#BristolCity 2019/20 financial results cover a season when they finished 12th in the Championship. Head coach Lee Johnson was replaced by Dean Holden in July 2020. Finances were impacted by COVID-19. Some thoughts in the following thread.

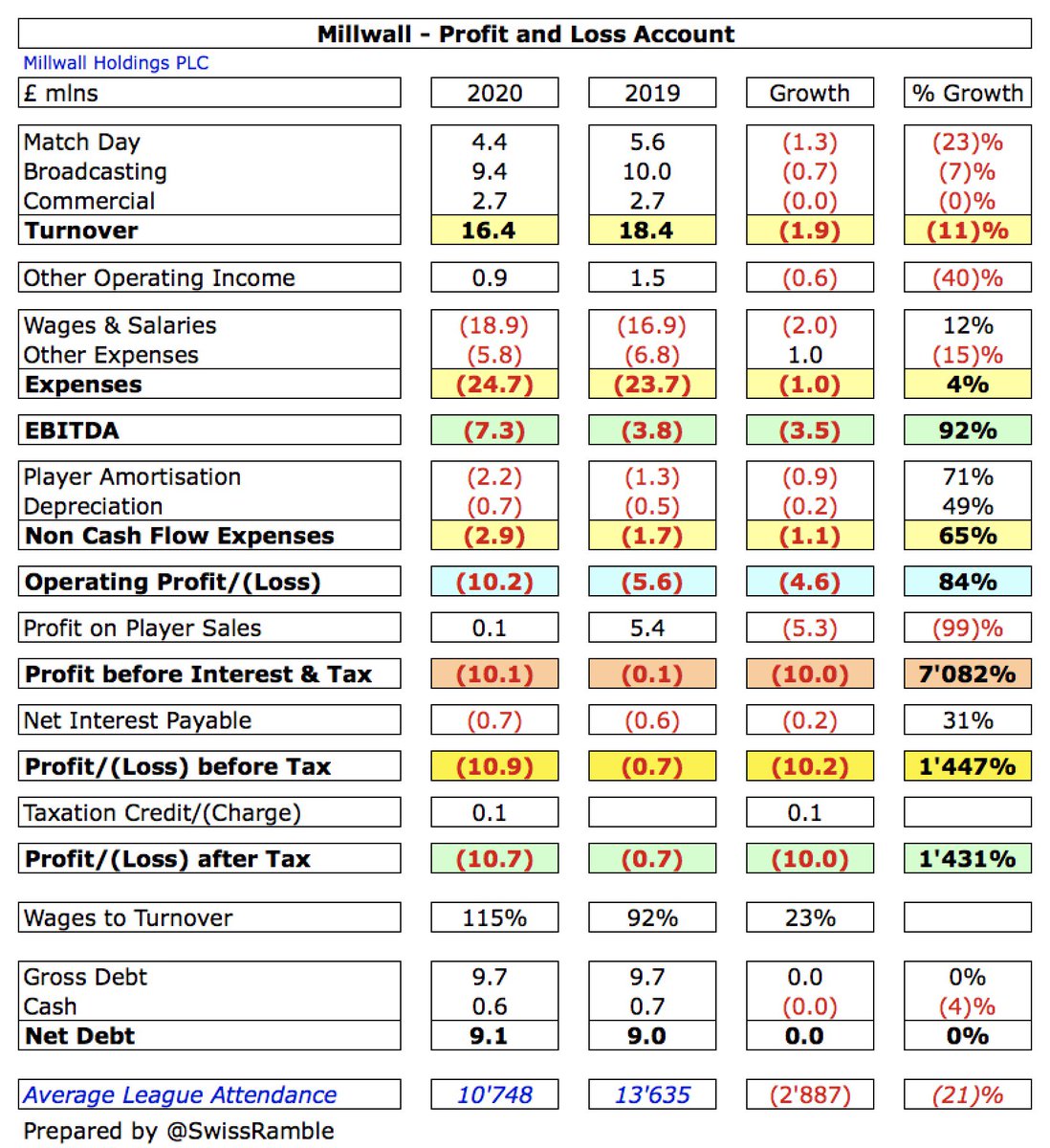

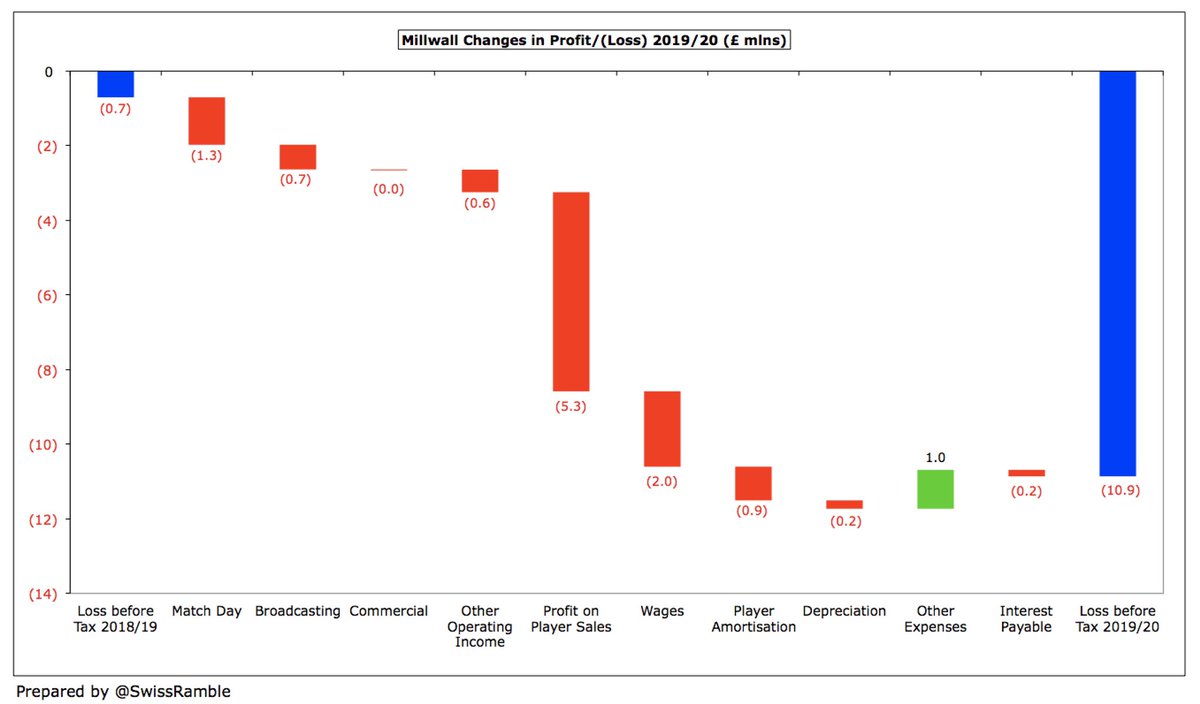

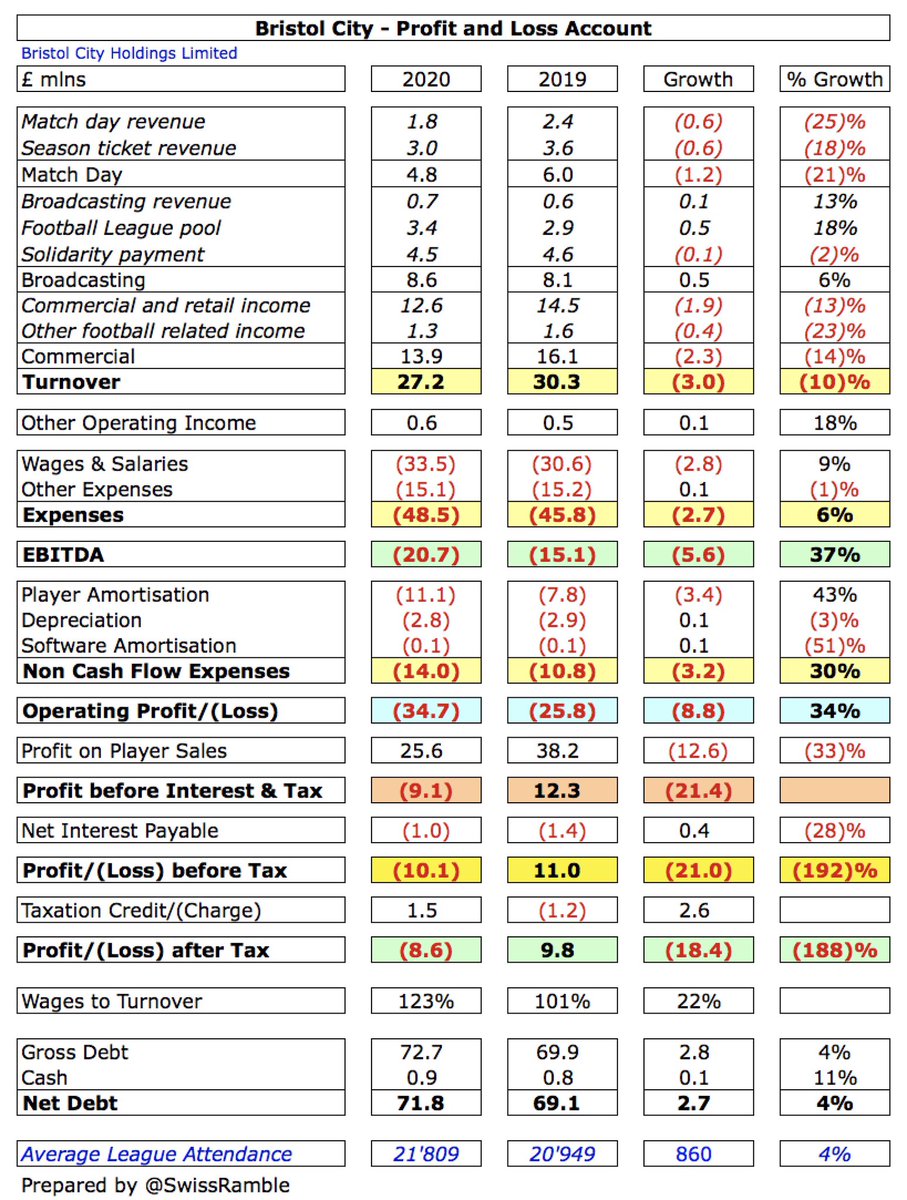

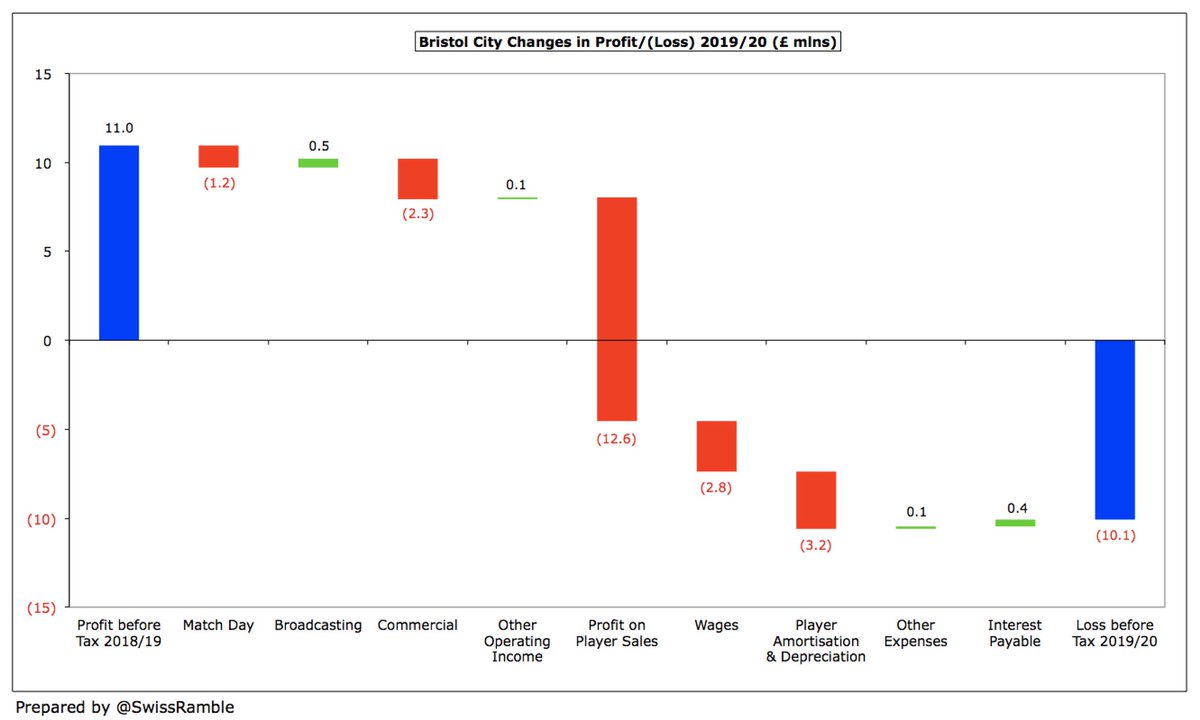

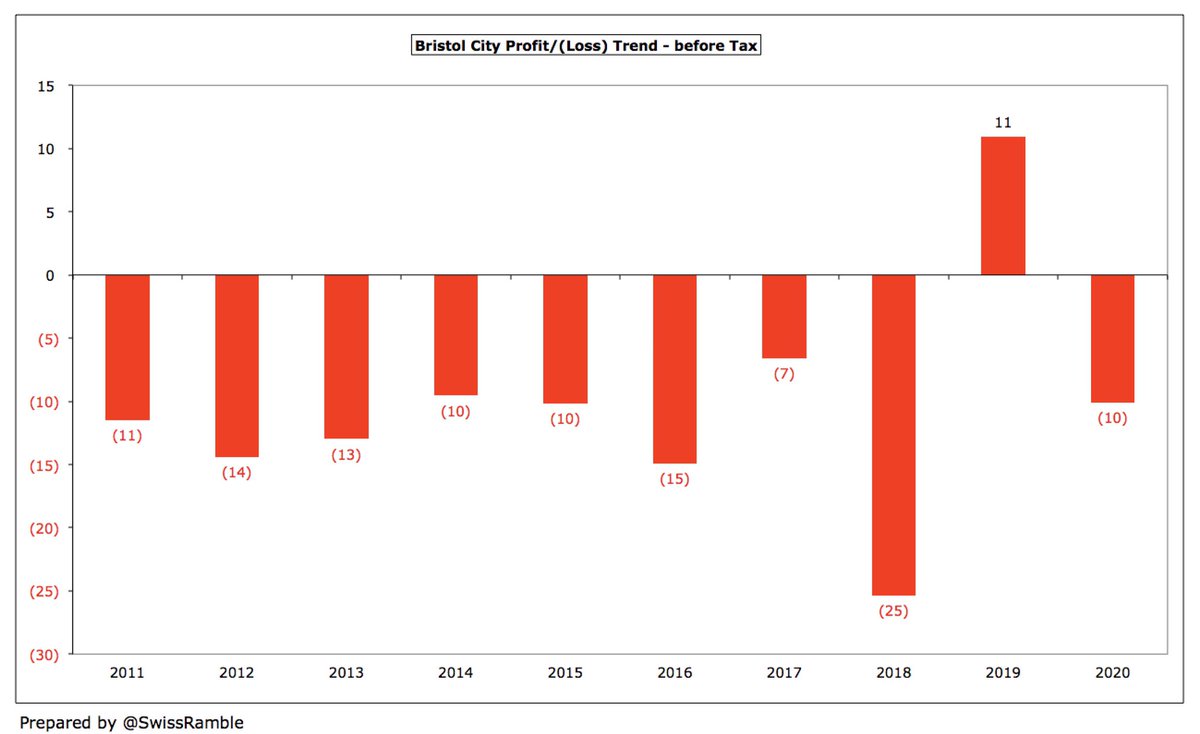

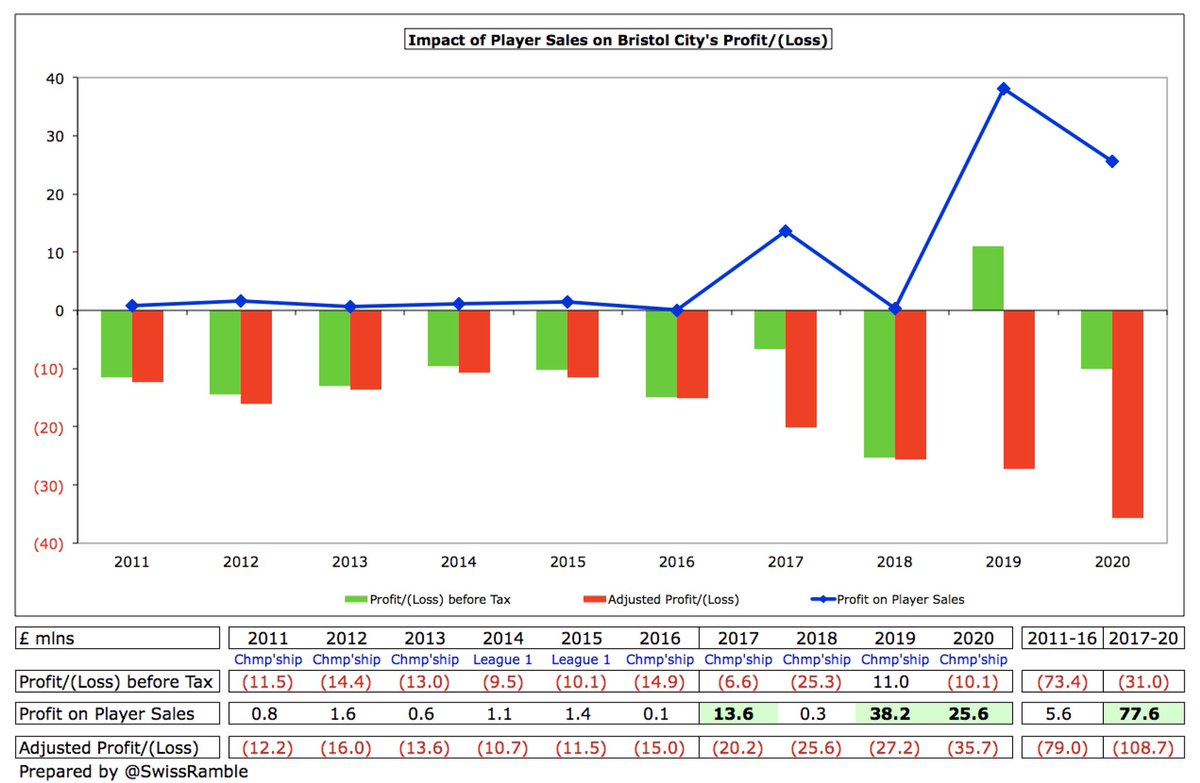

#BristolCity swung from £11m profit before tax to £10m loss, mainly due to profit on player sales falling £12m from £38m to £26m, while revenue dropped £3m (10%) from £30m to £27m and expenses rose £6m (10%) to £64m. After tax, £10m profit to £9m loss.

