Brighton and Hove Albion’s 2019/20 accounts cover their third season in the Premier League, when they finished 15th, an improvement on prior season’s 17th, under new head coach Graham Potter, but their finances were significantly impacted by the COVID-19 pandemic #BHAFC

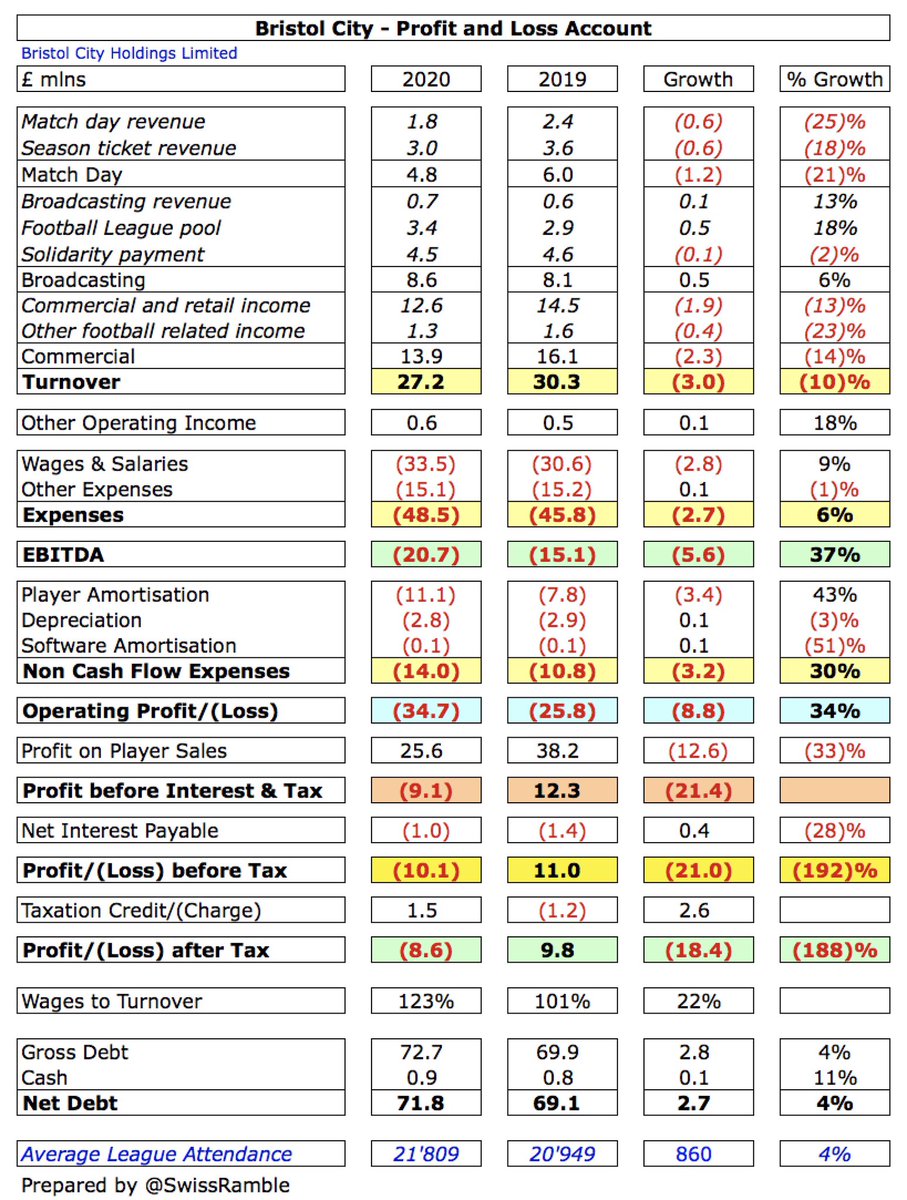

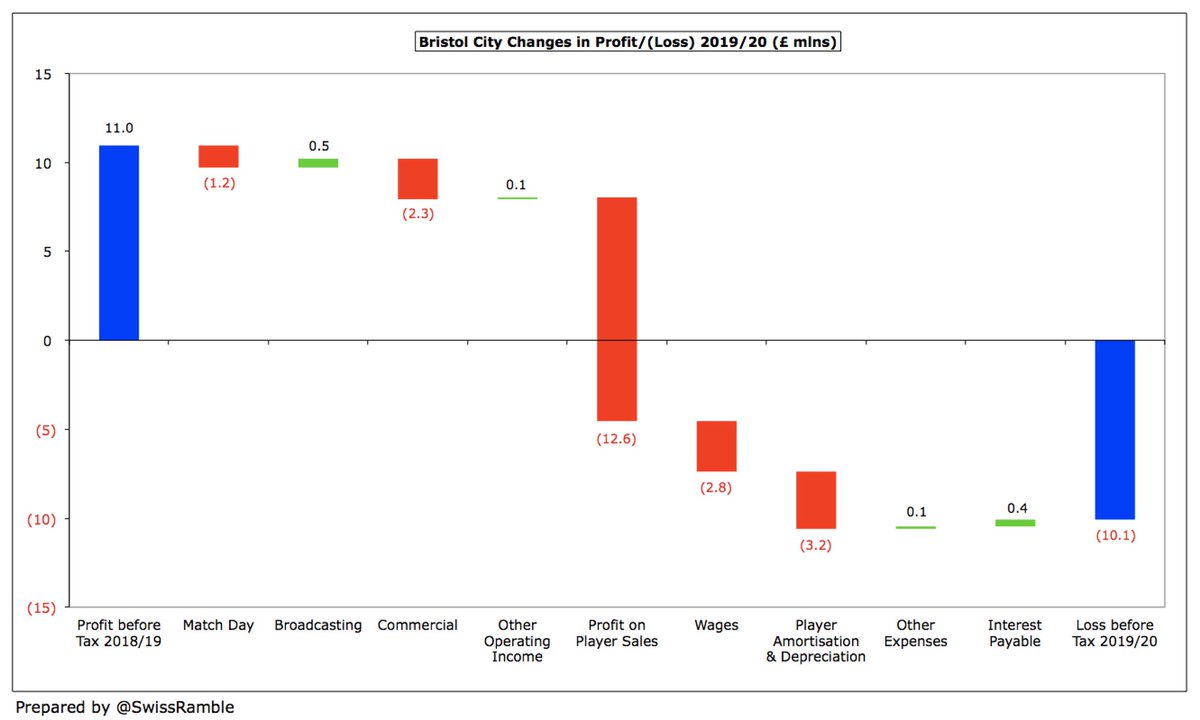

#BHAFC loss before tax tripled from £22m to £67m, a £45m decline, as revenue decreased by £15m (10%) from £148m to £133m, while profit on player sales of £5m became a loss of £1m, and expenses rose £24m (14%). Monks Farm development worth £0.6m (revenue £9.4m, costs £8.8m).

As a technical aside, #BHAFC have restated their 2018/19 accounts, increasing revenue by £4.8m from £143.4m to £148.2m, but this has been offset by a corresponding increase in other expenses, so net profit is unchanged.

#BHAFC £15m revenue fall was mainly due to COVID, which severely impacted all revenue streams, especially broadcasting, down £24m (21%) from £114m to £90m and match day, down £5m (27%) from £19m to £14m. Commercial £13m (82%) increased from £16m to £29m, due to Monks Farm £9m.

#BHAFC wage bill rose slightly (2%) from £102m to £103m, while player amortisation shot up £12m (37%) to £46m and other expenses increased £10m (29%) from £32m to £42m, including £9m for Monks Farm. Net interest payable up £0.7m to £3.3m.

