1/ I'm getting TONS of messages me asking me "Hey DC, what #NFTs should I buy?

The proper answer is ONLY ones that you enjoy and are willing to hold for years or possibly for forever.

But I will tell you some of the ones I have bought recently and why (MEGA-thread below)👇

The proper answer is ONLY ones that you enjoy and are willing to hold for years or possibly for forever.

But I will tell you some of the ones I have bought recently and why (MEGA-thread below)👇

2/ First, let's start with some caution: don't buy NFTs *expecting* financial return. You may be very disappointed.

Tastes can shift very quickly and decisively, and given market illiquidity, we could see price collapse under panic conditions.

I buy to collect & hold for years.

Tastes can shift very quickly and decisively, and given market illiquidity, we could see price collapse under panic conditions.

I buy to collect & hold for years.

3/ Second, let's discuss the only blockchain I'll buy high-value #NFTs on- that's #Ethereum.

Why? The linked thread covers it, but to summarize, I can't afford to put big sums of money into chains cutoff from DeFi and which might not exist in 5-10 years.

Why? The linked thread covers it, but to summarize, I can't afford to put big sums of money into chains cutoff from DeFi and which might not exist in 5-10 years.

https://twitter.com/iamDCinvestor/status/1360734757559164930?s=20

4/ With that out of the way, the first "art" project I started to dive into (after years of being personally focused on in-game NFTs), was #CryptoPunks by @larvalabs.

Punks are widely acknowledged to be the first digital collectible on Ethereum, pre-dating the ERC-721 standard.

Punks are widely acknowledged to be the first digital collectible on Ethereum, pre-dating the ERC-721 standard.

5/ There are only 10,000 CryptoPunks, algorithmically generated with no two alike.

At launch in June 2017, these were basically given away. Now, the least expensive costs ~$14K / more than 7 ETH.

larvalabs.com/cryptopunks/fo…

At launch in June 2017, these were basically given away. Now, the least expensive costs ~$14K / more than 7 ETH.

larvalabs.com/cryptopunks/fo…

6/ My thesis behind Punks is as blockchain art takes off, more people will want to own one of the OG collectibles. They have an 8-bit charm and make for fun avatars (like mine).

At 10K, there are enough to sustain a broad collector base, but also scarce enough to be valuable.

At 10K, there are enough to sustain a broad collector base, but also scarce enough to be valuable.

7/ Once I got a few Punks in my collection, I realized that I had been missing out on an entire world of #Ethereum collectibles.

The next stop on my journey must be $SOCKS, aka Unisocks from @Uniswap.

unisocks.exchange

The next stop on my journey must be $SOCKS, aka Unisocks from @Uniswap.

unisocks.exchange

8/ #DeFi will go down in history as a cataclysmic shift in finance (perhaps the biggest since the 1400s), and the emergence of Uniswap with Automated Market Maker technology will be a key part of that.

$SOCKS are actually ERC-20 tokens, redeemable for a NFT & real socks.

$SOCKS are actually ERC-20 tokens, redeemable for a NFT & real socks.

9/ $SOCKS have been around for a while and the price has climbed substantially (now at $37K).

Only 315 are left which have not been redeemed, and I plan to hold mine (unredeemed) as a collectible piece of DeFi history.

Only 315 are left which have not been redeemed, and I plan to hold mine (unredeemed) as a collectible piece of DeFi history.

https://twitter.com/uniswap/status/1126506339075641344?lang=en

10/ The next NFT project I jumped into at the advice of some Punk-ers were @TheHashmasks. Inspired by CryptoPunks, they take the concept and turn it up to 11.

Not just beautiful avatars, but token emission (as $NCT), hidden symbols and riddles, and a strong community.

Not just beautiful avatars, but token emission (as $NCT), hidden symbols and riddles, and a strong community.

11/ I don't know what the future holds for HashMasks, but I have a feeling that we ain't seen anything yet. IMO, link Punks, these have a shot at being remembered as OG pieces like Punks.

