#FCBarcelona 2019/20 accounts cover a season when they finished second in La Liga and reached the quarter-finals of the Champions League and the Copa del Rey. Their finances were significantly impacted by COVID-19 in the last 3 months. Some thoughts in the following thread.

#FCBarcelona swung from €4m pre-tax profit to €128m loss (€97m after tax, due to €31m tax credit). Revenue dropped €135m (14%) from record €990m to €855m, including €21m reduction in gain on player sales. This was only slightly offset by expenses falling €7m.

As a technical note, the #FCBarcelona definition of €855m revenue is different from the standard Deloitte Money League figure of €729m operating income, as it includes €80m gain on player sales, €45m impairment reversal and €2m for work performed and capitalised.

Excluding player sales, #FCBarcelona revenue fell €123m (14%) from €852m to €729m. Largest decrease in broadcasting €50m (17%) to €248m, followed by marketing & advertising €40m (11%) to €323m, competitions €33m (29%) to €81m and season tickets €6m (9%) to €55m.

#FCBarcelona wages fell €55m (10%) to €487m, split football €443m & other sports €44m, while other expenses were down €23m (10%) to €216m. However, player amortisation & impairment rose €31m to €174m, depreciation & provisions were up €13m and interest doubled to €28m.

Even though Real Madrid and Atleti saw profits fall in 2019/20, due to the pandemic, they both just about managed to break-even, so #FCBarcelona €97m loss is a real outlier. Worth noting Barca’s figures include €43m losses from other sports, eg. basketball €28m, handball €7m.

