1. Dollar-cost averaging (DCA) has been a popular way for long term hodlers to accumulate their core position in BTC. I’ve been thinking about this and modelled out a few backtests with some interesting findings. This is not investment advice.

2. Theoretically, DCA should help smooth out the ups and downs in buying BTC to help arrive at a more stable adjusted cost basis. The premise behind this approach is not to time the market but rather constantly buy BTC at a fixed schedule.

3. In this analysis I assumed we’re buying $100 worth of BTC every week on the same day. The period we’re observing is from 2015-01-01 to 2021-03-14 and we’re using daily Coinbase mid-price (avg of open/close) BTC spot data. Here’s the logic of the backtest:

3. A) The model will begin on 2015-01-01 which is a Thursday. This means that for every Thursday up until the last Thursday in our data we will buy $100 worth of BTC.

3. B) Throughout this process we will track the cumulative sum of BTC collected throughout 2015-01-01 to 2021-03-14. In total this gives us 324 Thursdays to buy $100 worth of BTC. In total we spend $100 x 324 = $32,400 in cash to buy this BTC.

3. C) Now to compare the lump-sum approach we’ll take the price of BTC on the same starting date of 2015-01-01 (BTC mid-price is ~$340) and fully invest the $32.4k all at once (~95 BTC). In this case we're not factoring for time-value of money given interest rates are quite low.

3. D) Lastly, we compare the ending cumulative balance of BTC between the DCA vs lump-sum approach from 2015-01-01 to 2021-03-14. DCA = 34.62 BTC vs. Lump Sum = 95.29 BTC. We can see nearly 3x more BTC was accumulated by investing the entire cash balance back in 2015.

4. This isn’t a fair comparison as BTC in 2015 was very different from today. To avoid cherry-picking any particular start date, it makes sense to treat *each individual day* as its own starting point for a backtest.

5. Put another way, the next backtest will start on 2015-01-02 which is a Friday. Using the same logic as above, we'll DCA into BTC for every Friday up until 2021-03-14. From here we'll compare the quantity of BTC collected using the two approaches.

6. In total there are ~2200 daily observations which means we can get ~2200 individual backtests showcasing the performance of DCA vs. lump sum investing.

7. Again, the whole goal of this process above is to reduce the chances of cherry-picking any particular day when BTC had extreme moves which would massively skew the results between DCA vs. lump sum investing.

