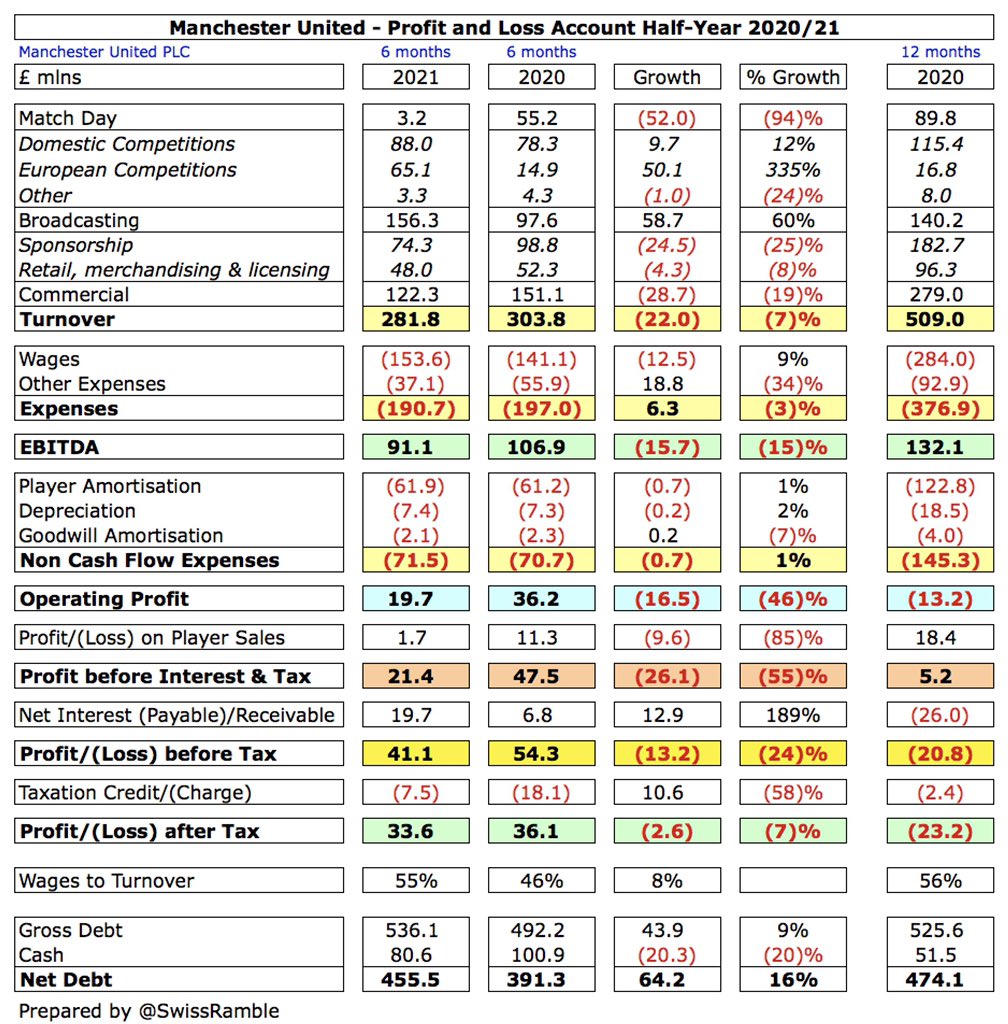

Manchester United have announced financial results for Q2 of 2020/21, incorporating the first 6 months of the season. This covers July to December 2020, so provides more insight into the impact of the COVID pandemic on football clubs. Some thoughts in the following thread #MUFC

#MUFC profit before tax for the first 6 months fell from £54m to £41m, as revenue dropped £22m (7%) from £304m to £282m and profit on player sales decreased £10m to £2m. Partly offset by £6m lower expenses and £13m more interest receivable. Loss after tax down from £36m to £34m.

Despite the reduction, a £41m profit during the pandemic times represents an impressive achievement for #MUFC. As Ed Woodward said, “While the disruption to our operations remains significant, we are pleased by the tremendous resilience the club has demonstrated.”