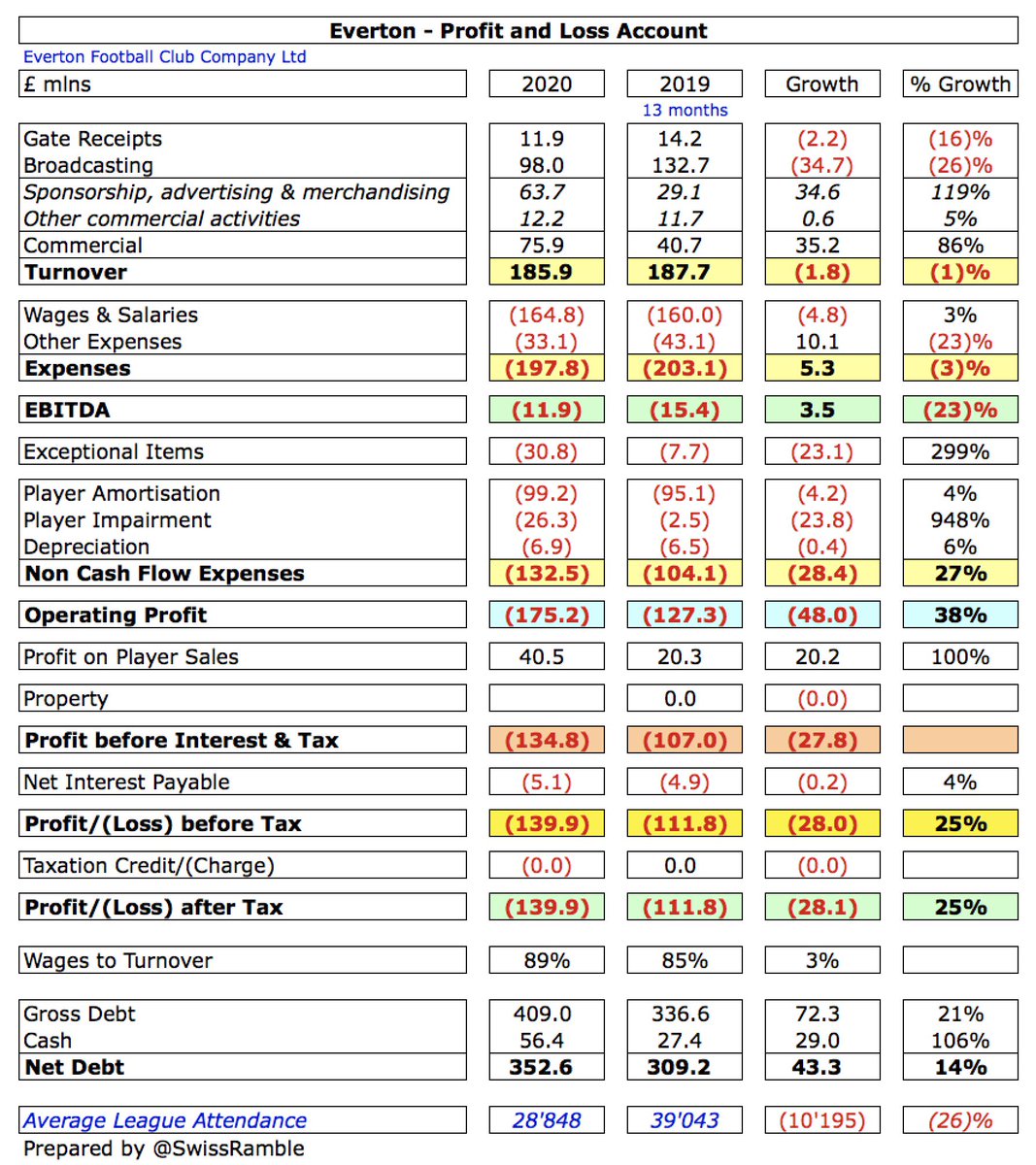

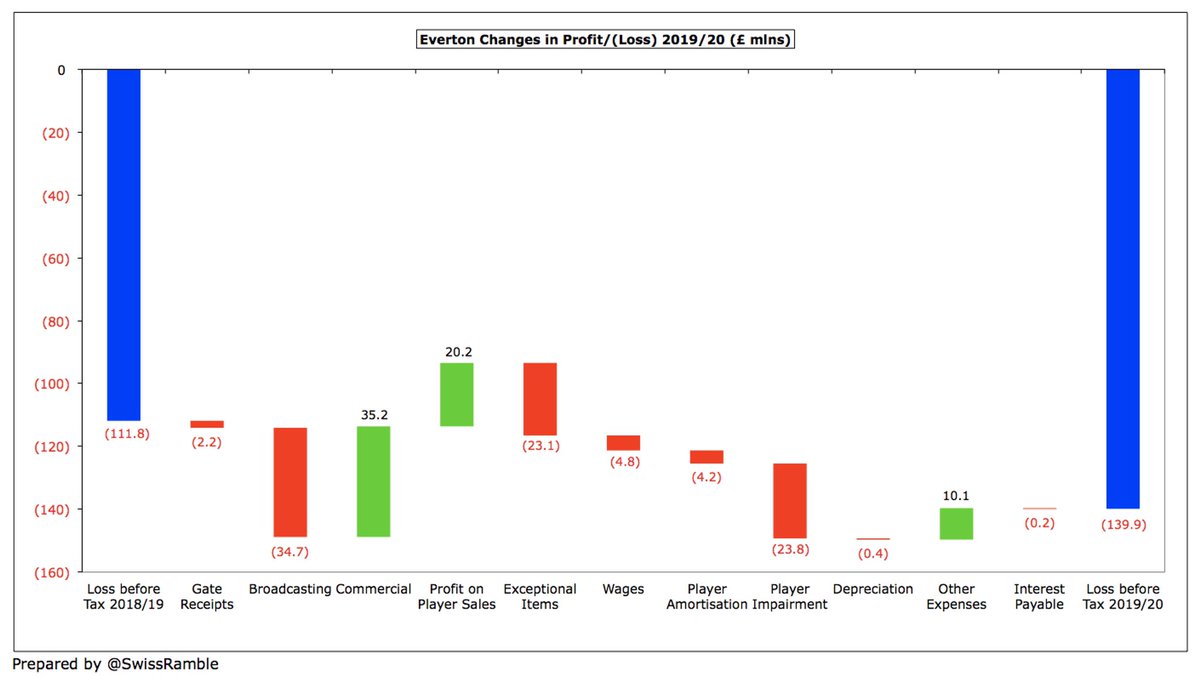

Clearly, COVID has had a major adverse impact on finances in 2019/20 with many leading clubs across Europe reporting horrific losses, e.g. Roma €204m, Milan €195m, Everton €158m, Inter €100m, Juventus €90m and Tottenham €72m, so #FCBarcelona are not alone.