Here are a few I grabbed / generated during the initial minting.

Here are a few I grabbed / generated during the initial minting.

12/ It was at that moment that something clicked for me. 💡

One of the most promising genres of art on the blockchain would be "generative art."

Art, generated by algorithms, created by an artist. And the hash for the minting tx provides the randomness.

artnome.com/news/2018/8/8/…

One of the most promising genres of art on the blockchain would be "generative art."

Art, generated by algorithms, created by an artist. And the hash for the minting tx provides the randomness.

artnome.com/news/2018/8/8/…

13/ Both Punks & HashMasks are forms of generative art (focused on avatars). But as the #NFT art scene on #Ethereum gains awareness, more people will want to collect high quality art for the sake of aesthetics and new forms of expression.

That's when I discovered @artblocks_io.

That's when I discovered @artblocks_io.

14/ @artblocks_io provides a platform by which artists can publish quality generative art.

Here, there is far less focus on gimmicks than on the art itself. IMO, they are helping to establish a new genre of art by marrying it with its perfect medium: the Ethereum blockchain.

Here, there is far less focus on gimmicks than on the art itself. IMO, they are helping to establish a new genre of art by marrying it with its perfect medium: the Ethereum blockchain.

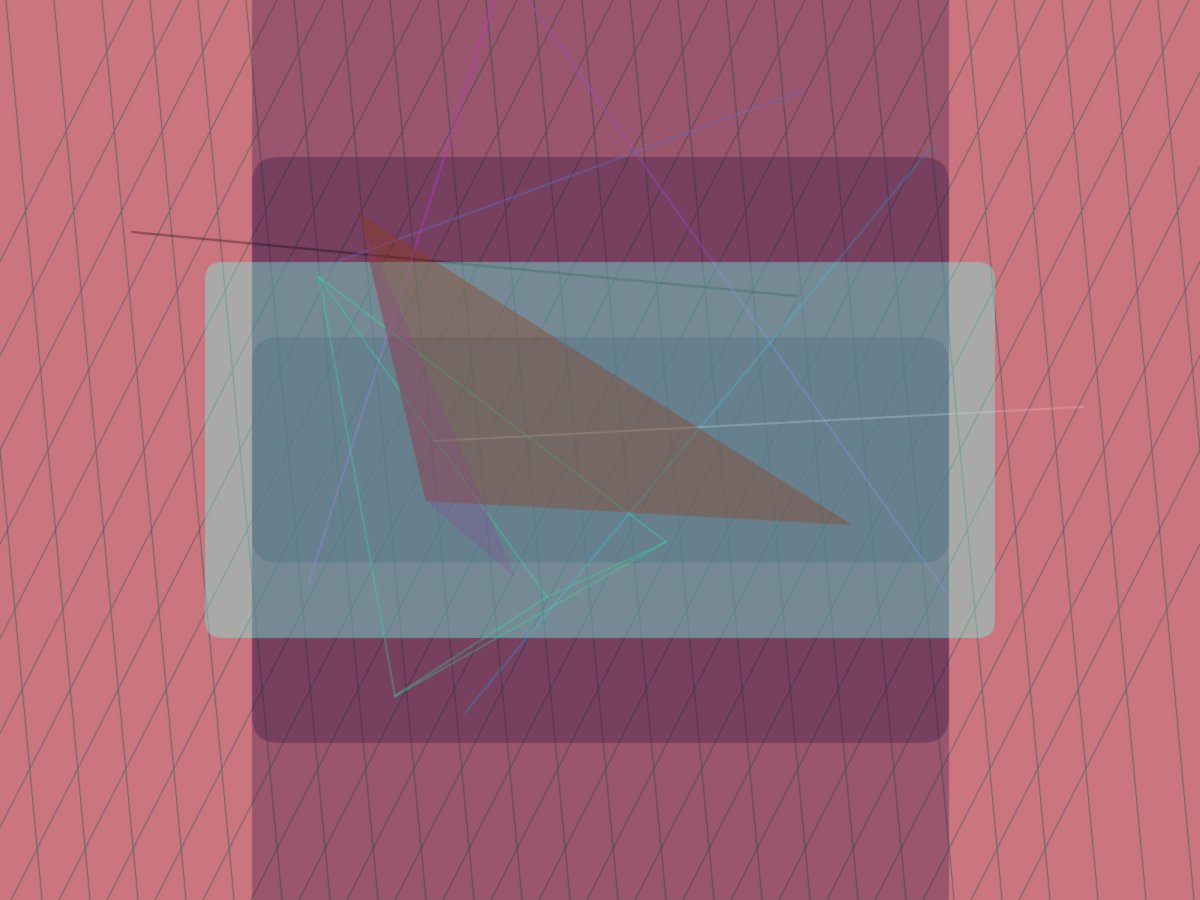

15/ #generativeart has been around for a while, but IMO, it shines when it meets blockchain based distribution.

Imagine limited edition series where 100 to 1000 pieces are minted. Each is unique (based on the algo), but has a cohesive feel as a set.

Perfect art collectibles.

Imagine limited edition series where 100 to 1000 pieces are minted. Each is unique (based on the algo), but has a cohesive feel as a set.

Perfect art collectibles.

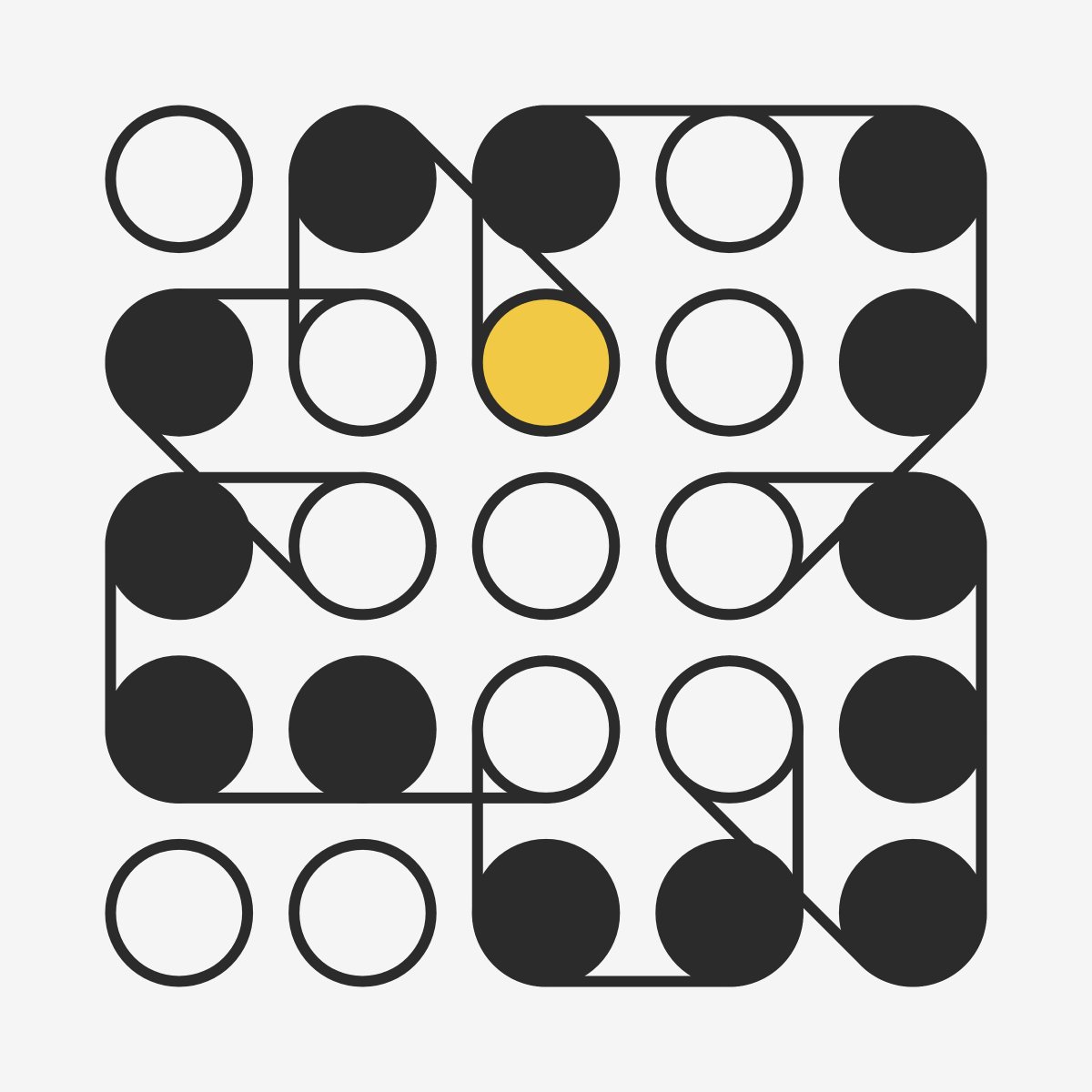

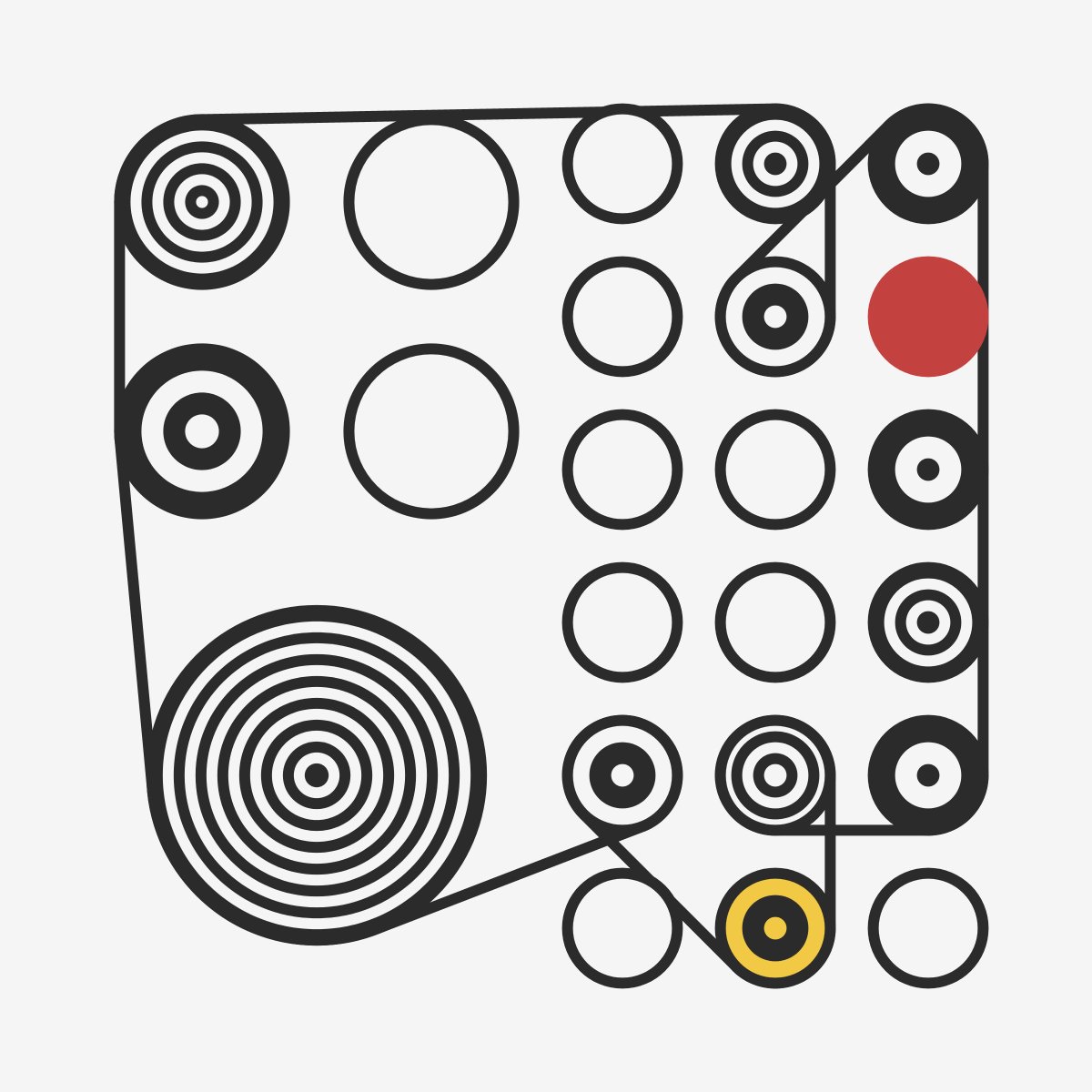

16/ @artblocks_io has been around for several months and has already built up a stunning collection.

While I think many of the series have great aesthetic value (and own pieces from many), the Ringers series from @dmitricherniak has captivated me.

artblocks.io/project/13

While I think many of the series have great aesthetic value (and own pieces from many), the Ringers series from @dmitricherniak has captivated me.

artblocks.io/project/13

17/ More than any other series, this helped me view generative art as a beautiful art form with epic potential.

Each piece is beautiful, but when taken as a collection, the diversity, yet effortless cohesion, is stunning.

Something tells me this will become a canonical series.

Each piece is beautiful, but when taken as a collection, the diversity, yet effortless cohesion, is stunning.

Something tells me this will become a canonical series.

18/ Once I saw the beauty (and potential) in generative art to become THE genre which blockchain could give life and meaning to, I scrambled to collect pieces from some of the foundational series in the genre.