#BHAFC £67m loss is obviously not great, but it is only 4th worst to date in 2019/20 Premier League, beaten by #EFC £140m, #SaintsFC £76m and #THFC £68m. Due to the pandemic, it is likely that other clubs will also post substantial losses when they publish their 19/20 accounts.

Without COVID #BHAFC loss would have been £25m lower, but still almost doubling from £22m to £42m. Revenue impact was £26m, mainly broadcasting £20m (rebates and deferrals to 2020/21 accounts) and match day £6m, while £1m savings from deferred player bonuses.

#BHAFC actually made £0.6m loss on player sales, down from £5.2m profit last season. Premier League profits here are lower in 2019/20, but Brighton are smallest, way below #EFC £40m. However, they did not cash in on in demand players like Yves Bissouma, Ben White & Tariq Lamptey.

#BHAFC have made very little money from player sales. In fact, they have reported just £25m profit from this activity in the last 10 years, only twice achieving more than £5m. The 2020/21 accounts will be boosted by the sales of Knockaert to Fulham and Mooy to Shanghai SIPG.

In fact, #BHAFC £19m profit from player sales in 5 years up to 2019 was the lowest in the Premier League. In stark contrast, #CFC and #LFC made over £300m. Finance Director David Jones said, “Going forward, to reduce the deficit, player trading needs to be part of the business.”

#BHAFC have only posted a profit once in the last 10 years, in 2017/18 following promotion to the top flight. In that time, the club has accumulated £195m of losses, averaging £19m a year. Profitability has been declining since that first season in the Premier League.

#BHAFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, fell from £14m to £(12)m. This is one of the worst in the Premier League, though likely to be overtaken by others when 2019/20 accounts published.

#BHAFC operating loss (i.e. excluding player sales and interest) widened from £25m to £63m. Very few Premier League clubs make operating profits, but Brighton’s loss is (currently) one of the highest this season, though nowhere near as bad as #EFC £175m.

Despite last season’s decrease, #BHAFC £133m revenue is still over £100m more than the £29m reported in the Championship promotion season. Excluding £9.4m from Monks Farm residential and commercial development, revenue fell 17% (£25m) compared to 2018/19.

Due to the impact of the pandemic, #BHAFC £133m revenue is one of the smallest in the Premier League, though almost all clubs are lower in 2019/20, due to the pandemic. Either way, miles below the “Big Six”, e.g. #MUFC £509m, #LFC £490m and #MCFC £482m.

#BHAFC 10% revenue reduction over prior year in 2019/20 is smaller than other clubs who have reported to date like #MUFC 19%, #SaintsFC 15% and #THFC 15%, though Brighton would have been 17% without including revenue from the Monks Farm project.

#BHAFC were not included in the Deloitte Money League, which ranks clubs globally by revenue, presumably because they have excluded £9m for the Monks Farm project. That would give adjusted revenue of £124m, compared to 30th placed Milan £130m.