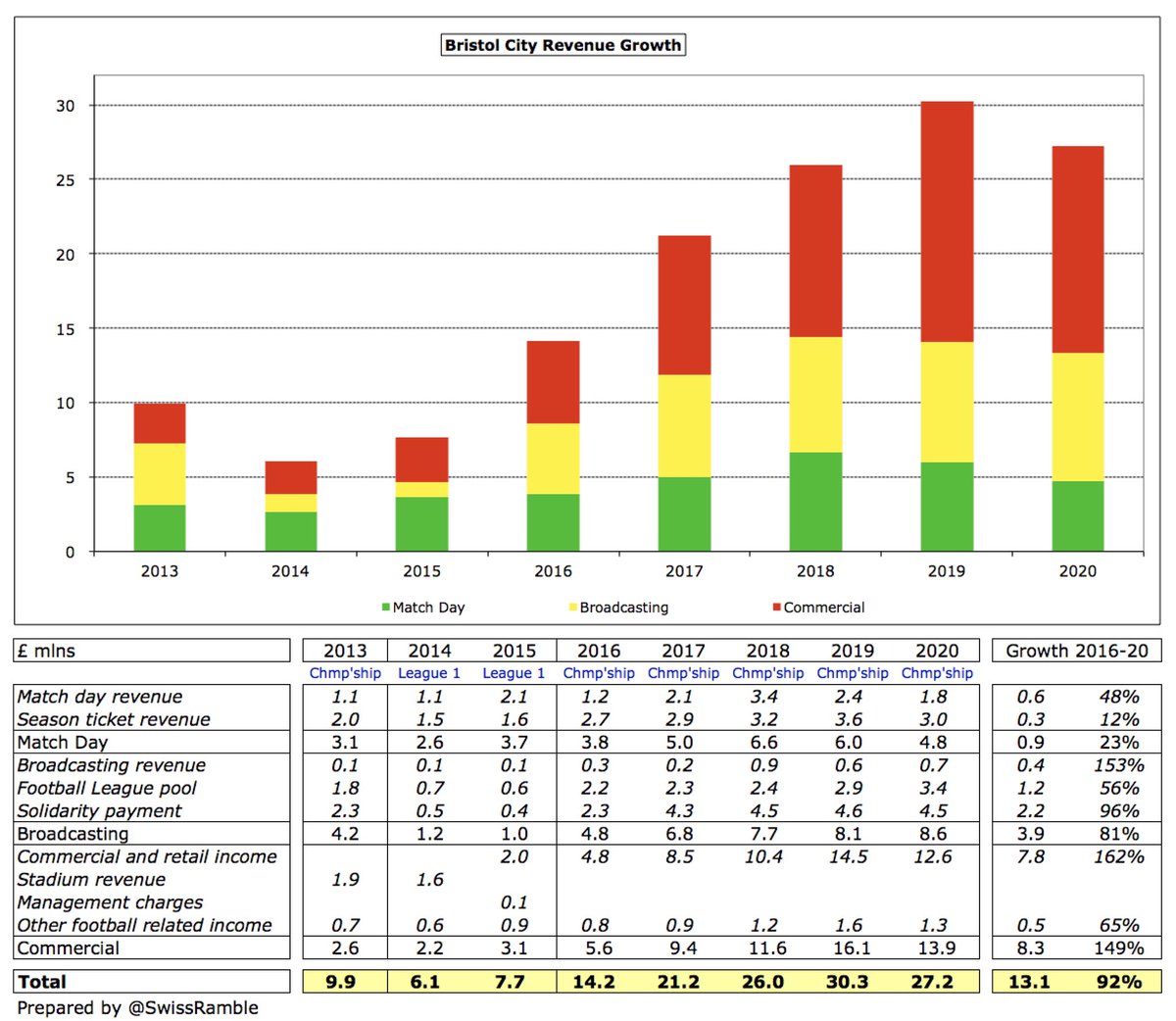

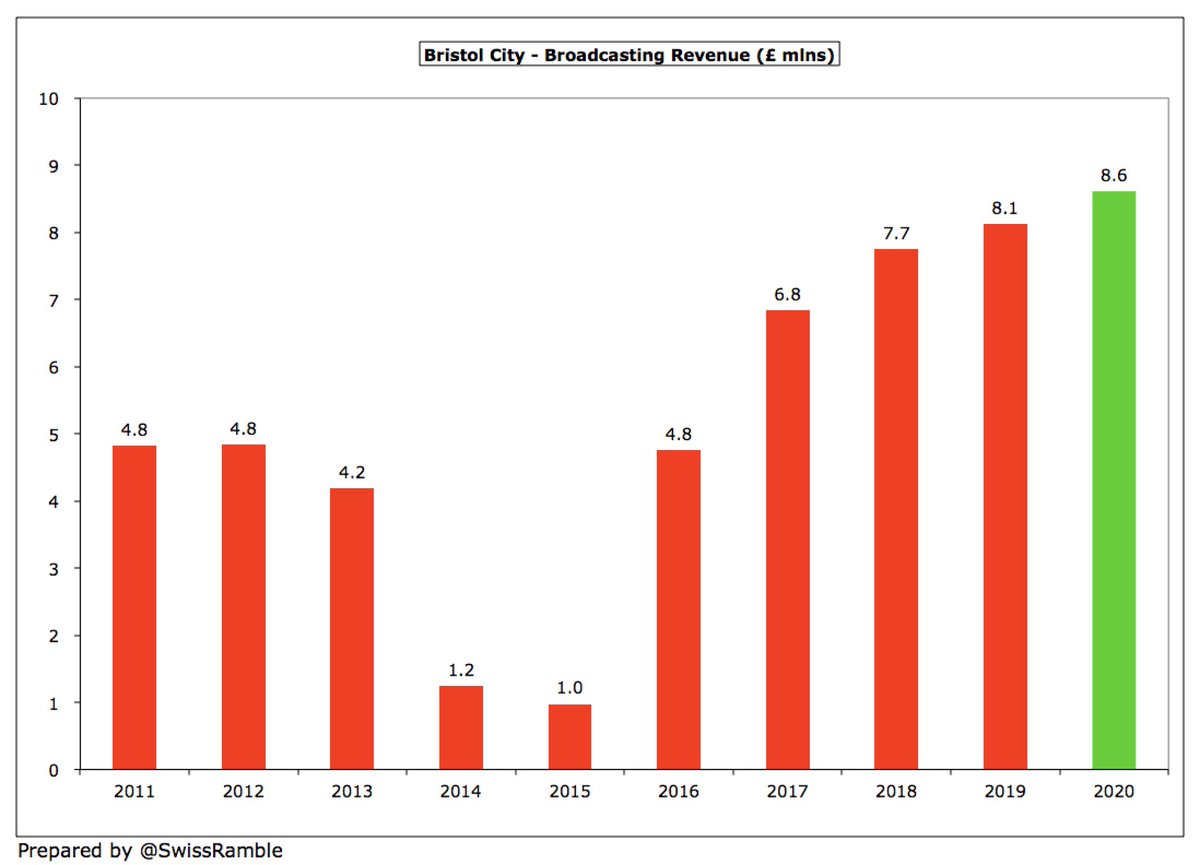

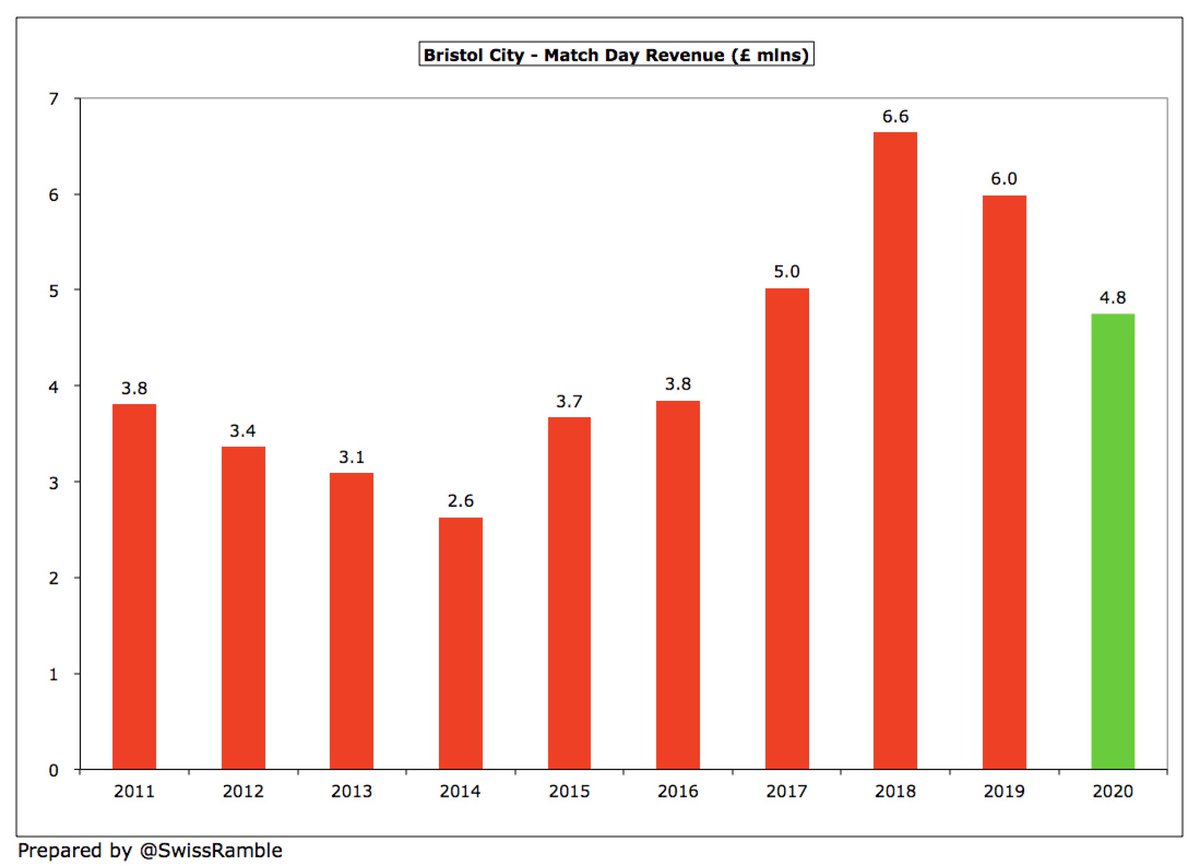

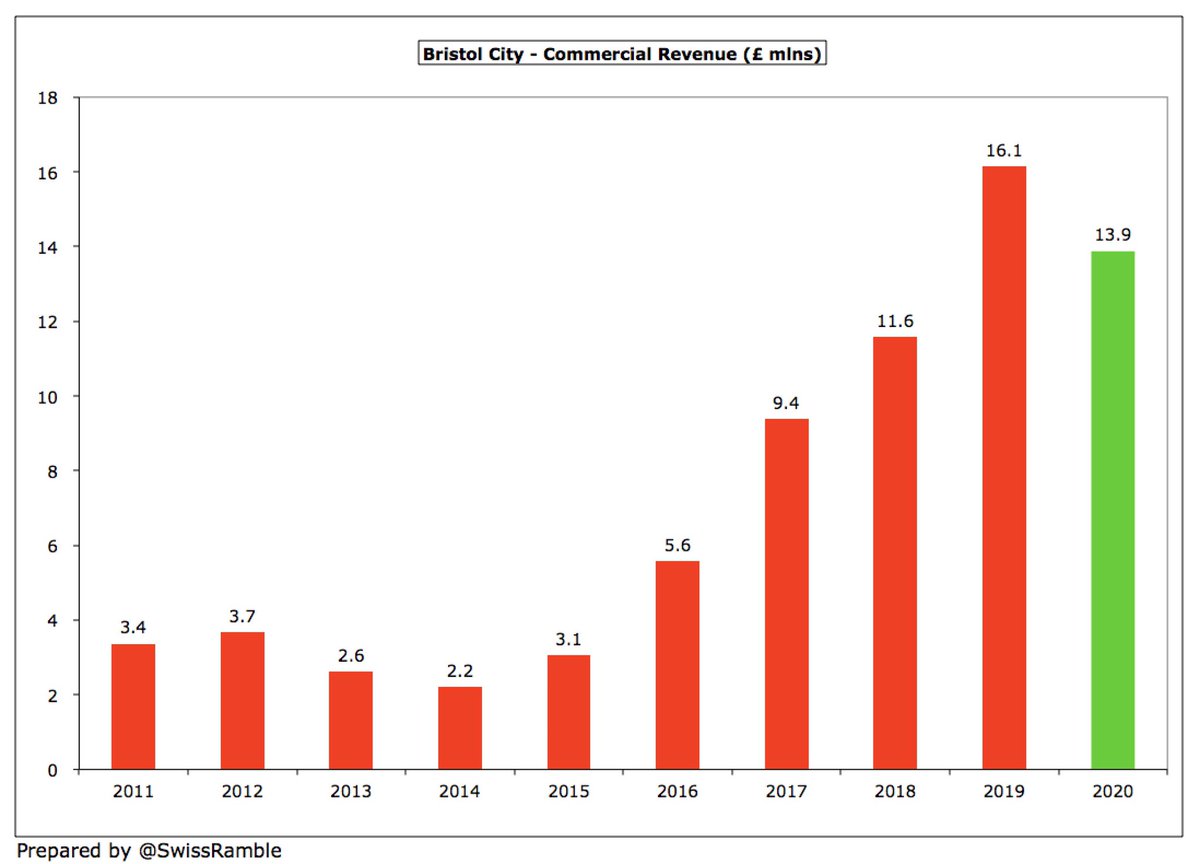

#BristolCity revenue decrease was mainly driven by commercial falling £2.3m (14%) to £13.9m, though match day also dropped £1.2m (21%) to £4.8m, as 5 games were played behind closed doors. On the other hand, broadcasting increased £0.5m (6%) to £8.6m.

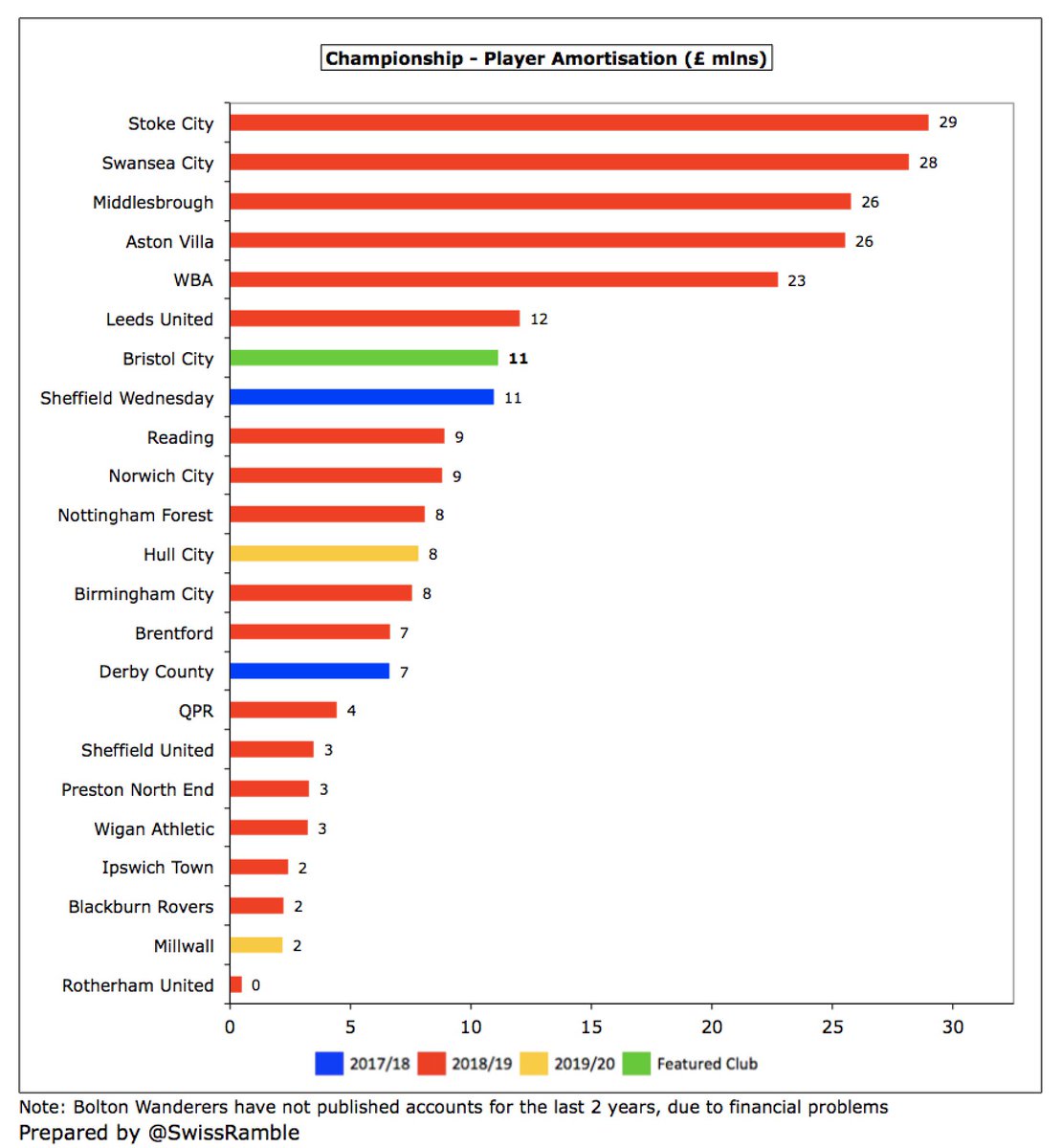

The #BristolCity wage bill grew £2.8m (9%) to £33.5m, while player amortisation rose £3.4m (43%) to £11.1m. Other expenses and depreciation were flat at £15.1m and £2.8m respectively. Net interest payable fell £0.4m (28%) to £1.0m.

As a technical aside, this analysis is based on Bristol City Holdings Ltd, which owns two significant subsidiaries: Bristol City Football Club Ltd and Ashton Gate Ltd, which operates the stadium facilities.

