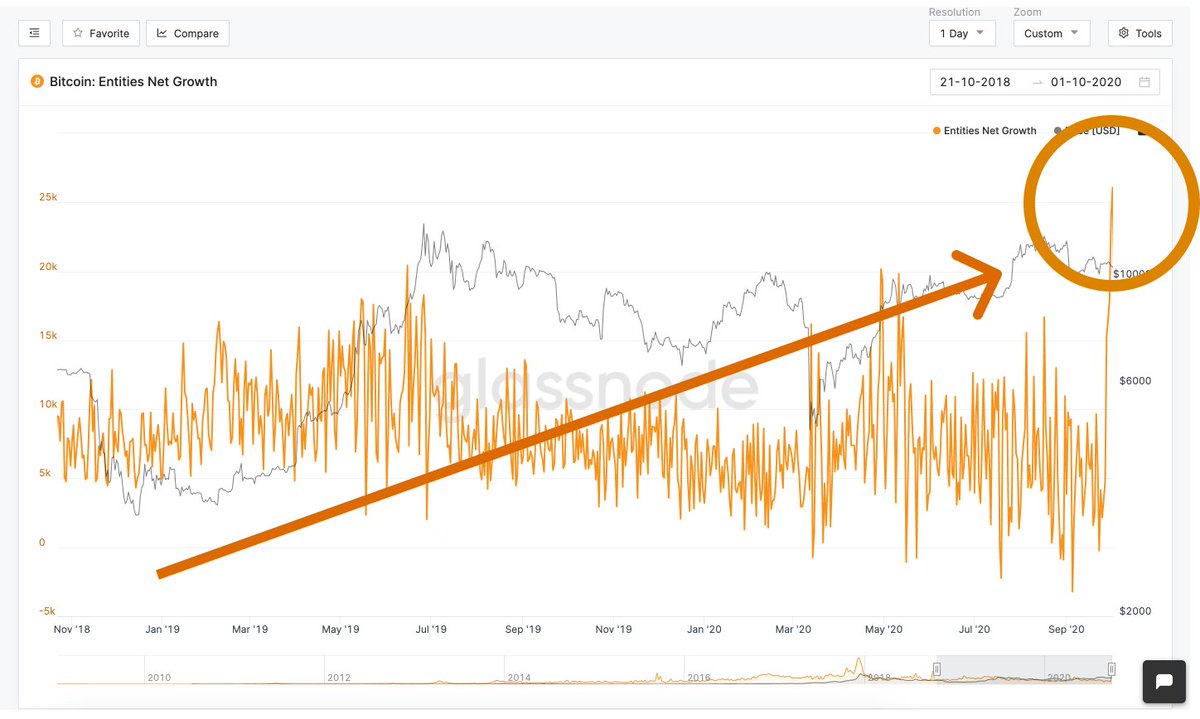

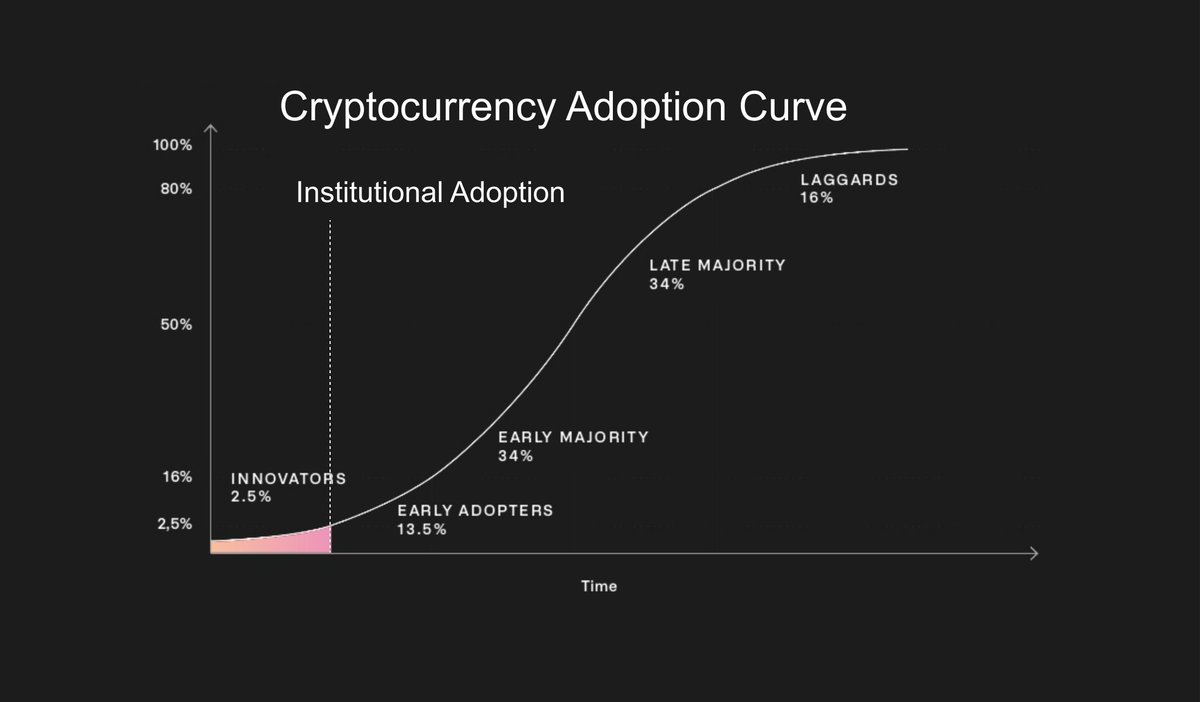

1/ We've reached a critical inflection point in bitcoin's adoption curve.

A moment wholly unique in the history of markets.

Are you ready for what comes next? 👇