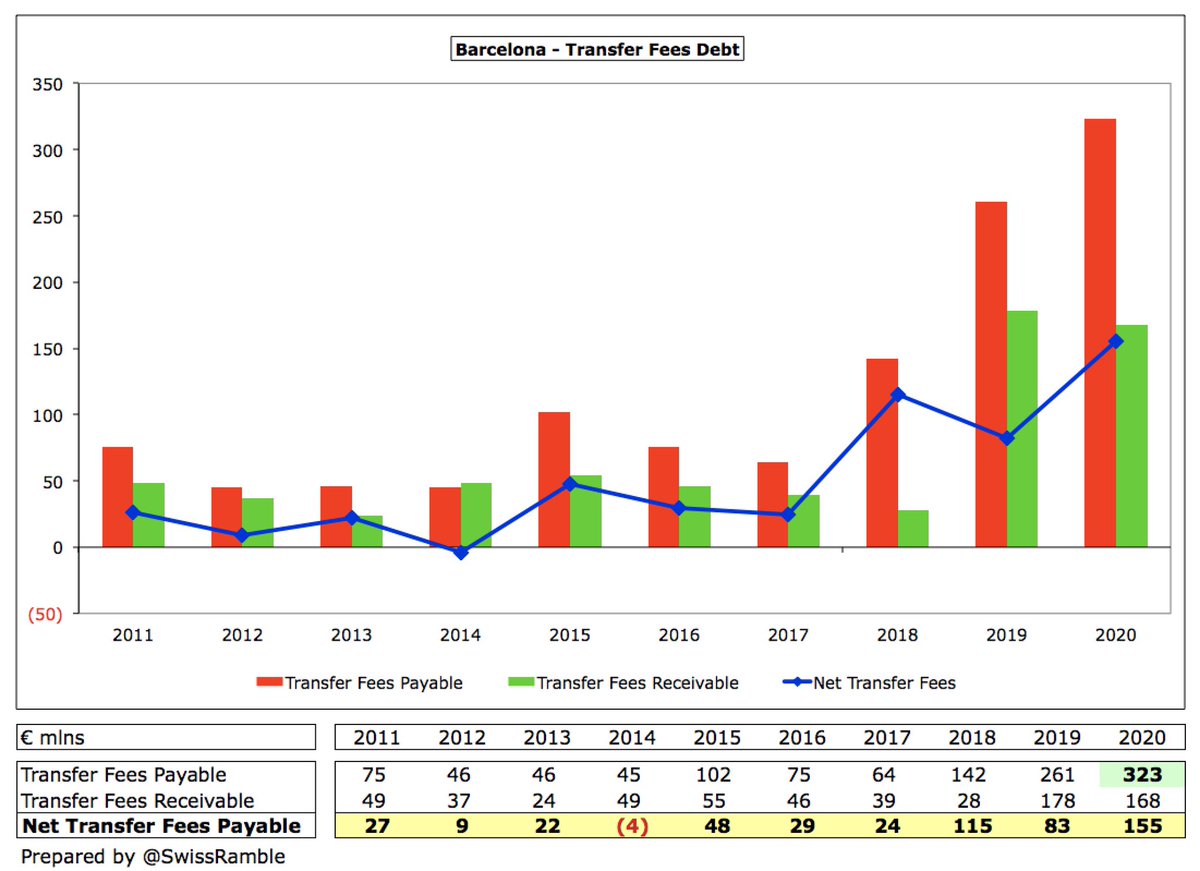

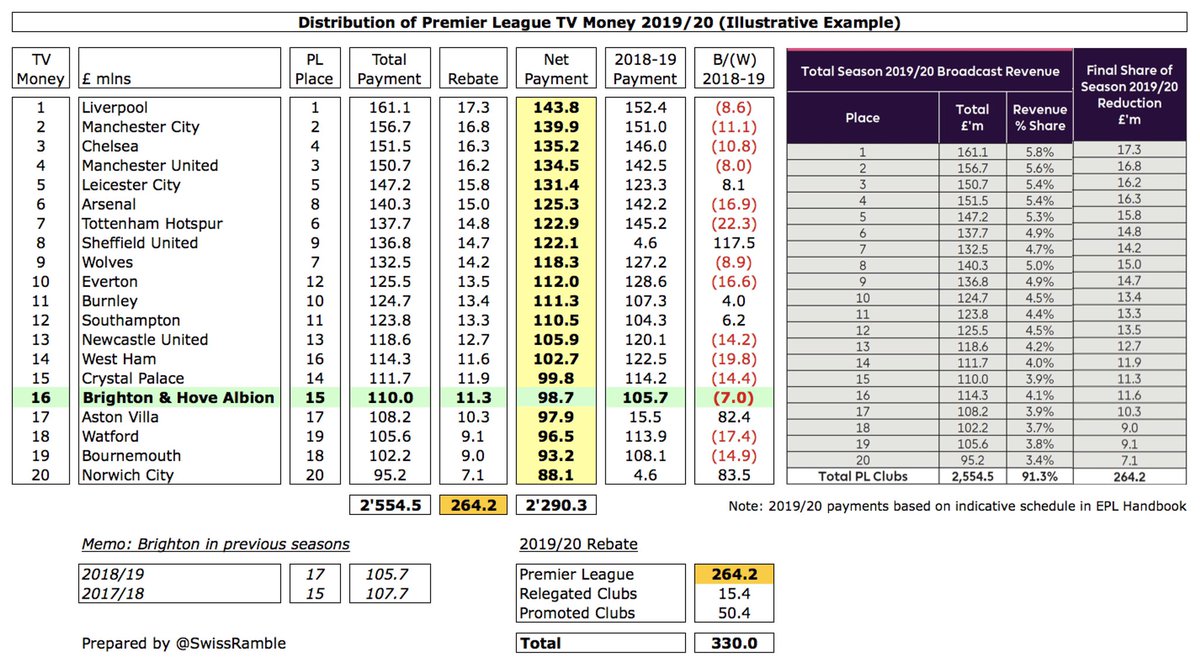

#BHAFC broadcasting income fell £23m (21%) from £113m to £90m, due to revenue from 6 games slipping to 2020/21 accounts (plus rebate to broadcasters), offset by better Premier League finishing position. Lowest in the Premier League, but other clubs will also fall in 2019/20.

As the 2019/20 season was extended beyond the 30th June accounting close, #BHAFC Premier League TV money was lower than prior year, though much of the revenue decrease has been deferred into the 2020/21 accounts, so is only a timing difference.

#BHAFC match day revenue fell £5m (27%) from £19m to £14m, due to the suspension of the season, then playing 5 games behind closed doors after the resumption. Income very low compared to elite clubs, e.g. #THFC earned around 7 times as much (£95m).

#BHAFC average attendance fell slightly from 30,426 to 30,359, based on a calculation for games played with fans. Still only 14th highest in the Premier League, though Seagulls fans will note that it is 5,000 more than Crystal Palace. Ticket prices increased 1-2% in 2020/21.

#BHAFC are considering an increase in capacity at the Amex Stadium from 30,750 to around 32,000, as the club has an 8,000 waiting list for season tickets, though the pandemic might have an impact here.

