Deloitte have published the 24th edition of their annual Football Money League, which ranks the world’s leading football clubs by revenue, this time covering the 2019/20 season. Some thoughts in the following thread.

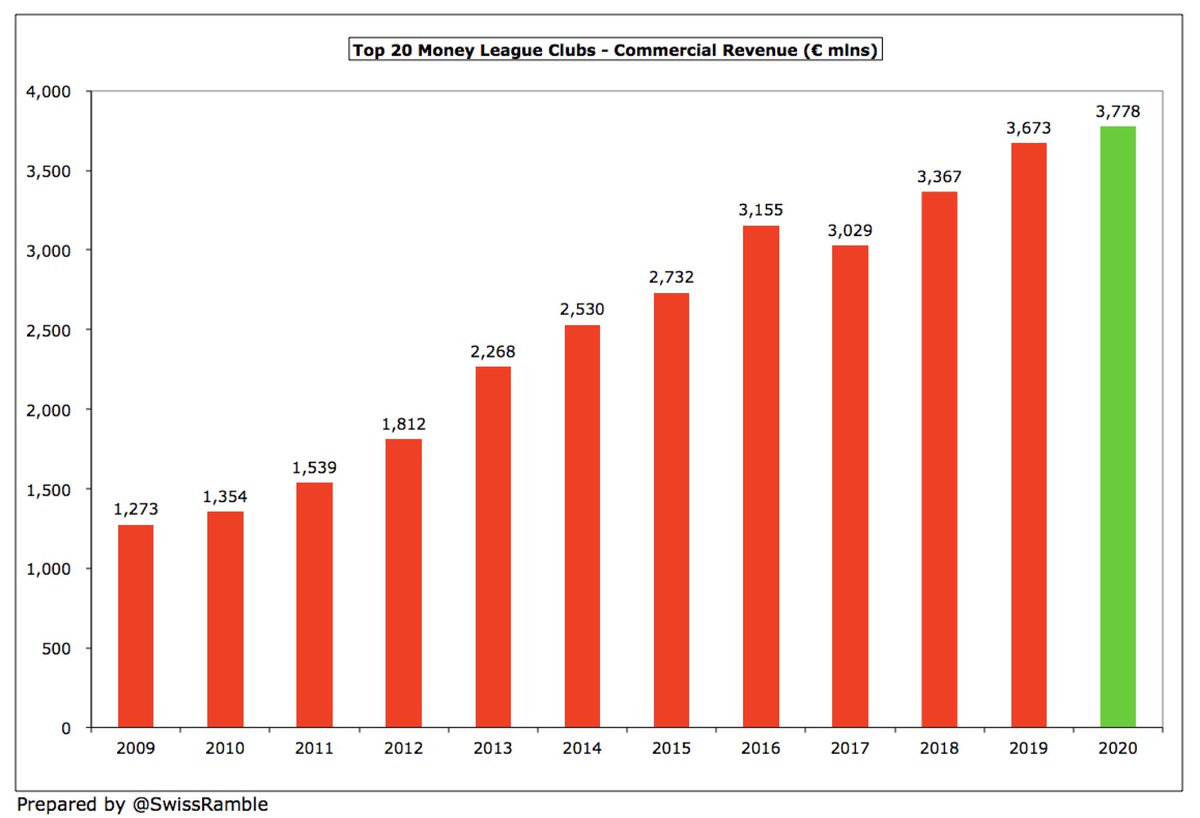

The 2019/20 season was impacted by the COVID-19 pandemic, leading to a £1.0 bln (12%) fall in revenue of the top 20 Money League clubs from £8.2 bln to £7.2 bln. Broadcast and match day fell £822m (23%) and £227m (17%) respectively, though commercial rose £87m (3%).

In terms of Euros, match day fell €257m (17%) from €1.5 bln to €1.2 bln, driven by matches either being cancelled or played behind closed doors without fans. Match day revenue is largely derived from gate receipts (including ticket and corporate hospitality sales).

Broadcasting fell €937m (23%) from €4.1 bln to €3.2 bln, due to the deferral of some revenue from 2019/20 to 2020/21 for games played after the accounting close, both in domestic leagues and UEFA competitions, plus rebates given to broadcasters for the disrupted season.

In contrast, commercial rose €105m (3%) from €3.7 bln to €3.8 bln, which reflected the start of new sponsorships and partnership agreements for several Money League clubs, offset by lower merchandising sales, impacted by the closure of retail outlets.

