We’ve seen many misrepresentations of Italy. Now there’s the new #Draghi government – use the opportunity for a “New Southern Policy”! We wrote an article with data to debunk myths, and present ideas for moving forward. Thread #CAIN /1

braveneweurope.com/philipp-heimbe…

braveneweurope.com/philipp-heimbe…

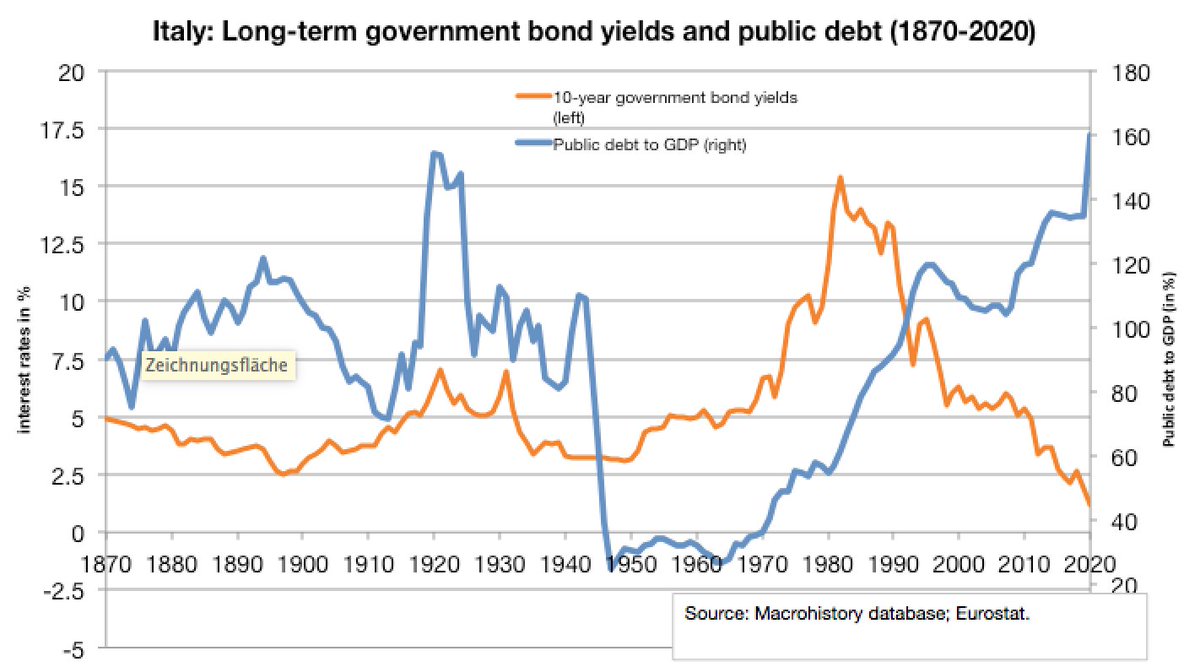

1.Due to Covid, Italy’s public debt has jumped to 160% of GDP. It’s important to understand why Italy's public debt was high already before Covid19: primarily as a legacy from the 1980s and 1990s, when interest rates on government bonds skyrocketed.