#BHAFC commercial income rose £13m (82%) from £16m to £29m, mainly due to the inclusion of £9.4m from the Monks Farm project and higher player loans (Knockaert to #FFC, White to #LUFC) in other income. Commercial had been rising until COVID struck. Mid-table in Premier League.

#BHAFC American Express shirt (and stadium naming rights) sponsor was lowest in the Premier League at £1.5m, though a new £100m 12-year deal (£8.3m a year) started this season. Kit supplier Nike extended to 2022, while sleeve sponsor JD Sports has been replaced by SnickersUK.

#BHAFC wage bill increased slightly (2%) to £103m, due to the desire “to be competitive in the Premier League.” Underlying increase was higher, as previous season included cost of change in management, while some bonuses deferred to 2020/21 accounts.

#BHAFC wage bill of £103m is currently 13th highest in Premier League, £11m below #SaintsFC £114m as a comparison, though other clubs’ wages may well reduce when 2019/20 accounts are published.

#BHAFC wages to turnover ratio increased from 69% to 78%, 5th highest (worst) in the Premier League, though better than #SaintsFC 90% and #EFC 89%. Could well be overtaken when other clubs publish 2019/20 accounts. Excluding impact of pandemic, would have fallen to 66%.

#BHAFC highest paid director, chief executive Paul Barber, saw his remuneration increase from £1,496,000 to £2,022,000, due to a once-off loyalty bonus and benefits related to retention and personal performance. One of the best paid in English football.

