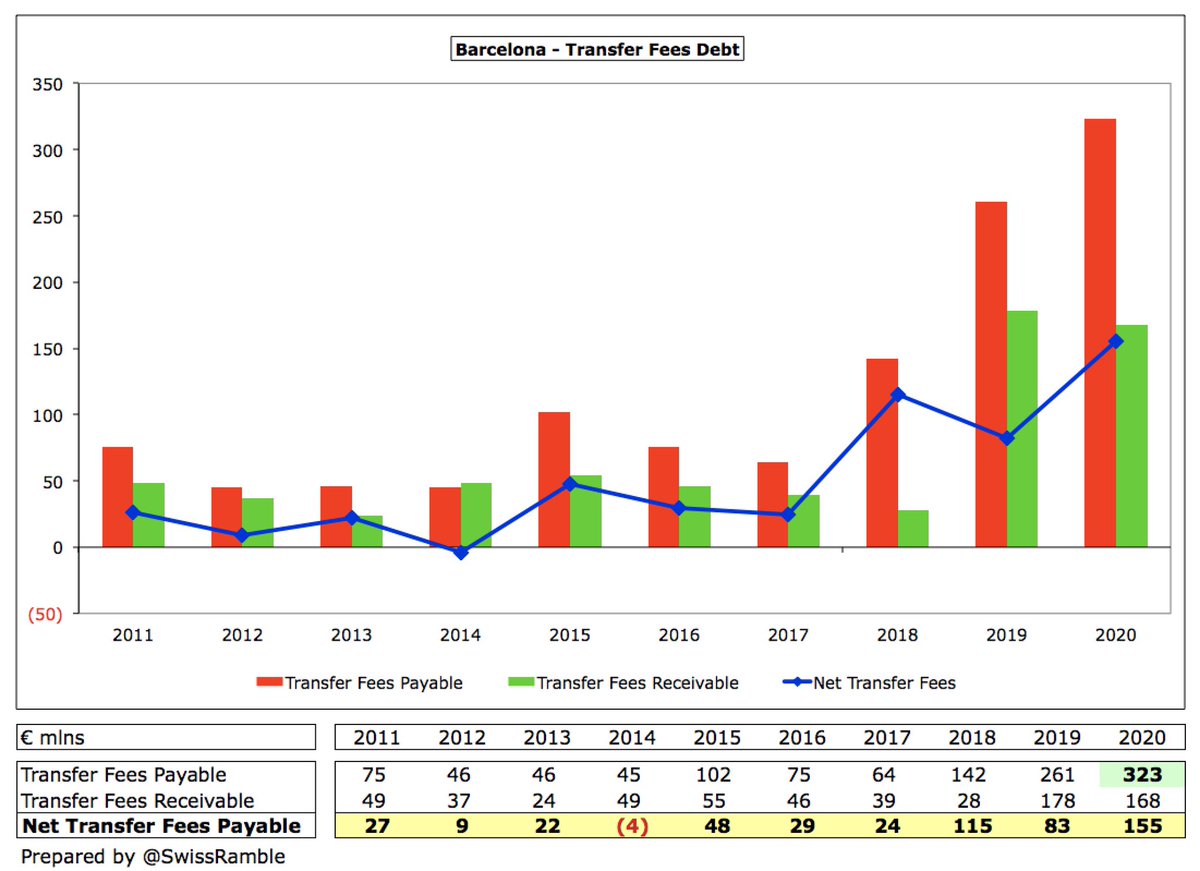

After yesterday’s review of #FCBarcelona financials, I was asked to provide some more detail on their transfer debt, which increased from €261m to €323m in 2020. Amounts owed to Barca by other clubs fell from €178m €168m, so net payables nearly doubled from €83m to €155m.

