Chelsea’s 2019/20 financial results covered a season when they finished 4th in the Premier League, were beaten in the FA Cup final and reached the last 16 of the Champions League, but their finances were adversely impacted by the COVID-19 pandemic. Some thoughts follow #CFC

#CFC swung from £102m loss before tax to £36m profit, despite revenue dropping £40m (9%) from club record £447m to £407m, as profit on player sales surged £82m to £143m and expenses fell by a hefty £90m. After tax, improved from £97m loss to £32m profit.

All #CFC revenue streams decreased, impacted by COVID, though the damage was limited by the return to the Champions League. Broadcasting was down £18m (9%) to £183m, while there were falls in match day, down £12m (18%) to £54m, and commercial, down £10m (5%) to £170m.

There were significant #CFC cost reductions, especially player amortisation, down £40m (24%) to £127m, while wage bill fell £2m (1%) to £283m. Other expenses cut £21m (18%) to £96m, including lower match day costs. No repeat of prior year £27m exceptional costs for Conte exit.

#CFC £36m profit is the best result to date of Premier League clubs that have published 2019/20 accounts. It is likely that others will report substantial losses, due to the pandemic. So far we have seen: #EFC £140m, #SaintsFC £76m, #THFC £68m, #BHAFC £67m and #MUFC £21m.

COVID has obviously impacted #CFC revenue with some deferred into 2020/21 accounts, while 4 matches were played behind closed doors and retail sales were hit. Without the pandemic and consequent suspension of football in March, the club had projected record revenue and profit.

In this way, the pandemic has significantly impacted finances in 2019/20 with many leading clubs posting horrific losses, e.g. Roma £179m, Milan £171m, Inter £90m, Barcelona £85m and Juventus £79m. Only Benfica and Ajax joined #CFC in posting sizeable profits.

Of course, #CFC bottom line was significantly boosted by £143m profit on player sales, up from prior year £60m, mainly due to the sales of Eden Hazard to Real Madrid, Alvaro Morata to Atletico Madrid and Mario Pasalic to Atalanta. This is the highest by far in the Premier League.

In fact, #CFC £143m 2019/20 profit on player sales is the highest ever reported in the Premier League. To underline the importance of player trading to Chelsea’s strategy, six of the 20 largest profits in England from this activity have been generated by the Blues.

#CFC business model is far more reliant on player sales than any other major English club. In the last 6 years, they have made nearly half a billion from this activity with only #LFC anywhere near them. From 2014 their annual profit here has averaged £77m.

It may surprise some that #CFC have now posted profits in 3 of the last 4 years, though the one loss was a hefty £102m in 2018/19. This represents something of a turnaround for Chelsea, who have reported almost half (nine) of the top 20 losses in Premier League history.

#CFC 2019/20 improvement partly because prior year was hit by £27m for the exit of Antonio Conte and his coaching team (including legal costs), though no mention of reported £4m compensation paid to #DCFC for Frank Lampard. Paid £96m in last 13 years for sacked managers.

#CFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, fell from £43m to £27m. This is mid-table in the Premier League, though likely to look better when other clubs publish 2019/20 accounts.

#CFC operating loss (excluding player sales & interest) improved from £163m to £112m, though 2nd highest to date in the PL. Very few clubs make operating profits, but Chelsea have consistently posted losses, offset by payer sales. In fact, they were the worst in Europe in 18/19.

Even after the £40m fall in 2020, #CFC revenue has still grown by £78m (24%) since 2016 from £329m to £407m, driven by commercial £54m and broadcasting £40m. Chairman Bruce Buck said, “Despite the impact of COVID, the revenue streams remained strong.”

That said, #CFC £78m revenue growth in the past 4 years has been significantly outpaced by #LFC £188m and #THFC £182m, and is also below #MCFC £90m. On the other hand, both #AFC and #MUFC have seen their revenue fall in this period, by £10m and £6m respectively.

#CFC £407m revenue is fourth highest in the Premier League, though a fair way behind the top 3 clubs: #MUFC £509m, #LFC £490m and #MCFC £482m. Chelsea did overtake Tottenham in 2019/20 to once again claim the title of highest revenue in London.

All Premier League clubs’ revenue has decreased in 2019/20, due to the impact of the pandemic, though #CFC 9% fall is one of the smallest falls in percentage terms, thanks to Champions League qualification. EFC 1% decrease is due to once-off £30m for stadium naming rights option.

#CFC climbed one place to 8th in the Deloitte Money League, which ranks clubs globally by revenue, though there is a substantial £62m gap to the next club, PSG £474m. Long way below the Spanish giants, Barcelona and Real Madrid, £627m, but revenue is only one aspect of finances.

#CFC broadcasting income fell £17m (9%) from £200m to £183m, due to revenue from 10 games slipping to 2020/21 accounts plus rebate to broadcasters, offset by return to the Champions League. Still third highest in the Premier League, only behind #LFC £204m and #MCFC £190m.

As the 2019/20 season was extended beyond the 30th June accounting close, #CFC Premier League TV money was less than prior year, exacerbated by lower league position, though much of the revenue decrease has been deferred into the 2020/21 accounts, so is only a timing difference.

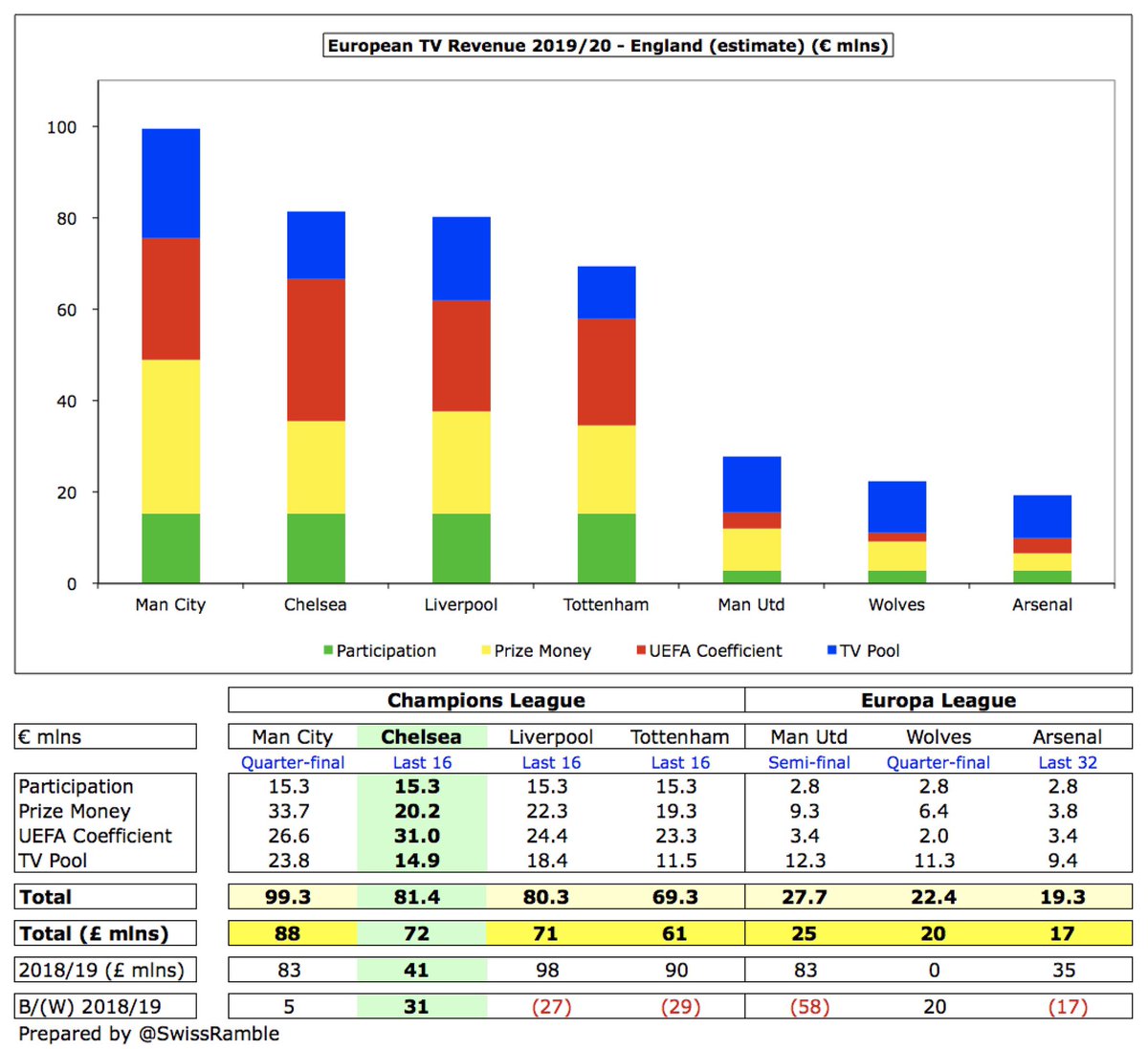

#CFC earned (estimated) £72m (€81m) for reaching the Champions League last 16, more than prior season’s £41m for winning the Europa League, comprising €15m participation fee, €20m prize money, €31m UEFA coefficient and €15m TV pool. This is before a 16% COVID rebate.

