Arsenal’s 2019/20 financial results covered a season when they finished 8th in the Premier League, won the FA Cup and reached Europa League last 32. Head coach Unai Emery was replaced by Mikel Arteta in December. Finances adversely impacted by COVID-19. Some thoughts follow #AFC

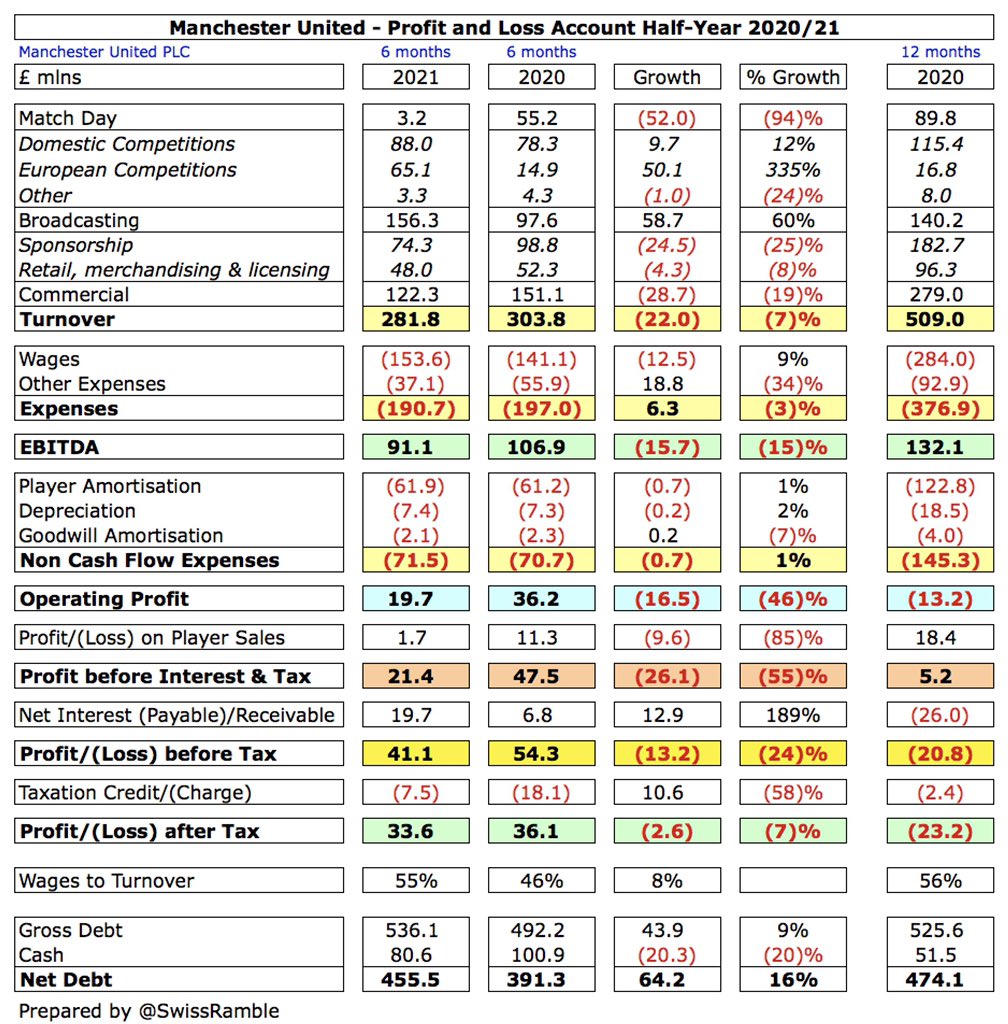

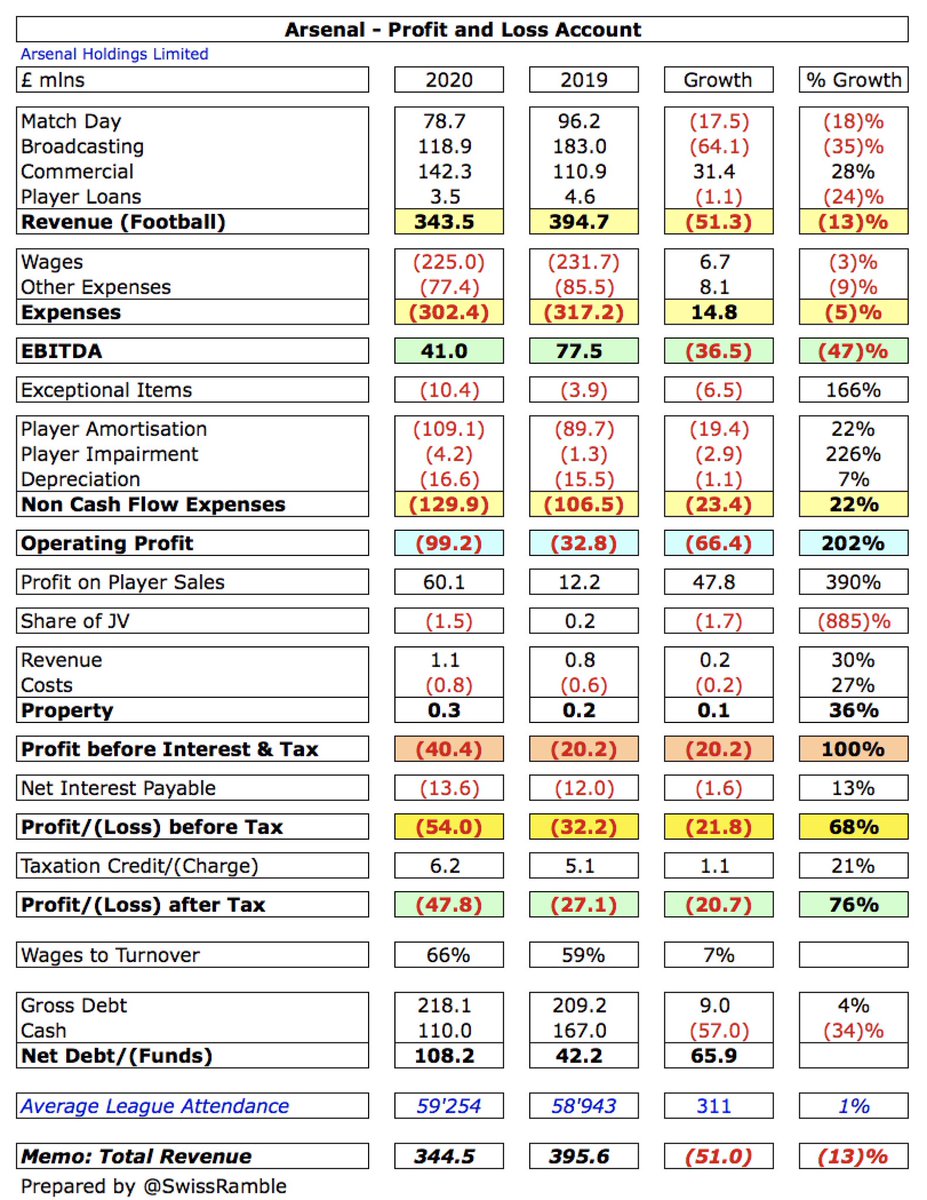

#AFC loss before tax loss widened from £32m to £54m, as revenue dropped £51m (13%) from £395m to £343m and expenses grew £18m (4%), offset by profit on player sales rising £48m from £12m to £60m. The loss after tax increased from £27m to £48m.

