1. I’ve been spending some time exploring systematic trading strategies for #BTC options on @DeribitExchange. I’ll go over a yield-generation strategy which showed some interesting results from the initial backtest phase. This is not investment advice.

2. A starting point could be to systematically sell 25 delta mid-term puts and roll this trade continuously over time. We’d run this strategy if we think BTC will continue to rally upwards or stay stagnant at current prices.

3. Another approach could be to use the same strategy above but for calls - ie: sell 25 delta calls and roll the trade continuously. We’d do this if we believe BTC will be stagnant or fall in price.

4. In both cases, we’d be selling naked options which can lead to devastating consequences if the risk is not managed properly (ie: OptionSellers). Nevertheless, if we’re collecting enough premium over time, there may be hope for this strategy.

5. This can be a good starting point but we can do better. Instead of just arbitrarily selling calls/puts, we can use a simple EMA cross-over signal to trigger when to sell calls/puts. This gives us a simple quantitative metric which can tell us which side of the market to be on.

6. We’ll use the 14/30 day EMA to classify the market as a “bull” or “bear” market. If 14 EMA > 30 EMA (bull market) we sell puts. If 14 EMA < 30 EMA (bear market) we sell calls. It's important not to over-optimize the window parameters because that can lead to overfitting.

7. Furthermore, we can make this strategy more robust by adding some additional criteria which can serve as signals for rolling into a new trade:

8.

a) Exit trade if option maturity <= 2 days (avoid short gamma exposure at expiry)

b) Exit trade if the option’s price <= 0.0015 (this is an arbitrary threshold - if we’ve captured most of the option premium, it’s not worth holding onto such a low risk-reward position)

a) Exit trade if option maturity <= 2 days (avoid short gamma exposure at expiry)

b) Exit trade if the option’s price <= 0.0015 (this is an arbitrary threshold - if we’ve captured most of the option premium, it’s not worth holding onto such a low risk-reward position)

9. Continued...

c) If the option is deep ITM (ie: > 80 delta), then it’s best to take the loss/free up our capital and move onto the next trade.

d) If the EMA signal changes sign (bullish --> bearish or vice-versa), we close the position and roll into the next trade.

c) If the option is deep ITM (ie: > 80 delta), then it’s best to take the loss/free up our capital and move onto the next trade.

d) If the EMA signal changes sign (bullish --> bearish or vice-versa), we close the position and roll into the next trade.

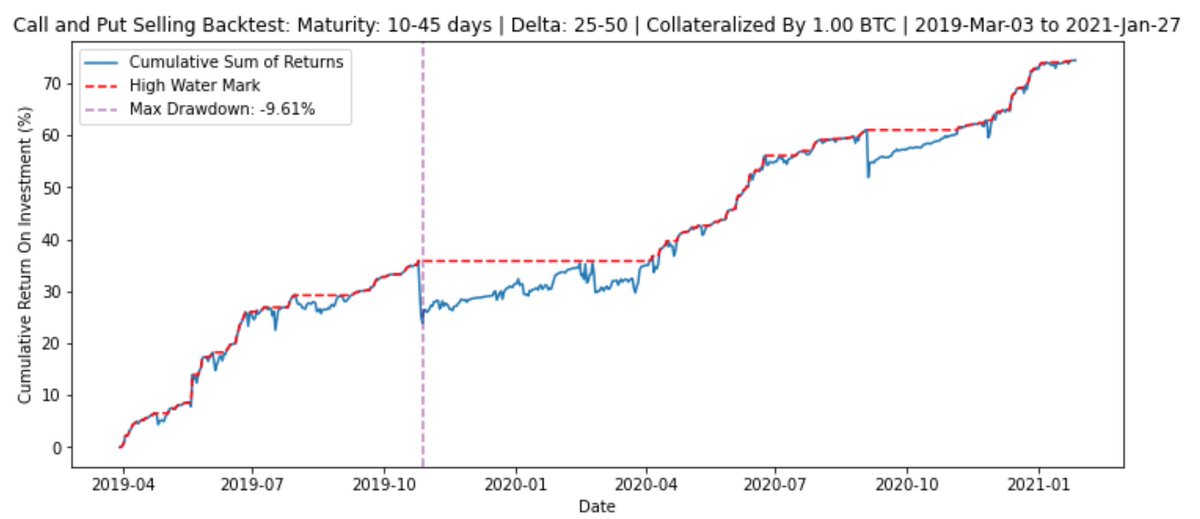

10. These additional criteria can filter out low quality trades and hold onto positions which increase our risk-adjusted returns. With the constraints listed above we have a decent yield strategy of selling ~25 delta calls/puts with an average maturity of 25 days.

11. Sharpe = 2.46 and Sortino = 3.24. Although this is a pretty good risk/reward profile, a large chunk of the edge comes from solid trade execution and getting filled near the option's mid-price.

12. That's why managing slippage is key especially for larger players. IMO, trading on @tradeparadigm is the only feasible way to harness alpha over a sustained period time for institutions. Otherwise, strategy edge over time can bleed away to the wide on-screen bid/ask spreads.

13. A few important things to note about this backtest...

14. The returns are not compounded rather the % ROI is added up across all trades. This was done with the assumption that we're investing the same $ amount into each trade which may/may not be realistic depending on your approach.

15. Also, all of these calcs are based on collateralizing each trade w/ 1 BTC. You can lever this strat but that comes at the cost of higher PNL volatility. Even if the option expires OTM, the mark-to-market journey to expiry may stop you out in the case of excessive leverage.

16. Would love to get some thoughts on how to improve this strategy without overfitting. Also - any suggestions on other systematic option strategies to explore?

@JSterz @ShreyasChari @ConvexMonster @SplitCapital @GammaHamma22 @kyled116

@JSterz @ShreyasChari @ConvexMonster @SplitCapital @GammaHamma22 @kyled116

• • •

Missing some Tweet in this thread? You can try to

force a refresh