#Inter 2019/20 accounts cover a season under new coach Antonio Conte when they finished 2nd in Serie A, reached the Coppa Italia semi-final and came 3rd in their Champions League group, dropping to Europe League before being beaten by Sevilla in the final. Some thoughts follow.

This was the fourth year under the management of Chinese shareholders, Suning Holdings Group, after they acquired a 69% majority stake in #Inter in June 2016 from Erick Thohir’s Indonesian consortium, ISC. In January 2019, Lion Rock Capital bought a 31% minority share from ISC.

#Inter pre-tax loss widened from €40m to €97m (post-tax €102m), significantly impacted by COVID, as revenue fell €68m (18%) from €370m to €302m, partly offset by profit on player sales increasing €22m to €62m, though expenses rose €11m, including €15m exceptional items.

#Inter largest revenue decrease came from commercial, down €51m (31%) from €166m to €115m, though broadcasting also fell €22m (14%) from €153m to €131m. Match day was flat at €47m, while player loans were up €6m to €9m.

As a technical note, this international definition of #Inter €302m revenue is different to the one in the club accounts, which also includes €61m gain on player sales plus €9m capitalisation of youth programme, giving revenue of €372m, down €45m (11%) from prior year €417m.

#Inter wage bill rose €5m (3%) from €193m to €198m, while player amortisation shot up €35m (42%) from €85m to €120m. On the other hand, other expenses were down €13m (13%) to €83m, depreciation fell €3m (12%) to €19m and net interest decreased €3m to €26m.

Incredibly, #Inter’s €102m post-tax loss is not the worst in Italy, as it is beaten by Roma €204m and Milan €195m, while Juventus also had a €90m deficit, all impacted by COVID. Note: some clubs have December year-end, so their 2019/20 accounts do not reflect the pandemic.

Clearly, COVID has had a major adverse impact on finances in 2019/20 with many leading clubs outside Italy also reporting horrific losses, e.g. Everton €158m, Barcelona €97m, Tottenham Hotspur €72m and Borussia Dortmund €44m, but #Inter €102m is one of the highest (worst).

Without COVID #Inter revenue would have been £51m higher at £424m, due to deferrals to 2020/21 accounts for events after 30th June, i.e. £7m (2%) higher than prior year. Allied to £20m expenses savings, the loss would have been “only” €71m, but still €22m higher than 2018/19.