#Autoglyphs from @larvalabs were a must have.

#Autoglyphs from @larvalabs were a must have.

19/ #Autoglyphs are recognized as the very first instances of generative art on the Ethereum blockchain. Only 512 were created, with an origin story similar to #CryptoPunks.

These may be remembered as THE series which gave life to this new genre of art.

These may be remembered as THE series which gave life to this new genre of art.

20/ After chatting with some folks, I realized I had missed another piece of history: @squigglyWTF

Squiggly helped catalyze the NFT gen art scene, and many view it as a turning point in the genre.

Only 100 were created, and I think they're beautiful.

squiggly.wtf

Squiggly helped catalyze the NFT gen art scene, and many view it as a turning point in the genre.

Only 100 were created, and I think they're beautiful.

squiggly.wtf

21/ As for my collection, it's an open book.

You can see my @artblocks_io holdings here: artblocks.io/user/0x59a5493…

And overall holdings here: opensea.io/accounts/DCinv…

Beware that I have some items that were sent to me that I didn't buy. I don't feel like paying the gas to remove.

You can see my @artblocks_io holdings here: artblocks.io/user/0x59a5493…

And overall holdings here: opensea.io/accounts/DCinv…

Beware that I have some items that were sent to me that I didn't buy. I don't feel like paying the gas to remove.

22/ One day, I hope to create some kind of virtual exhibition to celebrate generative art on #Ethereum.

It's funny because I've been in Ethereum & DeFi for so long, but barely paid attention this incredible #NFT art scene right under my nose.

But I'm glad I found it when I did.

It's funny because I've been in Ethereum & DeFi for so long, but barely paid attention this incredible #NFT art scene right under my nose.

But I'm glad I found it when I did.

23/ It's been a real journey for me over the past several weeks- falling down the #NFT art and #GenerativeArt rabbit holes.

I want to thank the community and artists in the @larvalabs (CryptPunks / Autoglyphs) and @artblocks_io Discords for being so helpful & welcoming.

I want to thank the community and artists in the @larvalabs (CryptPunks / Autoglyphs) and @artblocks_io Discords for being so helpful & welcoming.

• • •

Missing some Tweet in this thread? You can try to

force a refresh