#FCBarcelona were keen to emphasise that without COVID they would have posted a €2m profit, instead of a €128m loss. The net operational impact was €130m, comprising €203m revenue loss, partially offset by €73m cost savings (wages €44m, other €30m).

#FCBarcelona benefited from €73m profit on player sales, including Arthur to Juventus, Malcolm to Zenit, Perez to Roma, Cucurella to Getafe and Ruiz to Braga. That’s pretty good, but less than prior season’s €101m and below Atleti €136m and Real Madrid €101m.

Before last season’s €128m loss, #FCBarcelona had reported profits 8 years in a row, aggregating around a quarter of a billion pre-tax in this period. Large €83m loss in 2010 due to €89m of provisions and audit adjustments. Club has budgeted €1m profit for 2020/21.

Like many other clubs, #FCBarcelona have become increasingly reliant on player sales with average annual profits from this activity nearly quadrupling in last 3 years to €127m, including Neymar’s lucrative sale to PSG in 2018. However, 2020/21 budget only assumes net €28m.

#FCBarcelona EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered cash operating profit, fell from €179m to €104m (including player sales). Club said this would have risen to €234m without the impact of COVID.

Excluding player sales and interest), #FCBarcelona operating loss more than doubled from €83m to €173m in 2019/20 (€9m profit just 3 years ago). In fairness, most football clubs post operating losses, but Barca’s was one of the highest of Money League clubs in 2018/19.

Despite the steep revenue decrease, #FCBarcelona ongoing revenue has still grown €39m (6%) since 2018 from €690m to €729m, though by the club’s definition (including player sales and impairment reversals) revenue has decreased by €59m from €914m to €855m in that period.

Without the pandemic, #FCBarcelona said they would have achieved their objective of reaching €1 bln revenue (including player sales) in 2019/20, i.e. growing €69m from €990m to €1,059m. The €203m loss comprised stadium €67m, TV €35m, commercial €72m and transfers €29m.

#FCBarcelona have estimated a further €64m reduction in revenue in 2020/21 from €855m to €791m, partly mitigated by including TV money for 2019/20 competitions completed in July and August. That would mean a total revenue loss of nearly half a billion (€470m) over two years.

#FCBarcelona €123m revenue decrease in 2019/20 to €729m is much higher than Real Madrid’s €42m fall to €715m and Atleti’s €10m drop to €358m. That said, the Catalans’ revenue is still €14m higher than Madrid and twice as much as Atleti.

Of course, #FCBarcelona and Real Madrid revenue continues to put them in a league of their own in Spain. Their combined €1.4 bln revenue is more than all the other La Liga clubs combined (excluding Atletico Madrid).

Most clubs that have so far published 2019/20 accounts have announced significant revenue reductions, but #FCBarcelona €123m decrease has only been surpassed by #MUFC €133m, though their 14% drop is not as high as others in percentage terms.

In the last edition of the Deloitte Money League, based on 2018/19 accounts, #FCBarcelona overtook Real Madrid to have the highest revenue of any football club in the world, partly due to taking merchandising inhouse. Mix: commercial 46%, broadcasting 35% and match day 19%.

#FCBarcelona marketing & advertising revenue fell €40m (11%) to €323m, as club could not complete deals and retail stores were closed due to pandemic. In 2018/19 their commercial income of €384m was highest in Europe, ahead of PSG €363m, Bayern €357m and Real Madrid €355m.

#FCBarcelona have extended Rakuten shirt sponsorship by 1 year to June 2022, though media reports suggest that value has reduced from €55m to €30m. Nike €105m kit deal runs to 2028, while Beko sleeve/training deal worth €19m a year will expire in 2021.

#FCBarcelona broadcasting income fell €50m (17%) from €298m to €248m, partly due to 7 games played after 30 June accounts close, so revenue deferred to 20/21 accounts. Had 2nd highest TV revenue in the world prior year, just below #LFC €299m, but well ahead of Madrid €258m.

After years of individual deals in Spain, La Liga have introduced a collective deal, based on 50% equal share, 25% performance over last 5 years and 25% popularity (1/3 for average match day income, 2/3 for number of TV viewers). Gross income reduced by liabilities (7%).

Even after the changes, #FCBarcelona €153m and Real Madrid €145m still receive by far the highest TV income from La Liga’s TV deal, followed by Atletico Madrid €116m, then a big gap to Valencia €76m and Sevilla €73m. Lowest payment went to Mallorca €41m.