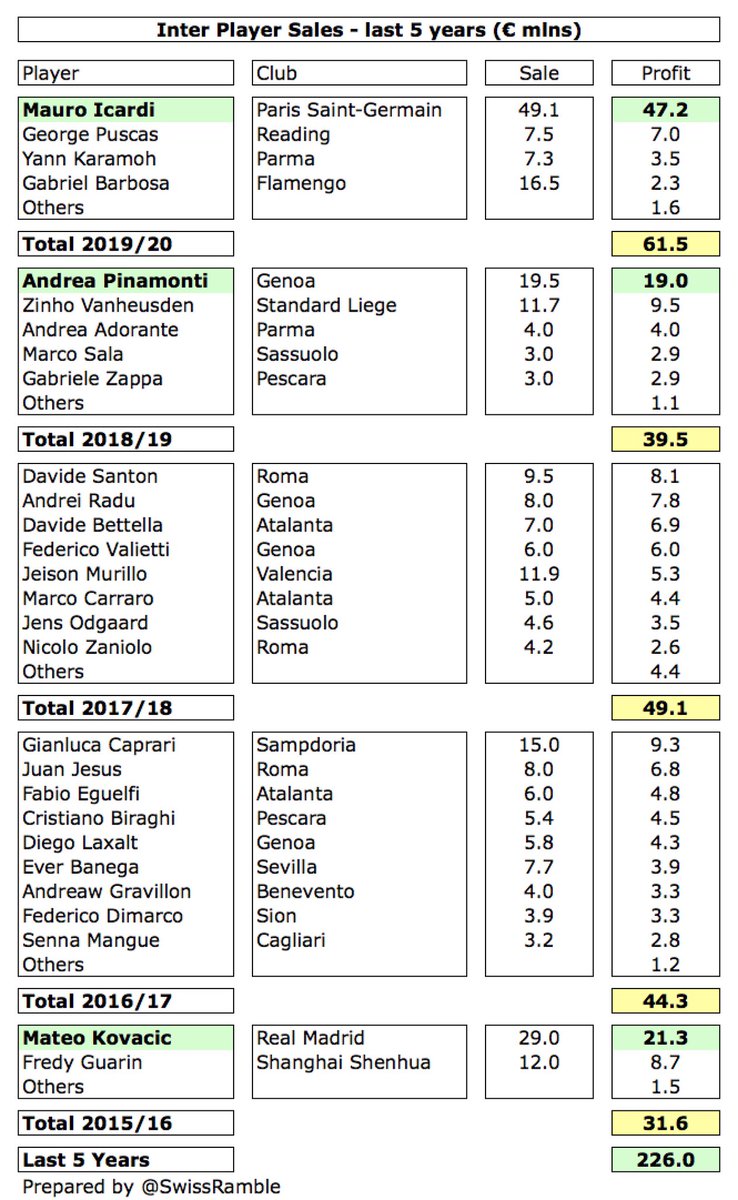

#Inter profit on player sales rose €22m to €62m, mainly Mauro Icardi to PSG €47m, George Puscas to Reading €7m and Yann Karamoh to Parma €3m. This was one of the highest gains from this activity in Italy, only surpassed by Juventus €167m, Napoli €96m and Genoa €80m.

#Inter are no strangers to losses, having only reported a profit once in the last decade (€33m in 2014). Over that period, they have accumulated €570m of losses (€604m after tax), including €164m in the 4 years under Suning’s control.

#Inter €33m profit posted in 2014 would also have been a massive loss without €139m from selling the brand to Inter Media & Communications. Exceptional charges fell from €26m in 2019 (provision for Luciano Spalletti dismissal) to €15m in 2020 (IRPEF withholding tax).

Like many clubs, #Inter have become increasingly reliant on player sales with the €226m profit generated from this activity in the last 5 years being around €100m more than the €122m reported in the preceding 5-year period.

That said, #Inter €226m profit from player sales in last 5 years is still a long way below Juventus €563m, Roma €372m and Napoli €325m, though is 3 times as much as Milan €72m. Only 3 players sold for a profit above €10m: Icardi €47m, Kovacic €21m and Pinamonti €19m.

#Inter EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), a proxy for underlying profitability, as it excludes once-off items like player sales and exceptional items, fell from €81m to €21m, though still the second best in Italy, only behind Atalanta €33m.

Similarly, #Inter operating loss (excluding profit from player sales and interest) widened from €51m to €133m, though still better than the enormous operating losses at the other members of the traditional “Big Four” Italian club: Juventus €234m, Milan €202m and Roma €195m.

Despite last year’s fall, #Inter ongoing revenue grew by €99m (49%) in the 4 years since the Suning takeover from €203m to €302m, though €46m has come from Regional (Chinese) sponsors. That said, Champions League qualification was also worth €46m, and match day was up €19m.

As a result, there is clear water between #Inter’s €302m revenue and the clubs immediately below them, namely Napoli €179m, Milan €172m, Roma €149m and Atalanta €141m. However, the nerazzurri are still a hefty €105m below Juventus’ €407m.

Due to COVID, most clubs have seen dramatic revenue falls in 2020, but #Inter €73m reduction (excluding player loans) is only surpassed by Roma €90m, though worse than Juventus €62m & Milan €58m. Atalanta and Fiorentina accounts closed in December, i.e. before the pandemic.

#Inter 18% revenue decrease in 2019/20 is pretty much in line with other European clubs that have so far published accounts, other examples including Juventus 18% and Napoli 17%. Net of revenue deferred to 2020/21 accounts, revenue would have been 2% higher.

#Inter remain in 14th place in the Deloitte Money League, which ranks clubs worldwide by revenue, though the gap to 13th placed Atletico Madrid has widened from €3m to €40m. Note: Deloitte exclude player loans in their revenue definition.

