In reality, the 21M BTC supply cap is a pipe dream.

Why am I so sure about this?

Thread 👇

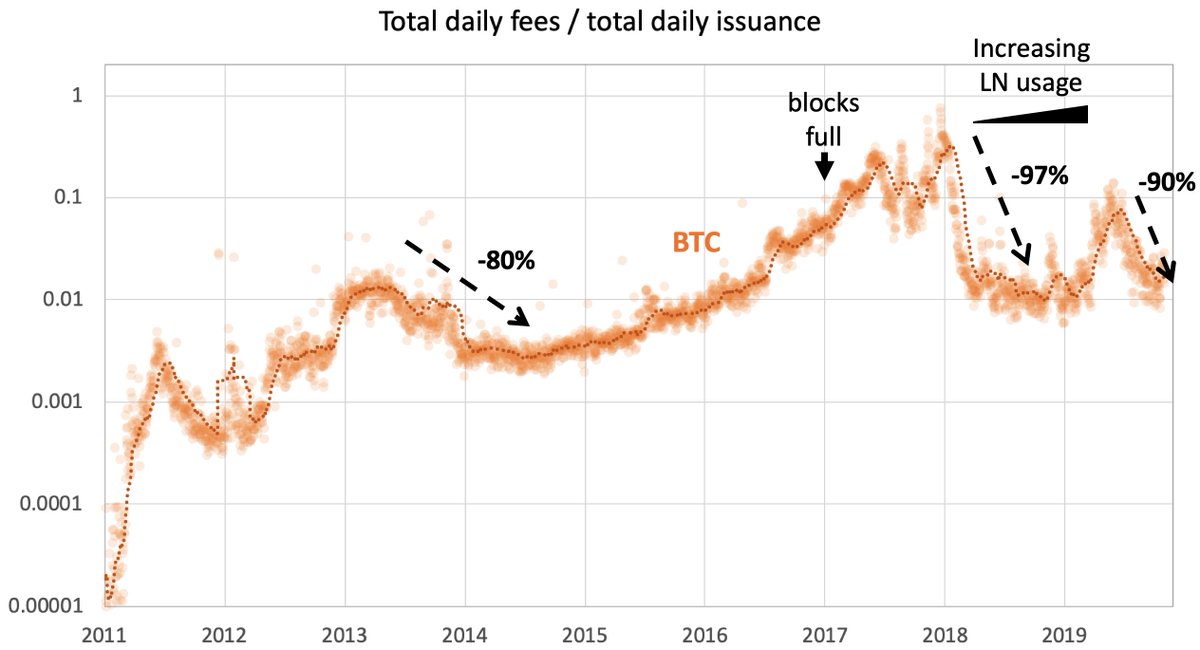

Multiple studies indicate that #PoW becomes unstable when the block subsidy is low:

bis.org/publ/work765.p…

medium.com/logos-network/…

medium.com/@hasufly/resea…

The great thing about inflation is that it incentivizes miners to secure the network even if there are few transactions. BTC users can rely on this baseline security at all times.

a) BTC has never been tested with near-zero inflation. It is entirely uncharted territory. Its strong security guarantees are “battle-tested” only in high-inflation-BTC. As such, low-inflation-BTC is as experimental as #IOTA.

1. The current bitcoin implementation will fail long before the supply cap is reached in 2140. Serious vulnerabilities will likely arise within the next 4 halvings (≤2036). By that time, the subsidy will have fallen to 6% of what it is today.