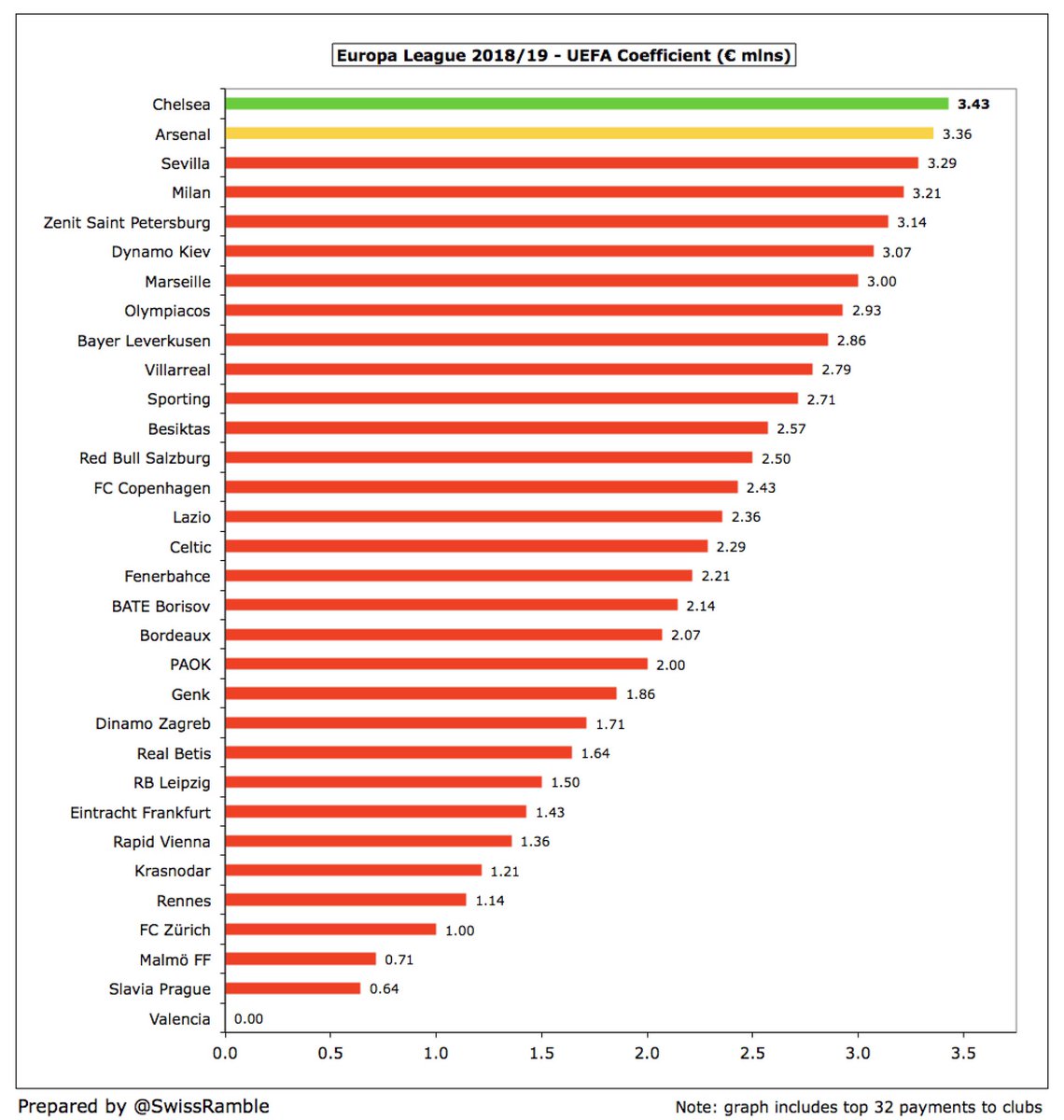

The difference between the European competitions is vividly seen in the new UEFA coefficient payment (based on performances in Europe over 10 years). #CFC were the highest ranked English team in the Champions League, receiving €31m, while they only got €3m in the Europa League.

Despite not qualifying for Europe in 2016/17, #CFC have earned an impressive €262m from Europe in the last five years, though a fair way behind #MCFC €390m, #LFC €310m and #THFC €299m. Difference between Champions League and Europa League is evident.

#CFC commercial revenue fell £10m (5%) from £180m to £170m, due to closure of non match day activities in March, lower pre-season income and decrease in player loans, partly offset by higher sponsorship. Only club in Big Six to see a fall in this revenue stream in 2019/20.

#CFC £170m commercial revenue is still 4th highest in the Premier League, though a long way below the top 3 clubs: #MUFC £279m, #MCFC £250m and #LFC £214m. Highest in London, ahead of #THFC £162m and #AFC £142m.

#CFC have long-term kit deals with Nike £60m (£900m over 15 years), but Three UK have replaced Yokohama as shirt sponsor in a 3-year deal from 2020/21, reportedly for the same amount of £40m. Also Hyundai sleeve sponsor £6m. However, Carabao training wear £10m deal ended in 2019.

#CFC match day revenue fell £13m (18%) from £67m to £54m, as they staged 5 fewer home games and then played 4 games behind closed doors due to COVID. Their income is 5th highest in the Premier League, outpaced by #THFC £95m, #MUFC £90m, #AFC £79m and #LFC £73m.

#CFC average attendance up slightly from 40,436 to 40,563 for those games played with fans. However, this is only 9th highest in the Premier League (and 4th best in London). Ticket prices remain frozen at 2011/12 levels.

This is why #CFC were looking to upgrade their stadium to 60,000 capacity, but the £1 bln development been put on hold, officially “due to the current unfavourable investment climate”. The club will however look at the significant uplift to #THFC revenue from their new stadium.

#CFC wage bill fell slightly (£2m) to £283m. There had been talk of a 10% cut in player salaries for 4 months, due to the COVID crisis, but this was ultimately rejected. Wages up £61m (27%) since 2016, which is lower than the growth at #MCFC, #LFC and #THFC.

As recently as 2015, #CFC had the highest wage bill in the Premier League, but their £283m is now behind #MCFC £315m and #LFC £310m, though they may fall when they publish 2019/20 accounts – in the same way that #MUFC dropped from £332m to £284m (now much the same as Chelsea).

Following the fall in revenue, #CFC wages to turnover ratio increased from 64% to 70%, the club’s highest since 2011. This is not too bad compared to most that have released accounts for 2019/20, but is significantly worse than #MUFC 56% and (particularly) #THFC 46%.

#CFC highest paid director’s remuneration was unchanged at £1.7m. That’s a tidy sum, but a long way below Ed Woodward’s £3.1m at #MUFC and Daniel Levy’s £3.0m at #THFC.