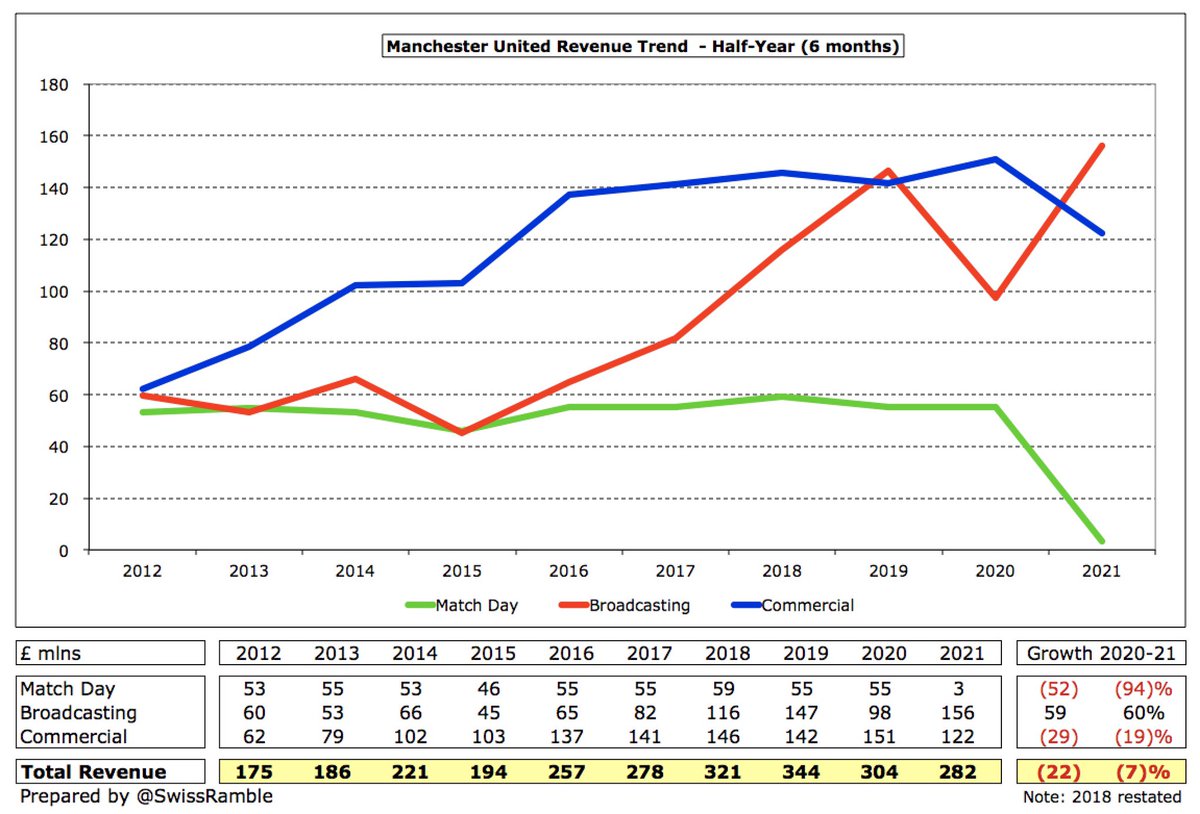

The main reason for #MUFC lower revenue was match day, which fell £52m (94%) from £55m to just £3m, while commercial dropped £29m (19%) from £151m to £122m. This was partly offset by broadcasting rising £59m (60%) from £98m to £156m, mainly due to return to Champions League.

#MUFC wage bill rose £13m (9%) from £141m to £154m, though other expenses decreased £19m (34%) to £37m, due to reduced business activity. Net finance income increased £13m to £20m, due to favourable swing in unrealised foreign exchange movements.