#FCBarcelona benefited from La Liga international TV deal rising by 30% in 2019/20, giving total TV rights of €2.0 bln. Although still a long way behind Premier League €3.6 bln, it is comfortably ahead of the others: Bundesliga €1.4 bln, Serie A €1.3 bln & Ligue 1 €1.2 bln.

#FCBarcelona earned €104m for reaching Champions League quarter-final, €13m less than prior season (semi-final), but more than Atleti €95m and Real Madrid received €84m. These figures are before any COVID rebate or deferrals to 2020/21 (last 16 & QF completed after 30 June).

Worth noting the influence on Champions League money of the UEFA coefficient payment (based on performances in Europe over 10 years), where #FCBarcelona had the 2nd highest ranking in 2019/20, giving them €34m. This change in distribution rewards good record of Spanish clubs.

#FCBarcelona have earned a hefty €396m from European competition in the last 5 years, only surpassed in Spain by Real Madrid €419m. Atletico Madrid’s success has brought them €359m, then a big gap to Sevilla €164m, Valencia €147m, Villarreal €65m and Athletic Bilbao €35m.

#FCBarcelona competitions revenue fell €33m (29%) to €81m, while season tickets & memberships were down €6m (9%) to €55m, as 6 home games were played behind closed doors. In 2018/19 they had the highest revenue in the world from match day with €159m, above Madrid €145m.

#FCBarcelona average attendance fell 29% from 75,328 to 53,400, the highest in Spain, ahead of Real Madrid 45,662 & Atletico Madrid 42,146. Impacted by games played without fans after La Liga suspended in March. Club expects no fans to February, 25% to May and 50% last 2 months.

#FCBarcelona Espai project, including Camp Nou redevelopment to increase capacity from 99,000 to 105,000 and add a roof, will cost €815m. Club looking for €150m additional revenue per annum: naming rights & sponsorships €50m, VIP boxes €50m, tickets, catering & events €50m.

#FCBarcelona football wages fell €58m (12%) from €501m to €443m, partly due to €32m lower bonuses, but still up by 30% (€103m) in 3 years. Total wages including other sports €487m – €513m including image rights. Budgeted to decrease a further €81m to €362m in 2020/21.

#FCBarcelona €443m wage bill is €65m higher than Real Madrid’s €378m, though the gap has more than halved in 2019/20. Nearly twice as much as Atletico Madrid €227m. Many players have since come off the wage bill: Luis Suarez, Vidal, Arthur, Rafinha, Semedo and Rakitic.

Not only is #FCBarcelona’s wage bill the highest in Spain, but their €501m in 2018/19 was also by some distance the highest in Europe, miles more than the closest challengers #MUFC €377m, PSG €371m, Real Madrid €362m, #MCFC €358m, Bayern €356m and #LFC €352m.

#FCBarcelona wages to turnover ratio worsened from 59% to 61%, still one of the better performances in Spain, but worse than Real Madrid 53%. In 2018/19 their ratio was pretty much the norm in Europe, a fair bit better than the likes of Roma 78% and Juventus 66%.

The other #FCBarcelona staff cost, player amortisation, the annual charge to write-down transfer fees over the length of a player’s contract, has risen by €28m (20%) from €146m to €174m, which means this expense has increased by over €100m in just 3 years.

#FCBarcelona total amortisation of €192m (including €18m depreciation) is the highest in Spain, above Real Madrid €177m and Atletico Madrid €135m. Reflects 2019/20 purchases of Griezmann (Atleti), Pjanic (Juventus), Junio Firpo (Betis) and Braithwaite (Leganes).