#Bitcoin

A moment wholly unique in the history of markets.

Are you ready for what comes next? 👇

#Bitcoin

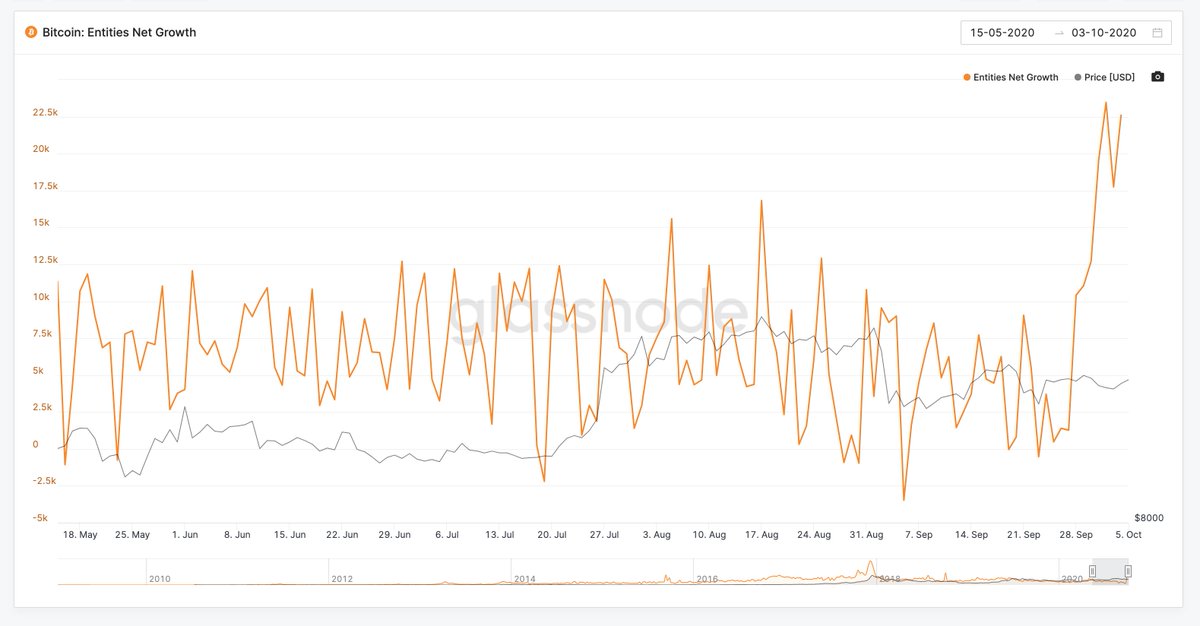

2/ A perfect storm of demand dynamics is driving #Bitcoin price.