#CFC player amortisation, the annual charge to expense transfer fees over the length of a player’s contract, fell £41m (24%) from £168m, the highest figure ever reported by a Premier League club, to £127m. Still highest in top flight, just ahead of #MCFC £127m and #MUFC £123m.

After rising from £71m in 2016 to £118m in 2019, other expenses decreased £22m (18%) to £96m, partly due to reduced match day costs following the postponement of matches in March. Prior year also included buyback of merchandising rights.

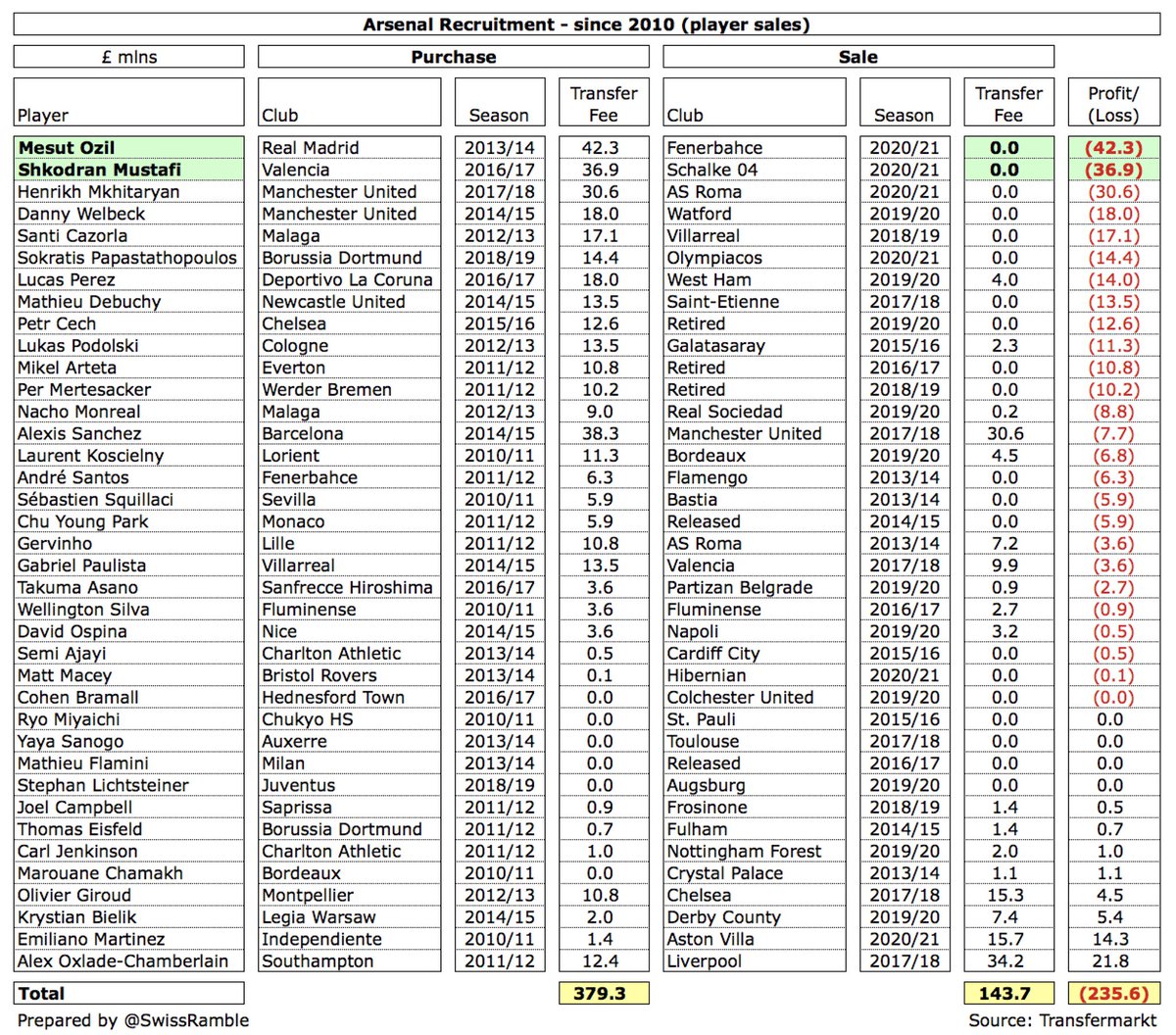

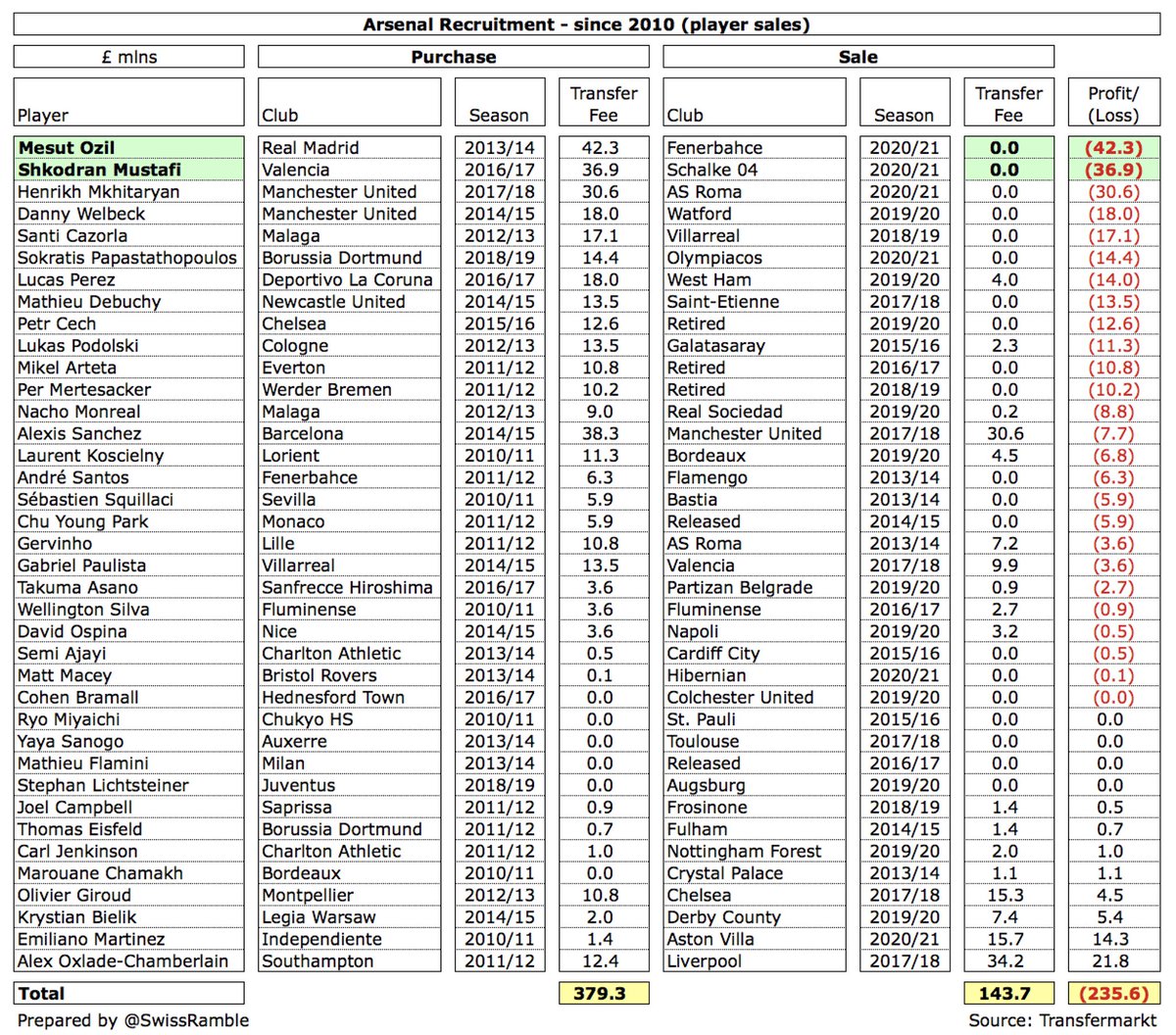

#CFC player purchases were “only” £94m, a steep reduction on the previous season’s £281m, due to a transfer ban in summer 2019. Mainly the acquisition of Timo Werner from RB Leipzig (June 2020) plus various signing-on fees. Significantly outspent by #MUFC £183m and #THFC £136m.