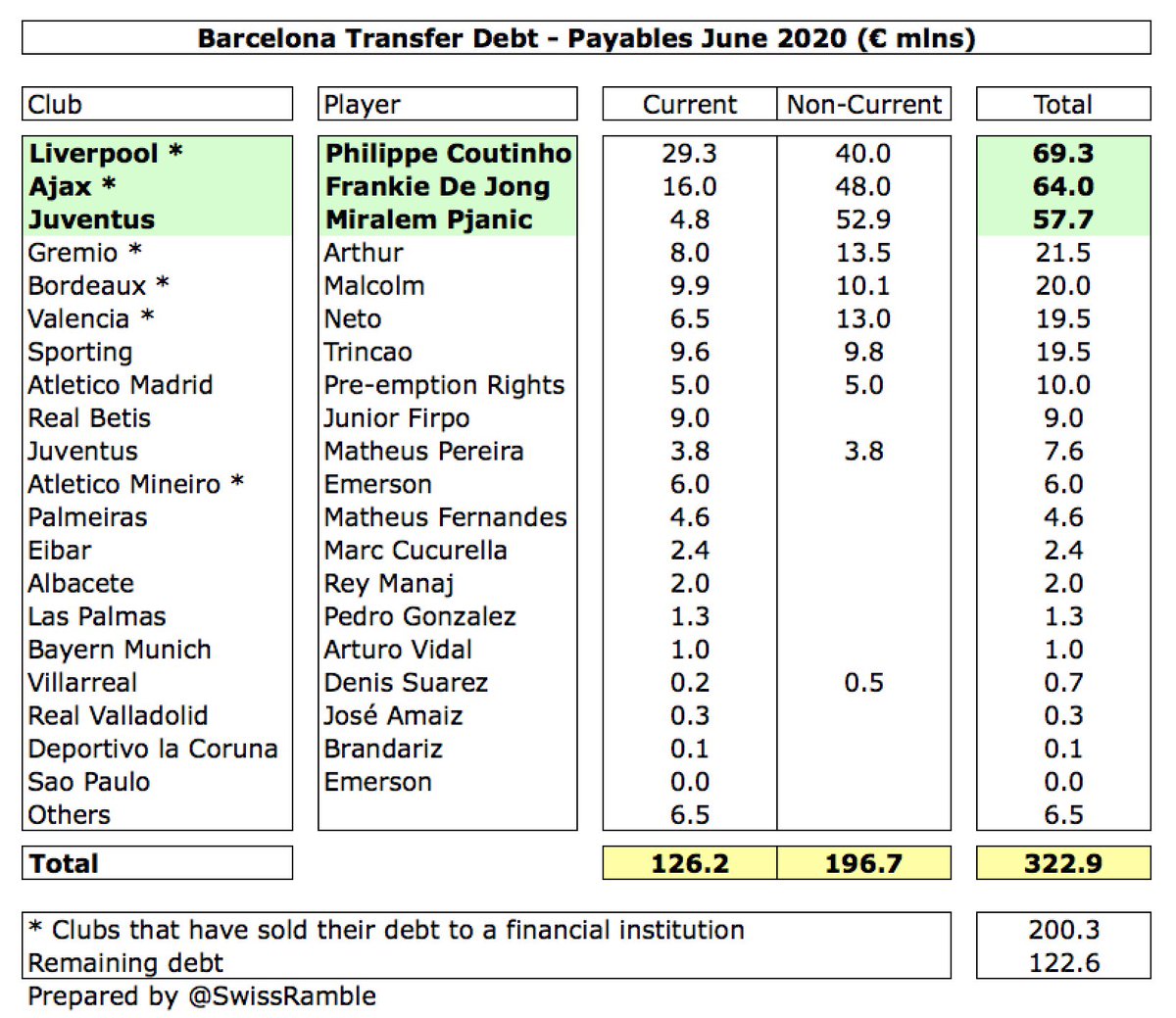

#FCBarcelona largest transfer debts are with #LFC €69m (Coutinho), Juventus €65m (Miralem Pjanic €58m and Matheus Pereira €8m), Ajax €64m (Frenkie De Jong), Gremio €21m (Arthur), Bordeaux) €20m (Malcolm), Valencia €20m (Neto) and Sporting €19m (Trincao).

However, it is important to note that some clubs have sold their debt to financial institutions (for a fee), so no risk of default/delayed payment in the cases of #LFC, Ajax, Gremio, Bordeaux, Valencia and Atletico Mineiro. Juventus payable is offset by their purchase of Arthur.

#FCBarcelona are in turn owed €168m transfer fees from other clubs. The largest receivable is from Juventus €75m (Arthur €66m, Marques €8m and Moreno €1m), followed by Zenit St Petersburg €29m (Malcolm), Getafe €12m (Marc Cucurella) and Roma €11m (Carles Perez).

• • •

Missing some Tweet in this thread? You can try to

force a refresh