Impacted by COVID, broadcasting fell £64m (35%) from £183m to £119m and match day dropped £17m (18%) from £96m to £79m. In contrast, commercial rose £31m (28%) from £111m to £142m, thanks to new sponsorship deals. Player loans were down £1m to £3m.

#AFC wage bill fell £7m (3%) to £225m, while other expenses were cut £8m (9%) to £77m. However, player amortisation and impairment increased £22m (25%) to £113m, while exceptional charges rose £6m to £10m (departure of Unai Emery and his staff).

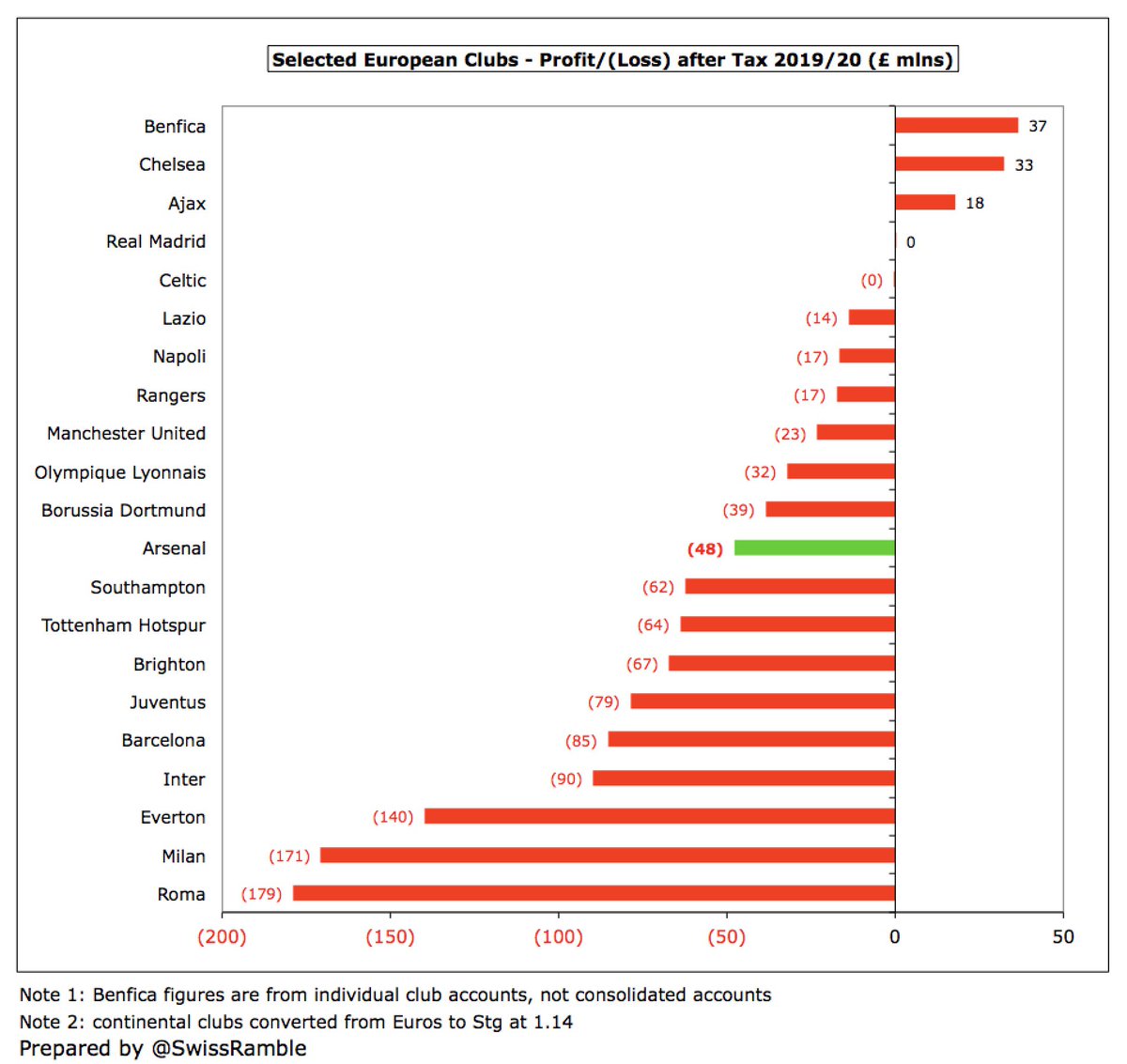

#AFC £54m loss before tax is obviously not great, though four Premier League clubs have reported higher losses to date in 2019/20, namely #EFC £140m, #SaintsFC £76m, #THFC £68m and #BHAFC £67m. Others also likely to post poor results for last season, due to the pandemic.