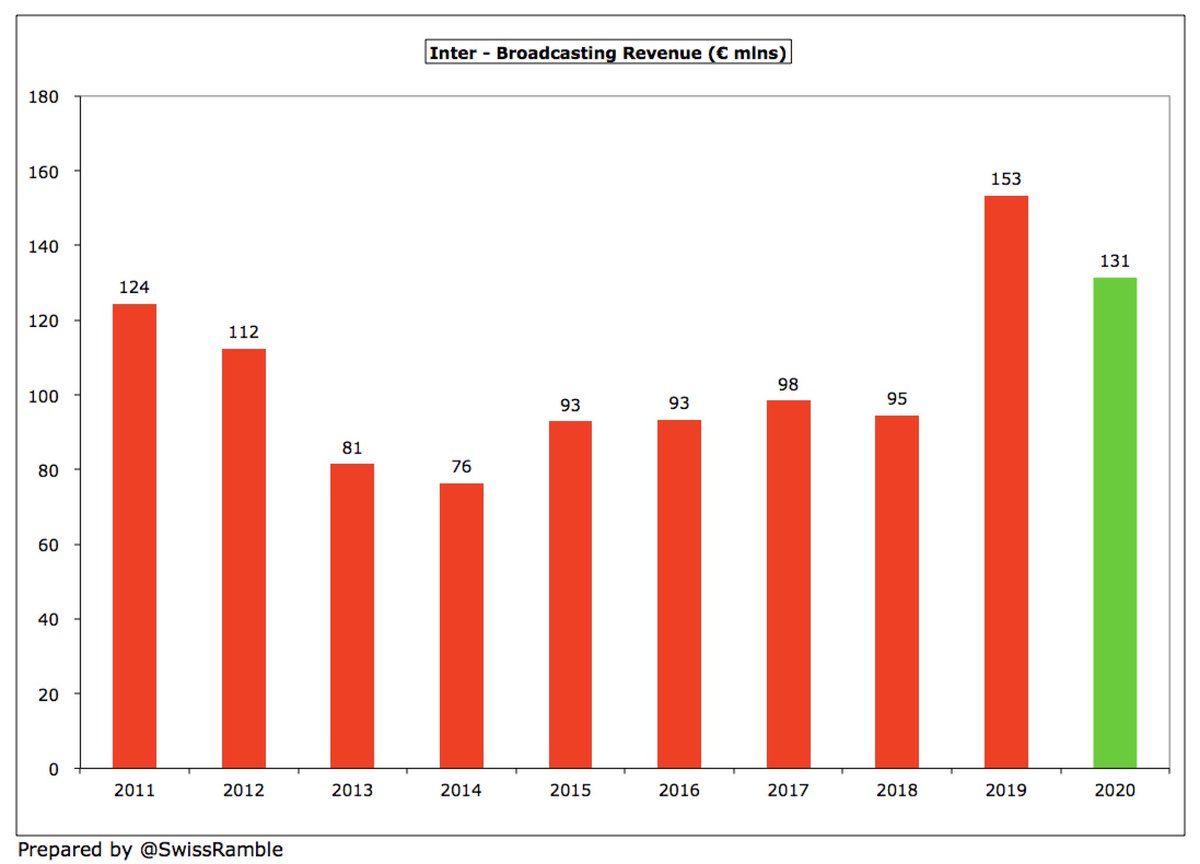

#Inter broadcasting revenue decreased €22m (14%) from €153m to €131m, as domestic fell €17m (20%) from €87m to €70m and UEFA money was down €6m (12%) from €52m to €46m. Includes RAI archive €10m & Inter TV €6m. 2nd highest TV income in Italy, only behind Juve €166m.

In 2018/19 #Inter received €83m TV money from Serie A: 50% equal share; 30% performance (15% last season, 10% last 5 years, 5% historical); and 20% supporters. However, 2019/20 revenue was much lower, as some income deferred to 2020/21 after a few games played in July & August.

It is imperative that #Inter qualify for Europe, ideally the Champions League, to boost their broadcasting income, as the TV rights in Serie A are relatively low. Indeed, there were big increases in England and Spain in 2019/20 and France in 2020/21, while Italy was unchanged.

#Inter earned €57m in Europe: €44m for finishing 3rd in Champions League group plus €13m for reaching Europa League final, though money from last 16 onwards deferred to 20/21, as games played after June. Below other Italian clubs: Juventus €87m, Napoli €70m & Atalanta €57m.

#Inter only received €117m from Europe in last 5 years, almost all from 2019 and 2020. This is miles behind Juventus €449m, Roma €255m and Napoli €246m, due to those clubs consistently qualifying for the Champions League. This has an impact on the UEFA coefficient ranking.

#Inter match day income flat at €47m (including memberships), despite playing 7 games behind closed doors due to COVID, as 2 biggest matches generated record receipts: Juventus (Serie A) €6.6m & Barcelona (CL) €7.9m. This was 2nd highest in Italy, only below Juventus €49m.

#Inter average attendance rose 7% to 65,800 for games played with fans, i.e. before the pandemic struck, despite higher ticket prices. This was by some distance the highest in Italy, well ahead of Milan 49,806, Roma 39,397, Lazio 38,357 and Juventus 36,629.