Comparisons between clubs are more challenging this year, as leagues adopted different responses to the pandemic. Some completed their seasons before end-June, while others extended their seasons beyond this date, meaning some revenue was deferred to 2020/21 accounts.

All the Big Five leagues paused in March 2020 with Ligue 1 cancelled the following month. The Bundesliga managed to complete its season by end-June, so could recognise a full season’s revenue in 2019/20, while the Premier League, Serie A and La Liga extended to July and August.

German clubs benefited from Bundesliga completing its season before end-June, so TV payments were received during 2019/20, while others (Premier League, Serie A & La Liga) had to recognise revenue over two seasons. Champions/Europa League games played in August booked in 2020/21.

In addition, many leagues have agreed large rebates with broadcasters, as the season was disrupted, leading to an inferior “product” being delivered. For example, the Premier League rebate is reportedly worth £330m, recognised over the life of the contract.

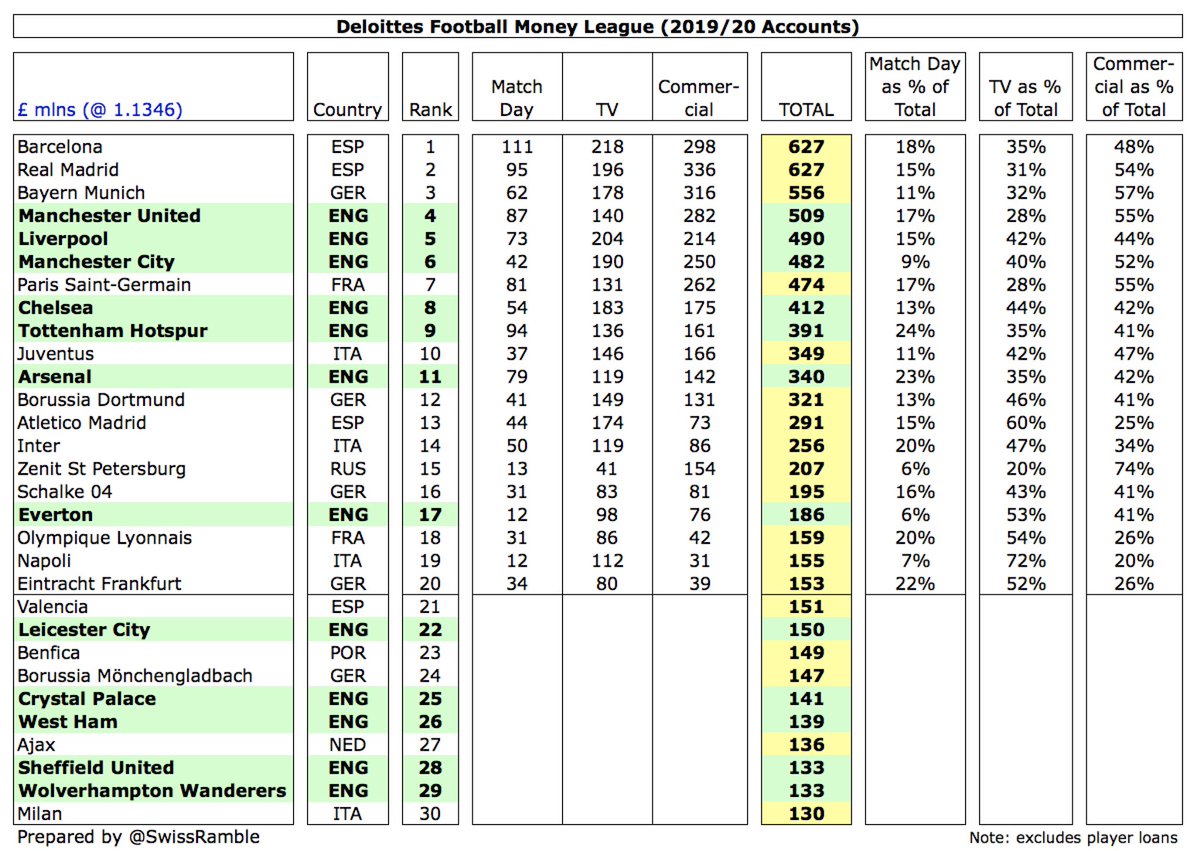

#FCBarcelona retained top spot in the Money League, despite revenue dropping £114m, fractionally ahead of Spanish rivals #RealMadrid, both with £627m. #FCBayern £556m overtook #MUFC £509m to claim third place, while #LFC £490m climbed two places to 5th, just ahead of #MCFC £482m.

