There's a saying that there are two types of problems - good and the bad ones. Let me give you an example on both. Larry Fink, CEO of @blackrock, the largest asset manager globally, recently told that (1/20)

in order to reach global #sustainability goals, all companies will have to change their business models and adapt to the #climate-compatible operations. This is a good problem to have because by the time we reach this point, (2/20)

the progress towards full #sustainability will already be significant, and momentum will be strong.

However, we can't create this good problem without a concrete plan (3/20)

However, we can't create this good problem without a concrete plan (3/20)

on enabling companies of all sizes to buy green energy directly from producers or at least have this option provided by their #energy suppliers.

Price of #renewableenergy is no longer a problem. In their New Energy Outlook Summary (NEOS), (4/20)

Price of #renewableenergy is no longer a problem. In their New Energy Outlook Summary (NEOS), (4/20)

Bloomberg reports that either wind or PV are the cheapest new sources of #electricity in countries making up around 73% of world GDP. Economic incentives are there to develop #renewableenergy projects even without government subsidies. (5/20)

So, what's stopping us from getting more #RenewableEnergy adoption? @sacca @crystale @claydumas

The real issues come from the renewable projects financing process. It is unnecessarily complicated, expensive and lengthy. (6/20)

The real issues come from the renewable projects financing process. It is unnecessarily complicated, expensive and lengthy. (6/20)

Majority of #renewableenergy projects are financed by Power Purchase Agreements which are direct agreements between corporate energy buyers and #greenenergy generators. (7/20)

Due to their complexity and cost, these deals are accessible only to the small number of corporate global #energy consumers with yearly energy spending in millions of dollars.

So, we get to the real problem (the bad one) - (8/20)

So, we get to the real problem (the bad one) - (8/20)

despite making up 2/3 of the global #energyconsumption, most corporate and industrial energy users can't access direct #greenenergy procurement. @sacca @crystale @claydumas The capital needed to #renewable energy development is restricted from reaching these projects. (9/20)

The growth of #renewableenergy procurement via PPAs is slowing down. Before I introduce the alternative to PPAs, let's take a look at the global #PPA deals data reported by Bloomberg. (10/20)

Last year's growth in terms of PPA volumes by MW was only 18% compared to 48% in 2019 and 119% in 2018.