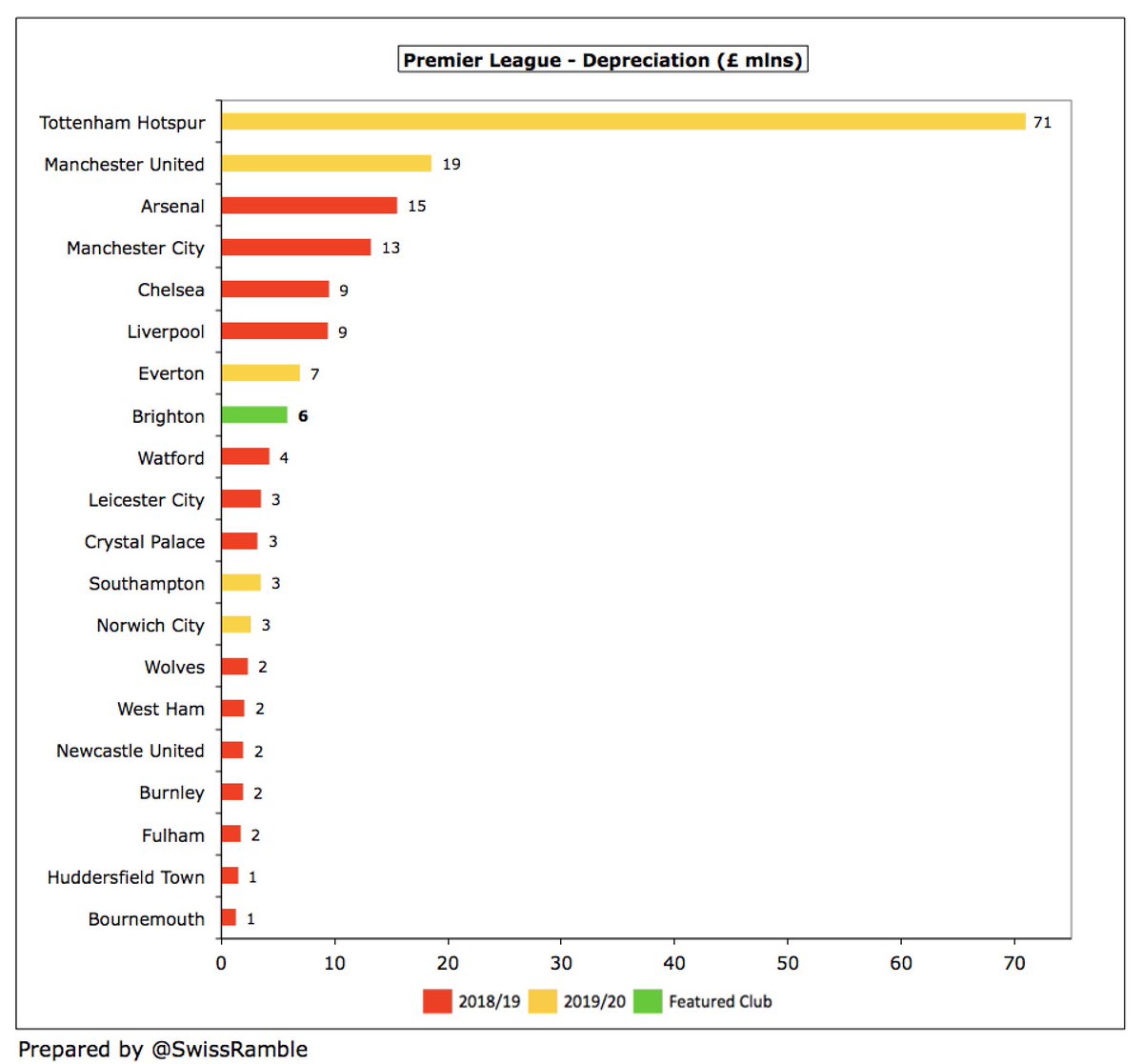

#BHAFC player amortisation, the annual charge to write-down transfer fees over the life of a player’s contract, rose by £13m (37%) from £33m to £46m, reflecting investment in the playing squad. This expense has shot up from just £6m in 2017 (last season in the Championship).

