Heavy Electrical Equipment sector, bird's eye view :

Quantitative view : Top 5 companies take away 90% of the market capitalization of the entire sector.

We'll have to narrow down our qualitative search to these 5 companies and ignore the rest.

Quantitative view : Top 5 companies take away 90% of the market capitalization of the entire sector.

We'll have to narrow down our qualitative search to these 5 companies and ignore the rest.

Return ratios and company health (debt burden) shows that despite Adani having highest market cap, it has poor ICR, indicating heavy debt.

Siemens has 0 debt and an ICR of 150. This is indicative of a very healthy balance sheet.

Siemens : 1

Rest : 0

Siemens has 0 debt and an ICR of 150. This is indicative of a very healthy balance sheet.

Siemens : 1

Rest : 0

Inferences :

Adani has highest market cap but :

BHEL has the highest sales

Siemens has second highest sales

BHEL and Siemens has highest profit

Adani's profit, compared to the rich valuation is too LOW, signaling an overvaluation bubble in Adani.

Adani has highest market cap but :

BHEL has the highest sales

Siemens has second highest sales

BHEL and Siemens has highest profit

Adani's profit, compared to the rich valuation is too LOW, signaling an overvaluation bubble in Adani.

Growth rate analysis suggests that Adani has the fastest rate of growth (potentially why the market is giving it rich valuations).

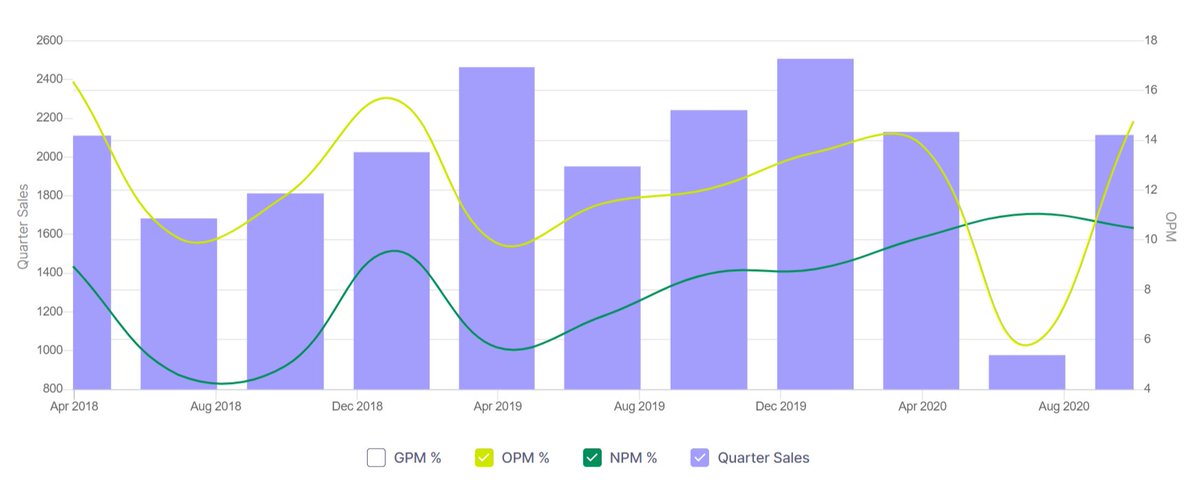

Profit ratios show that

Triveni Turbine has highest NPM in the sector

Voltamp has highest ICR (i.e profit/debt)

But both are miniscule players. Ignore them

Adani has highest debt (red flag)

Siemens (ICR) : annual profit is 150x times debt.

Massive green flag for Siemens.

Triveni Turbine has highest NPM in the sector

Voltamp has highest ICR (i.e profit/debt)

But both are miniscule players. Ignore them

Adani has highest debt (red flag)

Siemens (ICR) : annual profit is 150x times debt.

Massive green flag for Siemens.

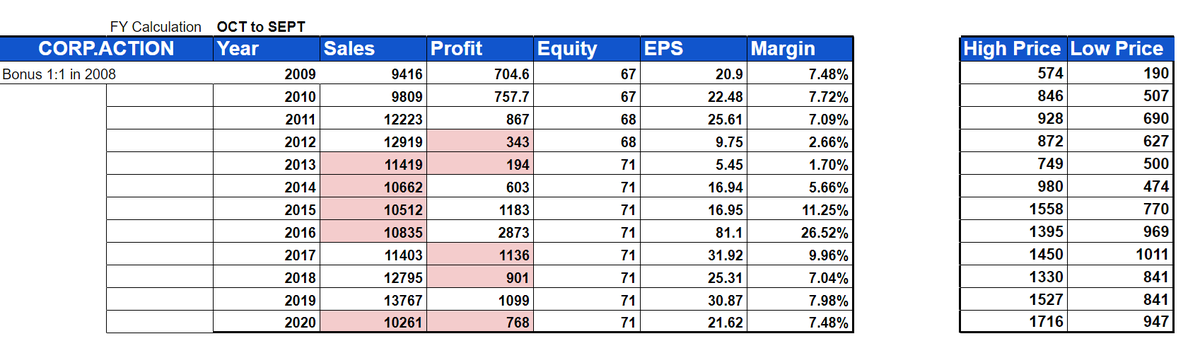

Siemens has highest ROE in the sector, indicating that the management is able to churn out big profits today (1000Cr) from relatively smaller startup capital of 71Cr Vs Adani, which is making ONLY 68Crs profit today from a massive startup capital of 1500Cr.

Final verdict: The heavy electrical sector as a whole runs on wafer thin margins of 3-4%. It is a capital intensive sector commanding huge turnover but miniscule profits. 90% are in debt.

Siemens is good company, from a bad sector. This will become a 🚀if the sector turns around

Siemens is good company, from a bad sector. This will become a 🚀if the sector turns around

• • •

Missing some Tweet in this thread? You can try to

force a refresh