There are no fewer than five English clubs in the top ten, also including #CFC £412m (8th) and #THFC £391m (9th). #AFC £340m remained 11th, just behind #Juventus £349m. Zenit St Petersburg and Eintracht Frankfurt were new entrants to the top 20, replacing #ASRoma and #WHUFC.

The top 20 clubs have a very different revenue mix, so the highest/lowest amount of each revenue stream are: match day – #FCBarcelona £111m / #SSCNapoli £12m; broadcasting – #FCBarcelona £218m / Zenit St Petersburg £41m; commercial – #RealMadrid £336m / #SSCNapoli £31m.

Almost all clubs saw revenue fall year-on-year, due to the pandemic, with largest decrease at #MUFC £118m, followed by #FCBarcelona £114m, #S04 £91m and #PSG £86m. Only 2 increased revenue: Zenit, (accounts closed Dec 2019, so pre-COVID), and #EFC (stadium naming rights option).

In percentage terms, the steepest decline was at #S04 32% (no European qualification), #Inter 20% (termination of some Chinese sponsorships), #MUFC 19% (Europa League instead of Champions league) and #TeamOL 19% (Ligue 1 suspended in April).

The majority of the revenue decrease at the top 20 clubs was driven by broadcasting with both #THFC and #MUFC down over £100m. The largest match day falls were in Spain: #RealMadrid £33m and #FCBarcelona £29m. Commercial dropped most at #PSG £58m and #Inter £50m.

English clubs were protected from a worse COVID impact by higher commercial revenue, mainly new sponsorships, with strong growth at #EFC £39m, #AFC £31m, #LFC £28m, #THFC £27m and #MCFC £20m. Also good commercial growth at #RealMadrid £23m and Zenit £18m.

In England #MUFC £509m still highest revenue, just ahead of #LFC £490m, who returned to top 5 for first time in 18 years. #CFC £412m overtook #THFC £391m for best London ranking. Promotion saw first appearance for #SUFC (28th). #NUFC did not provide figures, so are missing.

The importance of European qualification is evident from #CFC return to the Champions League, though #LFC and #THFC had lower revenue after only reaching last 16 compared to the final in 2019. #MUFC hurt by dropping to Europa League, though #WWFC did well after reaching QF.

Spanish one-two for the third consecutive year. #FCBarcelona £627m retained top place, narrowly ahead of #RealMadrid, despite a £114m revenue fall. Madrid only dropped £40m, as benefited from taking merchandising in-house. #Atleti £291m and Valencia £151m are miles below big two.

German clubs were least impacted, as the Bundesliga was completed in the financial year, meaning an average year-on-year decline of just 4% for #FCBayern £556m, #BVB £321m, Eintracht Frankfurt £153m and Gladbach £147m. #S04 down 32% to £195m, due to no European qualification.

#Juventus still Italy’s highest club in 10th place, but fell £56m to £349m, followed by #Inter £256m & #SSCNapoli £155m. #Milan 30th place (£130m) was their lowest ever, as they served a UEFA ban, while #ASRoma dropped out of top 30 after failing to qualify for Champions League.

#PSG dropped two places to 7th, as revenue fell £86m to £474m, well ahead of #TeamOL £159m. French clubs adversely impacted by the early cancellation of the Ligue 1 season and the deferral of Champions League revenue to 2020/21 accounts for games played in August.

The highest placed club outside the Big Five leagues was Zenit Saint Petersburg £207m in 15th, as they benefited from a return to the Champions League and their accounts closing December 2019 (pre-COVID). Benfica £149m (23rd) and #Ajax £136m (27th) also featured in the top 30.

Despite the €1.1 bln (12%) fall in revenue of top 20 clubs from €9.3 bln to €8.2 bln in 2020, this is still the 3rd highest ever total. Moreover, revenue has more than doubled from €3.9 bln in 2009. Growth in that period led by commercial €2.5 bln and broadcasting €1.5 bln.

Following revenue deferrals to 2020/21 and rebates, broadcasting is no longer the most valuable revenue stream, falling from 44% to 39%. It has been overtaken by commercial, up from 40% to 46%, while match day further fell from 16% to 15% (down from 26% in 2009).