#Inter and Milan have been working on a project to build a new stadium on the San Siro site and revitalise the surrounding area. Following the city council’s demands for changes, partly to preserve a section of the iconic old stadium, a revised plan was submitted in May 2020.

#Inter commercial revenue fell €51m (31%) from €166m to €115m, mainly due to early termination of some Regional (Chinese) sponsorships & deferred payment for Champions League qualification, offset by €10m COVID insurance payment. 2nd highest in Italy, far below Juve’s €186m.

Despite last season’s decrease, #Inter commercial revenue has grown by €38m (49%) under Suning, driven by substantial deals with Regional (Chinese) sponsors, though these fell from €97m to €46m in 2019/20. Growth in this revenue stream only outpaced by Juventus.

#Inter Pirelli shirt sponsorship is worth €11m, but club hopes to secure a €25-30m deal with an Asian sponsor when it expires in 2021 with talk of Evergrande (Juve Jeep deal worth €42m). Nike kit deal is €10m a year, though club paid €6m to take retail & licensing inhouse.

#Inter income from player loans income increased from €4m to €9m, mainly Perisic to Bayern Munich, Politano to Napoli and Lazaro to Newcastle. This is an important revenue stream for some Italian clubs with Inter the highest, ahead of Milan €8m and Roma €7m.

#Inter wage bill rose €5m (3%) from €193m to €198m, as increases in bonuses €6m & coaches’ salaries €7m (arrival of Conte) offset €6m reduction in player salaries. Wages up 59% (€74m) in the last 4 years, though cash flow issues have led to some delays in salary payments.

In fact, #Inter have seen the highest growth in wages in Italy in the last 4 years, as their €74m increase has outpaced Juventus €63m and Napoli €56m. In the same period, Roma were flat, while Milan are actually down €3m.

As a consequence, #Inter €198m wage bill is now the second highest in Italy, a fair way ahead of Milan €161m, Roma €155m and Napoli €141m. However, Juventus wages are still €86m (44%) higher, despite falling from €328m to €284m in 2019/20.

#Inter wages to turnover ratio increased from 52% to 66%, though this is still fairly low for Serie A, better than Roma 104%, Milan 93%, Napoli 79% and Juventus 70%. Atalanta are in a class of their own with just 49%.

#Inter player amortisation, the annual cost of writing-off transfer fees, surged €35m (42%) from €85m to €120m, which means that this expense has more than tripled in just four years (from €39m in 2016).

As a result, #Inter player amortisation of €120m is the second highest in Italy, though a fair way behind Juventus €167m, but ahead of Napoli €118m, Milan €95m and Roma €94m.

#Inter have really ramped up their expenditure in the transfer market, splashing out €685m in the last 5 years, more than twice as much as €296m in the preceding 5 years. 2019/20 included the purchases of Romelu Lukaku, Achraf Hakimi, Nicolo Barella and Christian Eriksen.

In fact, over the last 5 seasons, #Inter have the highest net transfer spend in Serie A with their €352m being ahead of Milan €291m, Juventus €223m, Parma €111m and Napoli €106m.

In terms of gross spend, the usual order is restored with #Inter €685m the second highest in Serie A behind Juventus €954m, including Cristiano Ronaldo’s huge fee. However, they comfortably outspent Milan €544m, Roma €532m, Napoli €508m and (especially) Atalanta €241m.

#Inter gross debt fell €50m from €461m to €411m, compromising €283m bonds, €78m shareholder loans and €50m bank loans. Debt up €142m in 4 years, but down from €521m peak in 2018. Would have been higher without Suning converting another €70m debt into reserves in 2019/20.

Nevertheless, #Inter €411m gross debt is the highest in Italy, above Juventus €396m (partly stadium), Roma €318m & Milan €115m. After the accounts closed, they further increased debt by issuing €75m of bonds in July 2020. Like the other bonds, these mature in December 2022.

The hefty debt comes at a price, as #Inter net interest payable is €26m (€34m payable less €8m receivable), though €3m lower than prior year. Mainly €16m on bonds (4.875%) and €9m on shareholder loans (6.5%). Second highest in Italy behind Roma €32m.