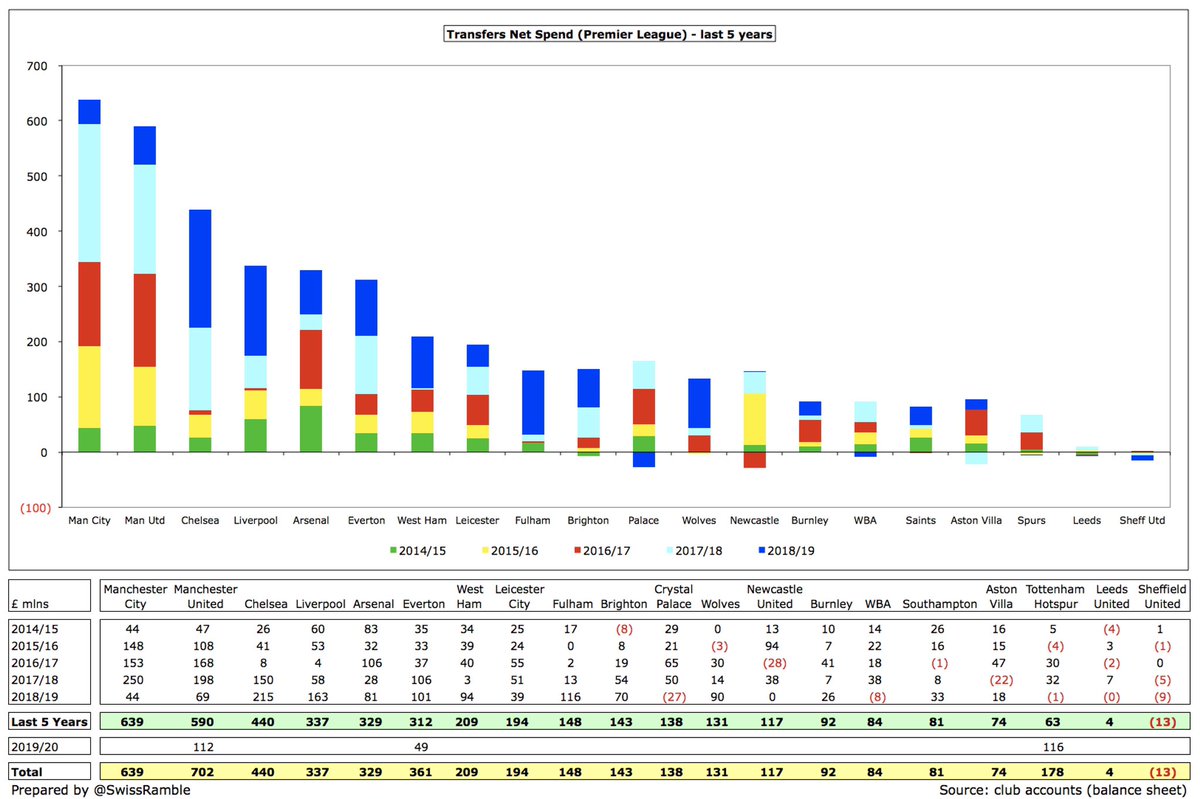

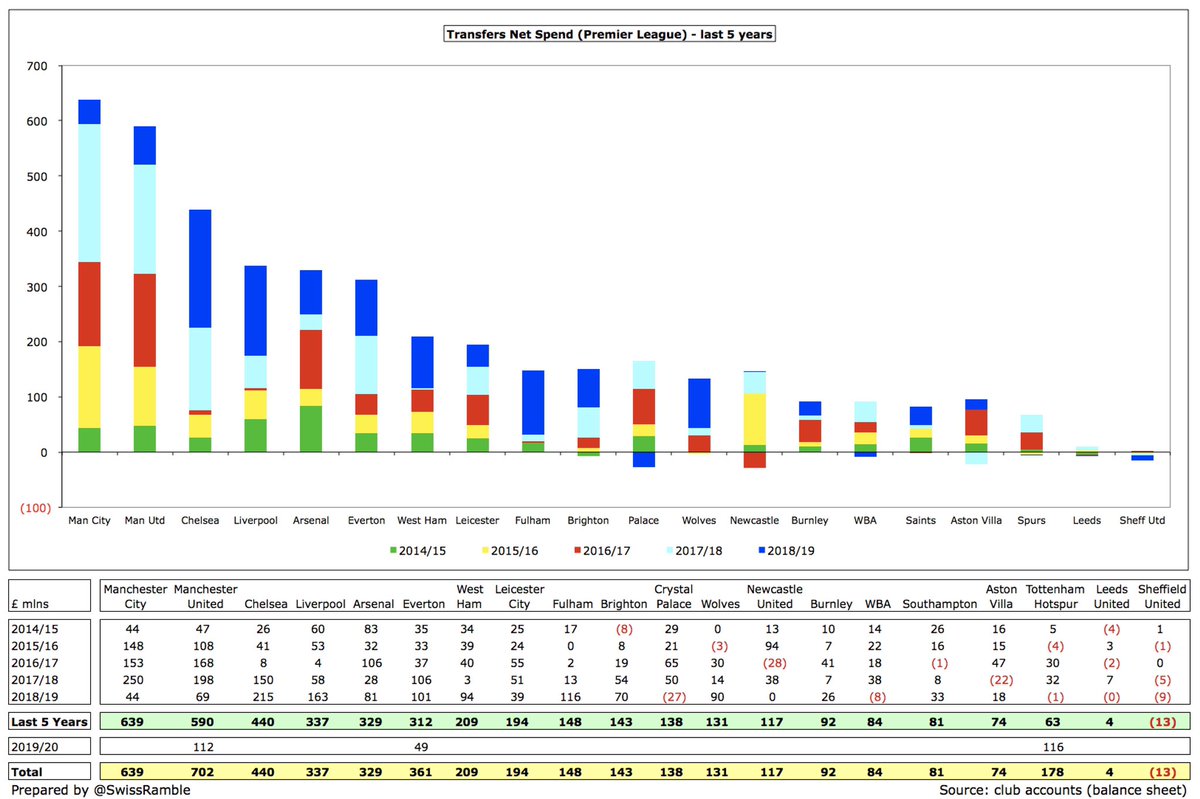

#FCBarcelona net transfer spend has more than doubled in the last 3 seasons, averaging €132m, compared to €64m over the preceding 5 seasons. The increase in gross spend is even more dramatic (€103m to €320m), but sales have also significantly increased (€40m to €189m).

Based on Transfermarkt figures, #FCBarcelona €359m net spend in the last five seasons (including €8m net sales in 2020/21 to date) is by far the highest in La Liga, nearly €300m more than Sevilla €75m, Atletico Madrid €72m and Real Madrid €56m.

It’s a similar story in gross spend with #FCBarcelona massive €1.0 bln around €400m more than their closest rivals, Atletico Madrid €668m and Real Madrid €589m. In fact, Barca’s expenditure is about the same as the bottom 15 La Liga clubs combined.

#FCBarcelona gross financial debt shot up by a striking €208m from €272m to €480m, comprising €279m bank loans and €201m bonds, which means a hefty €412m increase in only 2 years. Cash was relatively flat at €162m, so net debt grew from €114m to €318m.

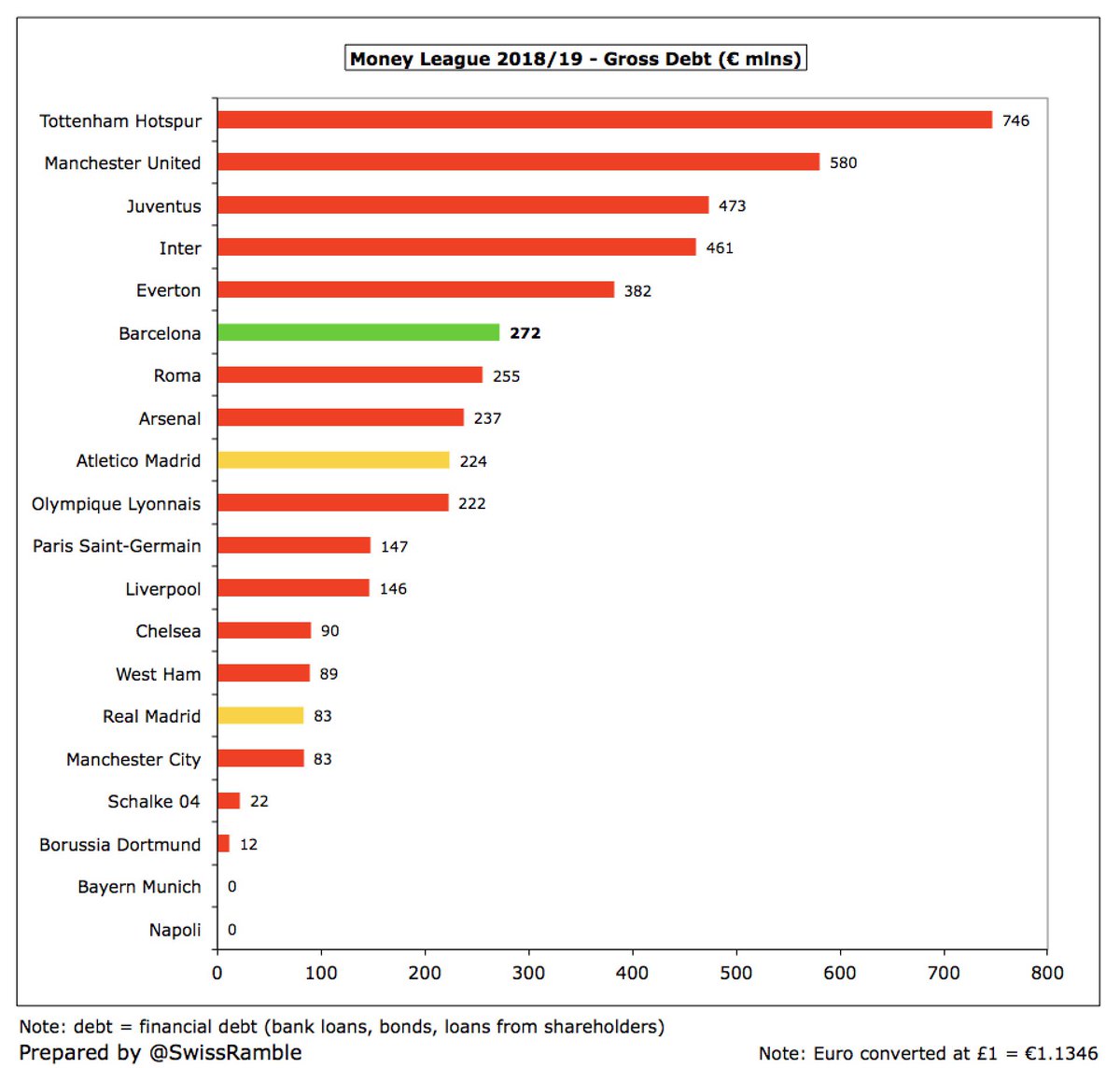

Per #FCBarcelona definition, including transfer debt, gross debt increased from €554m to €820m, while net debt more than doubled from €217m to €488m. In 2018/19 their €272m gross financial debt was 6th highest in Europe, far below #THFC €746m (new stadium) and #MUFC €580m.

#FCBarcelona net interest doubled from €14m to €28m, only below Atletico Madrid’s €34m in Spain, though budgeted to rise to €31m in 2020/21. Many clubs are raising more debt, which means higher interest charges, e.g. in 18/19 Inter €29m, #THFC €29m, Roma €28m & #MUFC €26m

#FCBarcelona transfer fees debt rose from €261m to €323m, up from €64m in 2017. Net payables of €155m after considering €168m owed by other clubs. Mainly owed for Coutinho (Liverpool) €69m, De Jong (Ajax) €64m and Pjanic (Juventus) €58m. Already highest in Europe in 2019.

Using the broadest possible definition of debt, #FCBarcelona total liabilities have increased €212m to €1.4 bln, including personnel €205m and public administrations €55m. Their €1.2 bln was only surpassed by #THFC €1.5 bln in 2018/19; around the same as #MUFC.

#FCBarcelona’s debt is very concerning, even before huge financing required for Espai/stadium project. Per the accounts, they need to pay €395m in next 12 months (bank €269m, transfers €126m) plus withheld wages, so reports that club is looking to reschedule are unsurprising.

#FCBarcelona lost €25m cash from operating activities in 2019/20, but then spent €97m (net) on players, €58m capital expenditure and £24m interest, benefiting from €3m tax credit. The expenditure was funded by €205m bank loans, so cash balance increased by €4m.

In last 10 years #FCBarcelona had €1.4 bln available cash (operations £1 bln, loans €374m), spending €760m (net) on players. Also invested €345m into infrastructure (Espai Barca & stadium), €62m on tax and €61m on interest payments, while increasing cash balance by €160m.

#FCBarcelona have been severely hit by COVID, but their model was already under severe pressure with an enormous wage bill and astronomical transfer spend funded by significant debt. Messi’s sale last summer would have been the smart thing to do. A period of austerity is likely.

• • •

Missing some Tweet in this thread? You can try to

force a refresh