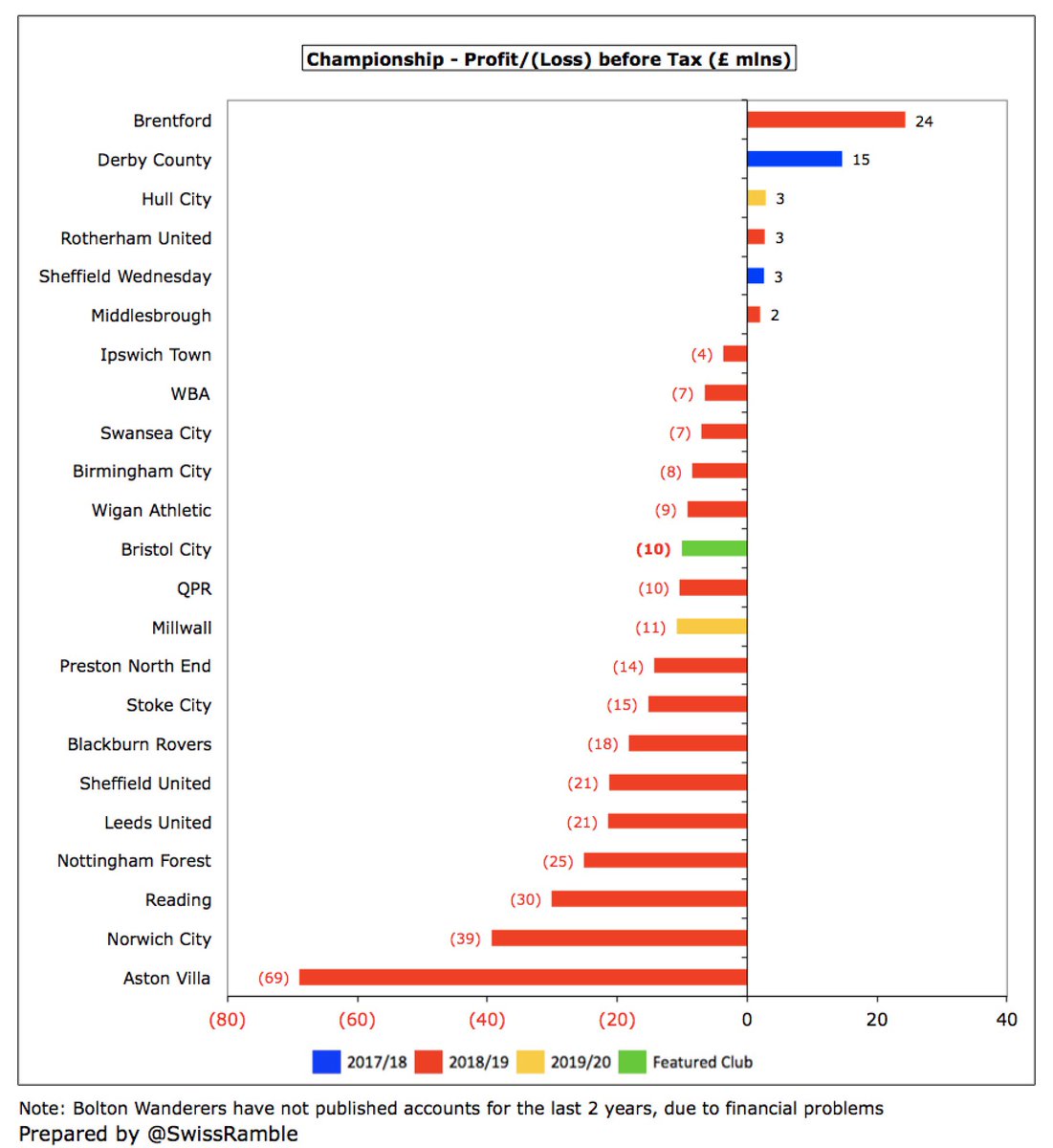

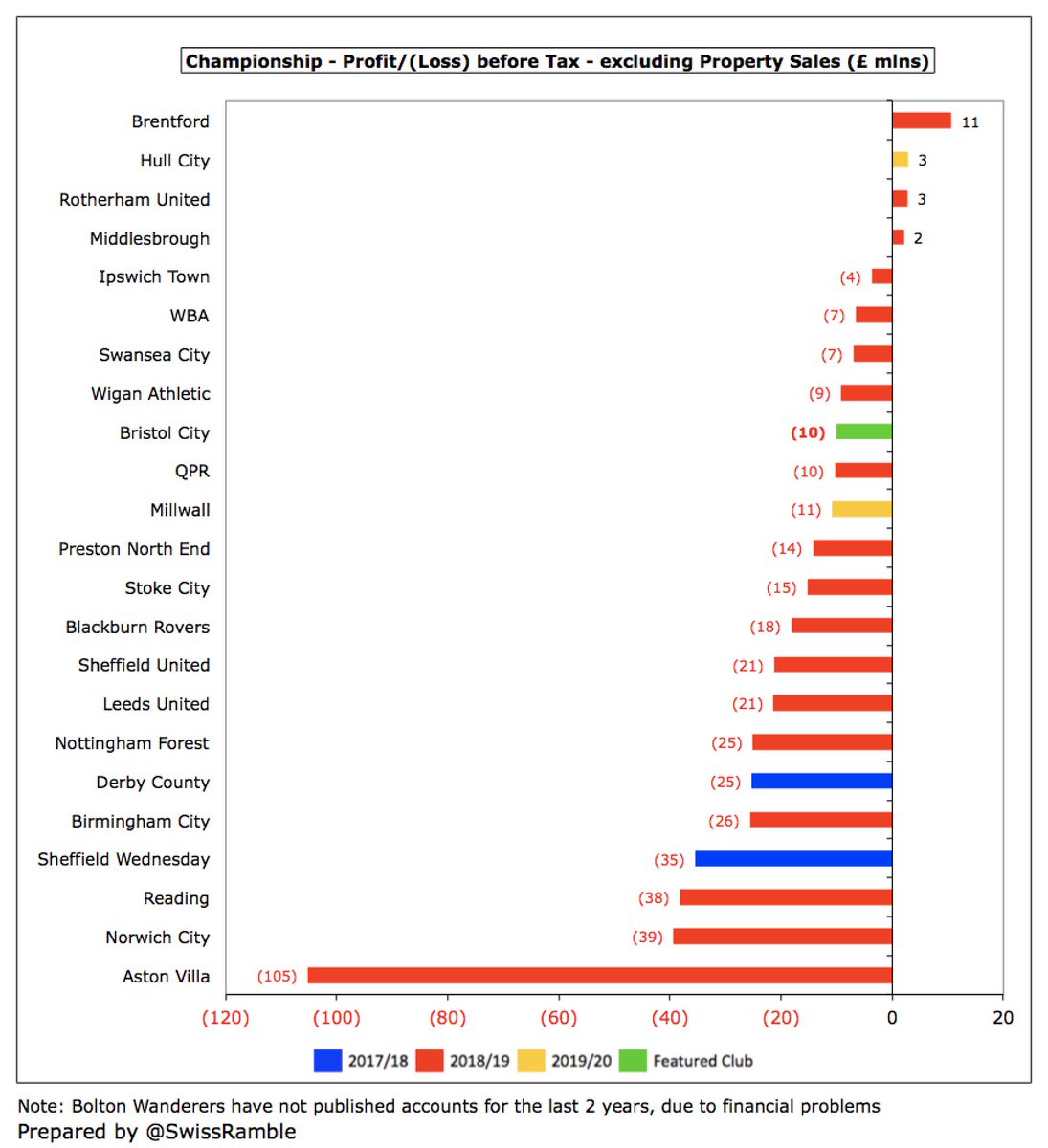

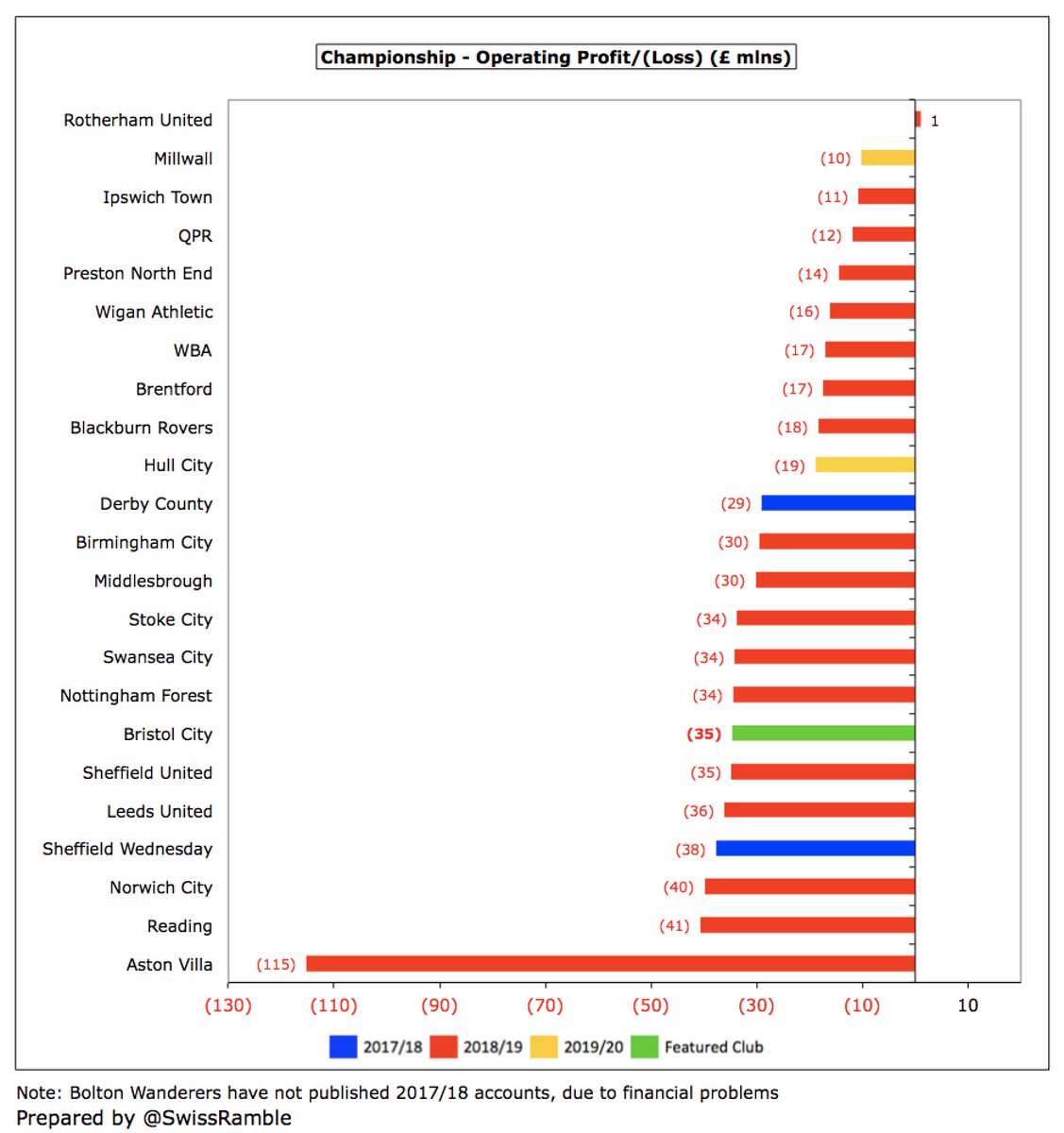

Despite the deterioration, #BristolCity loss of £10m is still only mid-table in the Championship. This result is likely to look better when other clubs publish their COVID-impacted 2019/20 accounts. In fact, even before the pandemic, no fewer than 6 clubs had losses above £20m.

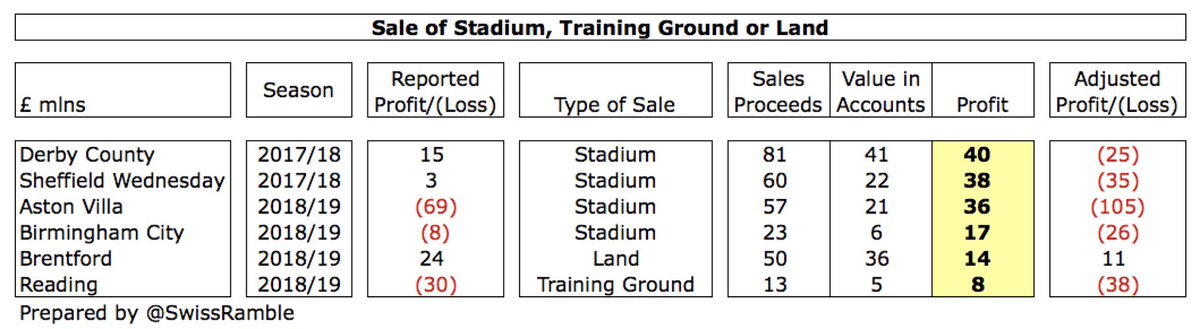

It is also worth noting that some clubs’ figures were boosted by once-off accounting profits from the sale of stadiums, training grounds and land, especially #DCFC £40m, #SWFC £38m and #AVFC £36m, so their underlying figures were even worse than reported.

Excluding property sales, only 4 Championship clubs are profitable with £11m highest profit in 18/19 made by Brentford. On this basis, #BristolCity £10m loss is actually 9th best financial performance in the division. May well be better when others publish 19/20 accounts.

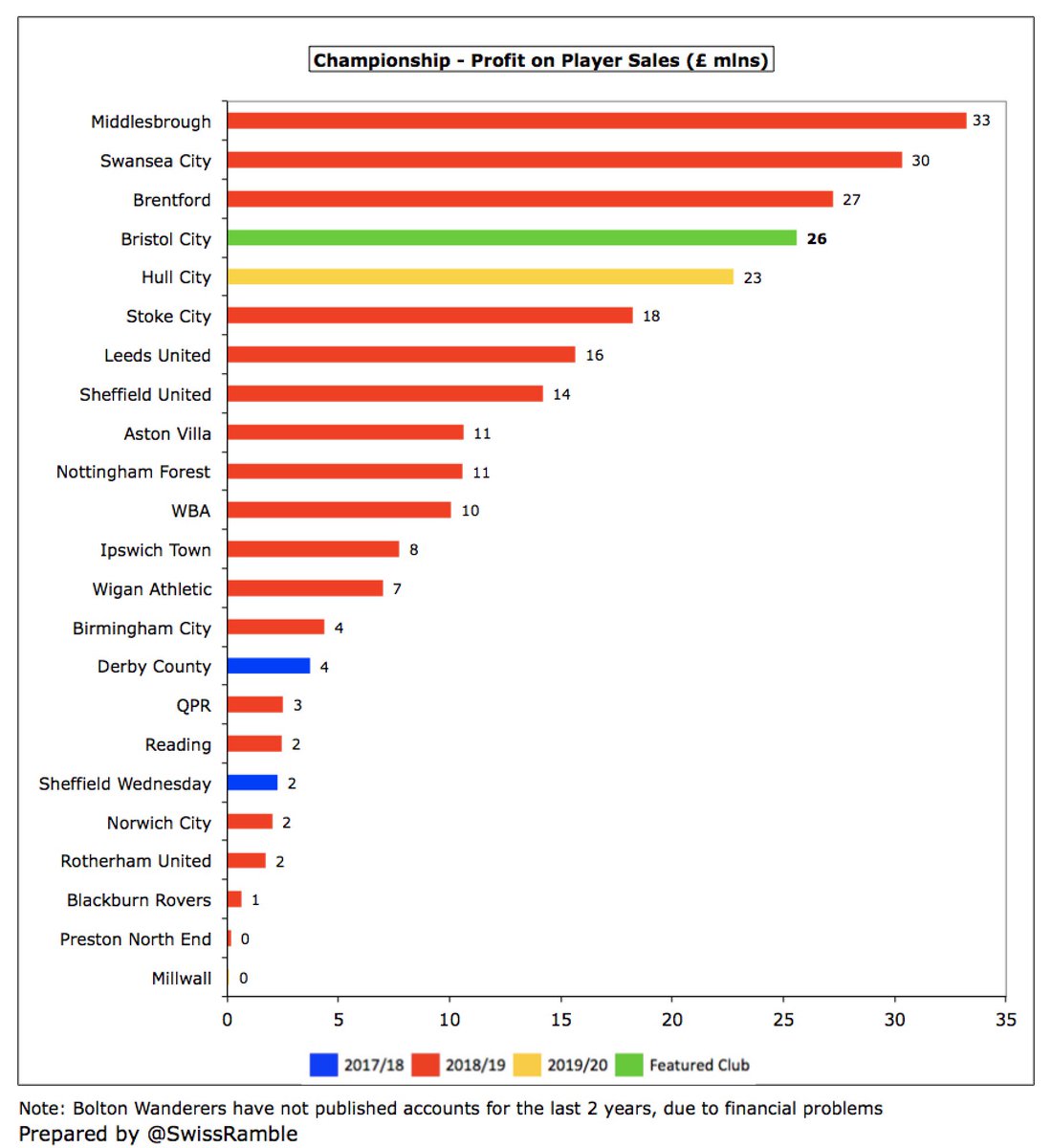

However, #BristolCity did benefit from £26m profit from player sales, mainly Adam Webster to #BHAFC, Josh Brownhill to Burnley, Mo Eisa to Peterborough and Marlon Pack to Cardiff City. Highest profit from this activity in the Championship to date in 2019/20.

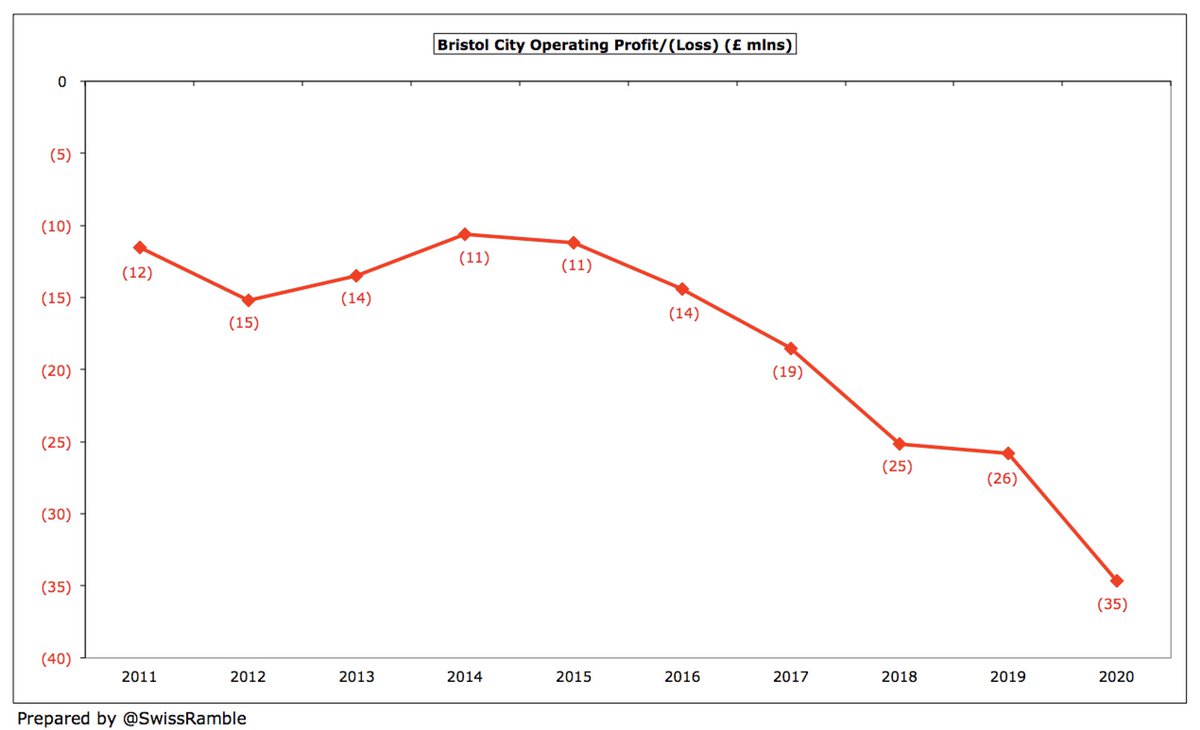

The 2019/20 £10m loss is nothing new for #BristolCity, In fact, 2018/19 was the first time that the club managed to generate a profit under owner Steve Lansdown. following its highest ever loss of £25m the previous year. Over the last decade, they have accumulated £104m losses.