Excluding COVID, #AFC revenue would have been £54m higher, as £34m broadcasting deferred to 2020/21 and £20m lost (match day £14m, commercial/TV £6m). Offset by £19m cost savings, including player wages cut, giving net £35m impact. However, would still have made a £19m loss.

n this way, the pandemic has significantly impacted finances in 2019/20 with many leading clubs across Europe posting horrific losses, e.g. Roma £179m, Milan £171m, Inter £90m, Barcelona £85m and Juventus £79m are all worse than #AFC £48m loss (after tax).

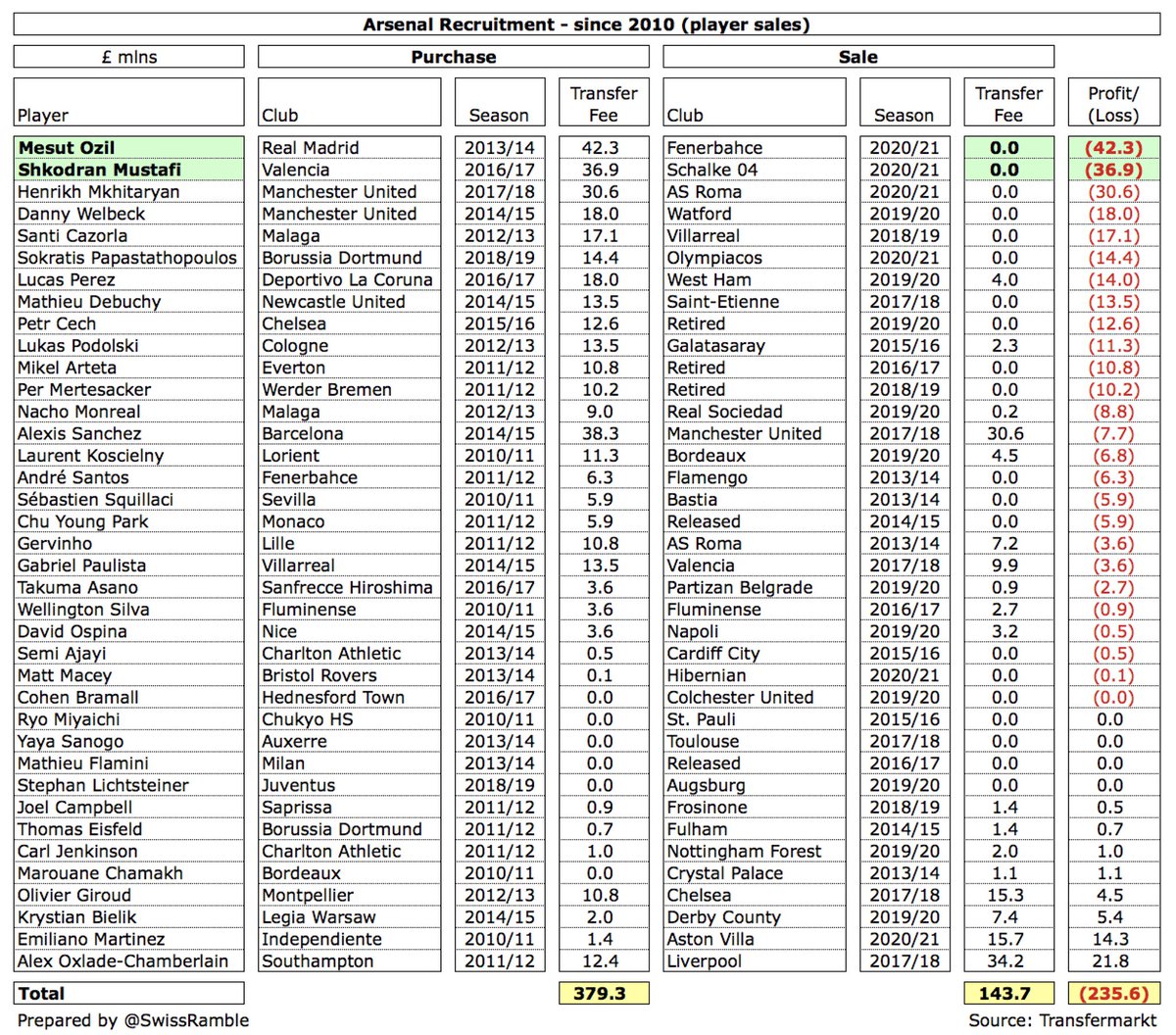

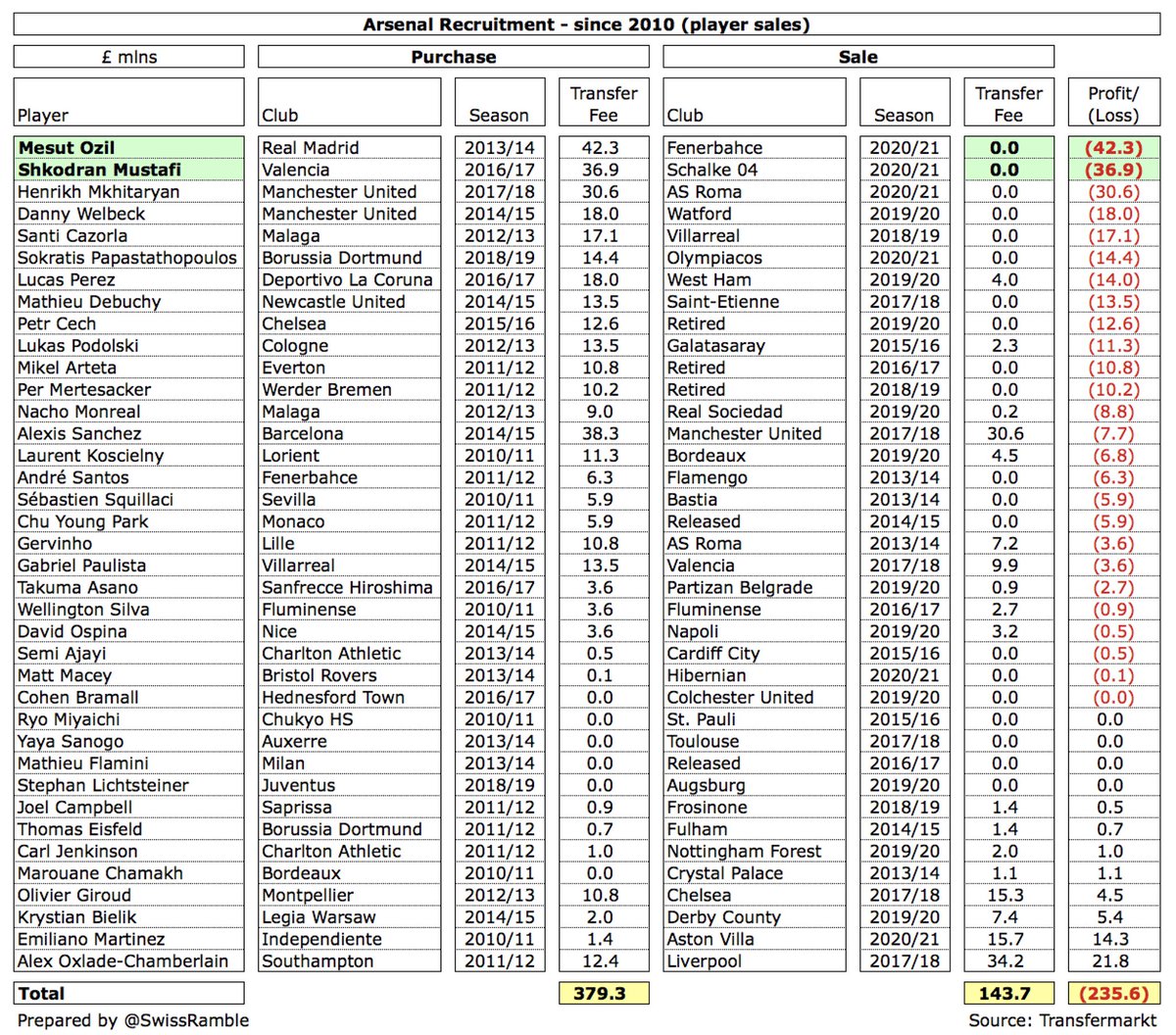

#AFC loss would have been even higher without £60m profit on player sales, significantly up from prior year £12m, mainly Alex Iwobi to #EFC and Krystian Bielik to #DCFC. This is the second highest in the Premier League in 2019/20 to date, though far below #CFC £143m.

#AFC have posted losses 2 years in a row for a combined £86m deficit. This followed 16 consecutive profitable years, during which they had a £393m surplus. The 2019/20 £54m loss is actually the 21st highest ever made in the Premier League – and this season will be even worse.

