Campaign Against Italy Nonsense (#CAIN):

Here's a SUMMARY THREAD with seven stereotype-defying pieces of data about #Italy. The country is not a basket case. The dominant narrative is distorted, fuels resentment and leads to bad policy outcomes.

braveneweurope.com/philipp-heimbe…

Here's a SUMMARY THREAD with seven stereotype-defying pieces of data about #Italy. The country is not a basket case. The dominant narrative is distorted, fuels resentment and leads to bad policy outcomes.

braveneweurope.com/philipp-heimbe…

1. Italians do not live beyond their means. Since 2012, Italy has been recording higher exports of goods and services than imports. The country consumes less than it produces – if anything, it lives below its means.

2. Private debt is relatively low in Italy compared to other OECD countries. Debt is not an issue for all sectors of the Italian economy.

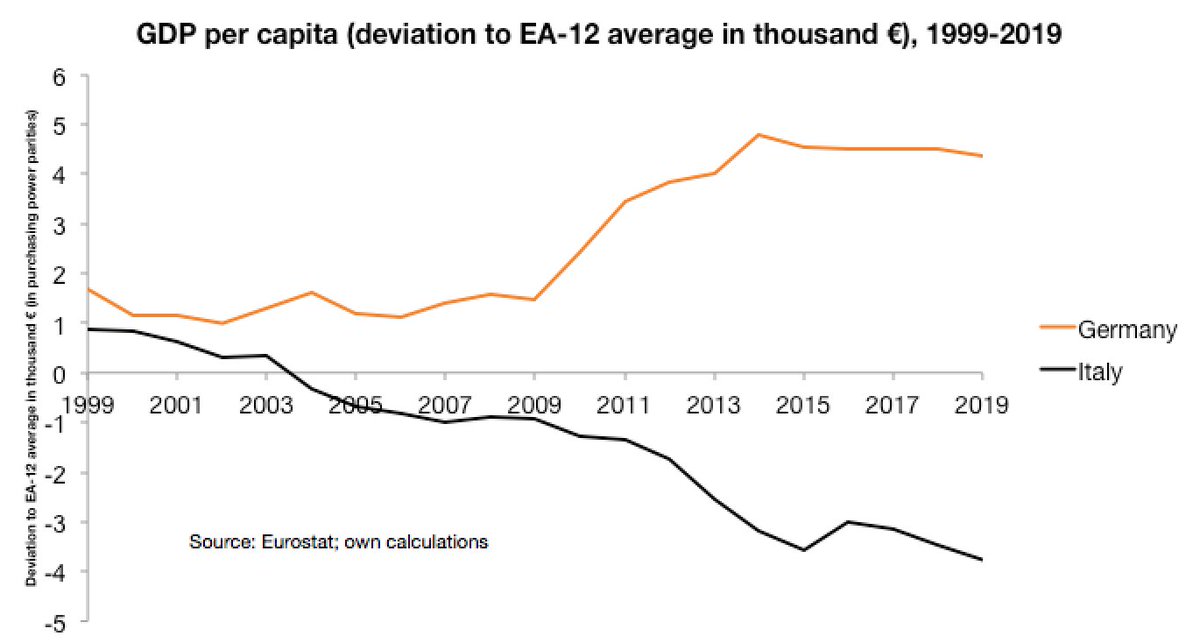

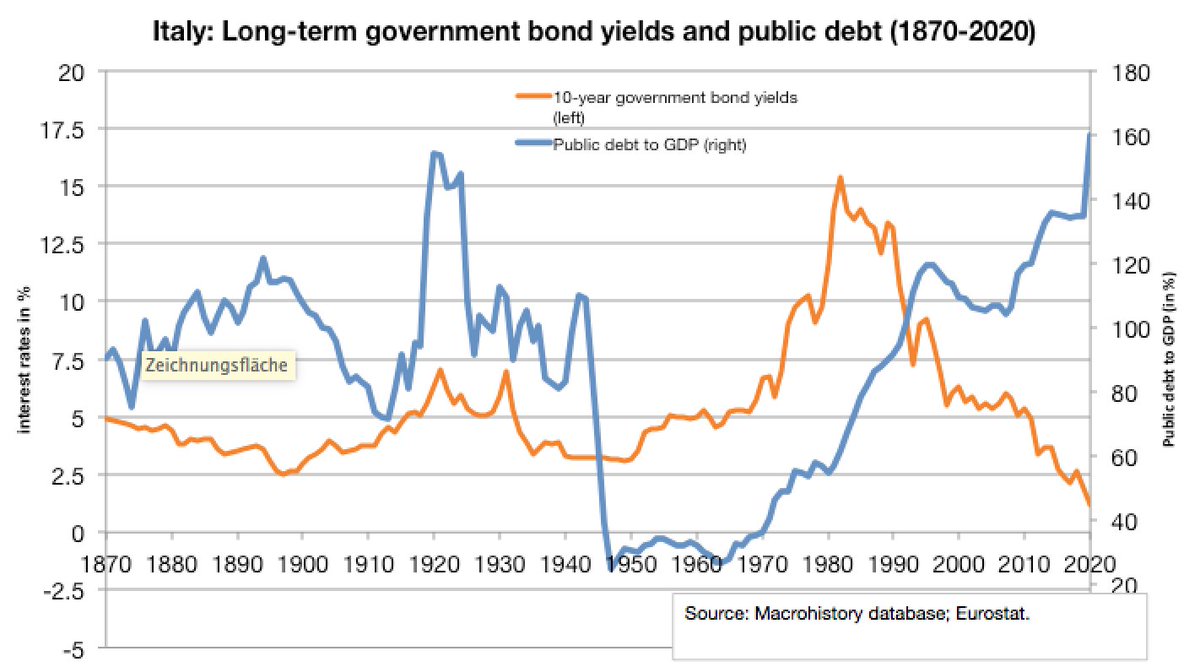

3. Public debt is primarily high because of legacy debt from the 1980s. If we exclude the burden of interest payments, the Italian state has been more "frugal" than any other EU country, consistently running "primary" budget surpluses since 1992.