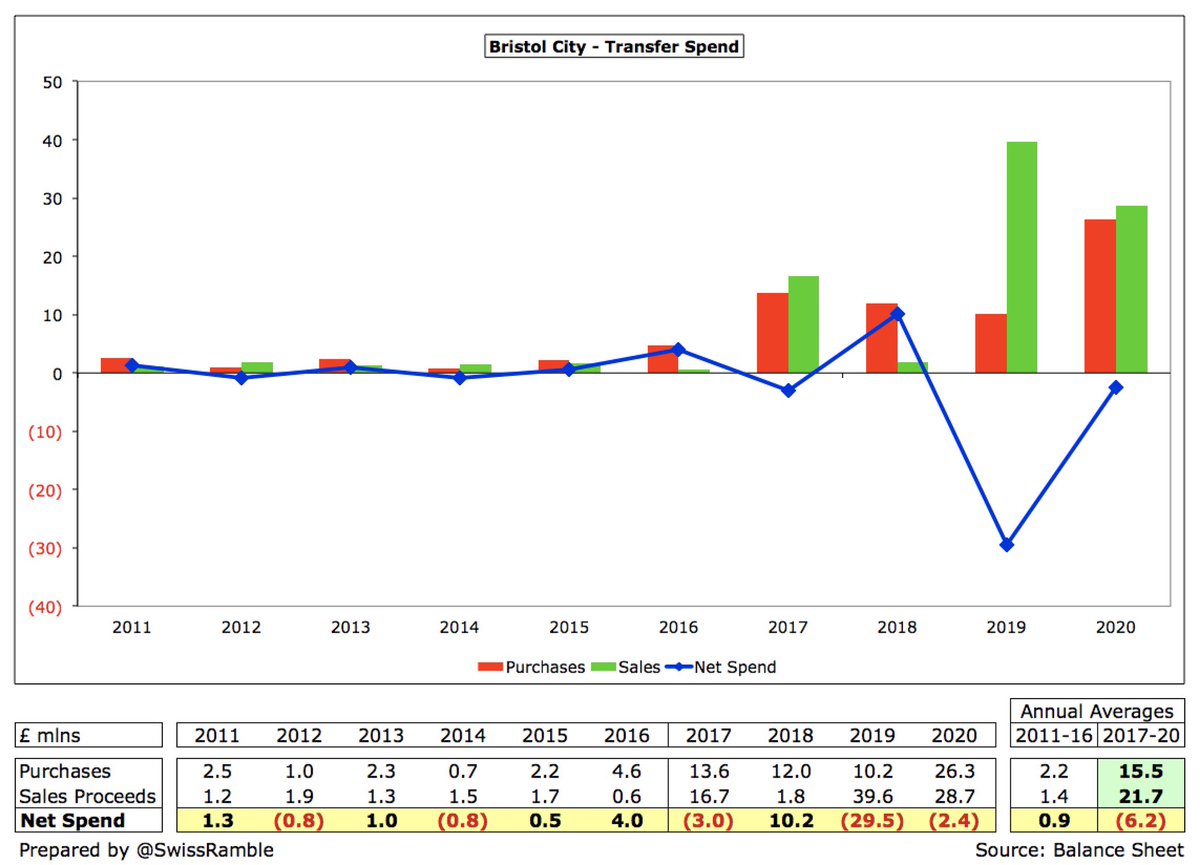

Player trading has become increasingly important at #BristolCity with £78m profits in last 4 years, compared to only £6m in preceding 6 years. As Lansdown said, this “is all part and parcel of the process” of making the club sustainable. That said, few sales made last summer.

#BristolCity operating loss (i.e. excluding player sales and interest payable) widened from £26m to £35m, as revenue fell, but expenses increased. This is surely the club’s worst financial performance ever, only offset by the lucrative player sales.

In fairness, most Championship clubs operate at a significant loss, due to very high wages to turnover ratios, as they compete for promotion to the “promised land” of the Premier League. That said, #BristolCity £35m operating loss was firmly in the bottom half of the table.

Despite last season’s decrease, #BristolCity revenue has almost doubled since their first season back in the Championship, from £14m in 2016 to £27m in 2020. Most of that £13m growth is commercial, up £8.3m, but there were also increases in broadcasting £3.9m and match day £0.9m.

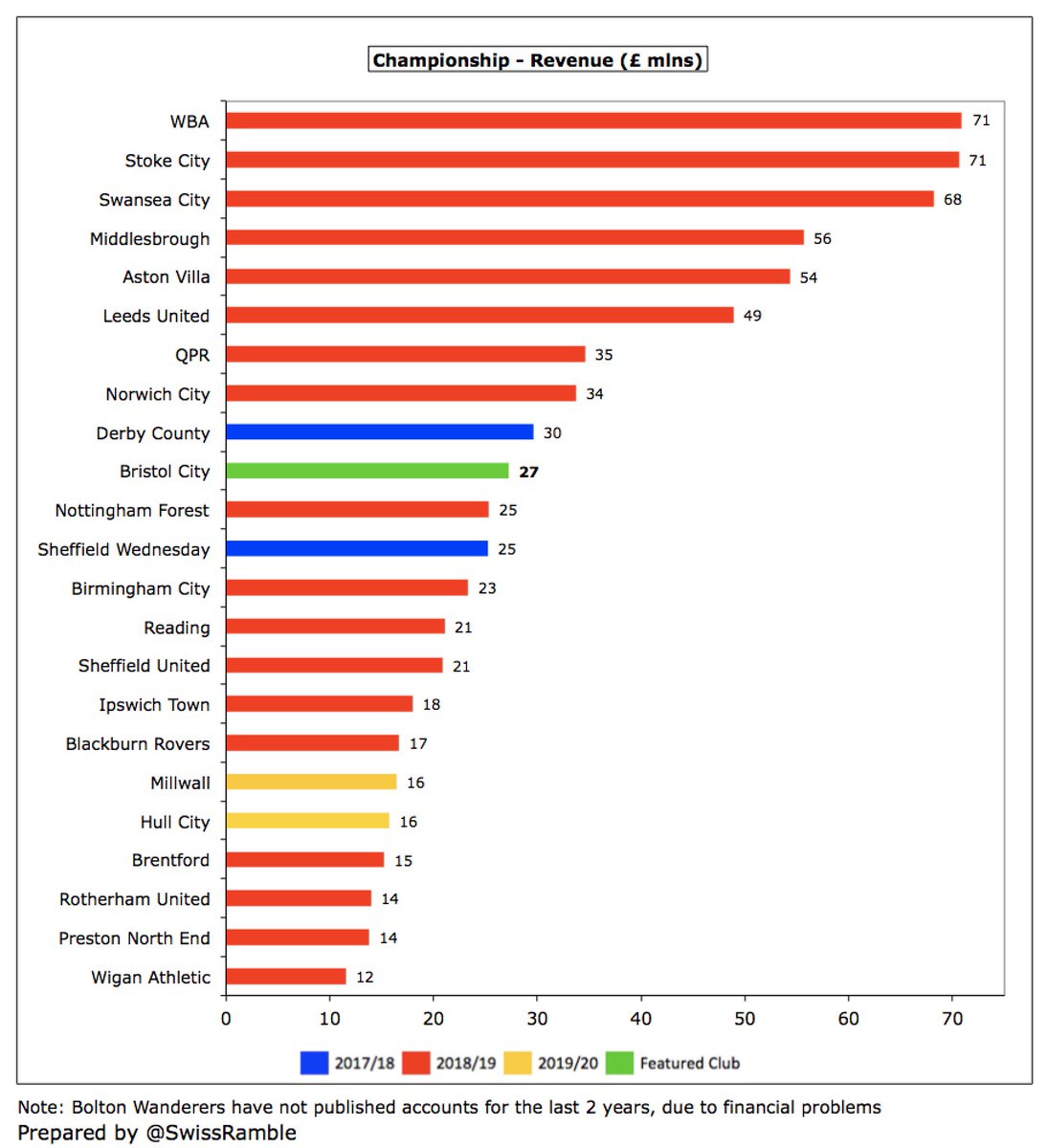

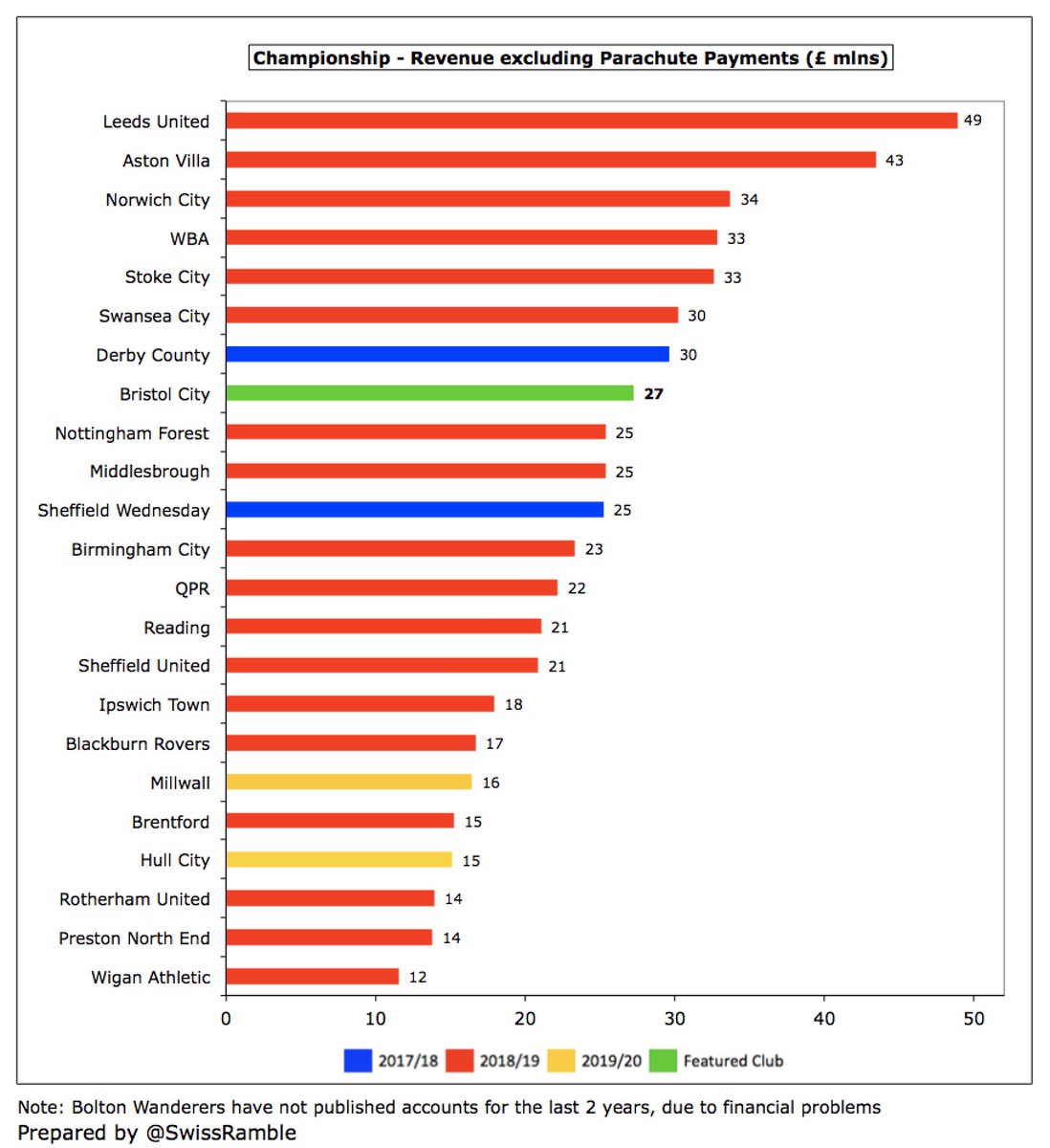

Even after the growth, #BristolCity £27m revenue is still only 10th highest in the Championship, significantly below some of the clubs benefiting from parachute payments, e.g. in 2018/19 WBA £71m, Stoke City £71m and Swansea City £68m.

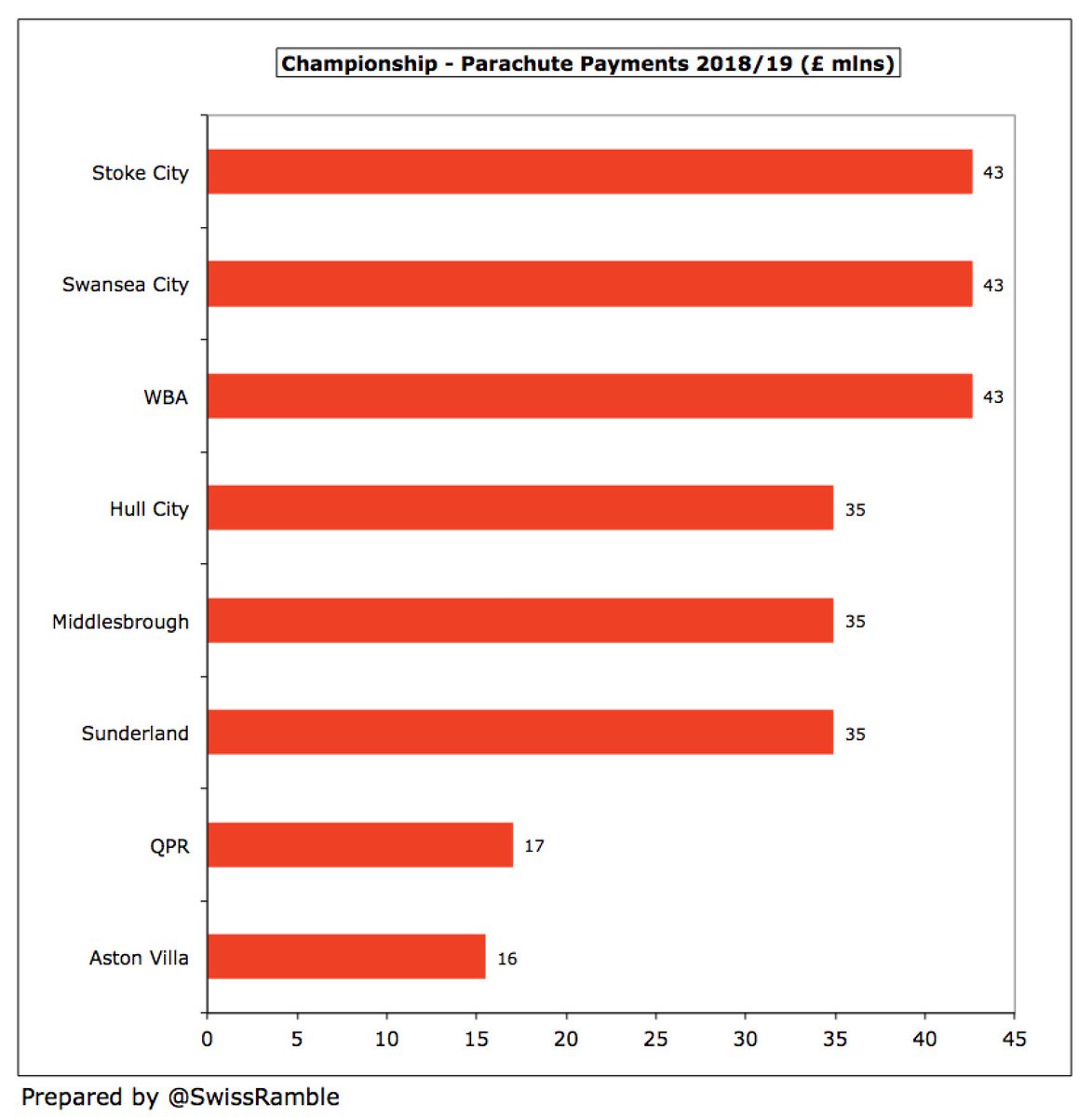

Championship revenue is hugely influenced by Premier League parachute payments with 8 clubs benefiting from these in 2018/19, led by #SCFC, #Swans and #WBA receiving £43m, followed by #hcafc, #Boro and #SAFC (all £35m), then QPR £17m and #AVFC £16m.

If parachute payments were excluded, #BristolCity £27m would be the 8th highest revenue in the Championship, though the gap to #LUFC £49m (figures from 2018/19) would still be £22m. However, they would have a very decent chance of making the play-offs.