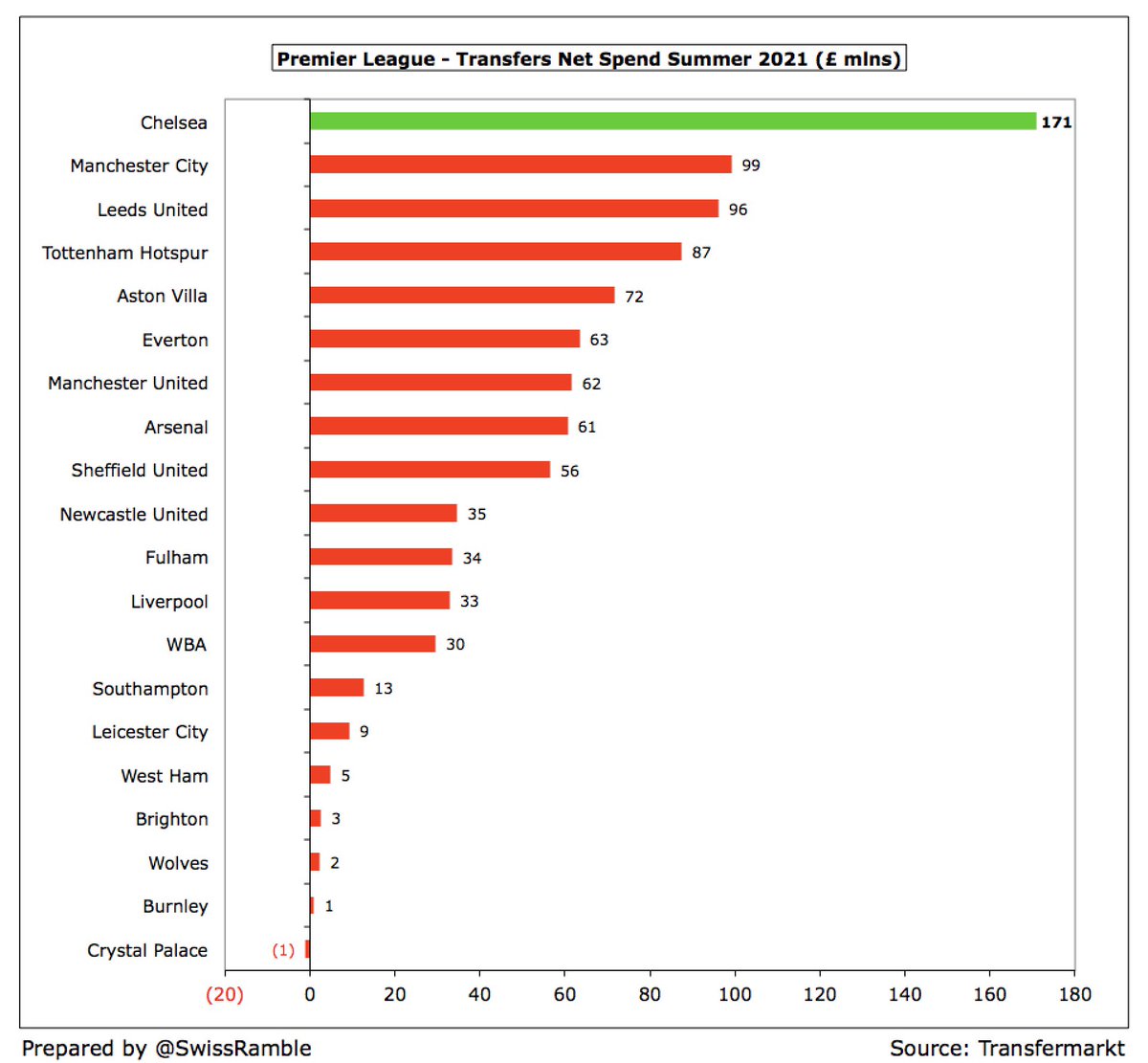

Due to high player sales of £190m, #CFC had net transfer sales of £97m in 2019/20. However, net spend has still averaged £89m over the last 3 seasons, as gross spend surged to £222m, partly offset by £132m sales.

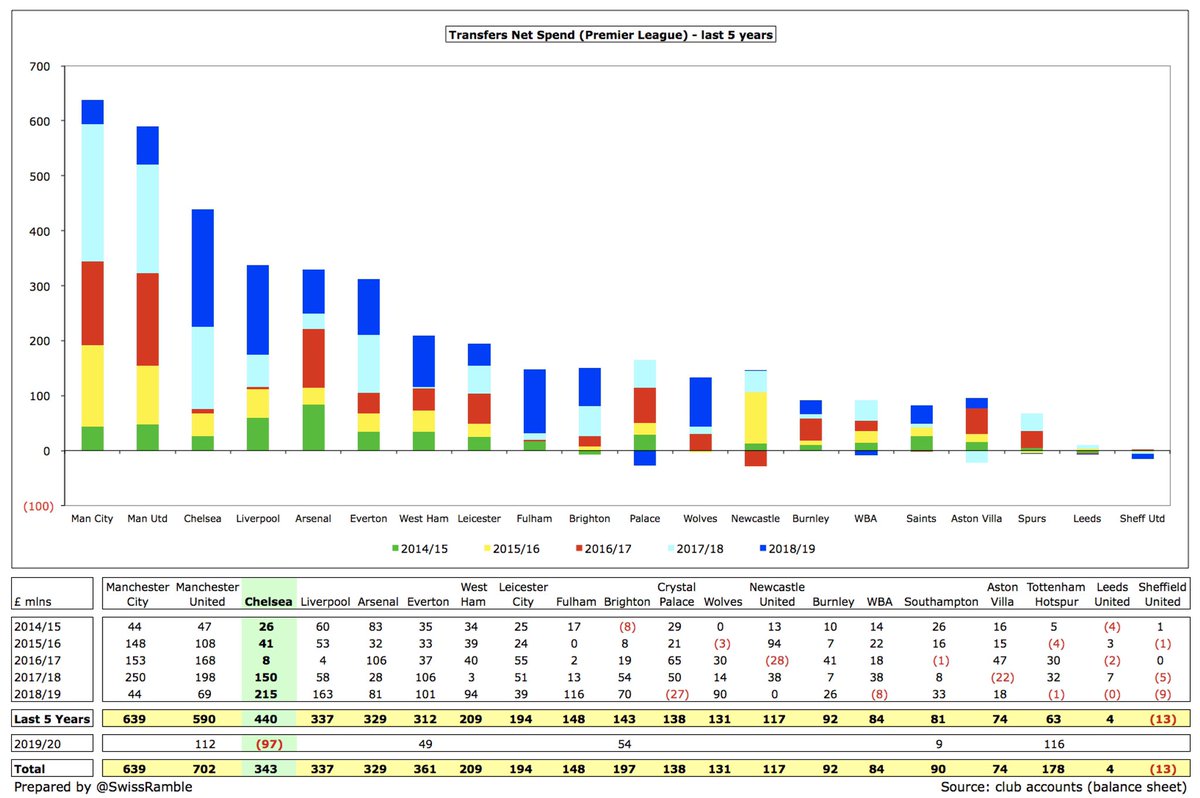

2019/20 was an anomaly for #CFC, due to the transfer ban, but in the 5 years up to 2019 they had the 2nd highest gross transfer spend of £890m, just behind #MCFC £892m, but more than #MUFC £870m. Net spend of £440m was 3rd highest, a fair way below #MCFC £639m and #MUFC £590m.