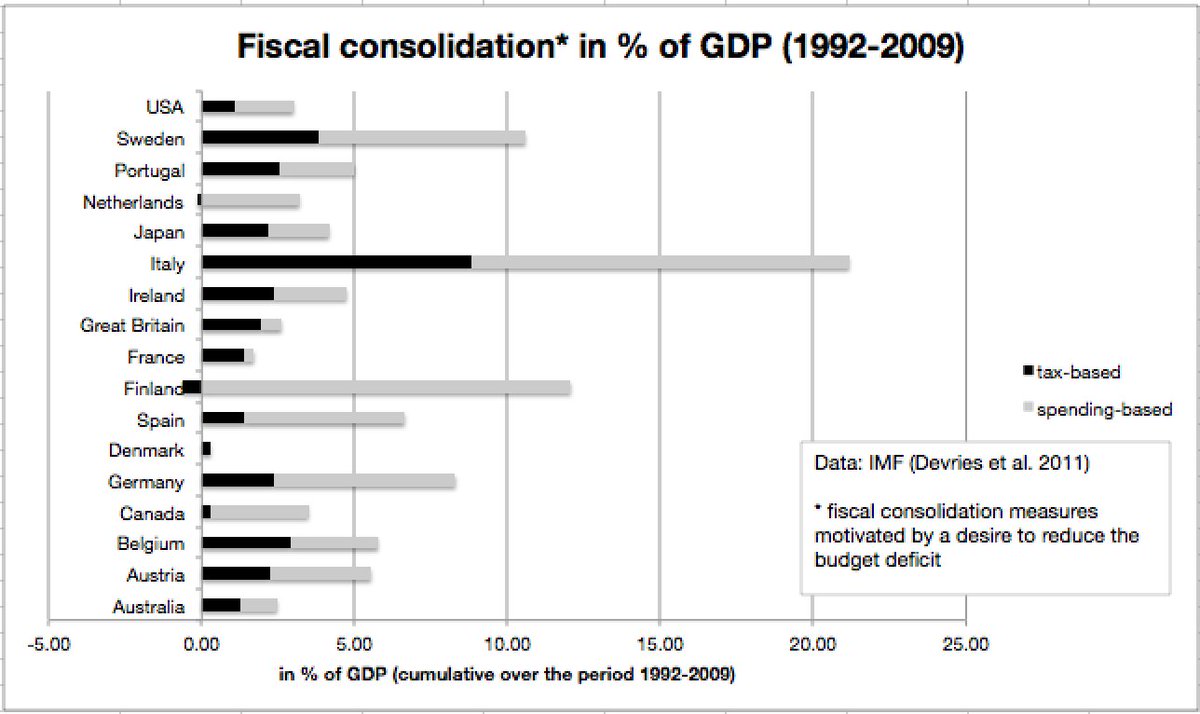

2.If we exclude the burden of interest payments, the Italian state is the world champion in running budget surpluses from the early 1990s up to Corona (“primary surpluses”). A lack of fiscal discipline locks different…

3.Running primary surpluses for 30 years had negative growth effects. Slow GDP growth relative to higher interest rates pushed up Italy's public-debt-to-GDP ratio. Too much fiscal consolidation is not good for debt sustainability.

4.Many claim that Italy just didn't do enough fiscal consolidation to fix its public finances. In fact, fiscal consolidation in Italy was far more sizeable than in any other advanced country (from early 1990s up to financial crisis). Austerity reduced growth.

5.Decades of tight fiscal policy have done real damage; in particular, the Italian health sector lost important capacity to offer adequate protection to the population during COVID-19 crisis; evidence: link.springer.com/content/pdf/10…

6.Public investment in Italy has fallen victim to fiscal austerity after the financial crisis. Investment has been cut more strongly than the €zone average, implying a decaying public capital stock - with negative short- and long-term growth effects.

7.I regularly read claims that grants from the EU recovery fund are just the next and largest round of European “gifts“ to Italy. In fact, Italy has so far been a net contributor to the EU budget, i.e. it has received less in EU funds than it has paid in terms of contributions.

8.Italy has been living beyond its means! But this claim is also false when looking at the economy. Since 2012, Italy has been recording higher exports of goods and services than imports. The country consumes less than it produces – living below its means!

9.Private debt is relatively low in Italy compared to other OECD countries. Much higher in some “frugal” countries (hello, Sweden/Netherlands/Denmark). Debt is in general certainly not more of an issue than in other countries.

10.Italy has carried out many market-liberal reforms. Labour market flexibilisation brought a sharp increase in fixed-term contracts and a decline in real wages. However, these structural reforms have contributed to reducing Italy's productivity growth.

11.Labour market liberalisation generated temporary jobs. However, cheap labour reduced real wages and diminished incentives for companies to make labour-saving investments – with negative effects on productivity, which is the basis for long-term growth.

12.Italy's persistent macroeconomic problems are partly a consequence of the shortcomings of the institutions, rules and policy prescriptions in the €zone. Fiscal consolidation and market-liberal reforms have not worked the promised magic.