#FCBarcelona £111m and #RealMadrid £95m still have highest match day revenue, despite registering the largest year-on-year falls, ahead of #THFC £94m, #MUFC £87m, #PSG £81m and #AFC £79m. Spurs were one of only 3 clubs to generate an increase after moving to a new stadium.

The highest percentage of match day revenue is in North London with #THFC 24% now ahead of #AFC 23%, followed by Eintracht Frankfurt 22%, #TeamOL 20% and #Inter 20%. In contrast, match day contributes less than 10% at Zenit 6%, #EFC 6%, #SSCNapoli 7% and #MCFC 9%.

Two clubs earned more than £200m from broadcasting, namely #FCBarcelona £218m and #LFC £204m, followed by #RealMadrid £196m, #MCFC £190m and #CFC £183m. English clubs were hit hard by revenue deferrals and rebates with largest YoY falls at #THFC £108m, #MUFC £101m and #AFC £66m.

Five of the top 20 clubs generated over half of their revenue from broadcasting: #SSCNapoli 72%, #Atleti 60%, #TeamOL 54%, #EFC 53% and Eintracht Frankfurt 52%. The top placed clubs are far less reliant on TV than smaller clubs, e.g. #MUFC and #PSG 28%, though Zenit only 20%.

Commercial held up well with many clubs increasing income, especially English: #EFC £39m, #AFC £31m, #LFC £28m, #THFC £27m & #MCFC £20m. Largest falls at #PSG £58m, #Inter £50m & #FCBarcelona £40m. Highest revenue: #RealMadrid £336m, #FCBayern £316m, Barca £298m & #MUFC £282m.

During the pandemic, commercial partnerships have become increasingly important with no fewer than 6 clubs generating more than half of their income from this revenue stream: Zenit 74% (mainly Gazprom), #FCBayern 57%, #MUFC 55%, #PSG 55%, #RealMadrid 54% and #MCFC 52%.