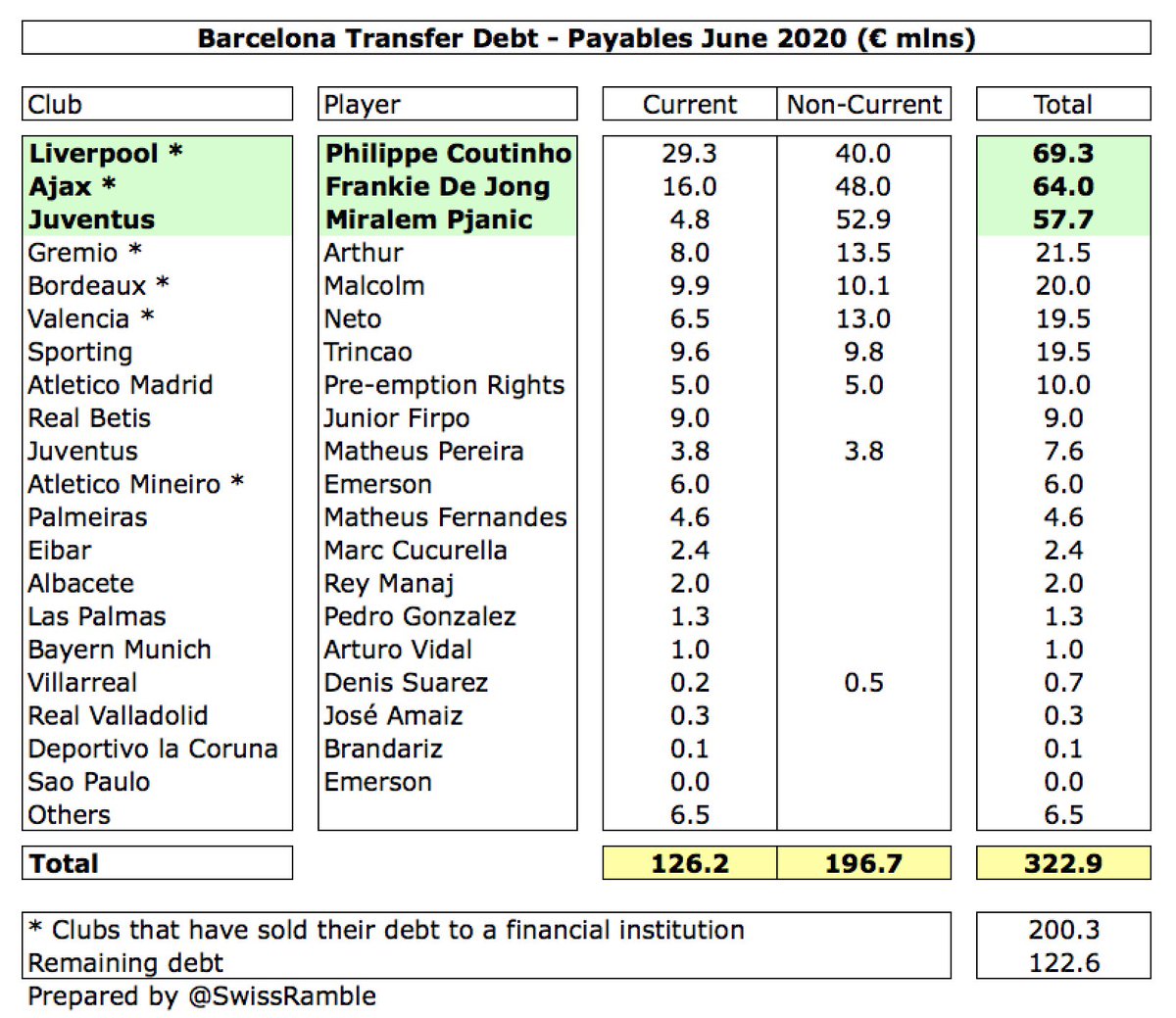

In addition, #Inter transfer debt rose from €135m to €207m, though owed €122m by other clubs, so net payable is €86m. This is second highest in Italy, only below Juventus €301m, but more than Roma €191m and Napoli €143m. Media reports that Hakimi stage payment delayed.

#Inter cash balance increased from €55m to €89m. Most Italian clubs hold very little cash with the exception of Inter and Napoli’s incredible €124m, so this is a useful buffer, but it will be needed (and more) to protect the club from COVID revenue shortfalls.

As a result of their large losses, #Inter failed UEFA’s Financial Fair Play (FFP) regulations in 2015. Despite UEFA relaxing their FFP rules, e.g. adjusting for COVID losses and combining 2019/20 and 2020/21 seasons, this will surely still be an issue for the club in future.

Like all other clubs, #Inter finances have been badly hit by COVID. Operational performance is dependent on support from the owners, but there are reports that Suning are looking to sell some or all of their stake. Otherwise, growth depends on the creation of a global brand.

• • •

Missing some Tweet in this thread? You can try to

force a refresh