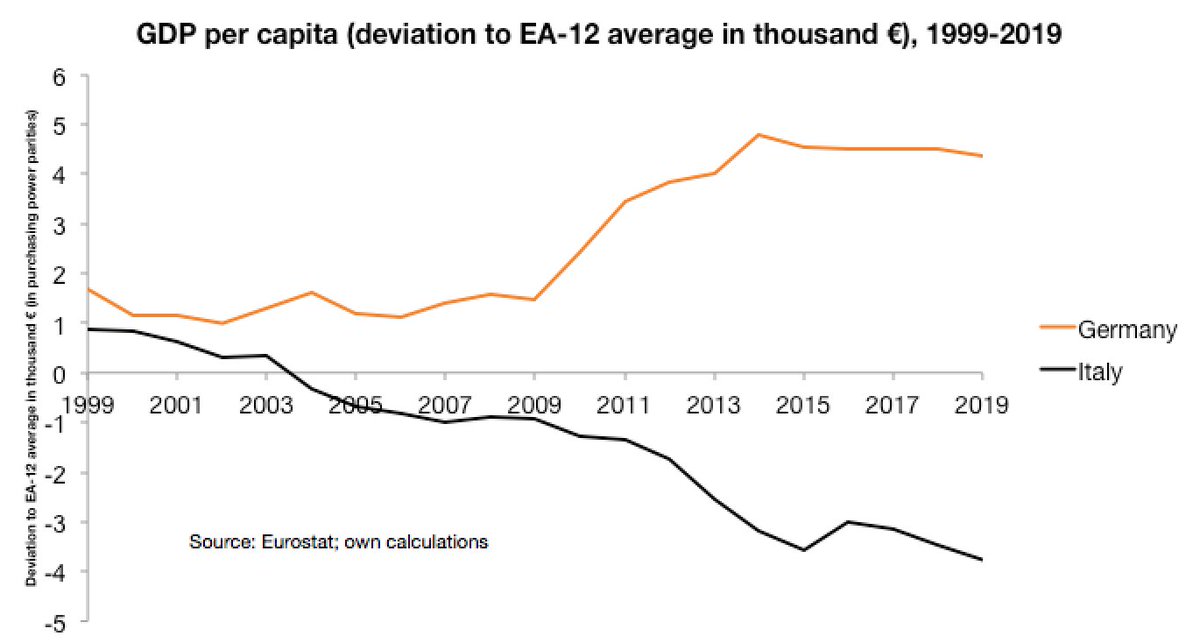

13.Italy's economy has lost ground in the €zone: 20 years ago, in 2000, Italy's per capita income was virtually equal to that of Germany (98.6% of German GDP per capita). Since the introduction of the euro, however, it has declined relative to Germany and to the €zone average.

14.Italian politicians certainly have to bear responsibility. But the macro policy framework matters – those who don’t see that doubling down on labour market liberalisation and fiscal austerity in the existing framework won’t solve Italy’s problems share responsibility as well.

15.Italy has never been a haven of political stability—the new Draghi-led government is the 67th since the war—and mafia and corruption have long been embedded. Yet this did not hinder the Italian economy from developing quite dynamically at times.

16.Despite all problems, Italy still records the second highest share of industrial production in the EU (behind Germany). Italy exports significantly more industrial goods than it imports.

17.Italy is an essential industrial player in Europe, especially in mechanical engineering, vehicle construction and pharmaceutical products. The OECD classifies the industries concerned as ‘medium-high-tech’ to ‘high-tech’. Italy’s top exports groups are similar to Germany.

18.That’s one of the main reasons why other (“frugal”) EU countries would also benefit greatly if EU recovery fund money were spent in a way that accelerates recovery of the Italian economy. The stakes are high.

19.Italy is of systemic importance. Italian exit from the €zone would have ripple effects in the financial system and negative consequences for all members. We should think about this, esp. as we discuss reforming the EU’s fiscal rules and the future of EU industrial policy.

20.If fiscal austerity and market-liberal reforms have not improved Italy's outlook, a more promising way forward is to try a strong investment strategy and to give Italy's industry a boost by launching a modern industrial strategy.

21.A strong Italy in a strong EU would very much be in the interest of those who want Europe to preserve its model of a socially balanced liberal democracy. And it would be in the interest of those who want a strong Europe so that it can compete with the US and 🇨🇳.

• • •

Missing some Tweet in this thread? You can try to

force a refresh