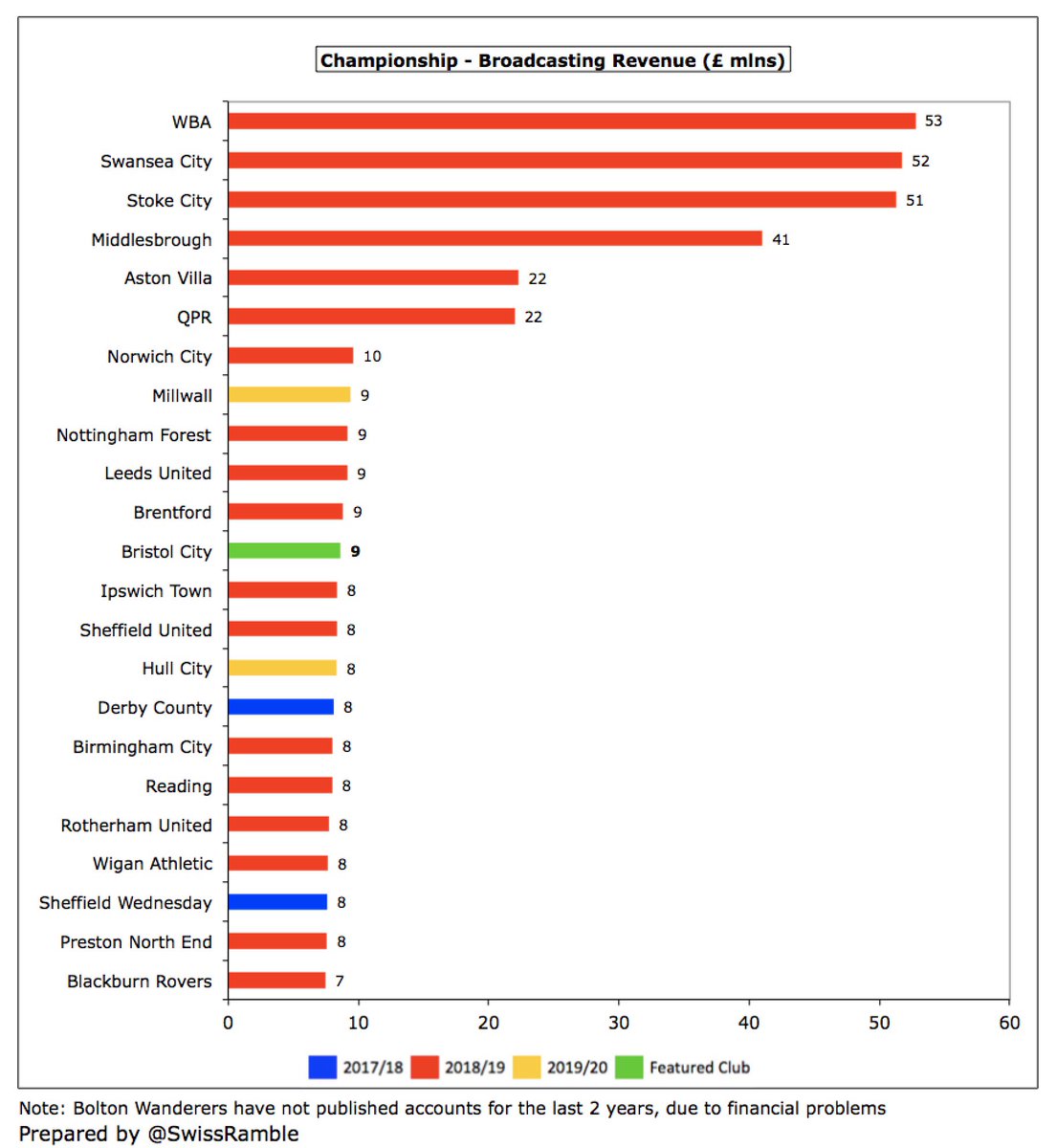

#BristolCity broadcasting income rose £0.5m (6%) to £8.6m, mainly due to an increase in the Football League pool. Most Championship clubs earn between £8m and £9m in TV money, but there is a big gap to the clubs with parachute payments (over £50m for WBA, Swansea and Stoke).

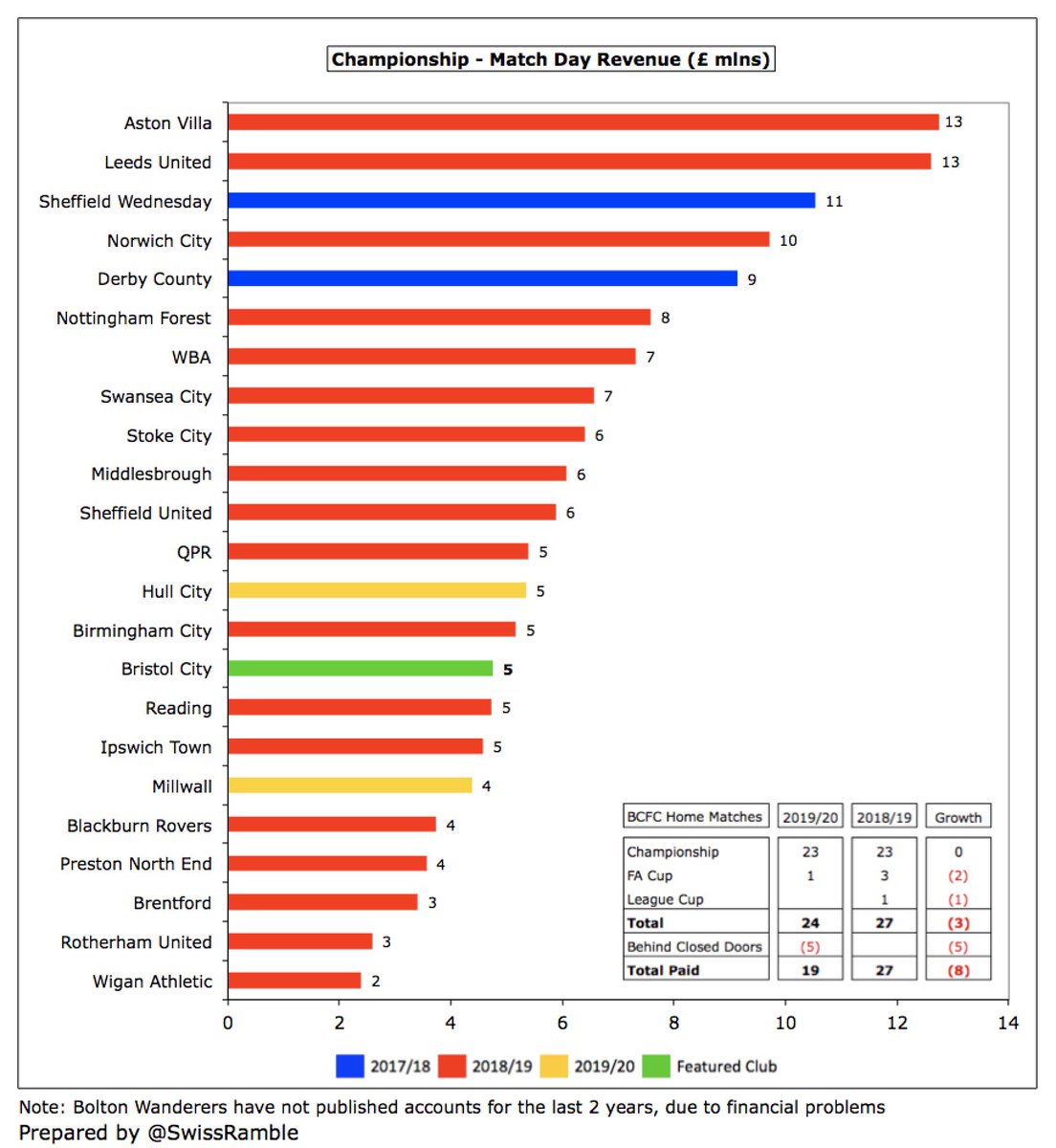

#BristolCity match day income fell £1.2m (21%) to £4.8m, largely due to playing 5 home games behind closed doors because of the pandemic, though previous season also included FA Cup run to the 5th round. This was firmly in the bottom half of the Championship.

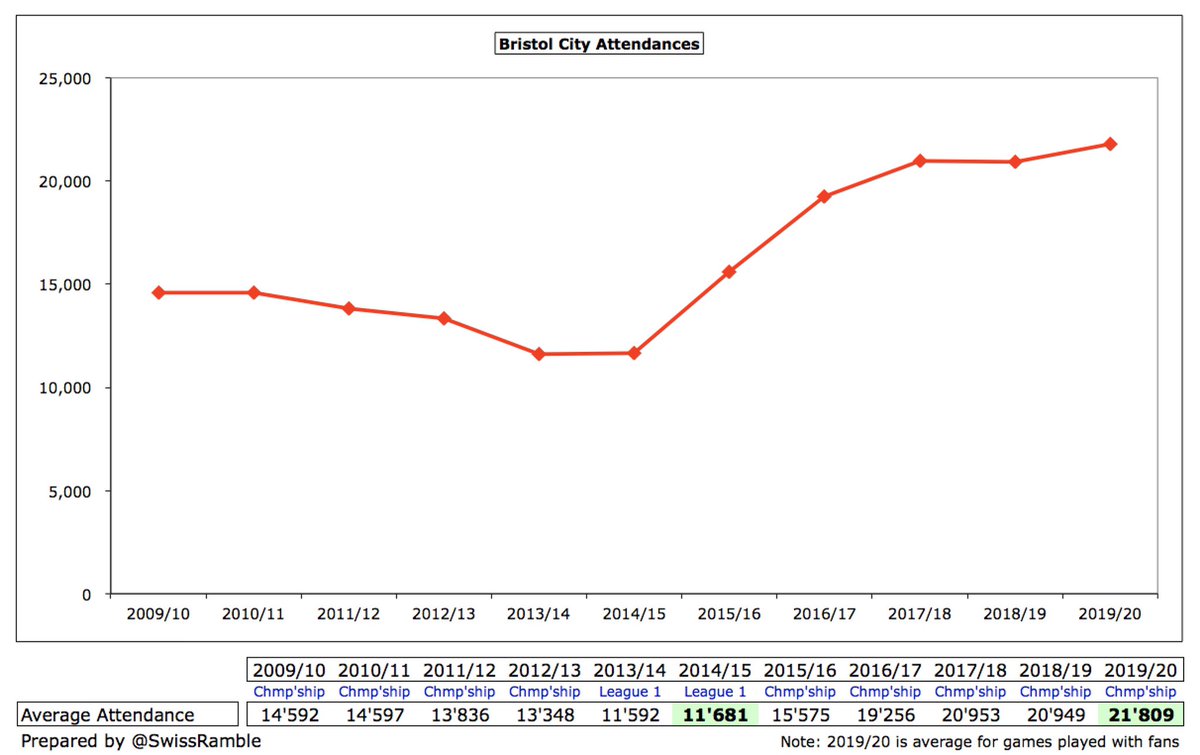

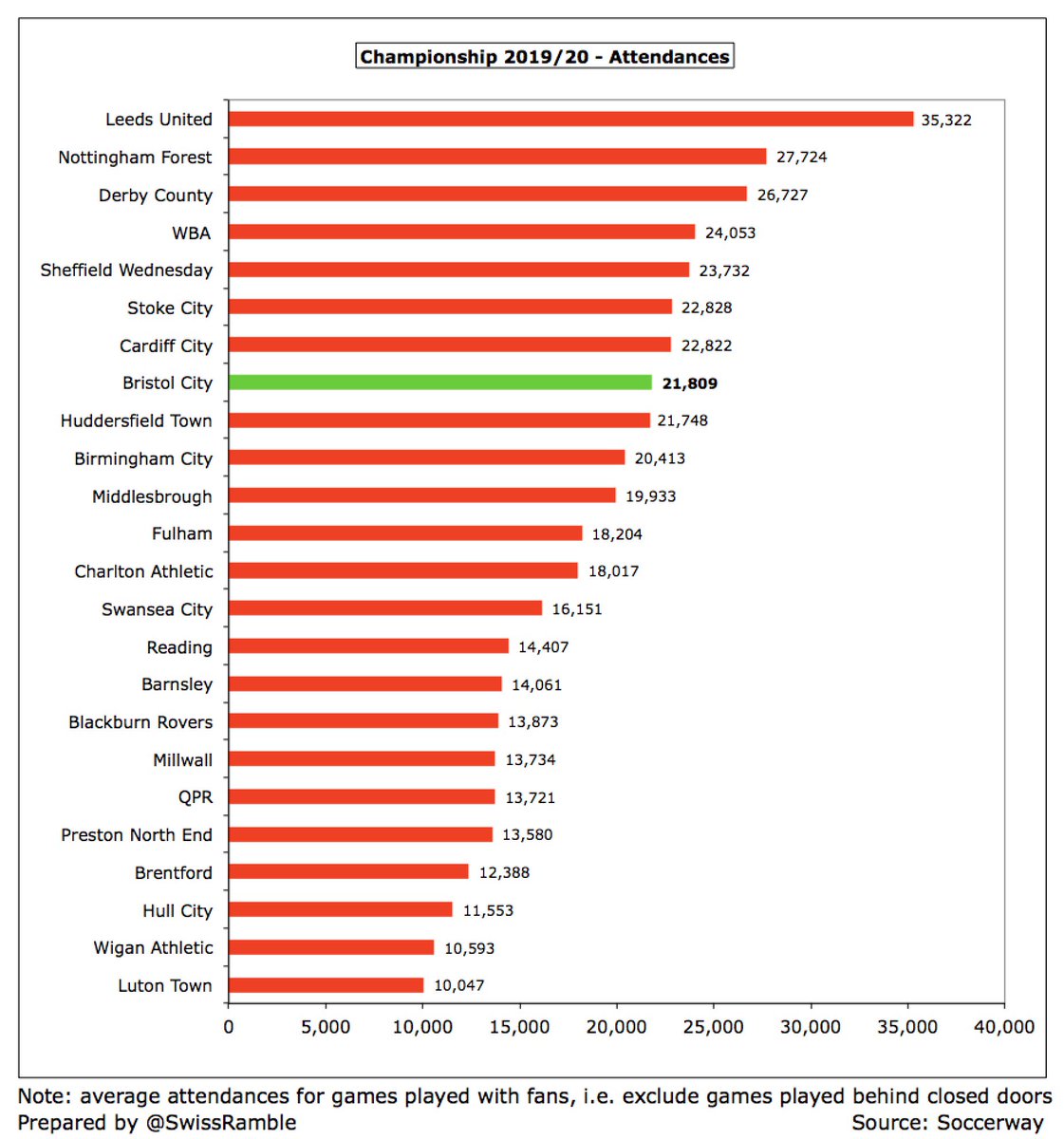

#BristolCity crowds have significantly grown since promotion from League One, rising 87% from 11,681 to 21,809. Based on games played with fans, their average attendance was 8th highest in the Championship, though around 14,000 less than Leeds United.

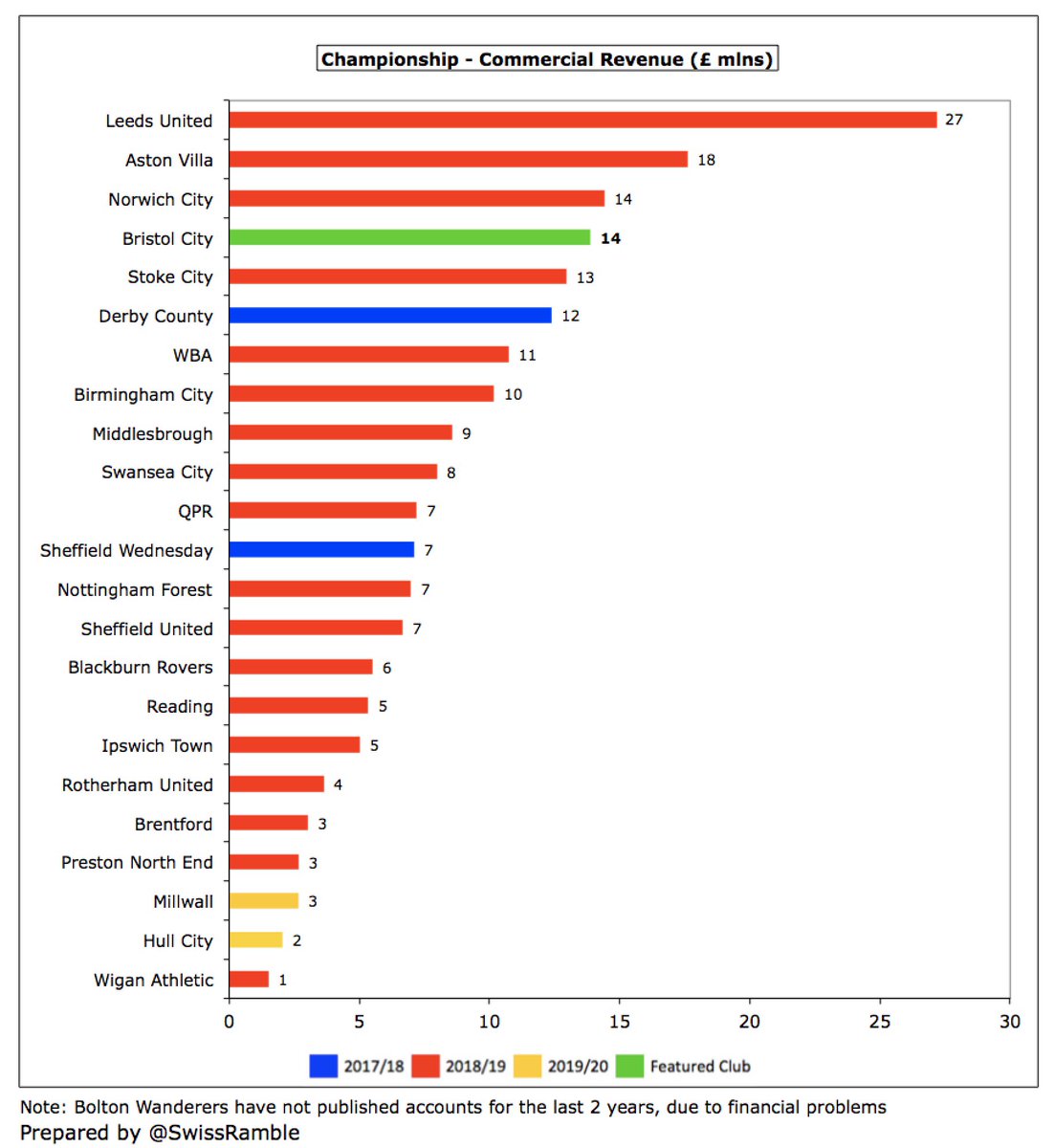

#BristolCity commercial income fell £2.3m (14%) to £13.9m, still their 2nd best ever and 4th highest in the Championship. Growth has been driven by expansion of Ashton Gate usage, e.g. conferences, summer concerts, though obviously impacted by COVID closures in 2020.

#BristolCity shirt sponsor was online casino company Dunder, though this has changed to MansionBet in 2020/21. Similarly, their kit was made by their own company Bristol Sport, but this has been replaced by an agreement with Hummel this season.