#AFC exceptional expenses rose £6m from £4m to £10m, due to the sacking of Emery and the appointment of Arteta. The club has now spent £31m on management changes in the last 3 years. Looks like no repeat of KSE £3m advisory fees in 2014 and 2015.

As #AFC noted, “player trading has a significant impact on overall profitability” with average annual profits rising to £40m over the last 5 years. However, 2020/21 will be much lower with the only meaningful sale being Emi Martinez to #AVFC.

Despite releasing many players for free over the last few years (most recently Ozil, Mustafi & Sokratis), #AFC still made £230m from player sales in last 6 years, which is the third highest in the Premier League, only behind #CFC £475m and #LFC £306m (only 5 years).

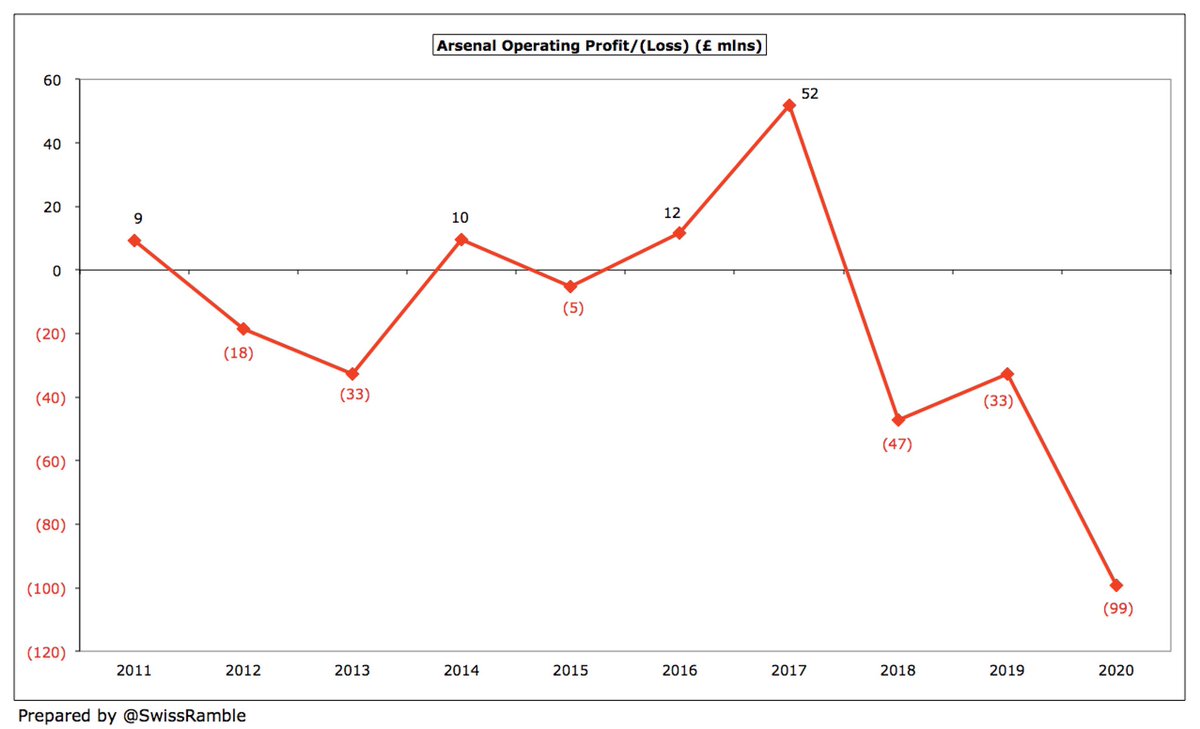

#AFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, fell from £78m to £41m. Lowest since 2013, though still 7th best in Premier League. Likely to be better placed when other clubs publish 2019/20 accounts.