Despite this growth, #BHAFC player amortisation of £46m is still firmly in the bottom half of the Premier League, £11m below #SaintsFC. For even more perspective, it is around a quarter of big spending #CFC £168m.

#BHAFC depreciation has also increased from just £100k in 2011 to £6m, reflecting the club’s investment in infrastructure (stadium and training ground). This is actually the 8th highest in the Premier League, only behind the “Big Six” and #EFC.

#BHAFC other expenses rose £10m (29%) from £32m to £42m, mainly due to £8.8m cost of sales for the Monks Farm project. Also includes the travel subsidy for rail and bus transport to the stadium, stadium maintenance and security, plus increased investment in women’s football.

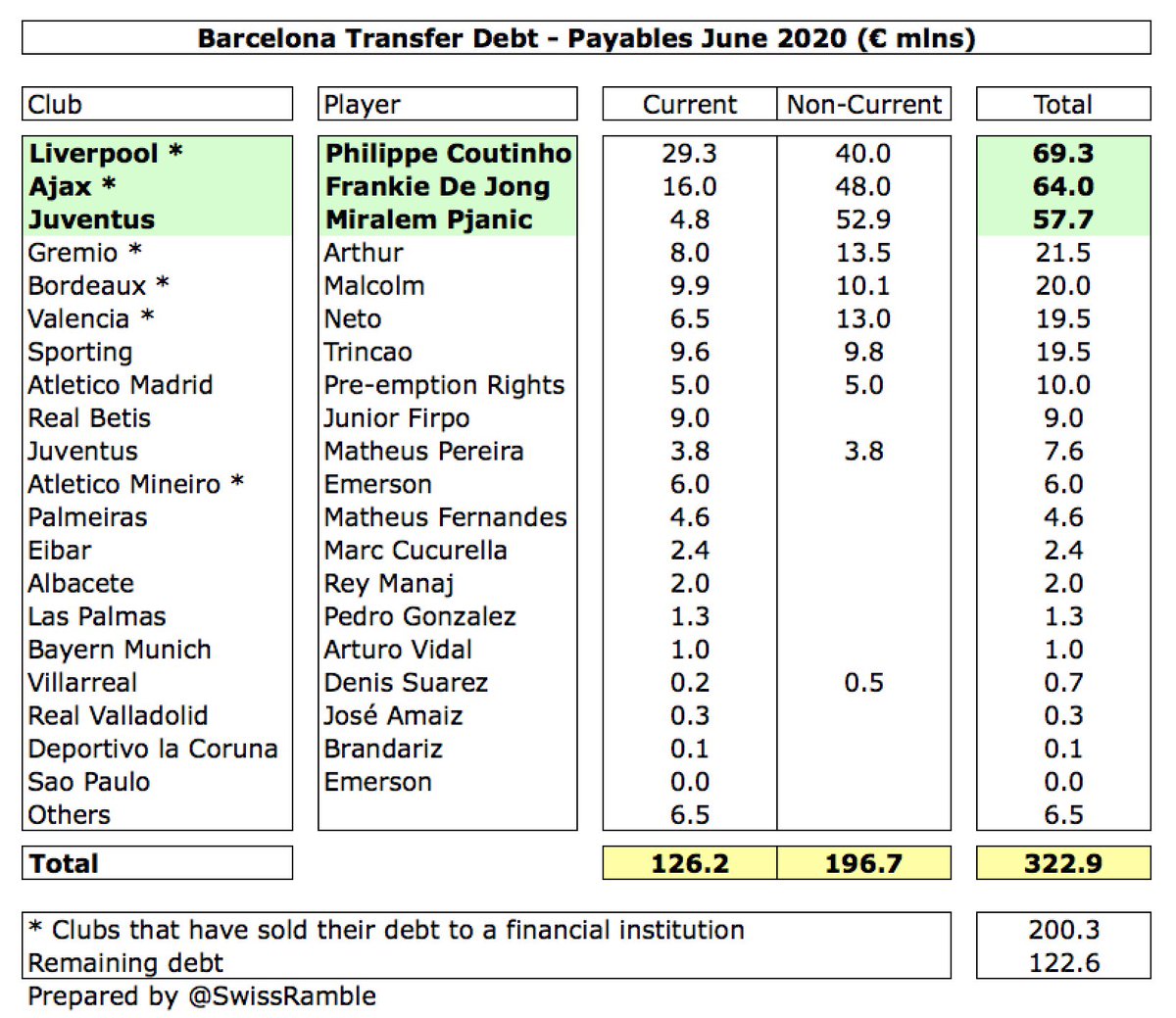

#BHAFC made £56m player purchases, including Adam Webster (Bristol City), Neal Maupay (Brentford) and Tariq Lamptey (Chelsea). This was less than the previous season’s club record of £78m and is still in bottom half of the top flight.

#BHAFC transfer spend has clearly increased since promotion to the Premier League, amounting to £191m in last 3 years, compared to £44m in preceding 7 years. Lower outlay last summer included Jakub Moder, Michal Karbownik, Andi Zeqiri, Jan Paul van Hecke and Joel Veltman.

#BHAFC gross debt increased by £26m from £280m to £306m, very largely from owner Tony Bloom in the shape of an interest-free, unsecured loan of £304m (up £32m). Overdraft cut by £6m from £8m to £2m. Since accounts closed, have taken on £37m bank loan against future TV money.

#BHAFC £306m gross debt is 4th highest in the Premier League, only behind #THFC £831m (new stadium), #MUFC £526m and #EFC £409m. However, the loans from Bloom can be considered as the friendliest of debt (he has converted £30m of debt to equity in the past).

#BHAFC debt is undoubtedly very high for a club of their size, though it is not an issue, so long as Bloom continues to provide support. The fact that his loan is interest-free gives Brighton a competitive advantage against those rivals that have to pay interest on their loans.

That said, #BHAFC have the lowest cash balance in the Premier League with just £4m as at 30th June 2020. At the other end of the spectrum, #THFC have £226m, including £175m funding from the Bank of England’s COVID facility.

#BHAFC transfer fees debt has also increased from £23m to £37m, though £3m is owed by other clubs, so net payable is £34m. In addition, contingent liabilities have grown from £21m to £31m. These are potential payables dependent on certain criteria, e.g. player appearances.

The cash flow statement reveals that Tony Bloom had to provide another £32m funding in 2019/20. Although #BHAFC generated £30m cash from operations, partly due to £46m increase in creditors, they spent £39m (net) on players and £14m on infrastructure) mainly the training ground.

This means that Bloom has now provided an incredible £392m of funding to #BHAFC through £303m of loans and £88m of share capital (including £30m loans converted into equity). In 5 years up to 2019, his £160m funding was 5th highest among Premier League owners.

The majority of Bloom’s £392m funding of #BHAFC has gone on investment into the stadium and the training ground (£190m), though a hefty £176m was spent (net) on new players, while £16m was used to cover operating losses and £11m loan repayments.

Despite the losses, the club have confirmed that #BHAFC have complied with all of the Premier League’s Profitability and Sustainability (FFP) rules. This is monitored over 3 years, so includes the £12m profit in 2017/18.

Bloom said, “Our longer-term aim is to establish #BHAFC in the top ten of the Premier League.” That requires significant investment, which has driven losses in last 2 seasons, though also increased the value of the squad. The pandemic continues to adversely impact the finances.

• • •

Missing some Tweet in this thread? You can try to

force a refresh