People who ask what apps are running on #Cardano $ADA to justify a #3 spot are missing the point.

From the start, @InputOutputHK prioritized the rollout of a decentralized PoS system ("Shelley") over smart contracts ("Goguen"), scaling ("Basho"), and governance ("Voltaire").

1/

From the start, @InputOutputHK prioritized the rollout of a decentralized PoS system ("Shelley") over smart contracts ("Goguen"), scaling ("Basho"), and governance ("Voltaire").

1/

They could have just gone for the low hanging fruit and create yet another dPOS like $Tron and $EOS.

But it was known already back then that dPOS gravitates towards cartel formation and centralization.

2/

But it was known already back then that dPOS gravitates towards cartel formation and centralization.

2/

Instead, they tackled the hardest problem first, started from first principles, published tons of research papers, and made a couple of good design decisions IMO.

Here's @IOHK_Charles 's 2017 white board video.

3/

Here's @IOHK_Charles 's 2017 white board video.

3/

In an ocean of scam projects that the #cryto space predominantly was in 2017, Cardano stood out for me as a legitimate project.

4/

4/

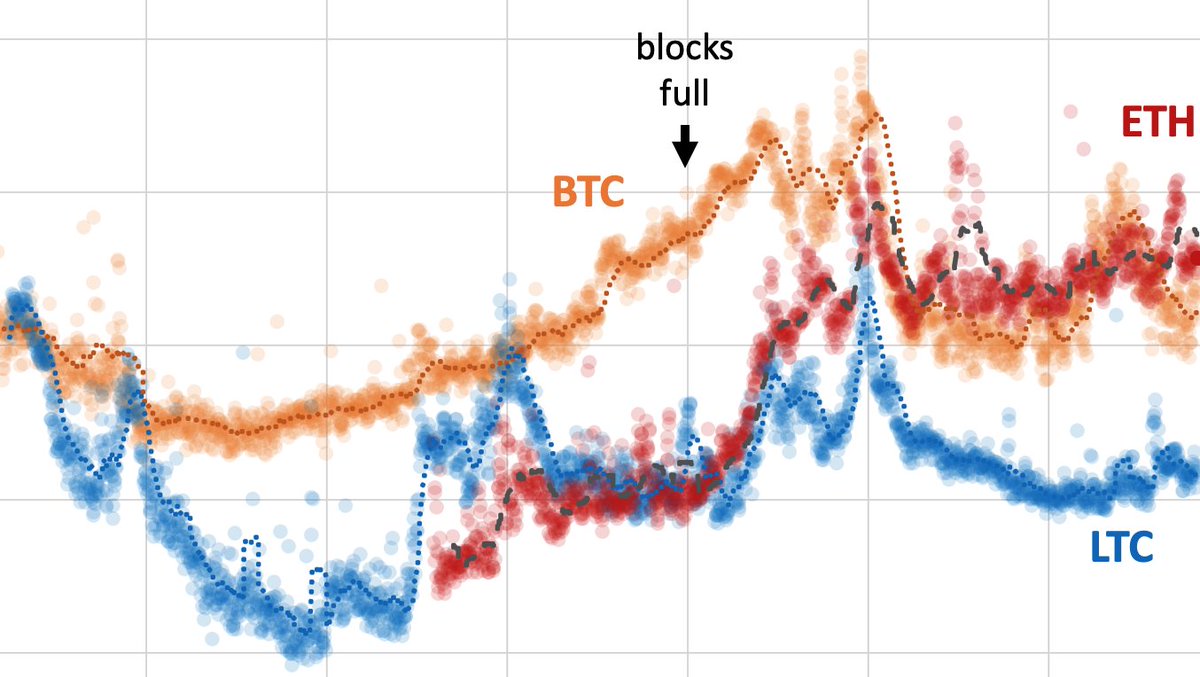

Since "Shelley" is live, the amount of settled tx volume, free revenue and exchange trade volume has exploded.

(source: @coinmetrics)

5/

(source: @coinmetrics)

5/

The @cardano community is growing, "Goguen" is about to ship—bringing tokens and smart contracts—and there’s measurable progress with "Voltaire".

None of this was obvious to happen even a year ago, hence $ADA price has skyrocketed recently.

6/

None of this was obvious to happen even a year ago, hence $ADA price has skyrocketed recently.

6/

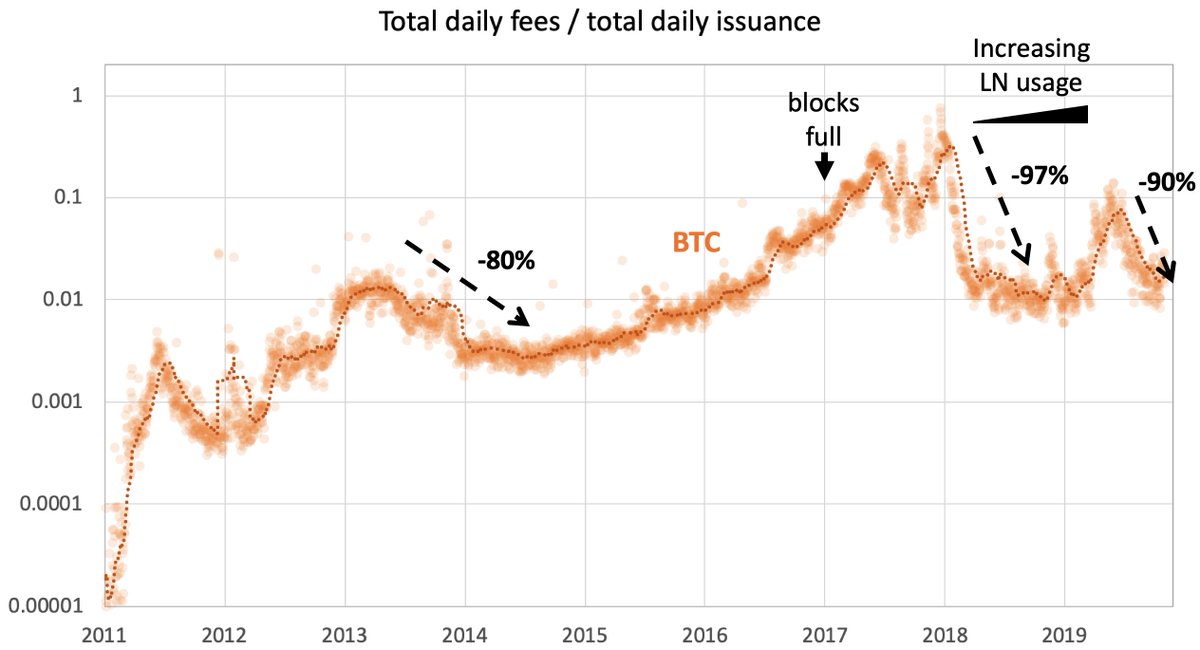

The best part: while #Bitcoin currently consumes >100 TWh of electricity per year (which is paid by hodlers via inflation), PoS like Cardano has negligible energy demand.

Not only the environment but also holders benefit (via staking rewards).

theguardian.com/technology/vid…

7/

Not only the environment but also holders benefit (via staking rewards).

theguardian.com/technology/vid…

7/

Decentralization: it is known that a few Chinese mining pools control BTC consensus. (source: btc.com)

Since it is trivially easy to distribute hash power across multiple pools, it is even possible that a single entity controls >51%.

8/

Since it is trivially easy to distribute hash power across multiple pools, it is even possible that a single entity controls >51%.

8/

In contrast, Cardano stake pools appear to be much more decentralized. (source: seeada.org)

I could not verify these numbers, but judging from online discussions, there’s a good number of independent block producers - certainly much higher than in EOS or Tron.

10/

I could not verify these numbers, but judging from online discussions, there’s a good number of independent block producers - certainly much higher than in EOS or Tron.

10/

None of this diminishes the amazing progress that other projects have made, especially #Ethereum.

But PoS needs to happen *yesterday*. The market knows that PoW is bad. Most companies don't want their image tainted by investing in #crypto.

12/

But PoS needs to happen *yesterday*. The market knows that PoW is bad. Most companies don't want their image tainted by investing in #crypto.

https://twitter.com/RaoulGMI/status/1364896784355627011

12/

A year ago, $XRP was #3 on @coingecko. $ADA is about 1000x more eligible than XRP to play in the big boy’s league.

13/

13/

• • •

Missing some Tweet in this thread? You can try to

force a refresh