THREAD: the article is a fair depiction but needs a local like me to fill the blanks. on.wsj.com/36jgtIP (/)

@nglinsman @amlivemon @DukeMarcude @eshow1969 @chigrl

@nglinsman @amlivemon @DukeMarcude @eshow1969 @chigrl

There is a reference to #NIRP, which is killing the #EU private sector, but I already wrote extensively on that. What caught my eye was: "The oversize exposure of banks to small businesses is part of Europe’s economic fabric. (/)

"Companies with fewer than 250 employees account for 99.8% of all firms and two-thirds of all private-sector jobs in the European Union, according to the European Commission. Small businesses in the U.S. also have economic weight, but they tend to be bigger."(/)

" About half of Europe’s workforce is employed by firms with fewer than 50 people, compared with about a quarter in the U.S., according to the U.S. Census Bureau." and now, the key point:(/)

"Given their size and the small economies they serve, many European companies have a hard time attracting investors, relying heavily on bank loans for financing. "

That is partly due to banks dominating, through regulatory framework, ALSO where private savings go. (/)

That is partly due to banks dominating, through regulatory framework, ALSO where private savings go. (/)

The past twenty years have been bad for banks. So, governments have found it convenient to do this faustian pact: Banks would be helped get fee income (i.e., managing savers money, at no risk to themselves) in return for "playing nice" on traditional banking.(/)

That has ranged from initially turning a blind eye to doubtful selling practices, to limiting access by savers if not through fee paying vehicles. One of the cornerstone of such policy is of course a fight against competition and disintermediation(/)

So, if you want to invest in small companies as a saver aspiring to become an equity investor directly.... good luck! ti's exceedingly MORE complicated than in the US.

Then, there is the other shoe. Many policies discourage companies from growing.(/)

Then, there is the other shoe. Many policies discourage companies from growing.(/)

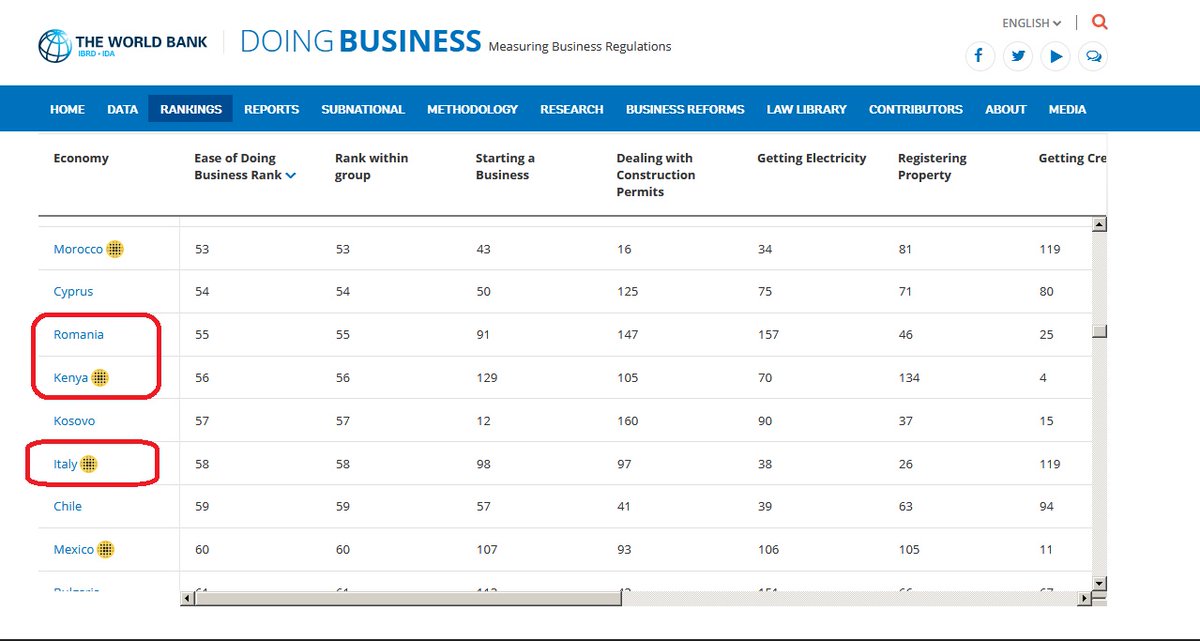

In Italy, in addition to the problems about starting company ( doingbusiness.org/en/rankings ), laws are set that impose more fixed costs at certain thresholds. So you either are born big, or the crossing of the Red Sea looks risky.(/)

Moreover, Schumpeter has not caught on over here: recycling is a religion on climate, NOT in the economy. In Italy, a bankruptcy could take a decade. (/)

Some, big politically connected companies, look on the upstart Zombies with a benevolent smile of an adult seeing a child take the first steps. #Alitalia.(/)

One other factor is that the continuous tendency towards more regulation and taxes means that entrepreneurs keep as little money as possible inside the company not to enhance ROI but to reduce risks. So... "it's complicated".

• • •

Missing some Tweet in this thread? You can try to

force a refresh