#AFC operating loss increased from £33m to £99m. Very few clubs make operating profits, but Arsenal now have the 3rd highest loss in the Premier League, only surpassed by #EFC £175m and #CFC £112m. This is concerning if they cannot compensate with player sales (as Chelsea do).

Following the decrease in 2019/20, #AFC revenue has now fallen £79m (19%) from the £423m peak in 2017 to £343m in 2020. Commercial is the most important revenue stream 41%, having overtaken broadcasting 35%, followed by match day 23% and player loans 1%.

In fact, #AFC £79m revenue fall in the last 3 years is the worst of the Big Six with only #MUFC also experiencing a decrease in that period. Despite the impact of the pandemic, all the others have significantly grown their revenue, most notably #LFC £126m and #THFC £86m.

#AFC £343m revenue remains 6th highest in the Premier League. They are comfortably ahead of 7th placed #EFC £186m, but the gaps to the top 5 are equally large, e.g. around £150m below the top 3 clubs (#MUFC £509m, #LFC £490m and #MCFC £482m).

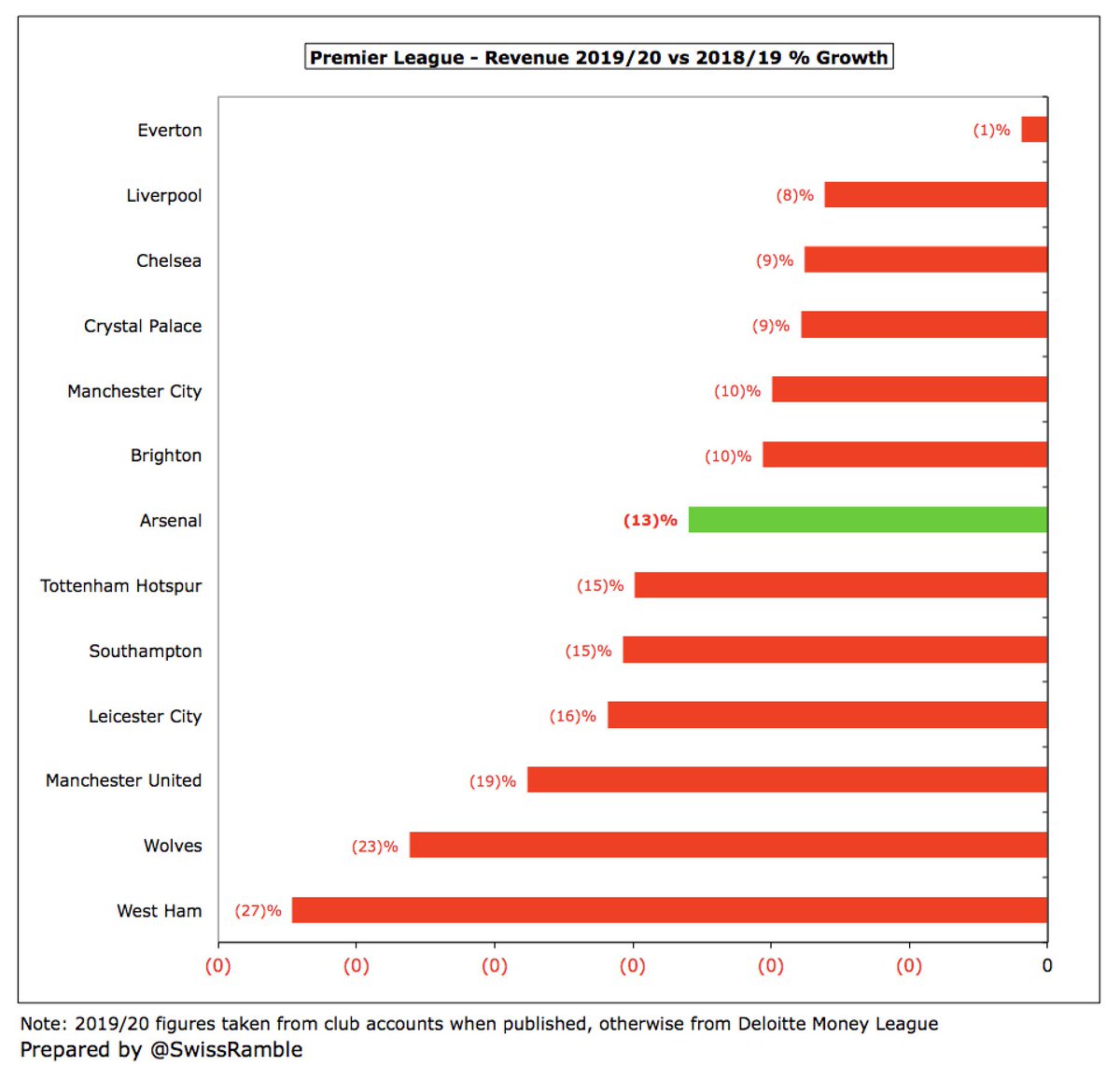

All Premier League clubs’ revenue is down in 2019/20, due to the impact of the pandemic, with #AFC 13% being in line with the average fall (though in absolute terms £51m is towards the higher end). EFC small 1% decrease is due to once-off £30m for stadium naming rights option.

#AFC remained 11th in the Deloitte Money League, which ranks clubs globally by revenue, though they are only £9m behind 10th placed Juventus. Former chief executive Ivan Gazidis will have surely noticed that Bayer Munich £556m are over £200m more than the Gunners.

The extent of #AFC revenue under-performance compared to other elite clubs is underlined by looking at their Money League trend over the last decade. Their ranking fell from 5th in 2011 to 11th in 2020, while their revenue was £95m higher than 10th placed club in 2016.

It will not have escaped #AFC fans’ attention that their North London rivals #THFC revenue has overtaken them in the last two years. Not only is the gap now £51m, but Spurs are ahead in all three revenue streams: match day £16m, broadcasting £17m and commercial £18m.

#AFC broadcasting income fell £64m (35%) from £183m to £119m, due to revenue from 10 games slipping to 2020/21 accounts and rebate to broadcasters, plus worse performance in the Europa League. Other clubs will see similar falls when they publish 2019/20 accounts.