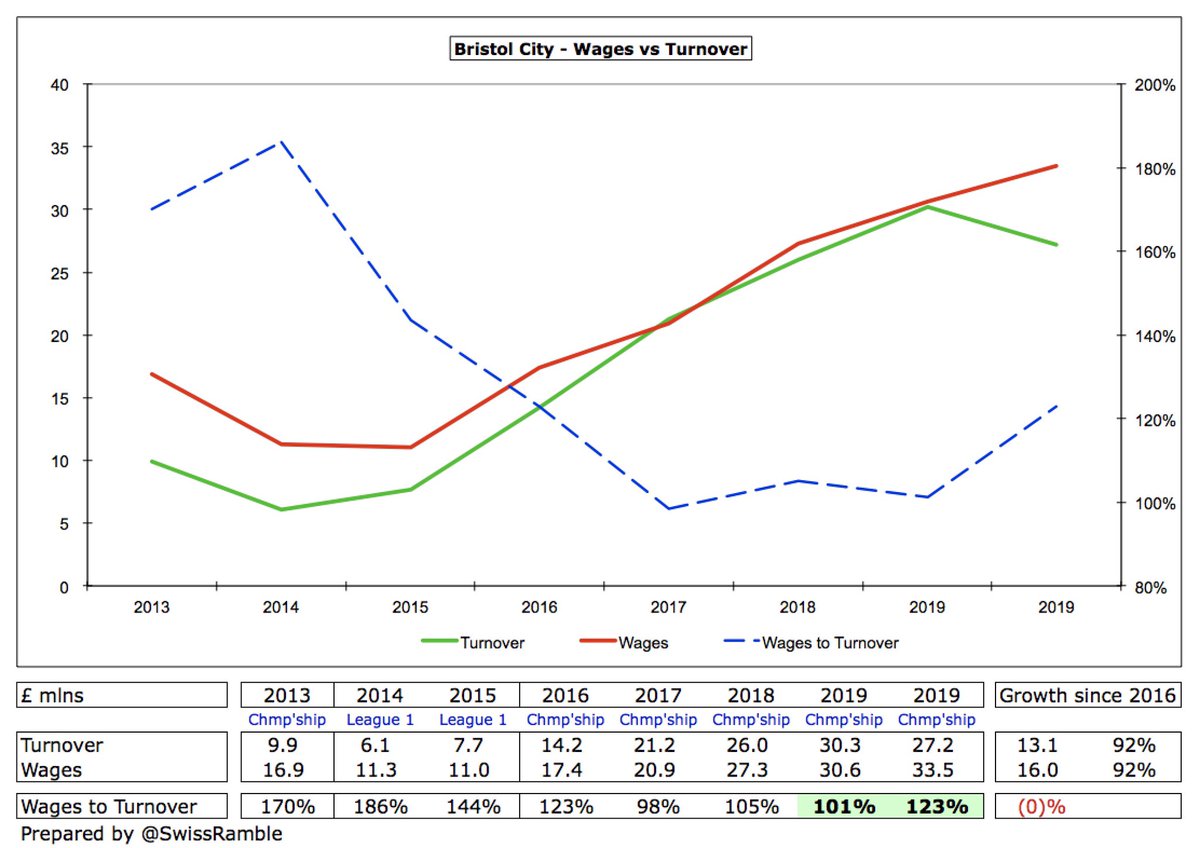

#BristolCity wage bill rose £2.8m (9%) to £33.5m, a club record, despite players agreeing to defer a percentage of their wages for 3 months due to COVID. This means that wages have nearly doubled (up £16m) since the first season after promotion from League One in 2016.

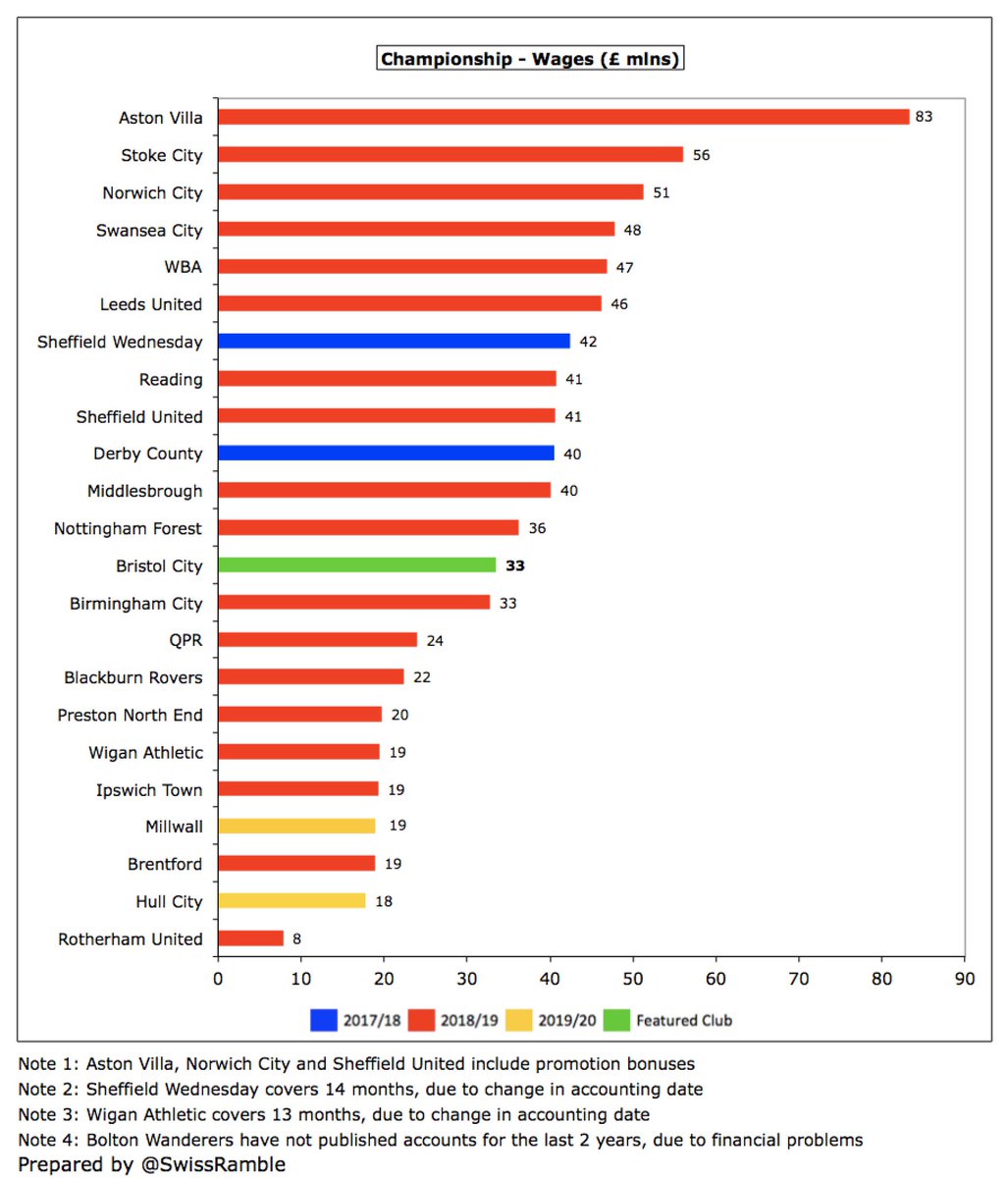

Despite the significant growth, #BristolCity £33m wage bill is still very much in the bottom half of the Championship, a long way below the likes of Aston Villa £83m, Stoke City £56m (both clubs with parachute payments) and Norwich City £51m (promotion bonus).

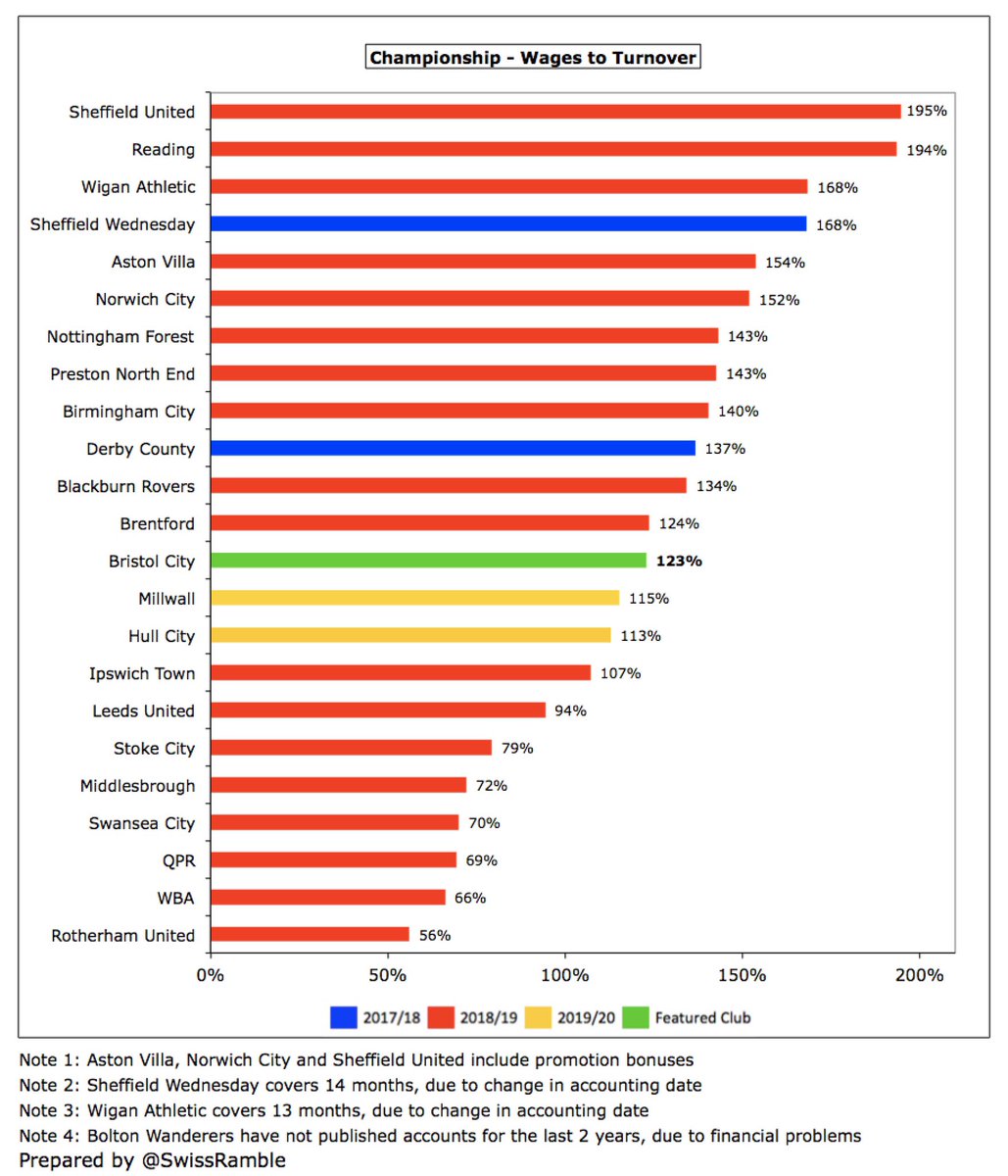

#BristolCity wages to turnover ratio increased from 101% to 123%, which is not great, but this is pretty much par for the course in this ultra-competitive division, where 16 clubs are above 100%, much worse than UEFA’s recommended 70% upper limit.

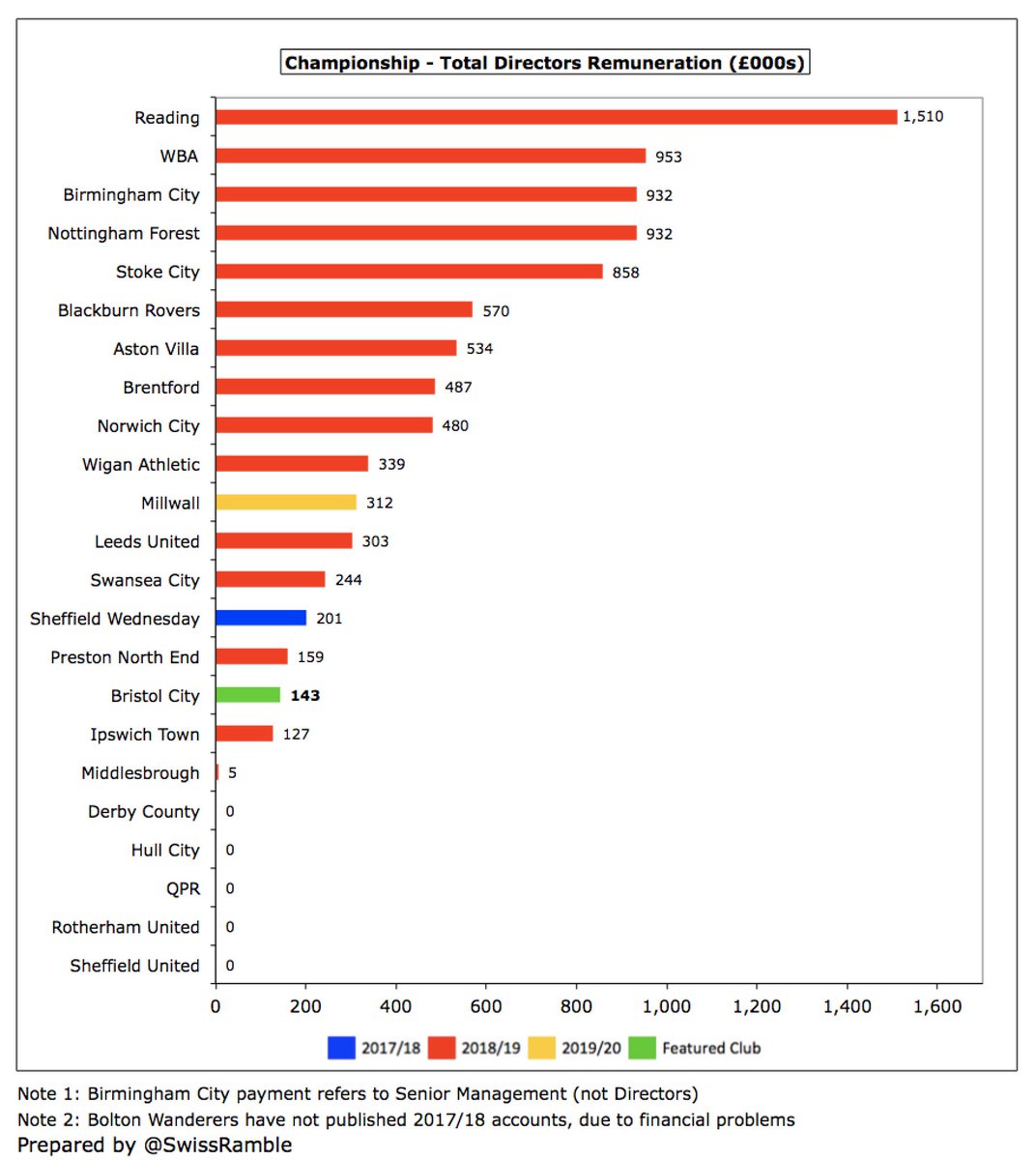

#BristolCity directors’ remuneration was virtually unchanged at £143k, very much on the low side for the Championship, especially compared to the likes of Reading £1.5m, WBA £953k, Birmingham City £932k and Nottingham Forest £932k.

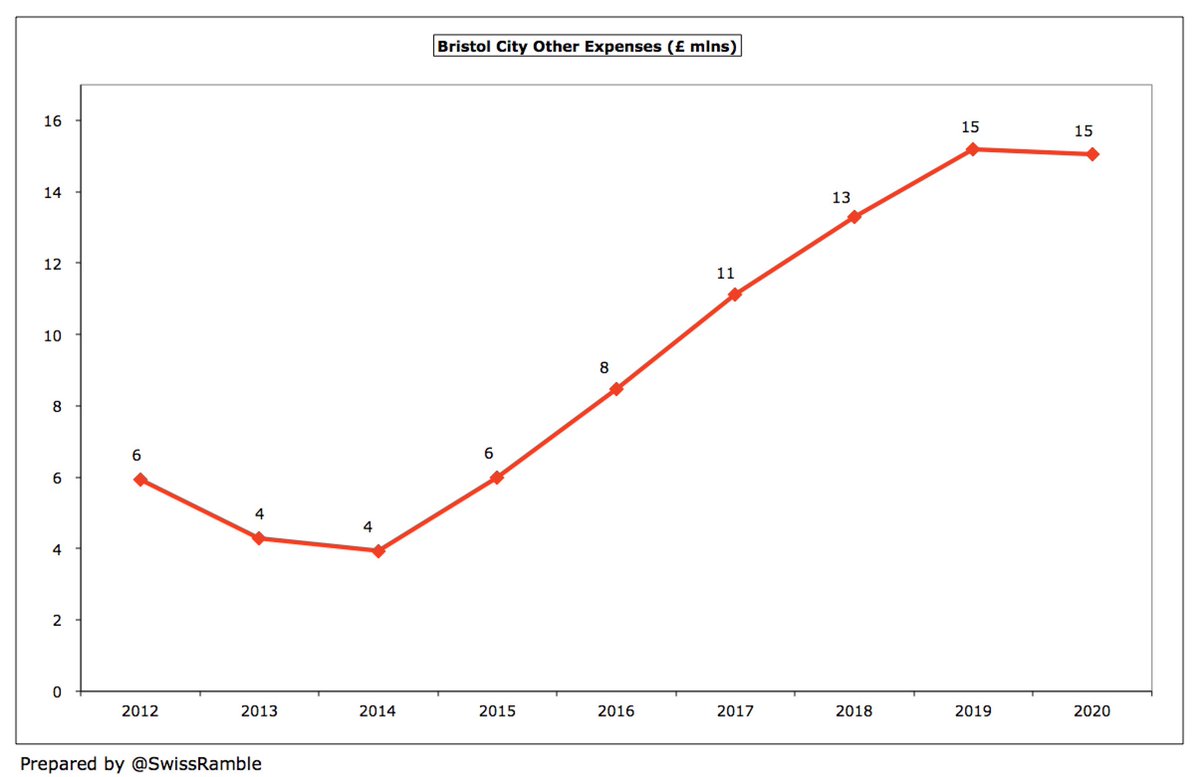

#BristolCity other expenses were flat at £15m, following 5 years of growth from less than £4m in 2014. No details of what is included in this cost category have been provided by the club, though likely to include expenses associated with commercial growth.

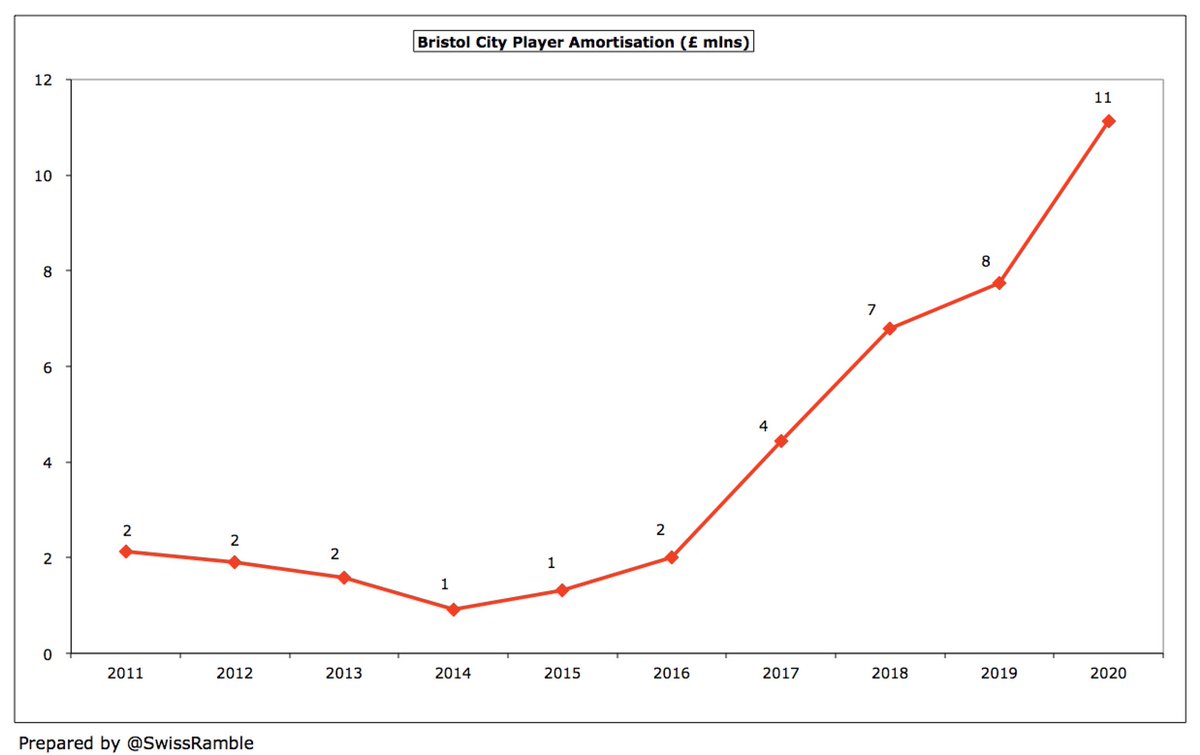

#BristolCity player amortisation, the annual charge to write-off transfer fees over a player’s contract, increased by £3.4m (43%) to £11.1m. This expense has significantly grown from just £0.9m in 2014, reflecting major investment in the squad in recent years.

Following the growth, #BristolCity player amortisation of £11m is one of the highest in the Championship, with all the clubs above them (with the exception of Leeds United) benefiting from parachute payments.

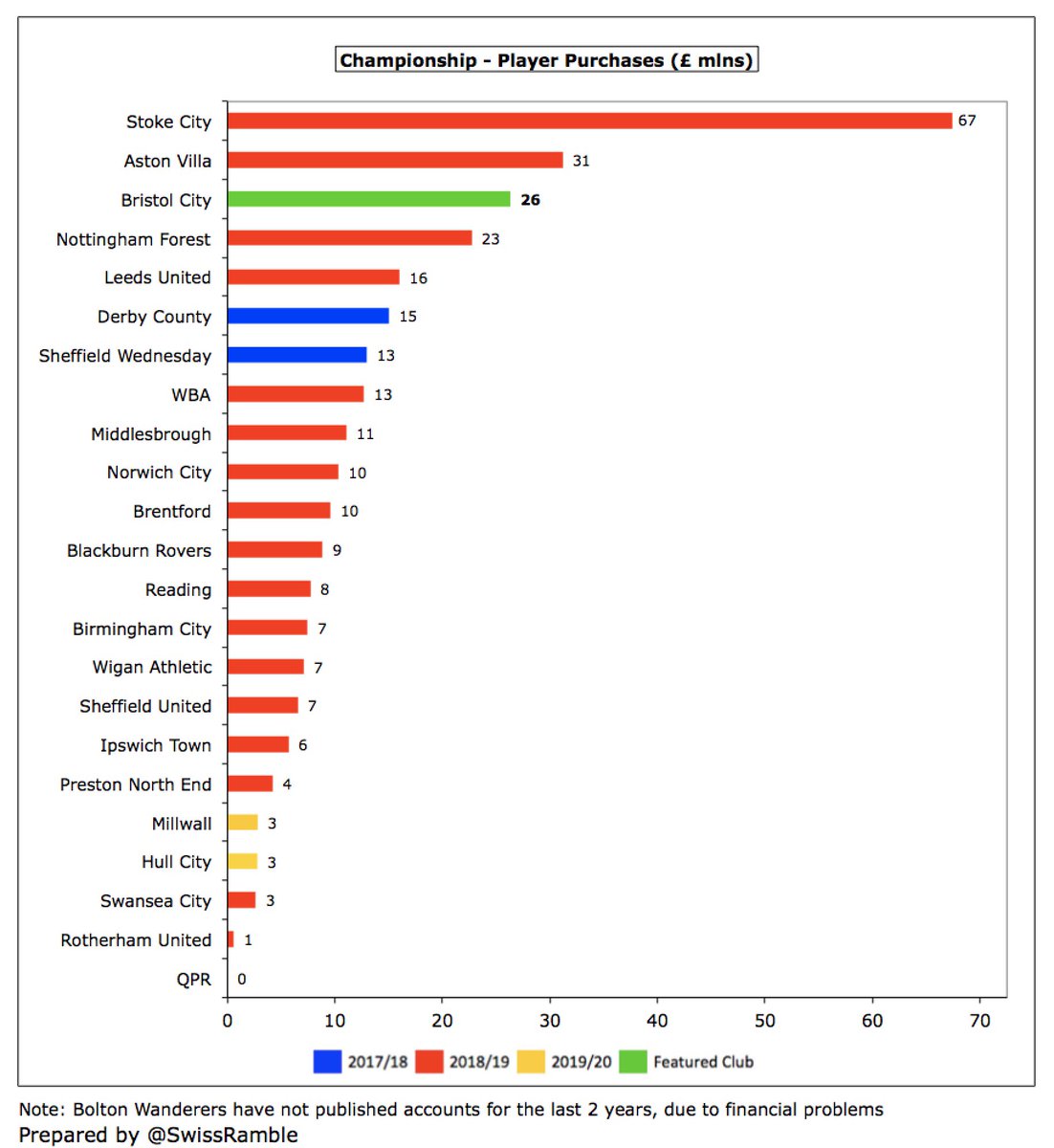

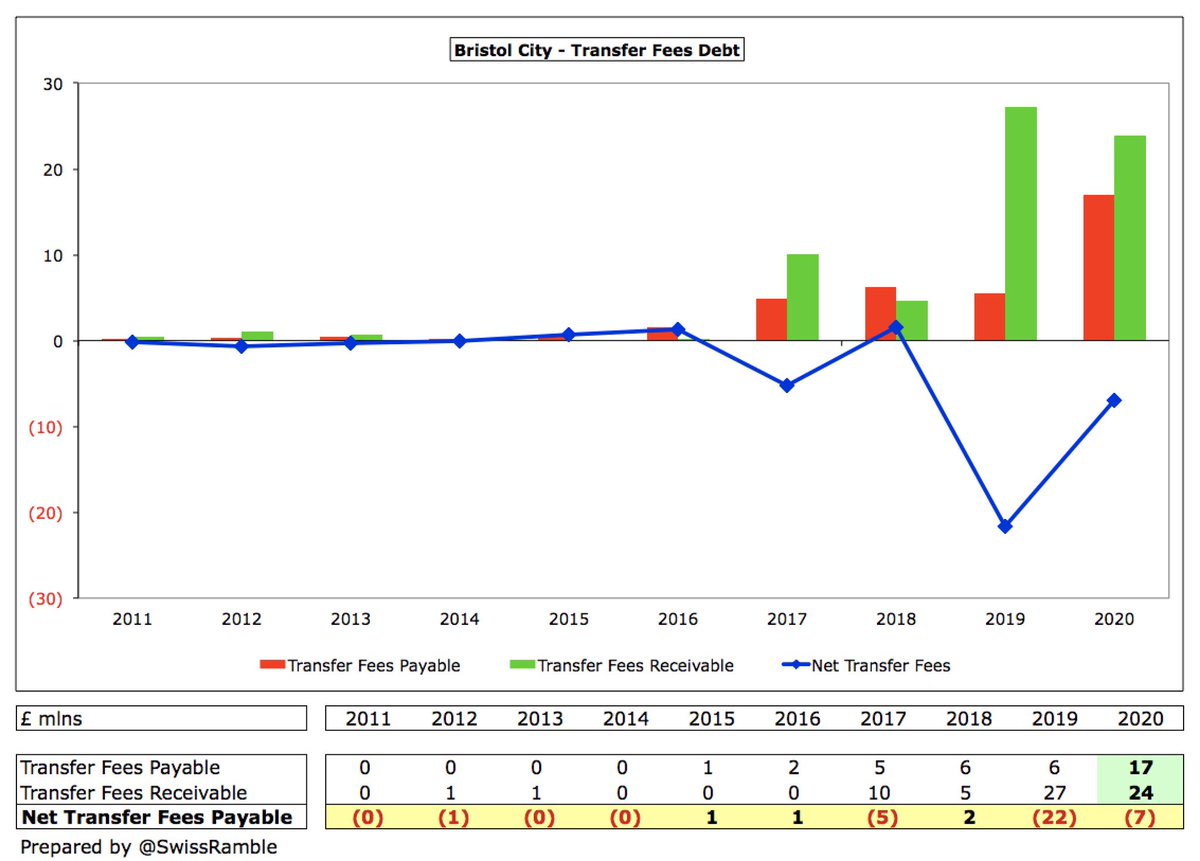

#BristolCity splashed out £26m on player purchases, one of the highest in the Championship, including Kalas, Palmer and Dasilva (Chelsea), Massengo (Monaco), Wells (Burnley), Bentley (Brentford) and Nagy (Bologna). More than £22m total expenditure in previous 2 seasons.

In last 4 seasons #BristolCity significantly increased annual average spend on players to £16m, but sales have also grown to £22m, leading to £6m net sales. This season has been much quieter with only Williams coming in for a fee, while only Eliasson and Szmodics generated cash.

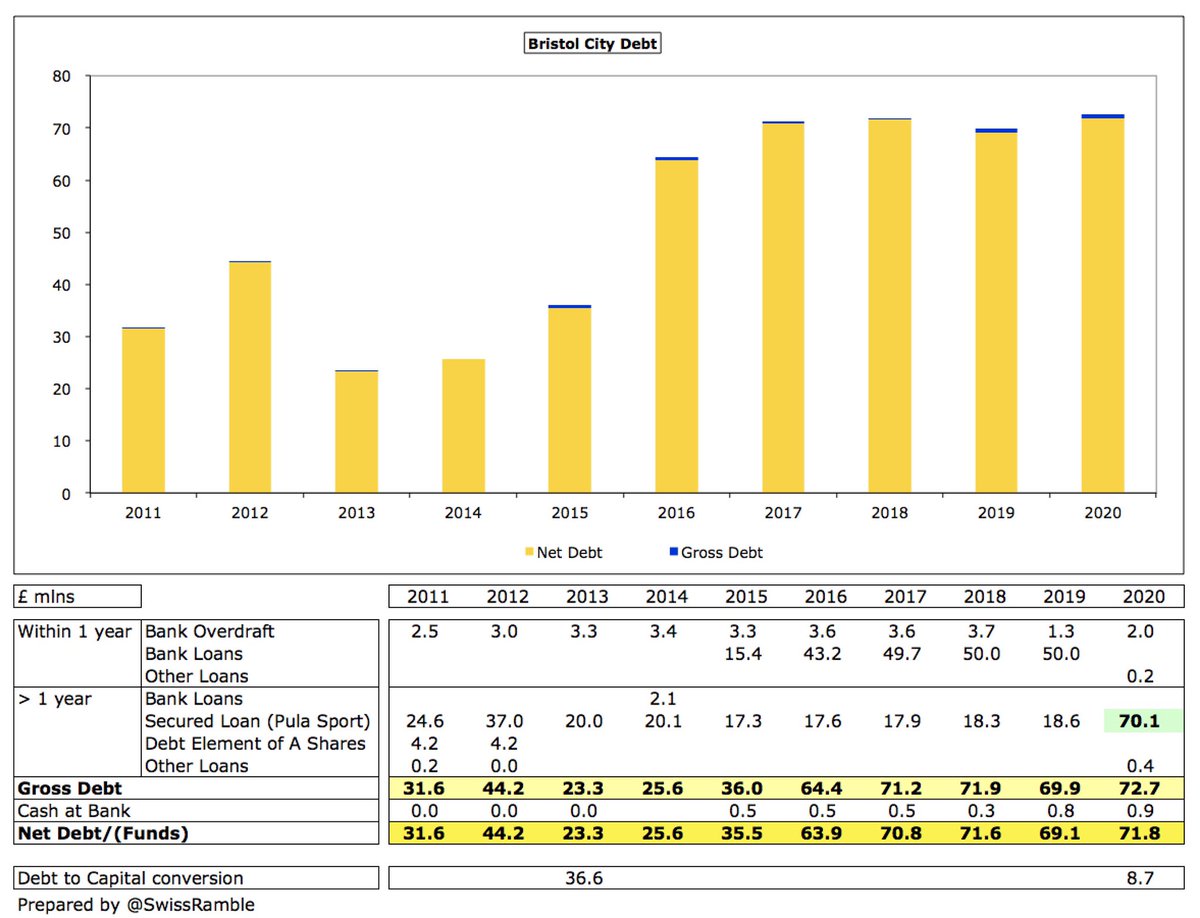

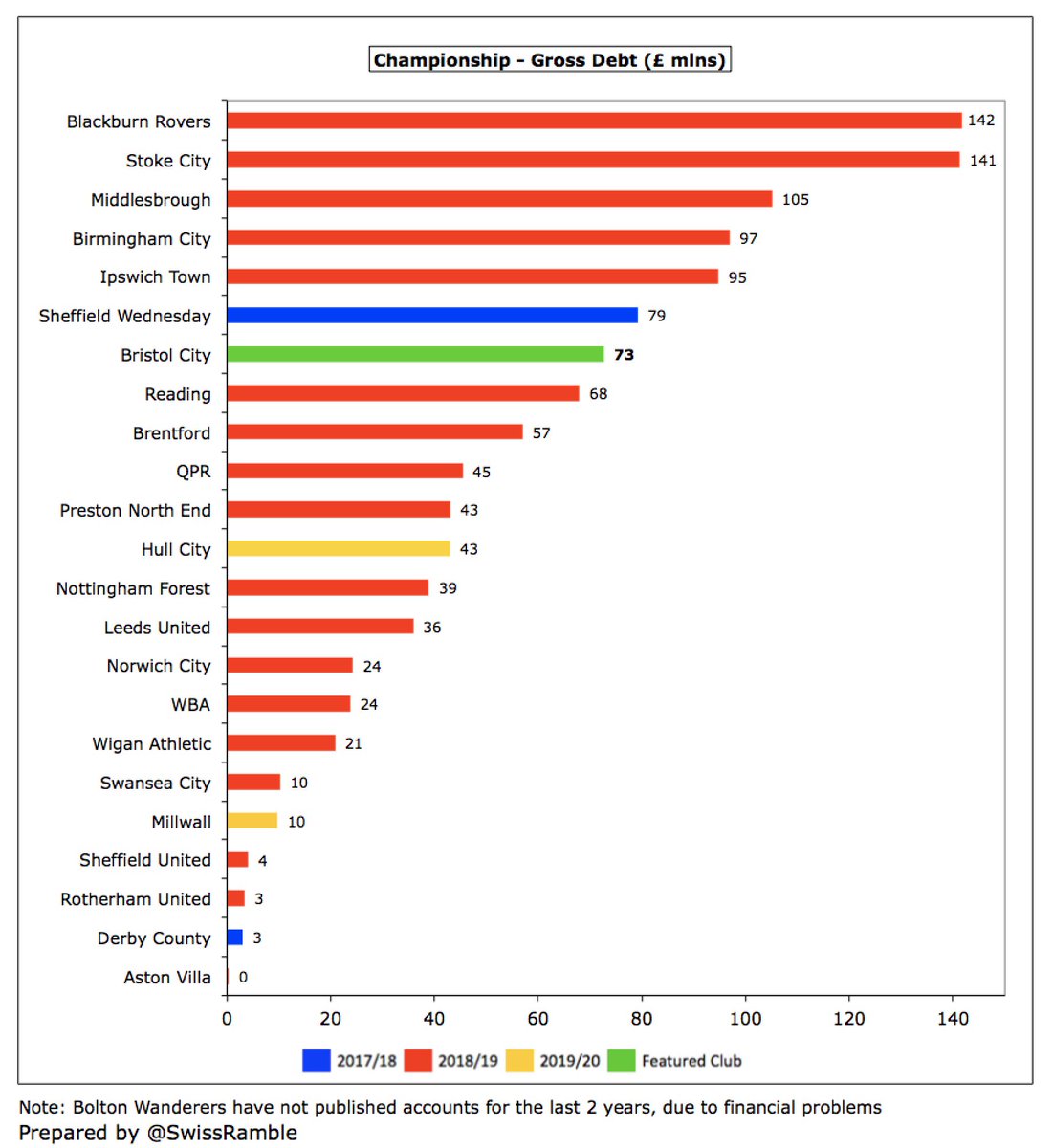

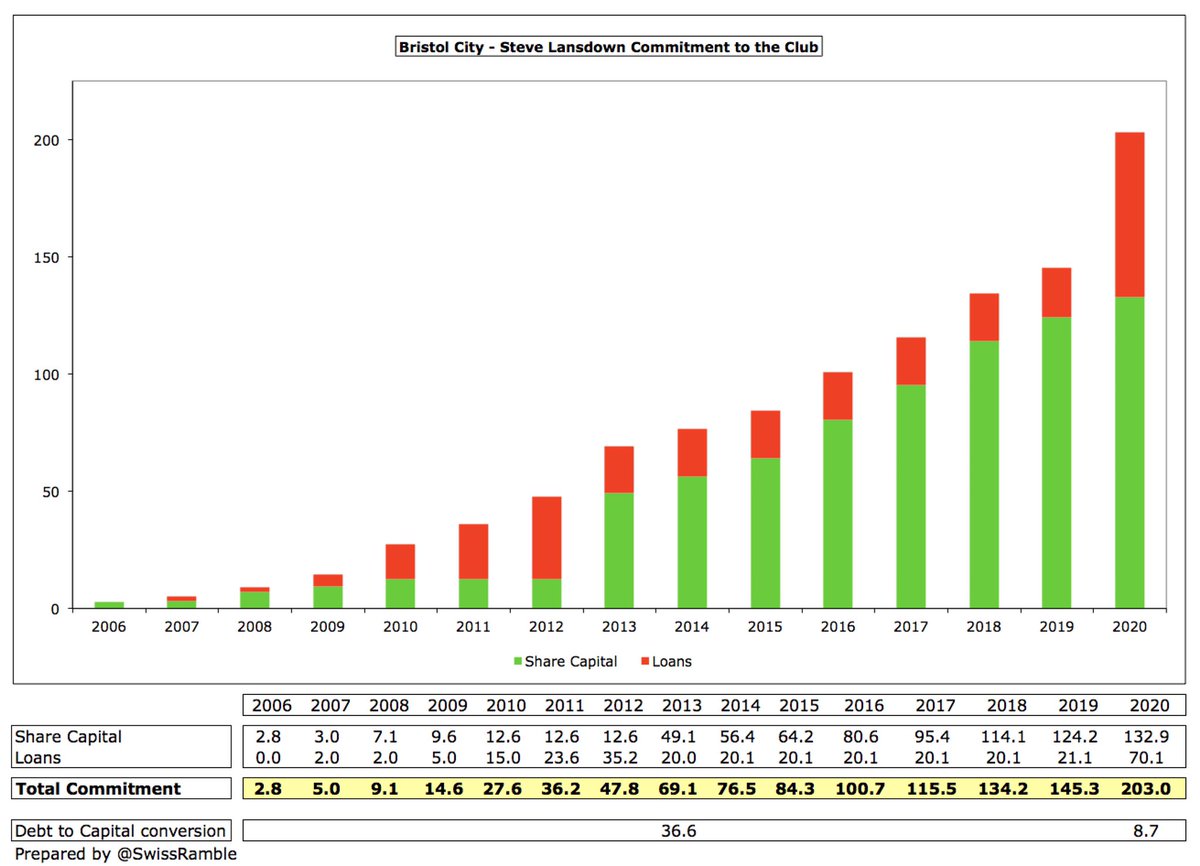

#BristolCity gross debt rose £3m to £73m, as the £50m bank loan and £19m loan from Pula Sports Ltd (Steve Lansdown’s company) were both refinanced by a £70m loan from the owners. Also have a £2m overdraft.