4. Over the last decades, Italy has been a net contributor to EU budget, i.e. it has received less in EU funds than it has paid in terms of contributions. Stories about Italy receiving "gifts" from the EU recovery fund are flawed, other members benefit from positive spillovers.

5. Italy has carried out many market-liberal reforms. Labour market flexibilisation brought a sharp increase in fixed-term contracts and a decline in real wages. However, these structural reforms have not helped Italy's productivity growth.

6. Italy remains an important location for industrial activity, recording the second highest share of industrial production in the EU (behind Germany). Italy exports significantly more industrial goods than it imports, and produces lots of high-tech stuff.

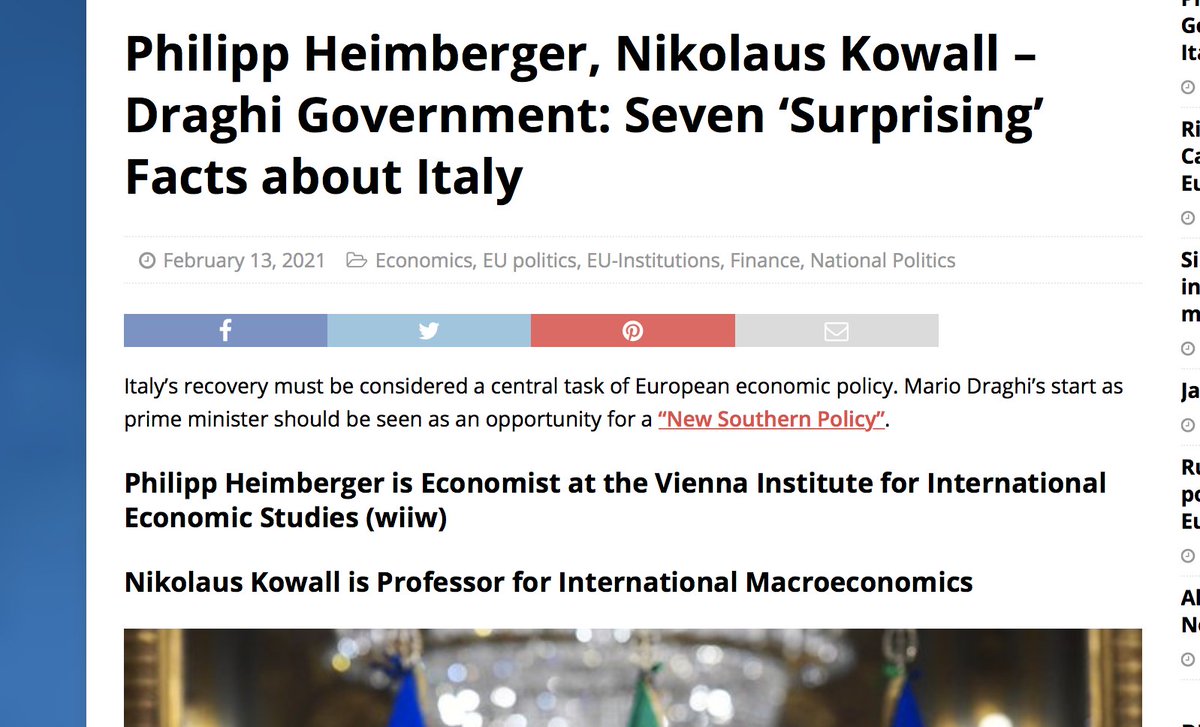

7. Italians are not wealthier than Germans or Austrians: the median Italian household holds more net wealth than the comparable German or Austrian household. But the average household is clearly wealthier in Germany and Austria.