I think something shifted in the market -- and active investors & traders would do well to adjust their mindset.

I think something shifted in the market -- and active investors & traders would do well to adjust their mindset.

3/ After years asleep at the wheel, institutional leaders are now jarred awake, en masse.

If they want this asset: they'll have to hustle, compete with the masses and FOMO in above ATH's.

Against a backdrop of scarcity unlike anything they've ever seen.

If they want this asset: they'll have to hustle, compete with the masses and FOMO in above ATH's.

Against a backdrop of scarcity unlike anything they've ever seen.

4/ They will buy *all* dips.

Their bots will not stop buying.

There isn't enough supply for all of them, and they know it.

Their bots will not stop buying.

There isn't enough supply for all of them, and they know it.

5/ And the whales who accumulated much lower?

How much appetite will strong hands have to market sell, just to run stops?

In the opening hours of the greatest bull market of their lives.

In a liquidity crisis.

How much appetite will strong hands have to market sell, just to run stops?

In the opening hours of the greatest bull market of their lives.

In a liquidity crisis.

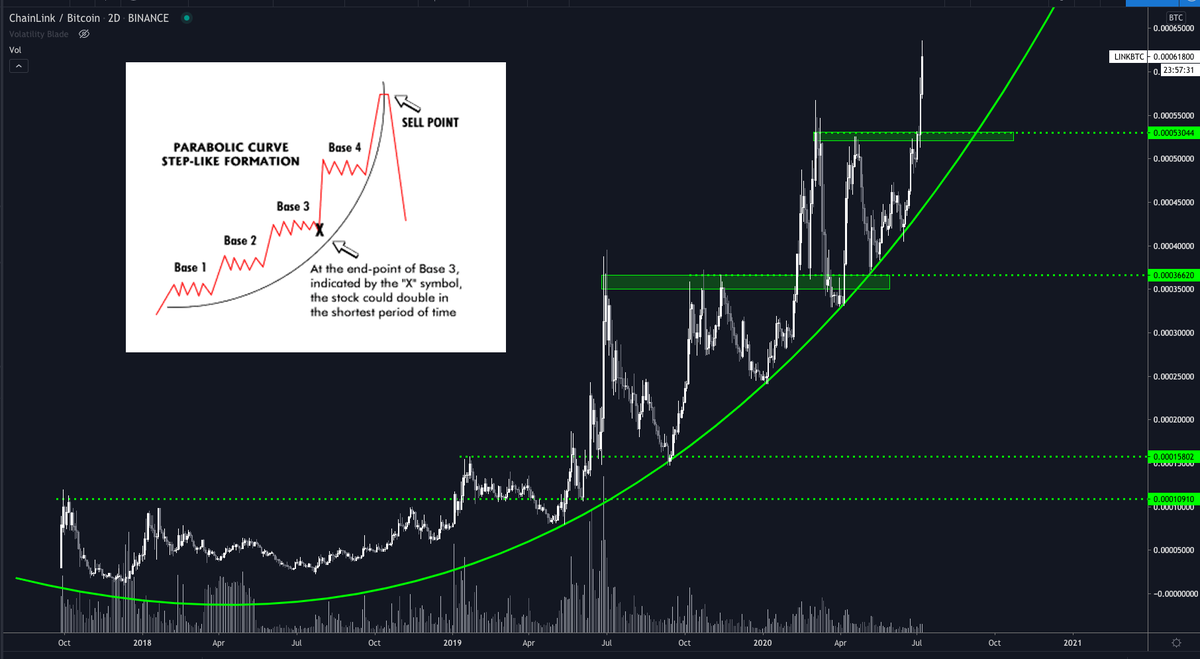

6/ This is why the halvening was never priced in.