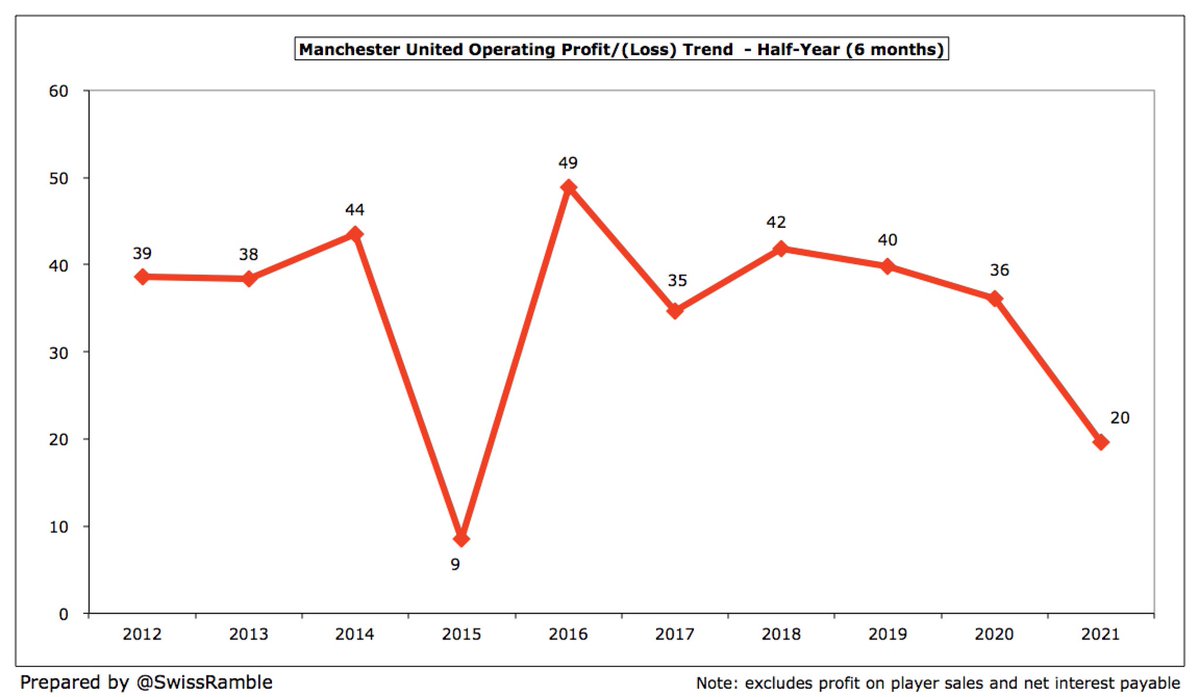

#MUFC £41m profit before tax is their lowest for the first 6 months since 2017. It is also worth noting that United tend to post losses in the second half of the year most seasons, e.g. £75m in 2019/20, so a full-year loss is still likely for 2020/21.

#MUFC have rarely made big money from player sales, but £2m in the first 6 months of 2020/21 is particularly low. Usually, very little profit from this activity is generated in the second half of the year, so United’s bottom line is unlikely to receive a boost here.

In 2019/20 #MUFC reported an operating loss of £13m (excluding player sales and interest) for the first time in ages. This is likely to be repeated this season, as operating profit fell from £36m to £20m in the first 6 months and there will probably be a large loss second half.

#MUFC revenue dropped £22m (7%) from £304m to £282m, which means this has fallen £62m from the £344m peak in 2019. The decrease would have been even higher if United had failed to qualify for the Champions League, as this has driven the growth in broadcasting income.

#MUFC match day income fell £52m (94%) from £55m to £3m, as all matches were played behind closed doors, whereas 15 home games were played in the prior year with fans in attendance. In a normal season this revenue stream generates around £110m full year.

#MUFC broadcasting rose £59m (60%) from £98m to £156m, mainly due to participation in the Champions League (Europe TV up £50m), though also benefited from revenue from 2019/20 games played after 30th June accounting close being deferred to 2020/21 accounts (domestic TV up £10m).

#MUFC commercial revenue fell £29m (19%) from £151m to £122m, as sponsorship dropped £25m (25%) from £99m to £74m, including no pre-season tour and prior year once-off credit, and retail was down £4m (8%) from £52m to £48m, due to Megastore closure for a month and lower footfall.

#MUFC wage bill rose £13m (9%) from £141m to £154m, the club’s second highest ever for the first half, mainly due to higher bonuses for Champions League qualification. If second half is the same, full year would be £307m, £23m (8%) higher than prior season’s £284m.

#MUFC £536m gross debt is £44m more than £492m prior year comparative, though only £10m higher than June 2020, as the club drew down £60m of Bank of America £200m credit facility. This is the highest debt since 2010, i.e. before the Payment in Kind loans were paid off.

#MUFC have a useful £81m cash balance, thanks to that £60m loan, but this is the lowest at this time of the year since 2015. United’s cash pile, as high as £308m in 2019, has taken a battering from a combination of COVID and transfer fees for Harry Maguire and Bruno Fernandes.

Higher gross debt and lower cash means that #MUFC net debt rose £64m (16%) from £391m to £456m. This means that net debt has increased by £138m (43%) in just 2 years since 2019 (£318m).

