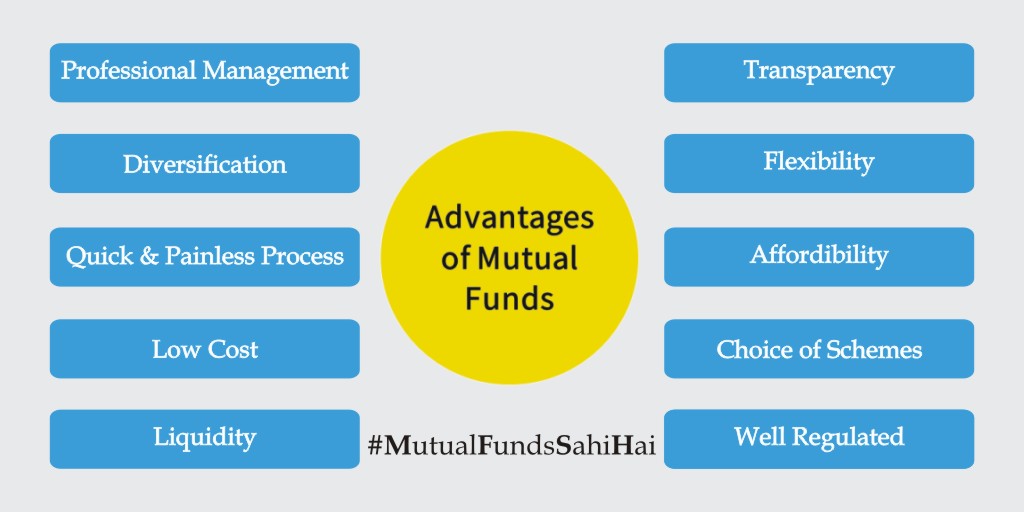

Thread 🧵 on Advantages of #Investing in #MutualFunds ...

🌟Must read for everyone, especially those who do not understand #Equities and have not yet invested significant amount in Mutual Funds as well.🌟

#MutualFundsSahiHai

@invest_mutual @dmuthuk views invited 🙏

🌟Must read for everyone, especially those who do not understand #Equities and have not yet invested significant amount in Mutual Funds as well.🌟

#MutualFundsSahiHai

@invest_mutual @dmuthuk views invited 🙏

1⃣ Professional Management:

#MutualFunds use services of experienced & skilled professionals, backed by a dedicated investment research team that analyses performance & prospects of companies and selects suitable investments to achieve objectives of scheme.

#MutualFundsSahiHai

#MutualFunds use services of experienced & skilled professionals, backed by a dedicated investment research team that analyses performance & prospects of companies and selects suitable investments to achieve objectives of scheme.

#MutualFundsSahiHai

2⃣ Diversification:

#MutualFunds invest in a number of companies across a broad spectrum of industries & sectors. This diversification reduces risk because seldom do all stocks decline at same time and in same proportion.

#MutualFundsSahiHai

#MutualFunds invest in a number of companies across a broad spectrum of industries & sectors. This diversification reduces risk because seldom do all stocks decline at same time and in same proportion.

#MutualFundsSahiHai

3⃣ Quick & Painless Process:

#Investing in a #MutualFunds reduces paperwork & helps us to avoid many equity investing related problems such as bad deliveries, delayed payments & follow-ups with brokers. This save our time & make investing easy & convenient.

#MutualFundsSahiHai

#Investing in a #MutualFunds reduces paperwork & helps us to avoid many equity investing related problems such as bad deliveries, delayed payments & follow-ups with brokers. This save our time & make investing easy & convenient.

#MutualFundsSahiHai

4⃣ Low Cost:

#MutualFunds are a relatively less expensive way to invest compared to directly investing in #StockMarket because benefits of economies of scale in brokerage, custodial and other fees translate into lower costs for investors.

#MutualFundsSahiHai

#MutualFunds are a relatively less expensive way to invest compared to directly investing in #StockMarket because benefits of economies of scale in brokerage, custodial and other fees translate into lower costs for investors.

#MutualFundsSahiHai

5⃣ Liquidity:

In open-ended schemes, investor gets money back at #NAV from #MutualFund.

In closed-ended schemes, units can be sold on #StockExchange at prevailing market price or investor can avail facility of direct repurchase at NAV by mutual fund.

#MutualFundsSahiHai

In open-ended schemes, investor gets money back at #NAV from #MutualFund.

In closed-ended schemes, units can be sold on #StockExchange at prevailing market price or investor can avail facility of direct repurchase at NAV by mutual fund.

#MutualFundsSahiHai

6⃣ Transparency:

#MutualFund #Investor get regular information on value of their investment in addition to disclosure on specific investments made by scheme, proportion invested in each asset class and fund manager's investment strategy and outlook.

#MutualFundsSahiHai

#MutualFund #Investor get regular information on value of their investment in addition to disclosure on specific investments made by scheme, proportion invested in each asset class and fund manager's investment strategy and outlook.

#MutualFundsSahiHai

7⃣ Flexibility:

Through features such as regular investment plans, regular withdrawal plans and dividend reinvestment plans, one can systematically invest or withdraw funds from #MutualFunds according to his/her needs and convenience.

#MutualFundsSahiHai

Through features such as regular investment plans, regular withdrawal plans and dividend reinvestment plans, one can systematically invest or withdraw funds from #MutualFunds according to his/her needs and convenience.

#MutualFundsSahiHai

8⃣ Affordability:

#Investors individually may lack sufficient funds to invest in high-grade stocks. A #Mutualfund because of its large corpus allows even a small investor to take the benefit of its investment strategy.

#MutualFundsSahiHai

#Investors individually may lack sufficient funds to invest in high-grade stocks. A #Mutualfund because of its large corpus allows even a small investor to take the benefit of its investment strategy.

#MutualFundsSahiHai

9⃣ Choice of Schemes:

#MutualFunds offer a family of schemes to suit every #investors varying needs to meet his financial goals.

#MutualFundsSahiHai

#MutualFunds offer a family of schemes to suit every #investors varying needs to meet his financial goals.

#MutualFundsSahiHai

🔟 Well Regulated:

All #MutualFunds are registered with #SEBI and they function within provisions of strict regulations designed to protect the interests of #investors. The operations of mutual funds are regularly monitored by SEBI.

#MutualFundsSahiHai

All #MutualFunds are registered with #SEBI and they function within provisions of strict regulations designed to protect the interests of #investors. The operations of mutual funds are regularly monitored by SEBI.

#MutualFundsSahiHai

#Investing for Life Goals 🎯 is like travelling a long road that goes uphill and downhill.

Choose #MutualFund #SIP to smoothen your ride.

Choose #MutualFund #SIP to smoothen your ride.

Beginners can read this basic book to learn everything about mutual fund investing -

amzn.to/38nbqIE

amzn.to/38nbqIE

• • •

Missing some Tweet in this thread? You can try to

force a refresh