As the 2019/20 season was extended beyond the 31st May accounting close, #AFC Premier League TV money was less than prior year, exacerbated by lower league position, though much of the revenue decrease has been deferred into the 2020/21 accounts, so is only a timing difference.

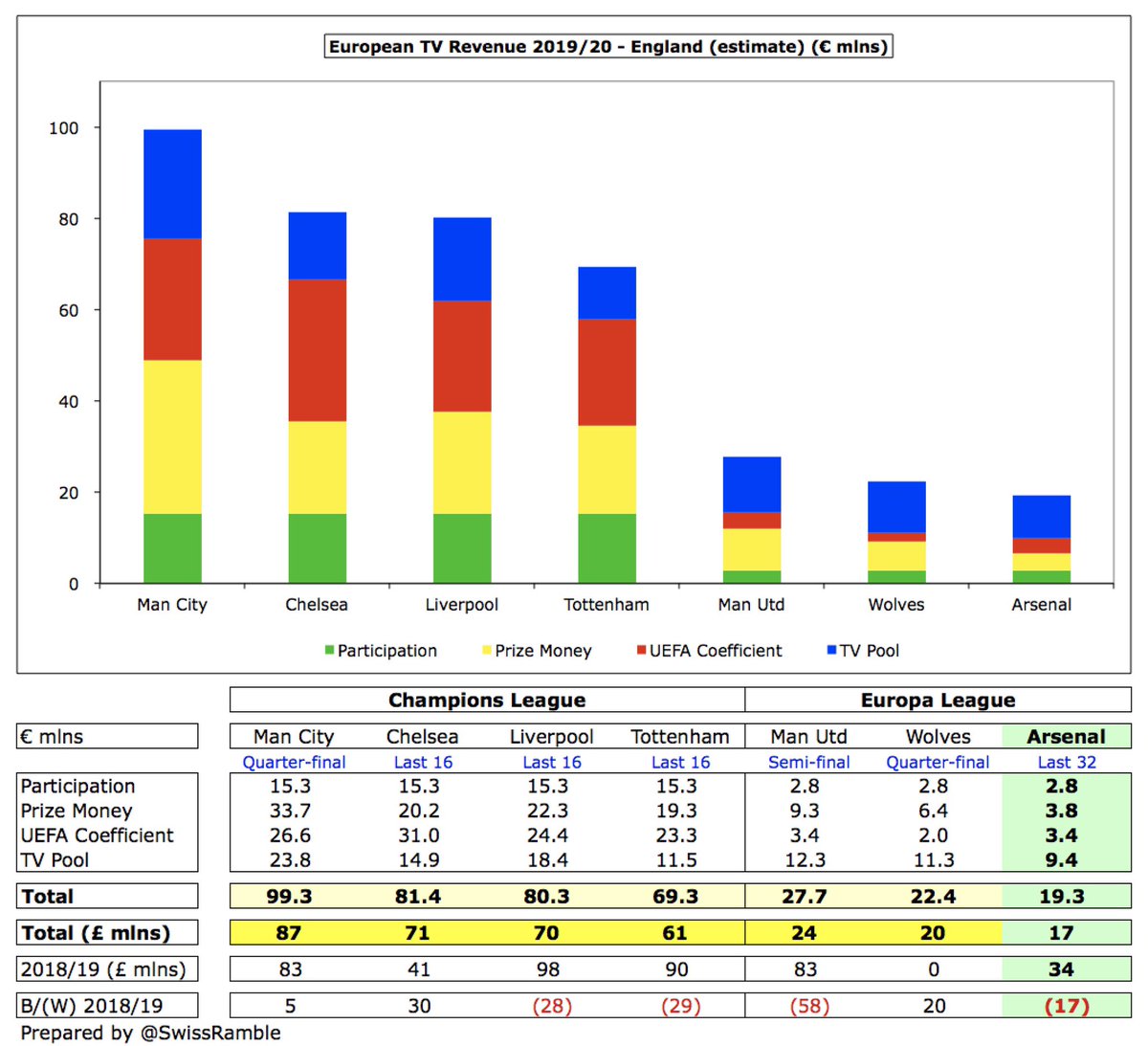

#AFC earned (estimated) £17m (€19m) from Europe after elimination by Olympiacos in Europa League last 32, half the prior season’s £34m for reaching the final. Much lower than Champions League representatives, e.g. #MCFC £87m. This is before a 16% COVID rebate.

#AFC have earned €214m from Europe in the last five years, the lowest of the Big Six and far below the likes of #MCFC €390m, #LFC €310m and #THFC €299m. There has been a clear drop-off in the last 3 years when Arsenal have failed to qualify for the Champions League.

#AFC match day revenue fell £17m (18%) from £96m to £79m, as they staged 5 fewer home games and then played 4 games behind closed doors due to COVID. Income is now 3rd highest in the Premier League, having been overtaken by #THFC £95m, due to their new stadium.

#AFC average attendance up slightly from 58,943 to 59,254 (tickets sold) for those games played with fans, which has fallen to 4th highest in the Premier League, behind #MUFC 72,726, #WHUFC 59,896 and #THFC 59,385.

As matches continue to be played without fans, #AFC are operating without one of their key revenue streams. To illustrate the importance of match day revenue, it accounted for 23% of the club’s revenue in 2019/20, the second highest in the Money League.

#AFC commercial revenue rose £31m (28%) from £111m to £142m, mainly thanks to the renewal of the Emirates sponsorship deal and a new kit deal with Adidas. As a result, the growth in Arsenal’s commercial income was the highest of the Big Six in 2020.

That’s obviously good news, but even after the growth in 2020, #AFC commercial income is still 6th highest in England, around half of #MUFC £279m. Also a long way behind #MCFC £250m and #LFC £214m, though within striking distance of #CFC £170m and #THFC £162m.

#AFC main commercial deals improved in 2019/20: Emirates sponsorship was extended at £40m (up £10m), while Adidas kit supplier £60m is twice the previous Puma partnership £30m. Worth noting that Emirates includes naming rights and does not allow separate training kit deal.

#AFC wage bill fell £7m (3%) from £232m to £225m (excluding severance payments) with growth offset by the COVID response, including 12.5% cut in player wages (subsequently reduced to 7.5% after Europa League qualification) and executive management waiving remuneration.