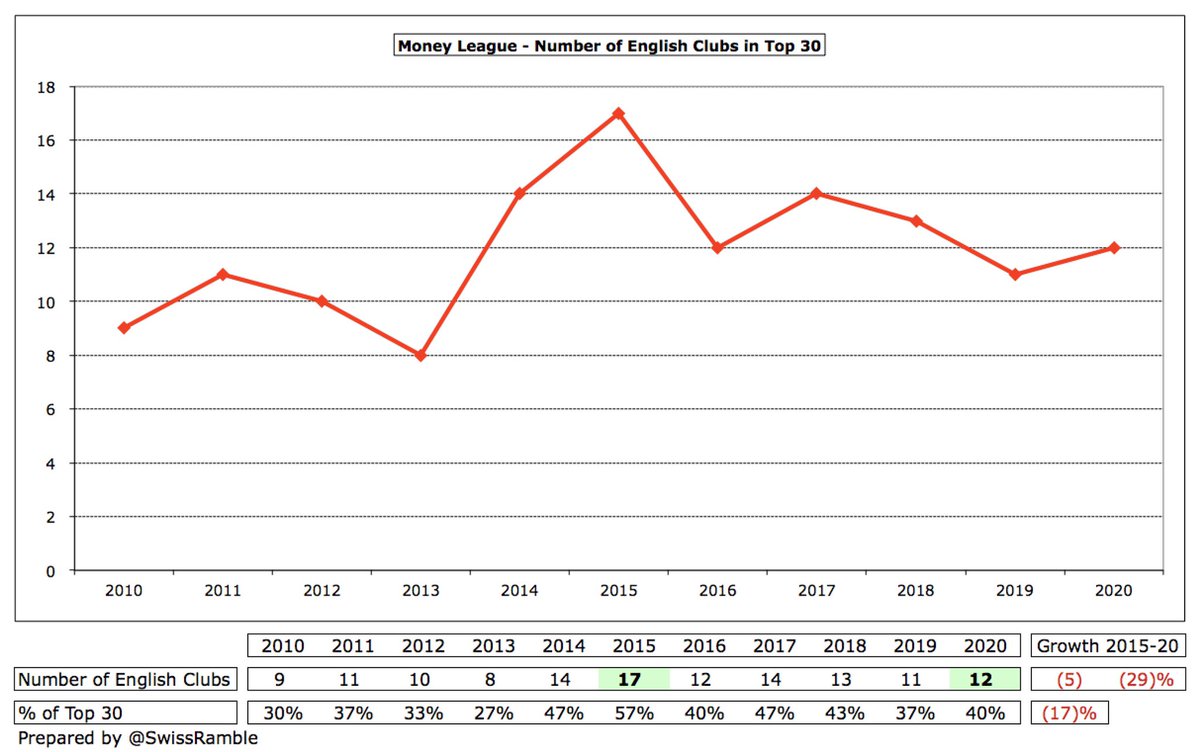

Total number of English clubs in top 20 fell from 8 to 7 (down from 10 in 2017), while Italy slipped from 4 to 3. In contrast, Germany rose from 3 to 4, as their season was completed in 2019/20, while Russia had 1 for first time since 2016. Spain 3 and France 2 unchanged.

England has 12 clubs in the top 30, much more than Germany 5, Spain 4, Italy 4 and France 2. There are only 3 clubs from outside the Big Five leagues, namely Zenit St Petersburg £207m, Benfica £149m (5th consecutive year), and Ajax £136m.

That said, the number of English clubs in the top 30 has steadily fallen from the peak of 17 in 2015 to 12 in 2020. However, to underpin the Premier League’s strength, #SUFC £133m reached 28th place immediately after their promotion to the top tier.

Clubs at the top of the Money League were most impacted by COVID in absolute terms, as seen by the significant revenue decreases at the leading clubs from each of the Big Five leagues. The only exception is #FCBayern, thanks to Germany completing its season in 2019/20 accounts.

The gap between top and bottom, defined as 1st place to 20th place, decreased from a record €633m to “only” €541m. This had been on a steadily upward trend, up from €207 million in 2006, before the pandemic struck.

Similarly, the gap between the 10th placed club and 11th placed club narrowed from €14m to €10m. This was as high as €57m in 2016, but has reduced since then, mainly due to #AFC dropping out of the top 10 to 11th. The gap to #BVB in 12th place has also fallen to €22m.

The financial threshold for membership of the Money League club has decreased to €174m, the lowest since 2016. However, it has still basically doubled since 2009, when you only needed €85m to become a member of the moneyed elite.

Just for a bit of fun, let’s now take a look at some of the comparisons between the leading clubs in each country to better understand the reasons for the differences in revenue between them.

The gap between #MUFC £509m and #LFC £490m narrowed to £19m, though United kept their noses in front, thanks to commercial strength (£69m higher). Liverpool nearly offset that in broadcasting (£64m more), as United played in Europa League, while #LFC were in Champions League.

However, #LFC £490m have to look over their shoulder at #MCFC £482m, who are only £8m lower. City’s commercial advantage was offset by Liverpool’s higher match day and broadcasting (included all Champions League last 16 in 1 year, while City’s was booked over 2 years).

In North London #THFC £391m are now £51m higher than #AFC £340m, outperforming their rivals in all three revenue streams: commercial £18m, broadcasting £17m and match day £16m. Spurs’ improvement in the latter category is due to their move to a new stadium.

#FCBarcelona and #RealMadrid had almost identical revenue of £627m, as Madrid closed the gap with their revenue only falling £40m against Barca’s £114m decline. Partly due to bringing merchandising inhouse (a year after their Catalan rivals), driving a £37m commercial difference.

Despite #BVB revenue only falling £12m to £321m, they still find themselves £235m below #FCBayern £556m. The Bavarians earn more in all categories, but the major difference of £185m is in commercial income.

In Italy #Juventus £349m and #Inter £256m both reported large decreases in 2019/20, but the gap between the two widened to £93m, mainly due to Juve generating £79m more commercial income, as some of Inter’s Chinese sponsorships were terminated early.

In France #PSG £474m are miles ahead of their closest challenger #TeamOL £159m, generating three times as much as revenue. The commercial difference £220m is enormous, but match day is also £50m higher, despite Lyon’s move to a new stadium, while broadcasting is £46m more.

Although the Money League only gives a partial picture of finances, focusing purely on revenue, it remains a useful indicator of success on the pitch, even though the rankings of individual clubs this year also depend on how different leagues reacted to COVID-19.

Like all industries, football is suffering during the pandemic, as reflected by lower revenue in 2020. It will fall even further this season, as the return of fans in significant numbers to grounds is unlikely. There will also be pressure on commercial agreements and TV deals.

• • •

Missing some Tweet in this thread? You can try to

force a refresh