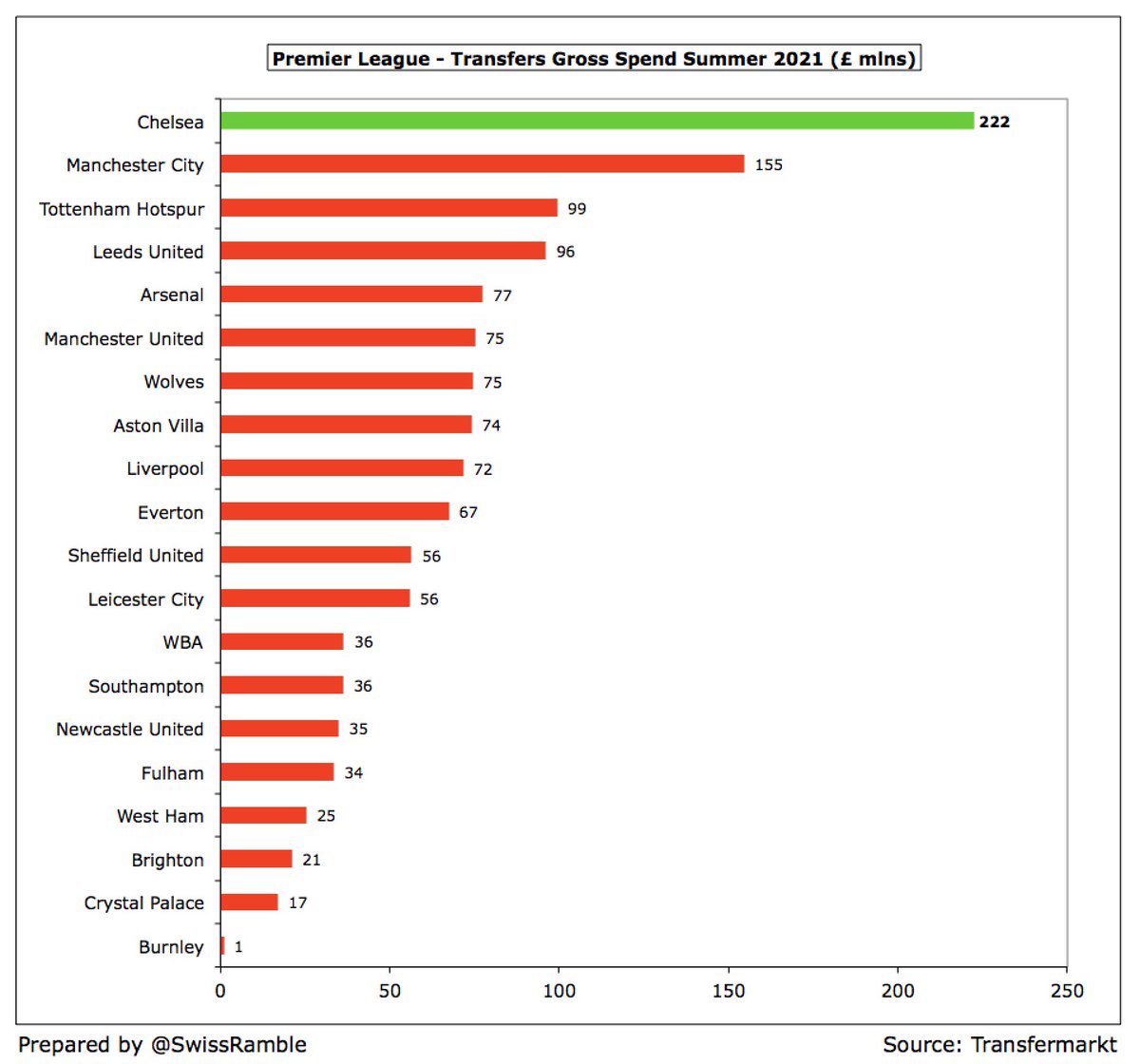

#CFC made up for lost time in 2020 by splashing out £199m on new players (£222m per Transfermarkt) to bring in Kai Havertz, Timo Werner, Ben Chilwell, Hakim Ziyech and Edouard Mendy (plus Thiago Silva & Malang Sarr on frees). By far the highest in the PL, as was £171m net spend.

#CFC only have £47m debt in the football club, down from £79m prior year, though it should be noted that the holding company, Fordstam Limited, does have £1.4 bln of debt in the form of an interest-free loan from the owner, theoretically repayable on 18 months notice.

#CFC £47m football club debt is one of the lowest in the Premier League, though their £1.4 bln holding company debt would be much higher than #THFC £831m (mainly new stadium), #MUFC £526m (even after all the Glazers’ re-financings), #EFC £409m, #BHAFC £306m and #AFC £209m.

As a result, #CFC have only paid £3.3m interest (mainly on transfer fee stage payments), while others have had to make substantial annual payments, e.g. #MUFC £20m, #THFC £14m and #AFC £11m.