This is why I think #Bitcoin goes to $35k-$40k, before a shakeout much worse than anything we've seen so far.

I’m not saying we teleport to $40k instantly.

Just small gains, pretty much every day, for many weeks.

This is why I think #Bitcoin goes to $35k-$40k, before a shakeout much worse than anything we've seen so far.

I’m not saying we teleport to $40k instantly.

Just small gains, pretty much every day, for many weeks.

7/ I could be wrong about this -- that's certainly happened before.

But this scenario would not be unprecedented:

This same thing happened in 2017, when #BTC broke previous ATHs after multiple tries.

But this scenario would not be unprecedented:

This same thing happened in 2017, when #BTC broke previous ATHs after multiple tries.

8/ If you feel like you don't have enough exposure:

*Don't* throw risk mgmt out the window -- because we can't know for sure if I'm right.

Buy gradually -- on small pullbacks, at the weekly TWAP, BTC's time-weighted average price.

*Don't* throw risk mgmt out the window -- because we can't know for sure if I'm right.

Buy gradually -- on small pullbacks, at the weekly TWAP, BTC's time-weighted average price.

https://mobile.twitter.com/zhusu/status/1334658392154021890

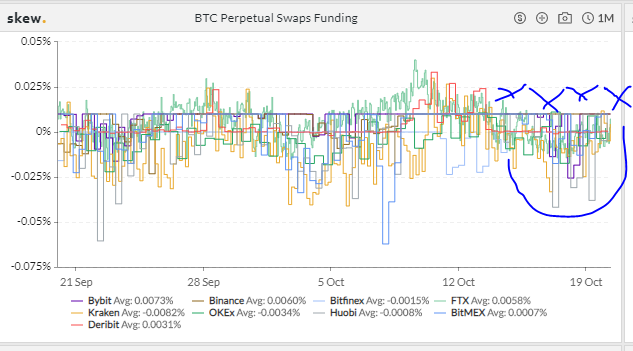

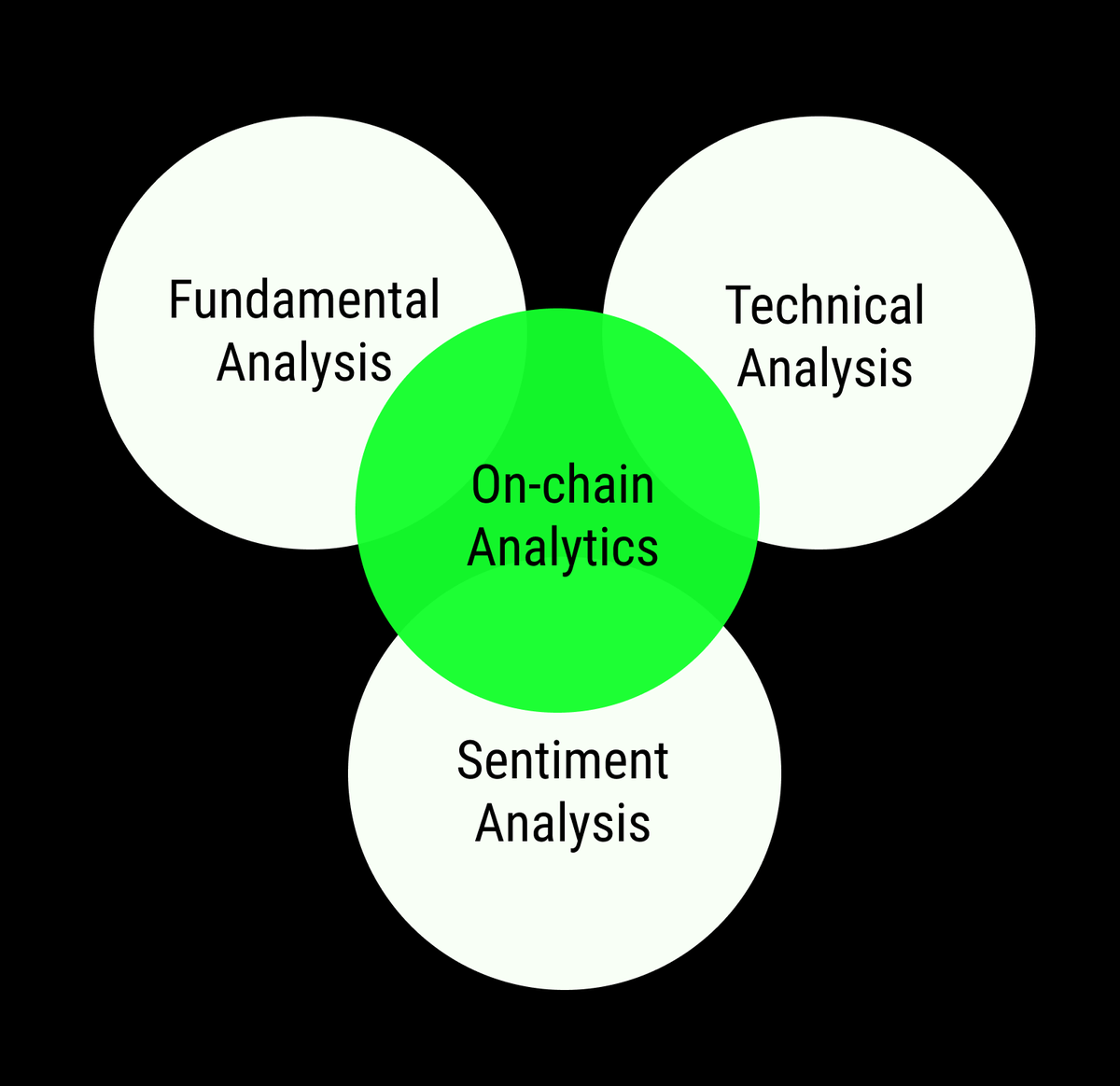

10/ How will you know when we're approaching the local top?

I will look to two metrics:

(and neither one is funding -- funding will be useless if this scenario plays out).

I will look to two metrics:

(and neither one is funding -- funding will be useless if this scenario plays out).

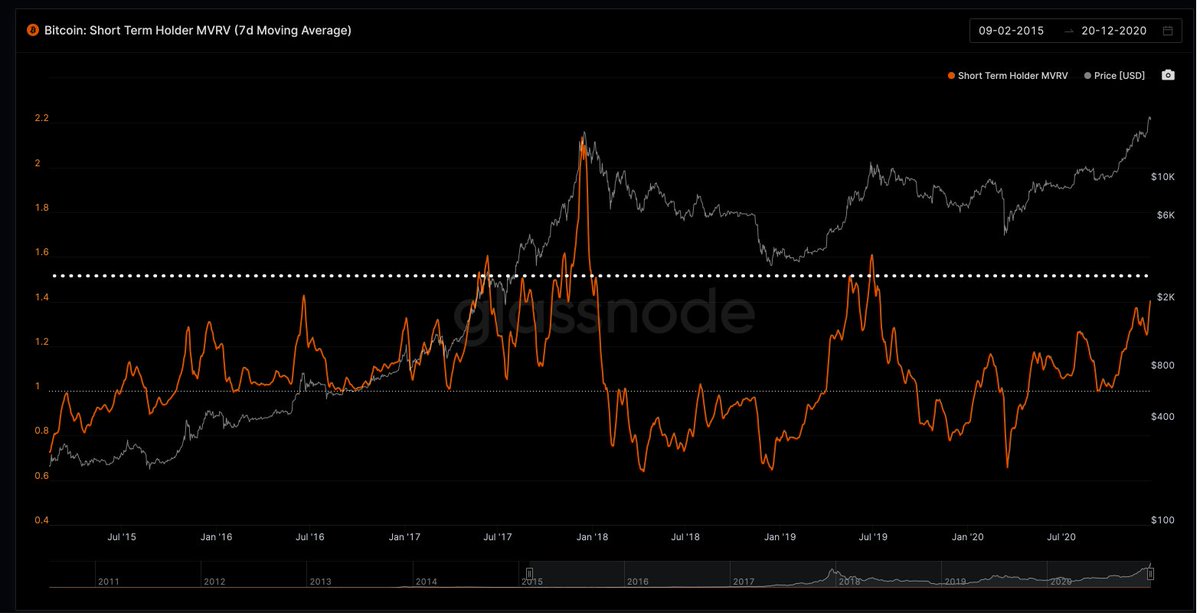

11/ The first is Short Term Holder MVRV, from @glassnode.