#BristolCity gross debt of £73m is quite large for a club of their size, but a few other clubs in the Championship owe more. The debt is not an issue, so long as Steve Lansdown remains a friendly owner, as he demonstrated last year by converting £8.7m of debt to equity.

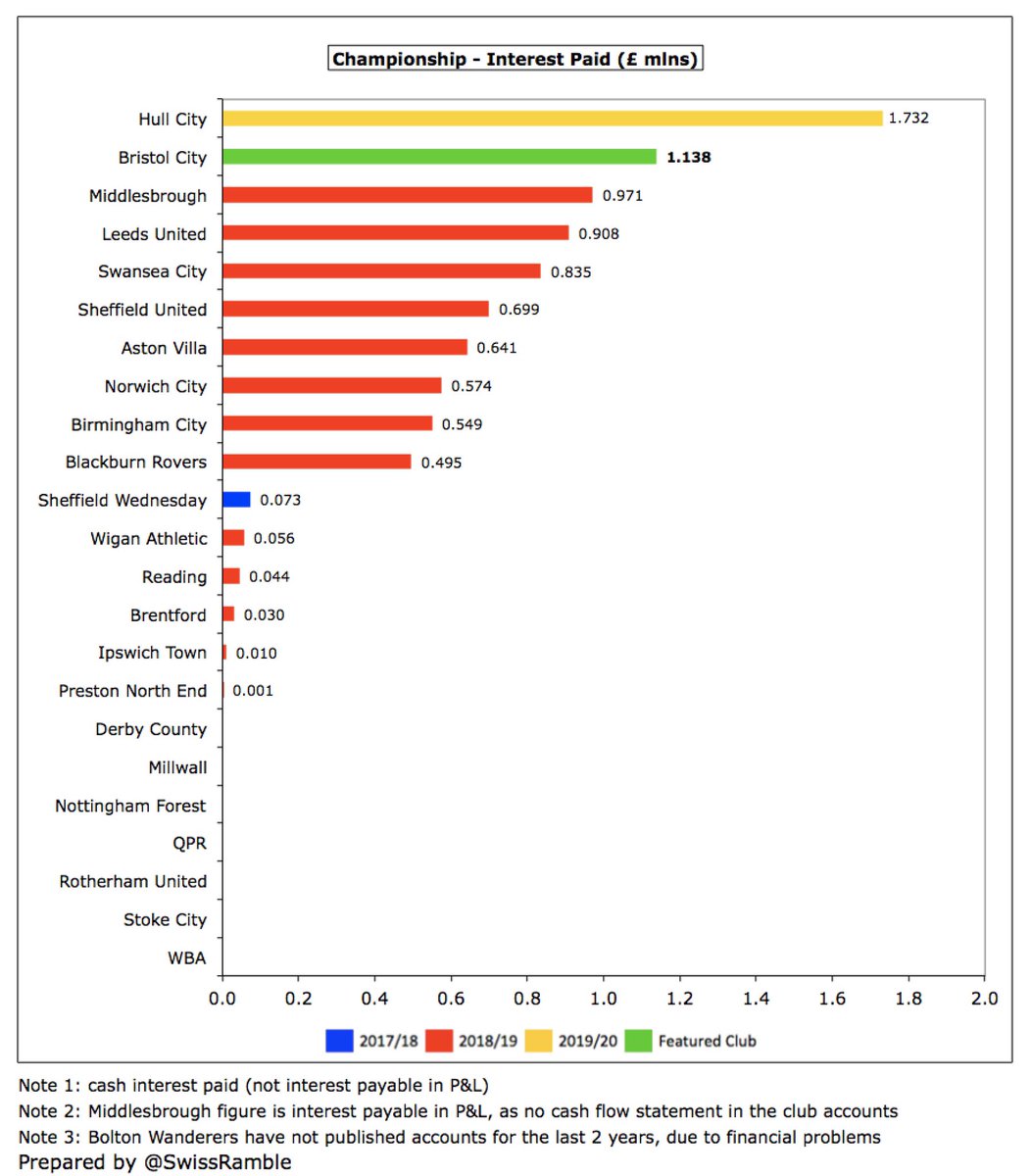

#BristolCity paid £1.1m interest in 2020 on the bank loan (LIBOR + 0.9%), the second highest in the Championship. Most owners provide debt interest-free, but the new Pula Sports loan has an interest rate 2% above the Barclays bank base rate.

#BristolCity transfer debt rose from £6m to £17m, while the amount owed to them from other clubs fell from £27m to £24m, giving a net receivable of £7m.

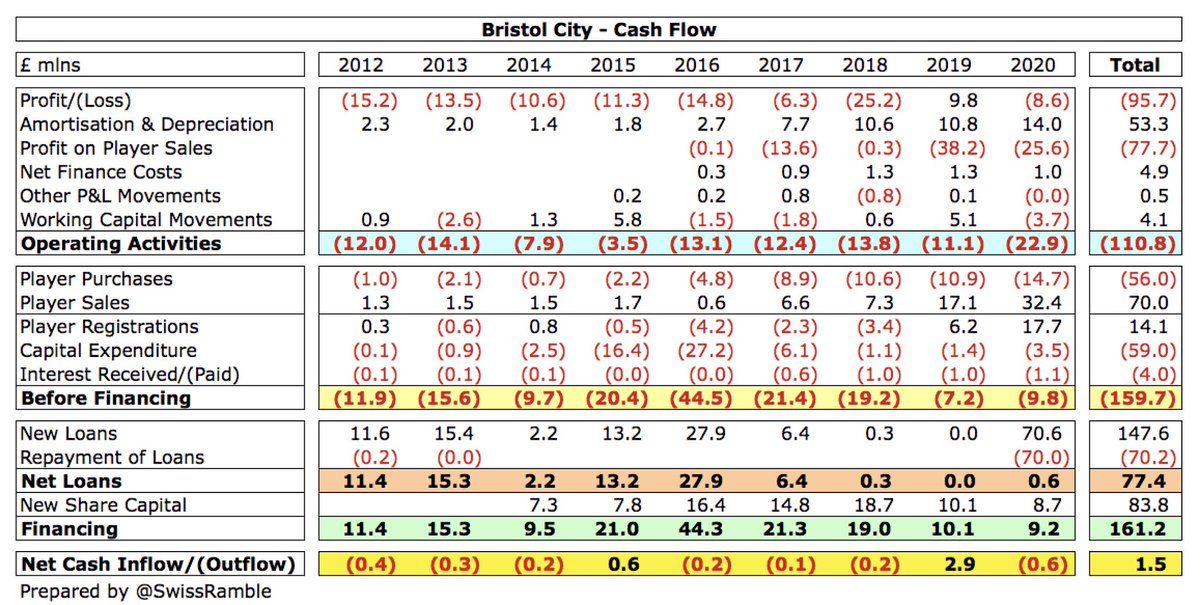

#BristolCity lost £23m cash from operations and spent £3m on infrastructure and £1m interest. They received (net) £18m from player sales with the shortfall being funded by £9m new share capital from owner Steve Lansdown.

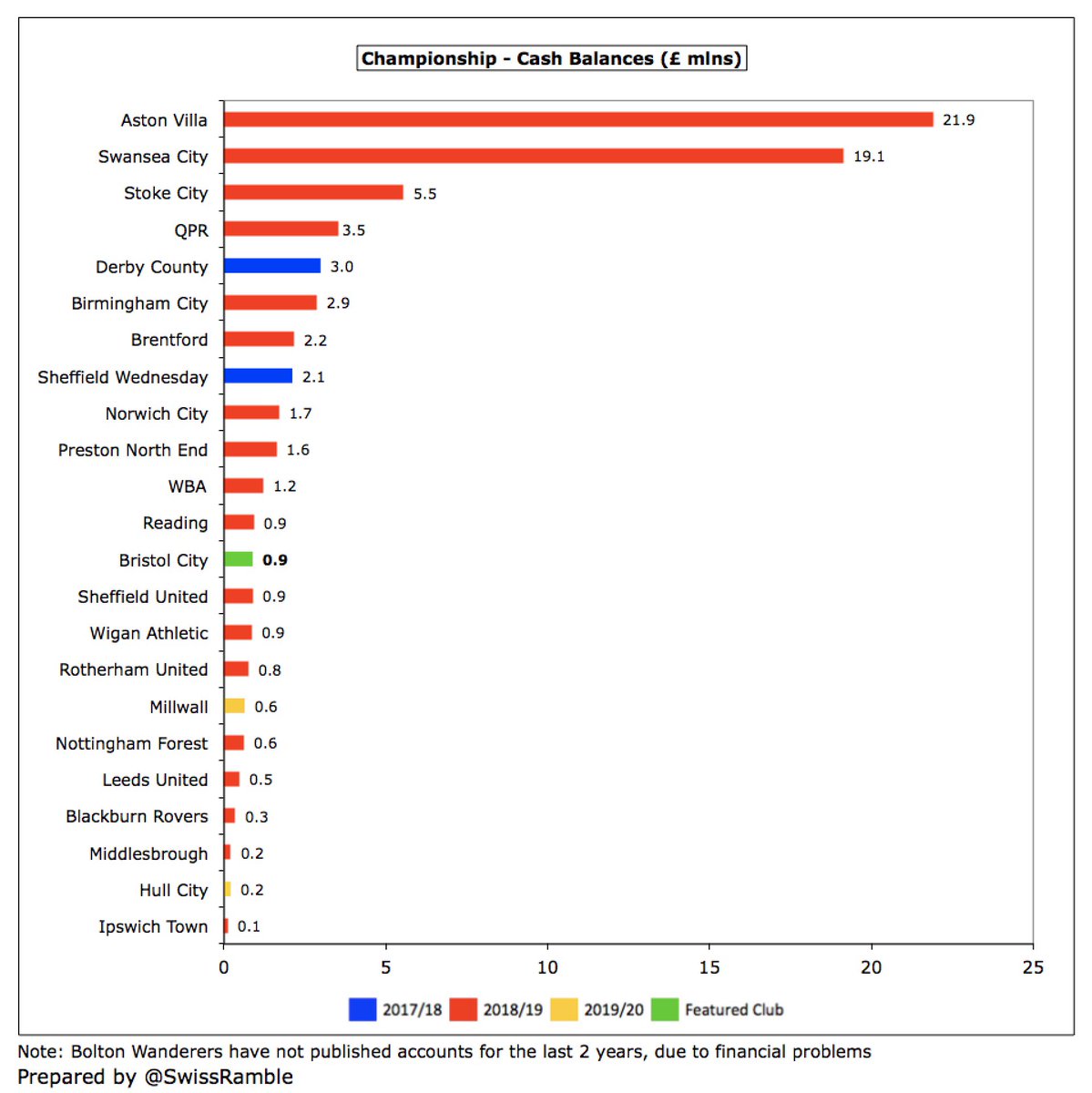

As a result, #BristolCity cash balance was basically unchanged at £0.9m. This is on the low side, but in fairness 15 clubs in the Championship had less than £2m cash in the bank, so this was not exceptional (though not a great buffer in the current climate).

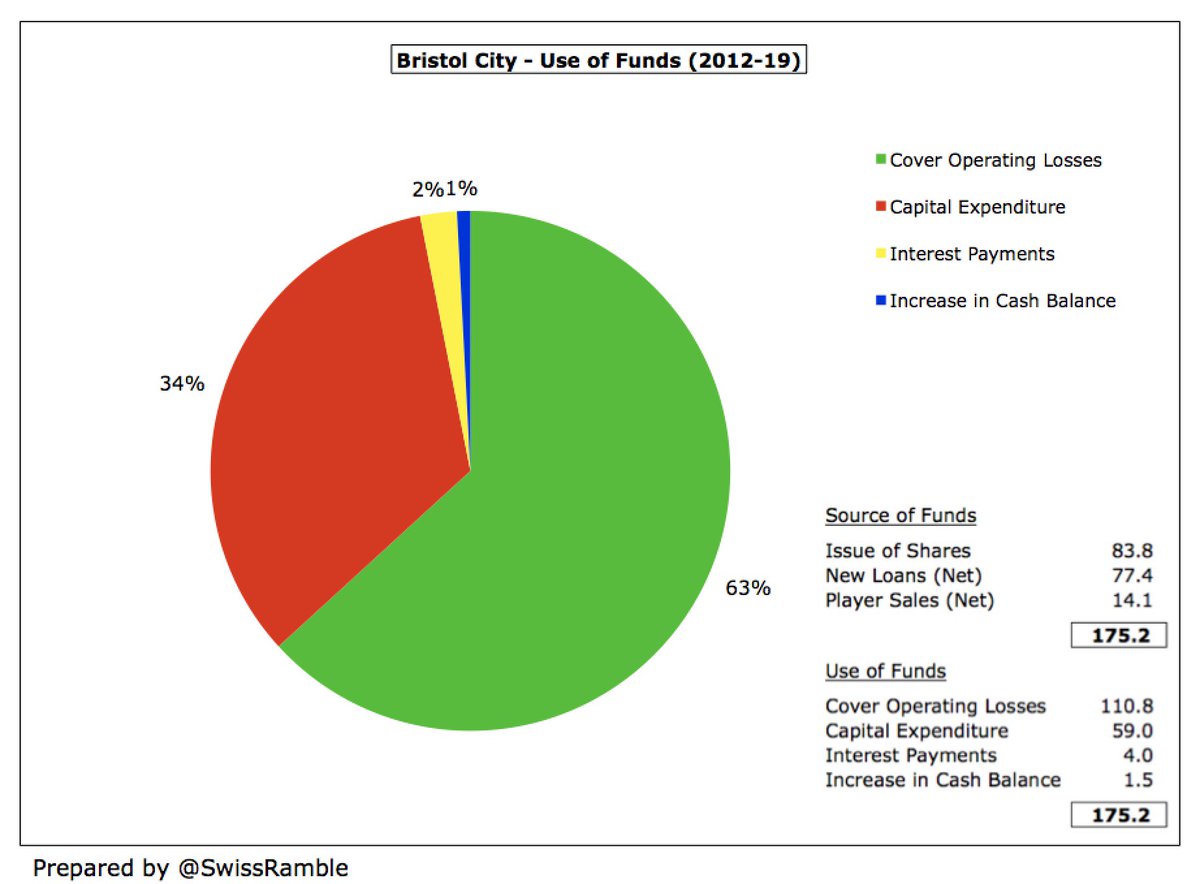

Since 2012 #BristolCity had available cash of £175m: (a) £84m from issuing share capital; (b) £77m from loans; (c) £14m from (net) player sales. Most of this has been used to cover operating losses £111m and on infrastructure investment £59m (mainly the stadium).

As the accounts state, #BristolCity is dependent on funding from Lansdown, the co-founder of financial services firm Hargreaves Lansdown. I estimate that he has put in around £203m to date (capital £133m, loan £70m) with little sign of the need for this funding going away.

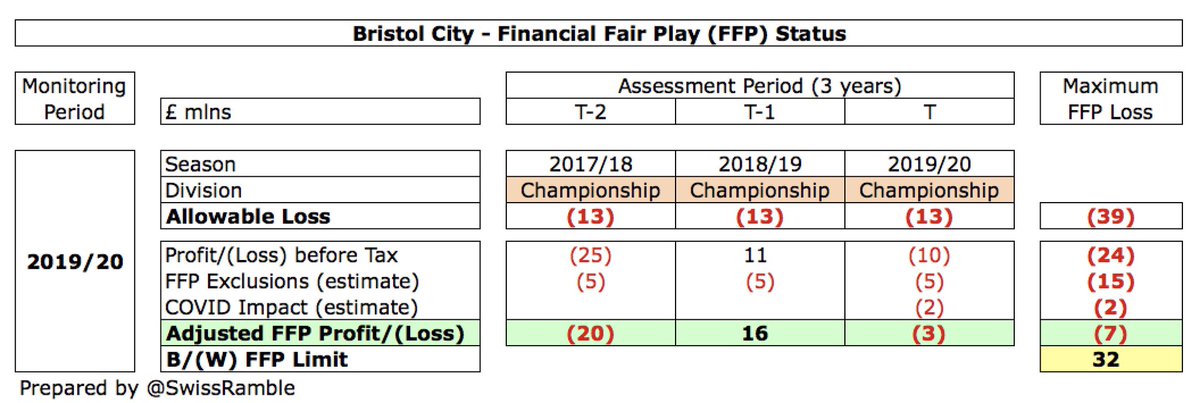

#BristolCity have no problems with Profitability & Sustainability rules. Reported £24m losses over 3-year monitoring period less estimated £17m allowable deductions for academy, community, infrastructure and COVID take their FFP losses to £7m, easily within the £39m target.

Like most Championship clubs, #BristolCity make operational losses, though they have limited the damage with profitable player trading. This revenue source is under pressure (as are others) in the current pandemic, so they are lucky to have a benevolent owner in Lansdown.

• • •

Missing some Tweet in this thread? You can try to

force a refresh