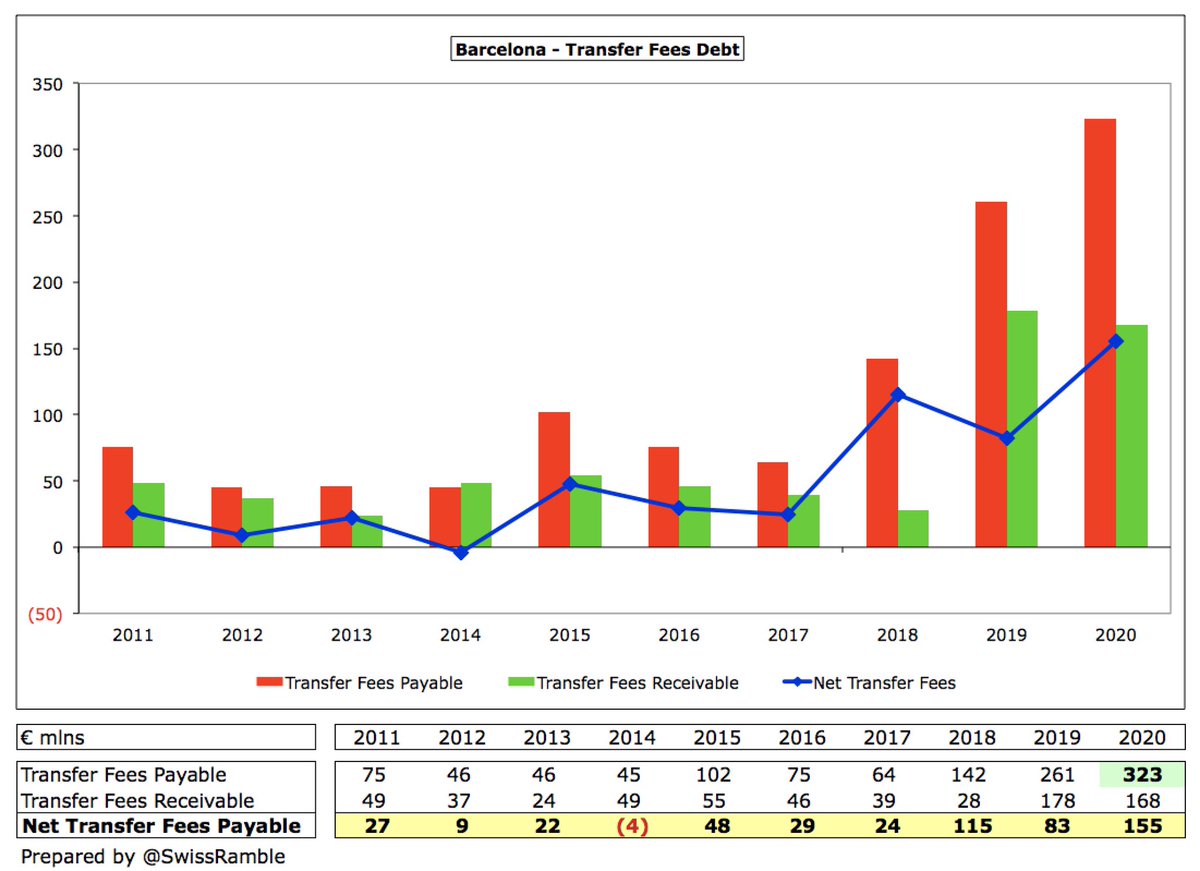

#CFC don’t separately report transfer debt, but if we assume this is 90% of Trade Creditors, we can see that this has fallen from £152m in 2018 to £128m in 2020. In contrast, transfer receivables have increased from £135m to £221m in this period, leaving £93m net receivables.

#CFC cash flow from operations in 2020 was £22m, but they then spent £28m (net) on player purchases, £6m capex and £24m net repayment of loans. This was partly funded by £7m new share capital, £5m interest received and £5m tax credit, though this resulted in £19m net outflow.

As a result, #CFC cash balance fell from £37m to £17m, which was a lot lower than the likes of #THFC £226m (boosted by £175m COVID loan from the government) and #SaintsFC £87m, though Chelsea can always rely on the “Bank of Roman”.

Since Abramovich acquired the club, he has put £1.3 bln into the club (though he was actually repaid £4.5m in 2020), including £357m share capital. Most of this funding has been seen on the pitch with a massive £1.1 bln spent on players (net), while £170m went on infrastructure.

To further illustrate the Russian’s generosity, in the 5 years up to 2019 he put £440m into #CFC, the highest of any Premier League owner. Next highest are #EFC £300m (Farhad Moshiri), #AVFC £193m (Nassef Sawiris & Wes Edens), #FFC £186m (Shahid Khan) & #BHAFC £160m (Tony Bloom).

#CFC confirmed they have complied with UEFA and Premier League financial regulations (i.e. FFP) and expect to do so for the foreseeable future. The rolling three-year assessment means that the 2019 loss is offset by profits in the other two years (plus allowable deductions).

Despite their huge transfer spend in last summer, #CFC should still be fine with FFP, as UEFA changed the rules to “neutralise the adverse impact of the COVID-19 pandemic by allowing clubs to adjust the break-even calculation for revenue shortfalls reported in 2020 and 2021.”

#CFC chairman Bruce Buck said, “the pandemic has had a significant impact on our income, but it is a sign of the strength and stability of our financial operation that we were still able to post a profit.” That is clearly true, but the strategy is very reliant on player sales.

• • •

Missing some Tweet in this thread? You can try to

force a refresh