This means that #AFC wages have grown £26m in the last 3 years, while revenue has fallen £79m. In that period, the increases at other leading clubs have been much more, e.g. #CFC £64m and #THFC £54m. Arsenal were £26m ahead of #LFC in 2015, but were £78m behind in 2019.

Josh Kroenke said, “We have a Champions League wage bill on a Europa League budget”, but #AFC £225m wage bill is actually a fair way behind #MUFC £284m and #CFC £283m, though higher than #THFC £181m. #MCFC £315m and #LFC £310m are yet to publish 2019/20 accounts.

#AFC wages to turnover ratio increased from 59% to 66%, better than #CFC 70%, but worse than #MUFC 56% and particularly #THFC 46%. Wages should fall following many player departures (including Ozil), though 55 staff redundancies will not have a significant effect on the accounts.

Following the departure of chief executive Ivan Gazidis, the highest paid director’s remuneration fell from £846k to £435k. He had trousered as much as £2.7m in his last full season in 2018. A long way below Ed Woodward’s £3.1m at #MUFC and Daniel Levy’s £3.0m at #THFC.

#AFC player amortisation, the annual charge to expense transfer fees over a player’s contract, rose £19m (22%) to £109m, doubling in last 6 years from £54m in 2015. Also £4m impairment charge, reducing player values (Mkhitaryan?). 5th highest in PL, not too far behind #CFC £127m.

#AFC depreciation rose slightly to £17m. This non-cash expense is often overlooked, but worth noting that this is the 3rd highest in the Premier League, only surpassed by #THFC £71m (new stadium and training ground) and #MUFC £19m.

#AFC made £182m player purchases, including Pepé, Tierney, Saliba, Martinelli, Mari, Luiz & agents’ fees, a club record and only below #MUFC £183m in 2019/20. They have splashed out an incredible £561m in last 4 years, averaging £140m, so they’ve spent money, just not very well.

In fact, #AFC £329m net transfer spend in the 5 years up to 2019 was around the same as #LFC £337m, who won Premier League and Champions League in that period, though a lot less than #MCFC £639m and #MUFC £590m. Similar for gross spend, though larger gap to other clubs.

#AFC gross debt increased by £9m from £209m to £218m, including a £15m loan from owner Stan Kroenke for the first time, offset by £6m repayment of external debt. Cash decreased by £57m from £167m to £110m, so net debt grew £66m from £42m to £108m.

#AFC £218m gross debt is 5th highest in the Premier League, a fair way behind #THFC £831m (new stadium) and #MUFC £526m (Glazer’s leveraged buy-out). #EFC £409m and #BHAFC £306m debt is very largely in the form of “friendly” owner loans.

#AFC paid £11m interest in 2019/20, only below #MUFC £20m and #THFC £14m. The fixed rate bonds cost 5.8% a year, while floating rate bonds were 7%. It is hoped that the redemption of the bonds in August 2020, replaced by a KSE loan, will lead to lower interest charges.

So Kroenke has replaced (not eliminated) around £160m of bonds with a loan, freeing up £27m debt service reserve. In January #AFC also borrowed £120m from government COVID facility (0.5% interest), maturing in May, to cover short-term requirements, similar to #THFC £175m loan.

