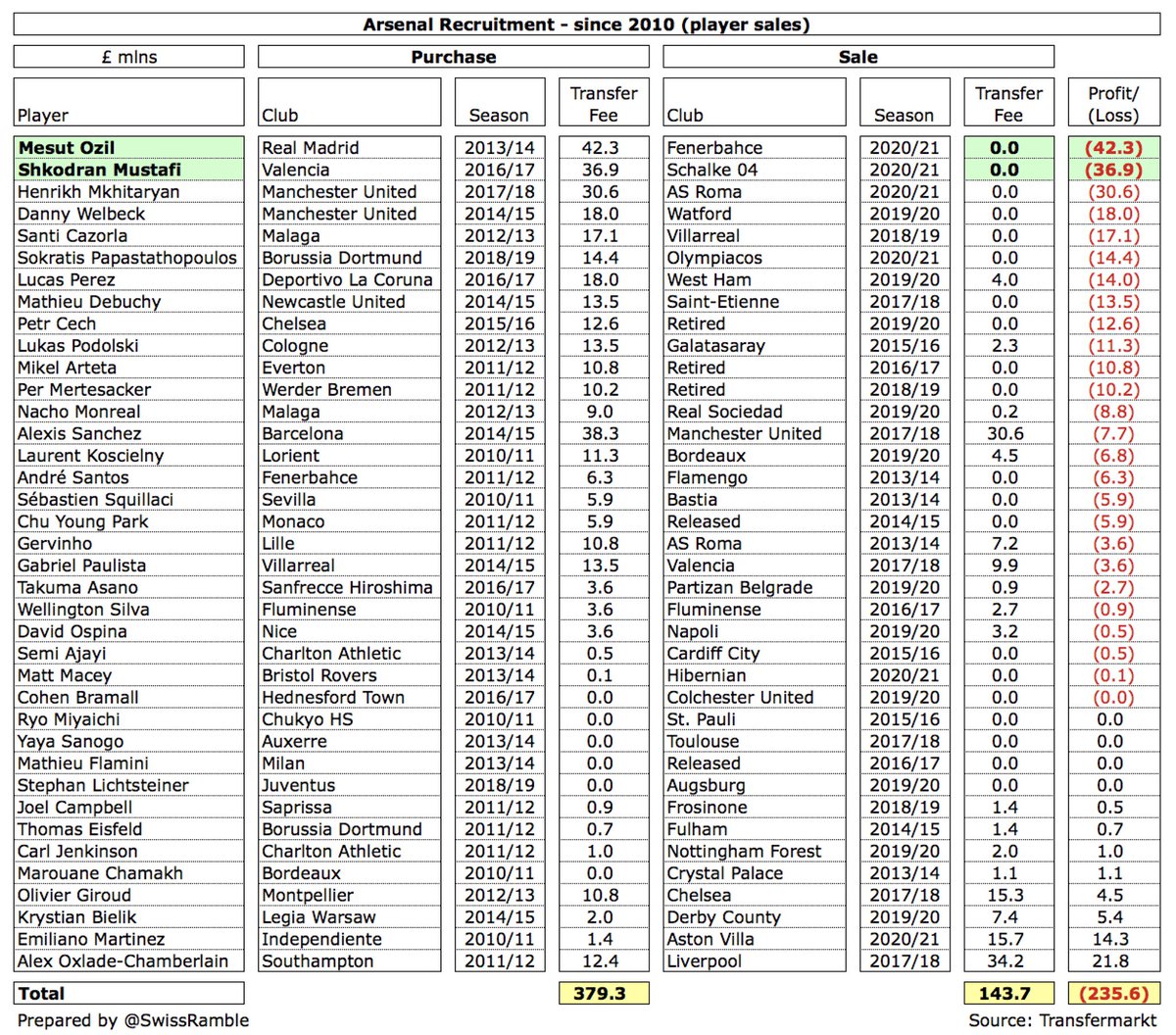

Arsenal have finally moved on Mesut Ozil and Shkodran Mustafi via free transfers, which raises the question of how good the club’s recruitment has been. Looking at this over a longer period, we can see that since 2010 they have lost (in cash terms) a cool £236m #AFC

The largest losses for #AFC in that period have indeed come from Ozil £42m and Mustafi £37m, but it has been a fairly consistent story of cash losses in the last decade. Highest profits generated by The Ox £22m, Martinez £14m and Bielik £5m.

Of course, from an accounting perspective some of these losses will have been reported as profits, as this is based on sales proceeds less value in the accounts, which is reduced each year by player amortisation. However, in the real world #AFC have lost a lot of money.