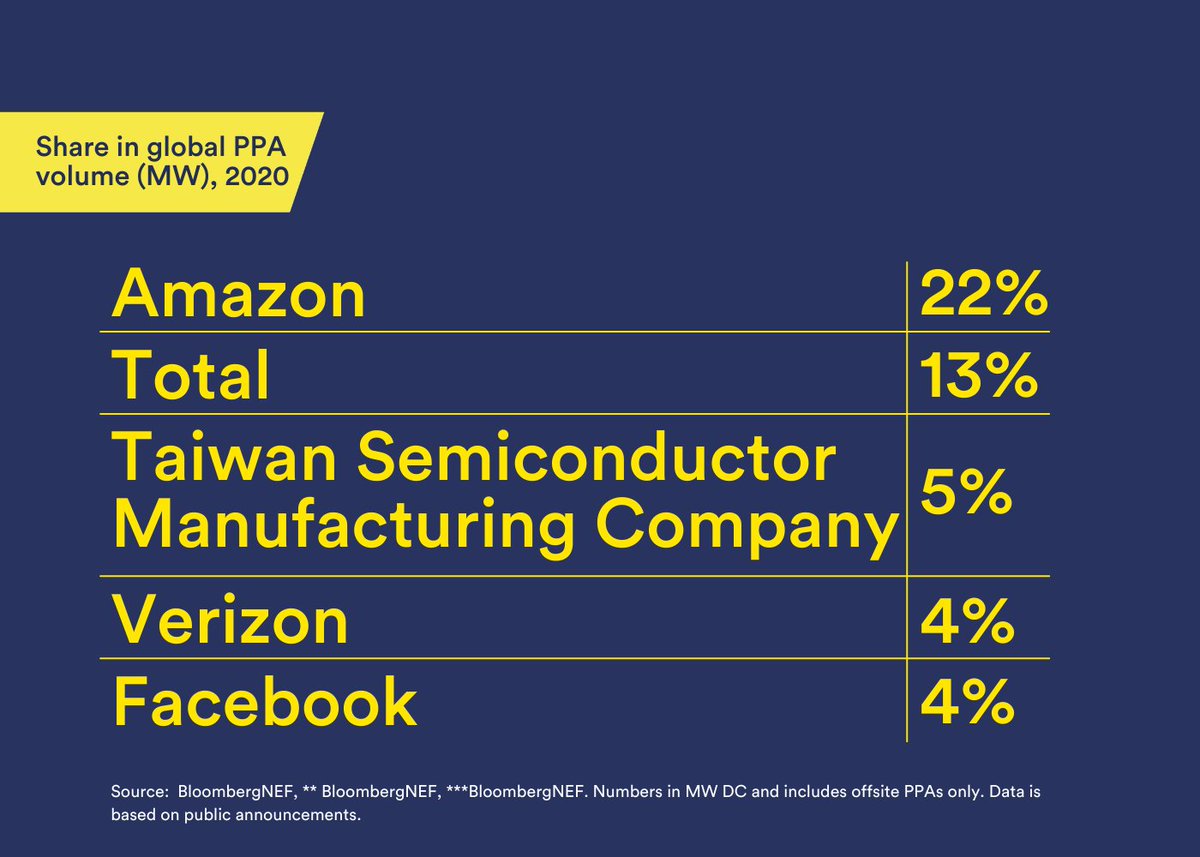

Few large volume deals distort the real progress of #energy procurement via PPAs. (11/20)

Few large volume deals distort the real progress of #energy procurement via PPAs. (11/20)

Even though there’s tremendous interest in #greenenergy investments as seen from the growth of sustainability-focused funds. However, most of the PPA progress was driven by a handful of multinational #technology companies. Last year, (12/20)

technology companies purchased approximately 40% of the total PPA volume.

Last year alone, the largest green energy buyer, Amazon made 22% of all the global PPA volume in terms of MW. In 2019, it was Google with 13%. In 2018, Facebook with 19%. (13/20)

Last year alone, the largest green energy buyer, Amazon made 22% of all the global PPA volume in terms of MW. In 2019, it was Google with 13%. In 2018, Facebook with 19%. (13/20)

Bloomberg NEOS forecasts that in order to reach global sustainability goals, we'll need an average annual wind-capacity deployment of 147GW and 246GW of #solar by 2050. We'll have to install 393GW of solar/wind-capacity every single year. (14/20)

Measuring in the current prices that would require $346 billion investments in #renewableenergy every single year. How does that stack up against the current global PPA volumes? Quite poorly. @sacca (15/20)

In 2020, PPA volume made up only 6% of the needed yearly average instalments.

Where should the money needed to power the growth of the #renewables come from? From companies of all sizes that don't meet the PPA procurement criteria due to their size. (16/20)

Where should the money needed to power the growth of the #renewables come from? From companies of all sizes that don't meet the PPA procurement criteria due to their size. (16/20)

@claydumas These companies make up to 95% of the total corporate and industrial #energyconsumption. If given the opportunity to buy #renewable, locally produced energy directly from local producers at market prices, they would for sure do it. (17/20)

@crystale Our platform connects companies, energy suppliers and #greenenergy generators to enable easy green energy transactions of any size. Energy suppliers globally are using #WePower to run their private green energy marketplaces. (18/20)

It gives them ultimate flexibility to offer custom made #greenenergy offerings directly from local green energy generators for each individual business. We make corporate green energy #procurement as easy as online shopping. (19/20)

#Greenenergy transition will be powered by companies of all sizes making an easy choice to buy locally produced #greenenergy. We are here to help this transition happen. (20/20)

• • •

Missing some Tweet in this thread? You can try to

force a refresh