I consider this the alpha metric on-chain for finding local #BTC tops.

I want to see STH-MVRV print above a 1.5, then make lowers lows.

I consider this the alpha metric on-chain for finding local #BTC tops.

I want to see STH-MVRV print above a 1.5, then make lowers lows.

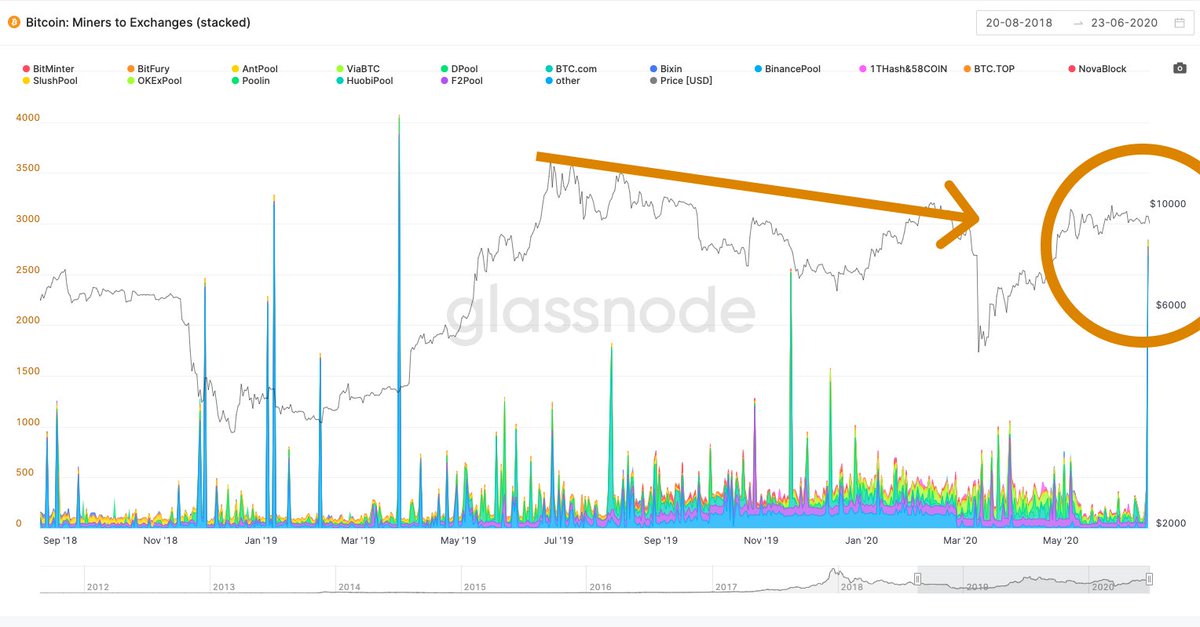

12/ The second is Whale Exchange Ratio.

On Gemini exchange: this metric was never wrong in 2020.

Gemini whales are #Bitcoin 's secret bellweather.

(Data from @cryptoquant_com)

On Gemini exchange: this metric was never wrong in 2020.

Gemini whales are #Bitcoin 's secret bellweather.

(Data from @cryptoquant_com)

13/ I'll be watching closely to see how all this plays out.

And regardless of the result - I feel grateful.

After enduring the long crypto winter, we're finally here at the beginning of something special. 👊

And regardless of the result - I feel grateful.

After enduring the long crypto winter, we're finally here at the beginning of something special. 👊

• • •

Missing some Tweet in this thread? You can try to

force a refresh