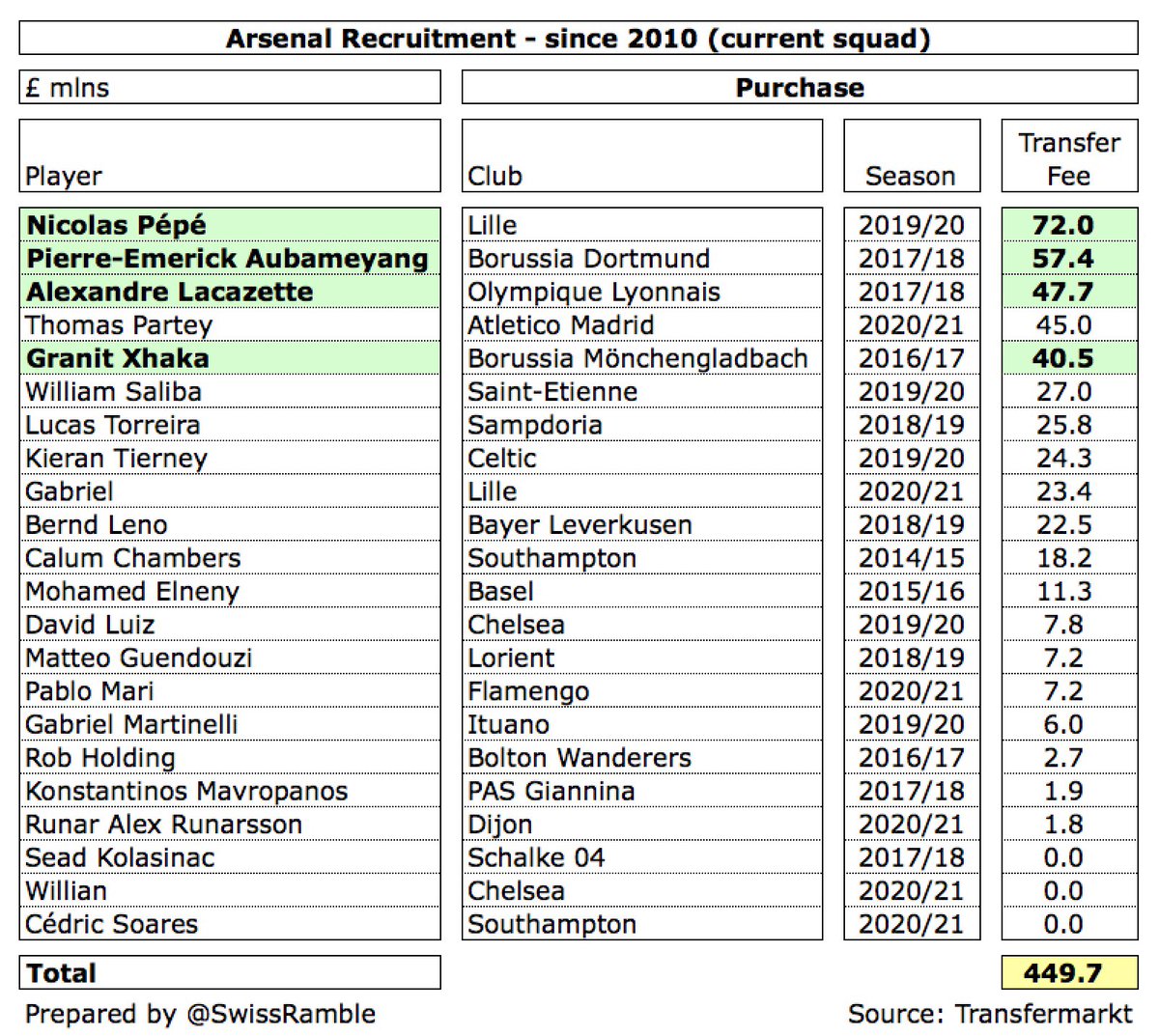

Moreover, some players recruited since 2010 are still at the club, which means that #AFC have around £450m of transfer cost in their squad, including Pépé £72m, Aubameyang £57m, Lacazette £48m and Xhaka £41m. It is unlikely any of these would command such high fees if sold.

Note that this analysis only includes players that #AFC bought from other clubs since 2010, as it focuses on recruitment, so excludes players from the academy, e.g. Alex Iwobi (£27m profit) and Chuba Akpom (£900k profit).

• • •

Missing some Tweet in this thread? You can try to

force a refresh