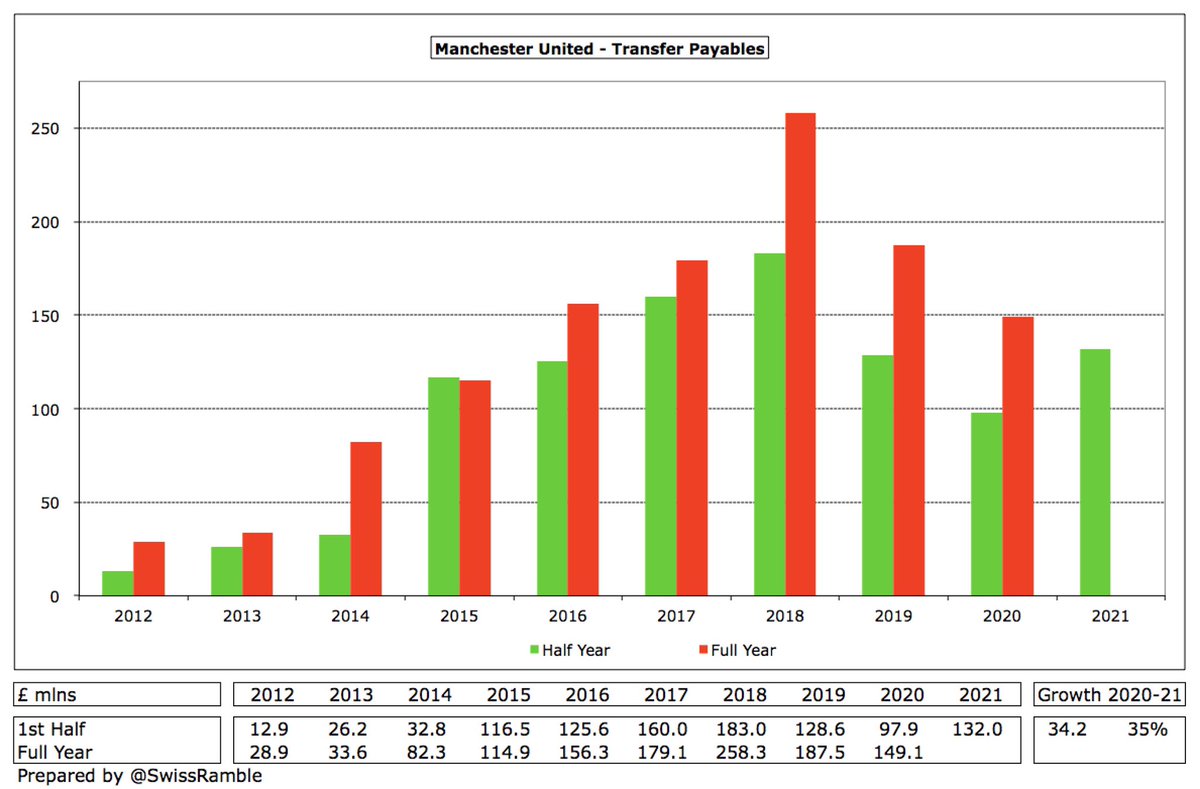

Furthermore, after two consecutive annual decreases, #MUFC transfer payables rose by more than a third (£34m) from £98m to £132m. That said, this is still a lot lower than the £258m peak in June 2018.

Similarly, #MUFC transfer receivables have grown from £17m four years ago to £60m, mainly due to Romelu Lukaku’s lucrative sale to Inter. United will hope that the financial challenges faced by Suning, Inter’s owners, do not impact the money they are owed.

As a result, #MUFC net transfer debt has increased from £41m to £73m, though this is still less than a third of the £229m balance three years ago in June 2018.

In the first 6 months #MUFC generated £75m operating cash flow, but spent all of this and more on bringing in £87m players (purchases £109m less £22m sales) plus £10m interest, £4m capex and £3m tax. This was funded by £59m loans, leading to £30m net cash inflow.

There are 3 main reasons for the £238m improvement between this season’s cash flow and prior season: (1) #MUFC spent £79m less player purchases (£165m vs. £87m); (2) working capital movements were £109m better, e.g. broadcasting payments slipped to 2021; (3) new £60m loan.

Although it has fallen from its peak, #MUFC still made a £10m interest payment in the first half. This will amount to £20m for the full-year, which is the highest in the Premier League, ahead of #THFC £14m and #AFC £11m. This is the cost of carrying so much external debt.

Despite the financial challenges, #MUFC have still found enough cash to pay their shareholders (mainly the Glazers) a full dividend. Nothing was paid in first 6 months, but £10.7m payment was made 7 days after these accounts. Works out to £23m annually (£112m in last 5 years).

Like many other clubs #MUFC have had to increase debt in response to the pandemic, despite posting a profit after 6 months this season. These results might look better than many feared, but it is worth remembering that figures are usually worse in the second half of the year.

Nevertheless, #MUFC are in better shape than most with their many commercial partners. While they will struggle with the financial challenges of COVID-19, Finance Director Cliff Baty said, “We are well positioned to weather the current uncertainty and optimistic for the future.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh