Thread. 👇

However, hash power is an exceptionally poor metric for security, as described—for instance—by @OhGodAGirl:

medium.com/@OhGodAGirl/th…

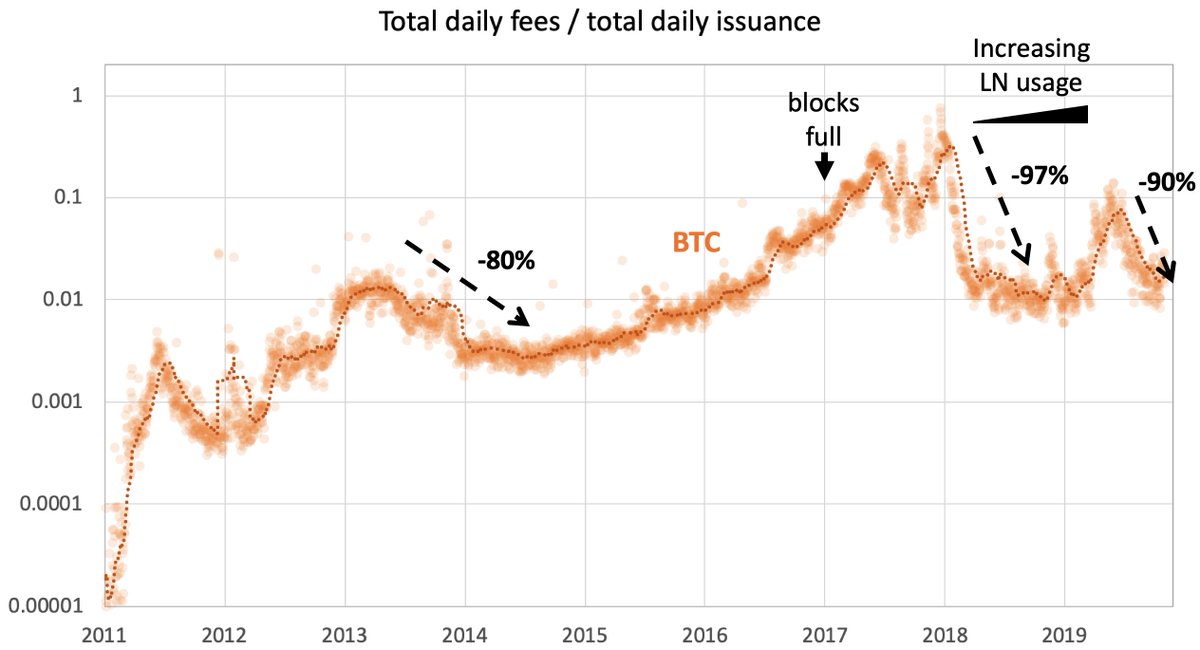

Let’s look at Bitcoin's F/I a bit more closely. (thanks to @coinmetrics for the raw data)

The bad news is that it has halted (in fact: decreased) since 2017, even though—or because?—blocks started filling up at the beginning of that year.

Note that F/I already adjusts for fluctuating market cap. The drop in total fees in early 2018 was even more dramatic: -99.3%.

Unfortunately, the increasing number of Lightning channels and growing network capacity in 2018 and the Lightning torch hype in early 2019 did nothing to improve the situation.

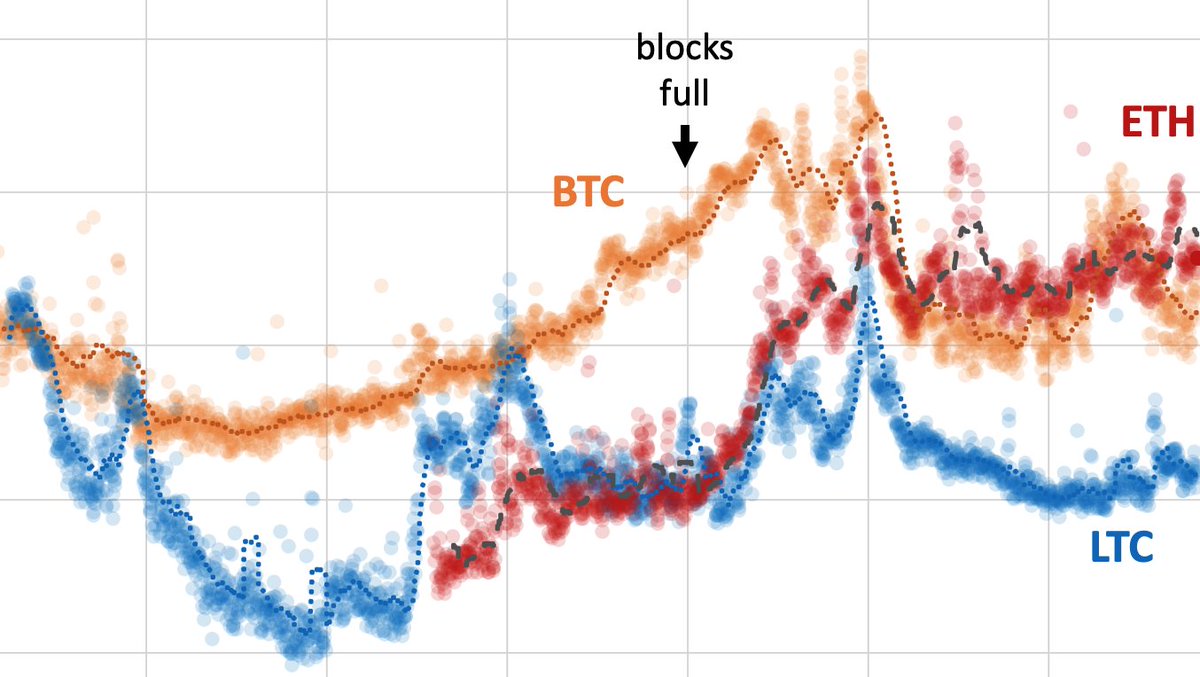

1. Ethereum's greater throughput allows for higher total fees.

2. A rise in demand for block space on Ethereum, owing to its diverse use cases (coin transfers, ICOs, #DEFI, games, etc.).

(See also @RyanSAdams tweet about the many positive developments in the Ethereum ecosystem):

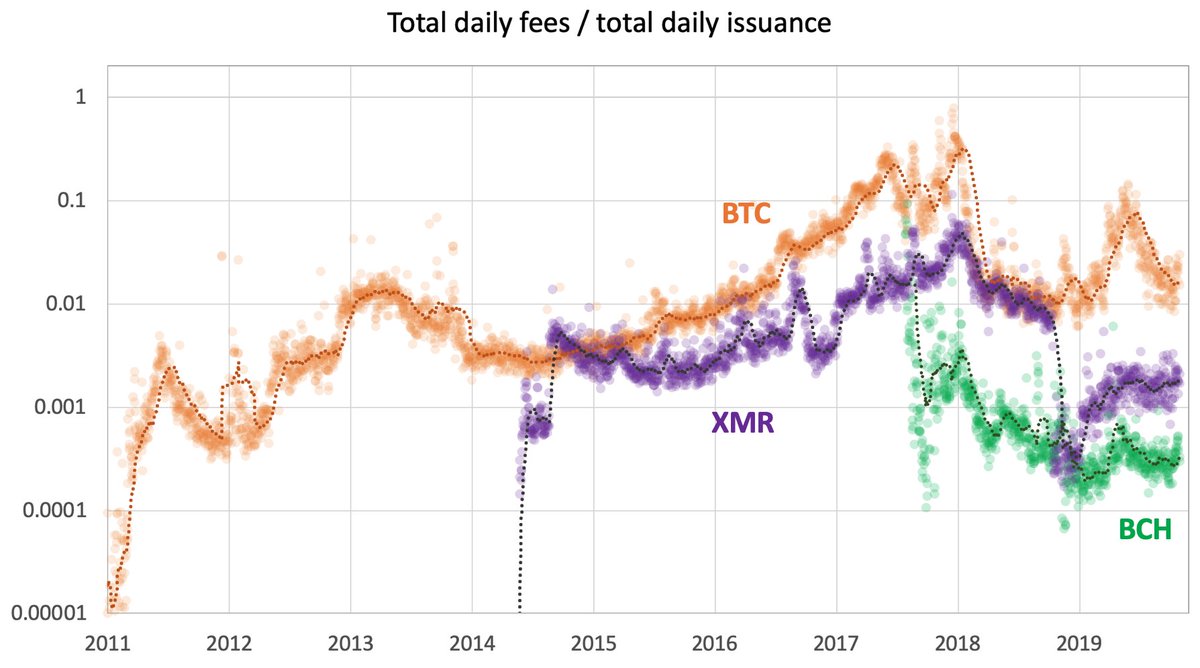

The case of LTC appears to be representative of low-cap PoW coins in general. e.g., neither #Monero $XMR nor Bitcoin Cash $BCH show any encouraging development in this metric.