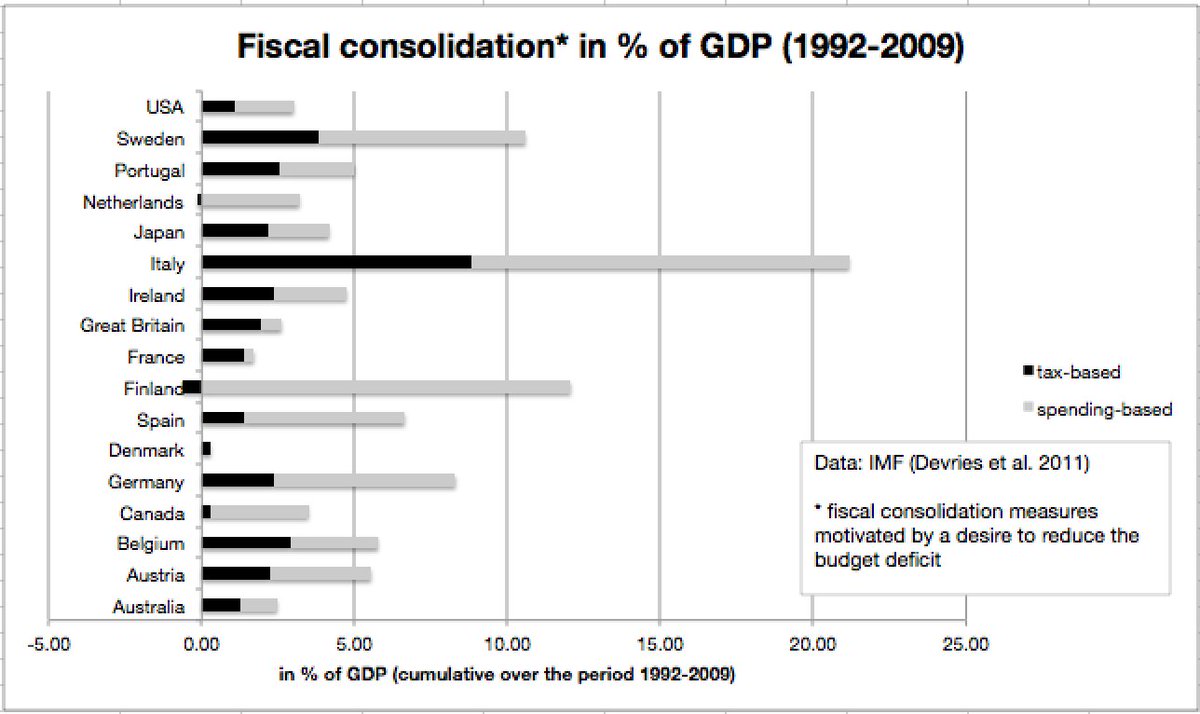

Permanent fiscal consolidation and market-liberal reforms over the last decades have not improved Italy's outlook. A more promising way forward is to launch an investment strategy combined with a modern industrial strategy to boost Italy's industry.

Italy certainly has significant structural problems (oversized banking sector, North-South divide, organised crime etc.). The question is: Under what conditions is the country better able to tackle these problems?

In this country of 60 million people, the stagnation of the last 20 years has been a breeding ground for fatalism rather than optimism. All the more reason for media and politicians in 🇩🇪, 🇦🇹, 🇳🇱 and beyond to refrain from treating Italy like a hopeless case.

A strong Italy in a strong EU would very much be in the interest of those who want Europe to preserve its model of a socially balanced liberal democracy in the 21st century. And it would be in the interest of those who want a strong Europe competing with the US and 🇨🇳.

From a European perspective, Italy's recovery must be considered a central task of economic policy. The start of #Draghi as prime minister should be seen as an opportunity for a "New Southern Policy" in the coming years. #CAIN

• • •

Missing some Tweet in this thread? You can try to

force a refresh