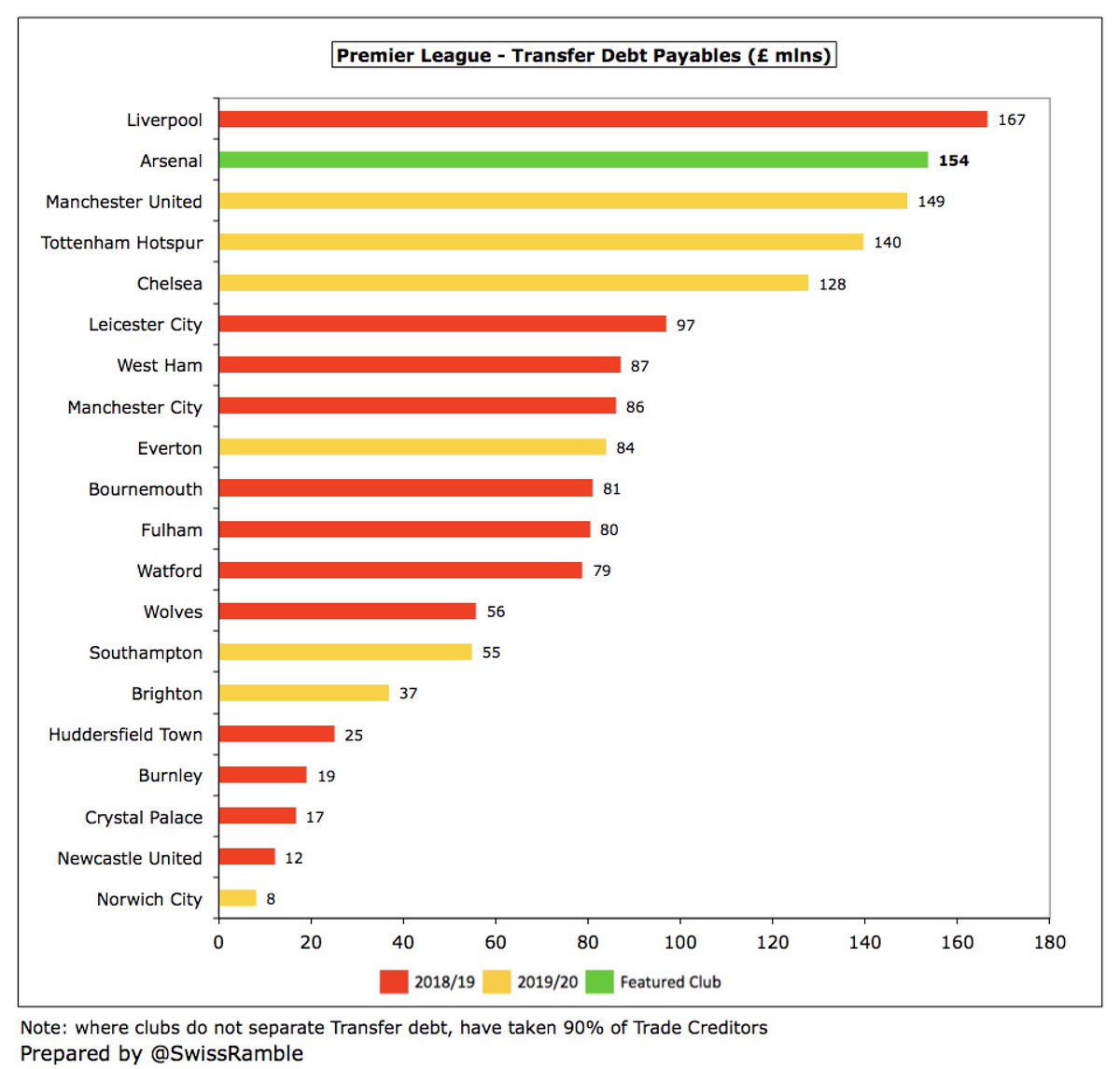

Like most clubs, #AFC player purchases have been largely funded by higher transfer debt, which has shot up from £77m to £154m, the second highest in the Premier League, only below #LFC. Club is owed £47m by other clubs, so net transfer payable is £107m, mainly over next 2 years.

#AFC operating cash flow was £23m (as high as £123m in 2018), but they then spent £58m (net) on player purchases, £13m on infrastructure and £4m tax. £20m went on servicing the debt (interest £10m, loan £10m), offset by Kroenke £15m loan, resulting in net £57m decrease in cash.

As a result, #AFC cash balance fell from £167m to £110m, the lowest since 2009, significantly impacted by COVID and exclusion of season ticket renewals. Still 3rd highest in Premier League, though a lot lower than #THFC £226m (boosted by £175m COVID loan).

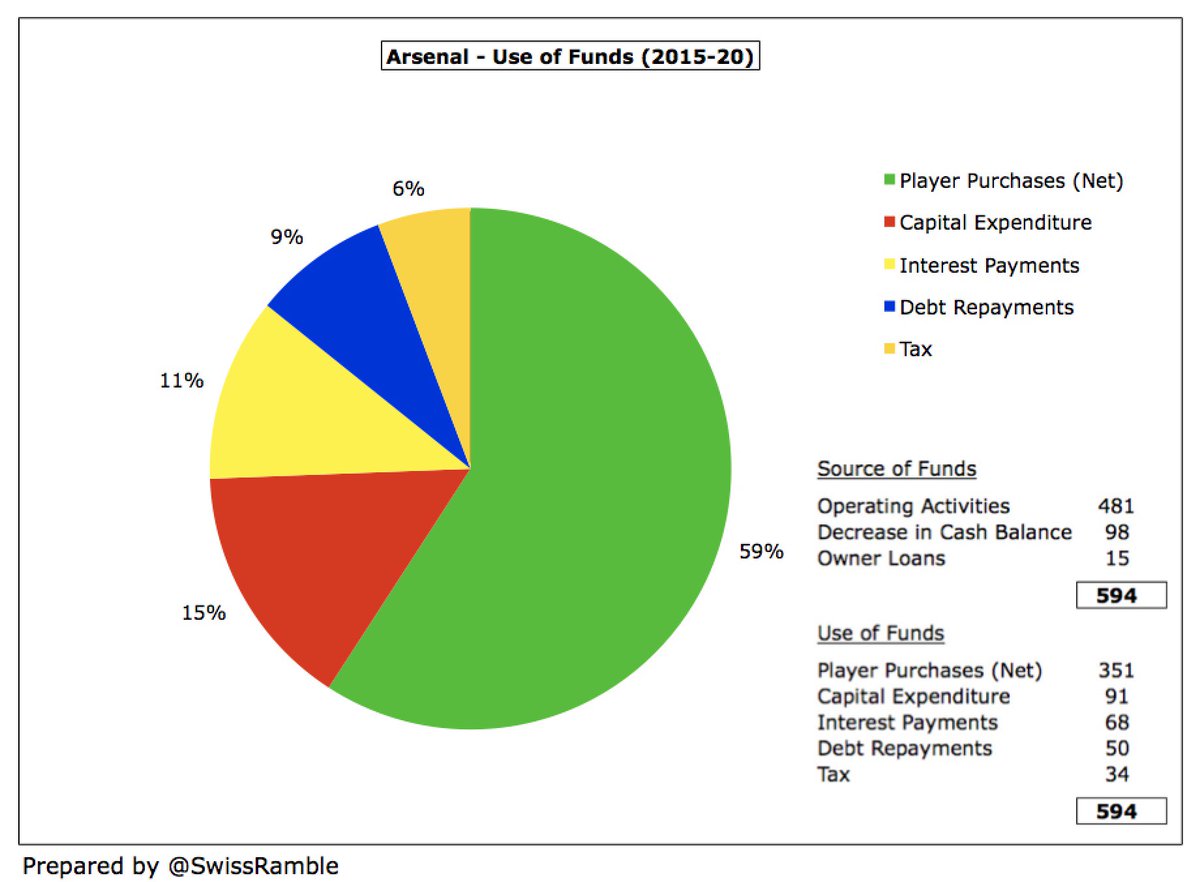

In the last 6 years #AFC have had nearly £600m available cash: £481m from operations, £98m decrease in cash balance and £15m owner funding. Around 60% (£351m) was spent on players (net), but important sums also went on interest/debt £118m, capex £91m and tax £34m.

Up until 2020 Kroenke had not put any money into #AFC (apart from buying the club) in contrast to many other owners. For example, Roman Abramovich provided £440m funding to #CFC in the 5 years up to 2019, while former Arsenal shareholder Farhad Moshiri put in £300m at #EFC.

#AFC results for 2019/20 are clearly not good, though have been materially impacted by COVID, as is the case for all football clubs. The bad news is that the figures in 2020/21 will be even worse, as almost all games are played behind closed doors and player sales are much lower.

#AFC have acknowledged that “the financial challenge remains significant”, but their self-sustaining business model is very dependent on Champions League qualification. As this seems unlikely, the owner might have to demonstrate what the club described as “unwavering support”.

• • •

Missing some Tweet in this thread? You can try to

force a refresh