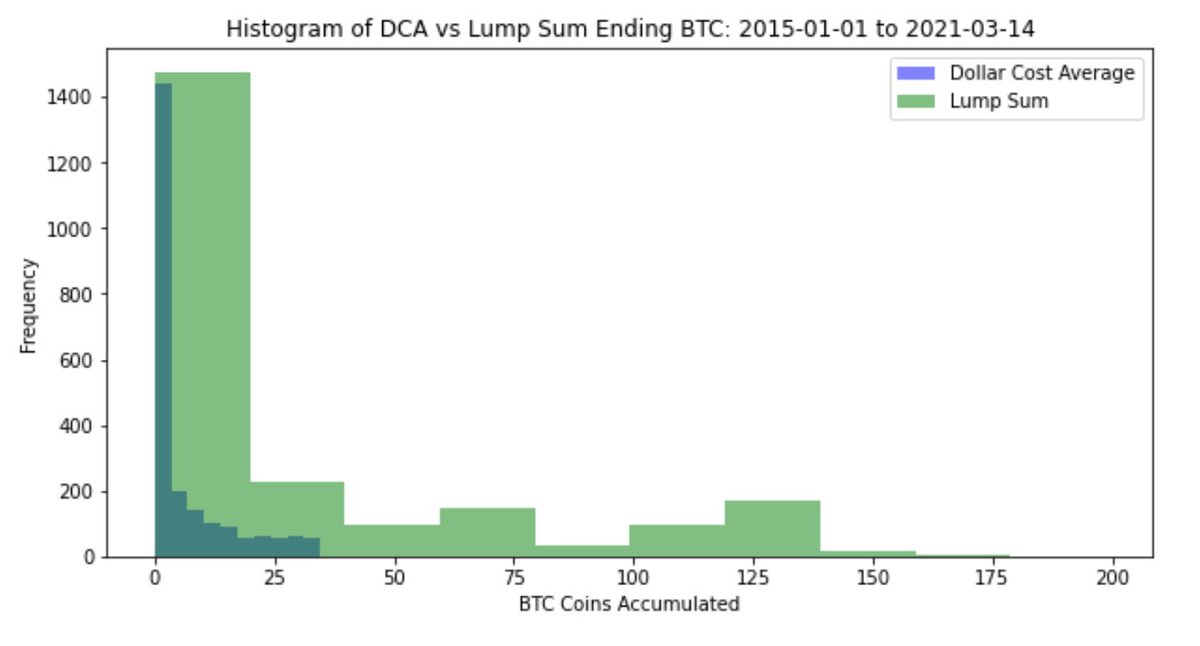

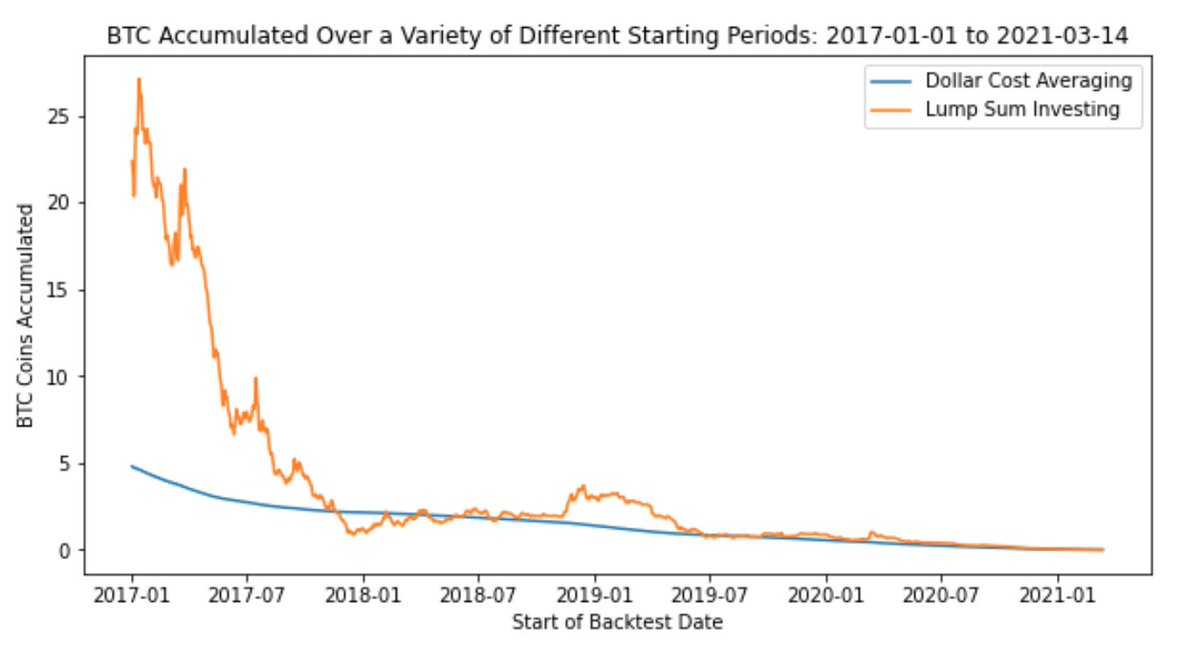

8. By plotting the distribution of the DCA and lump-sum cumulative ending BTC values, we can see the results are strongly in favour of the lump-sum approach. This is due to ultra low prices in the pre-2017 era.

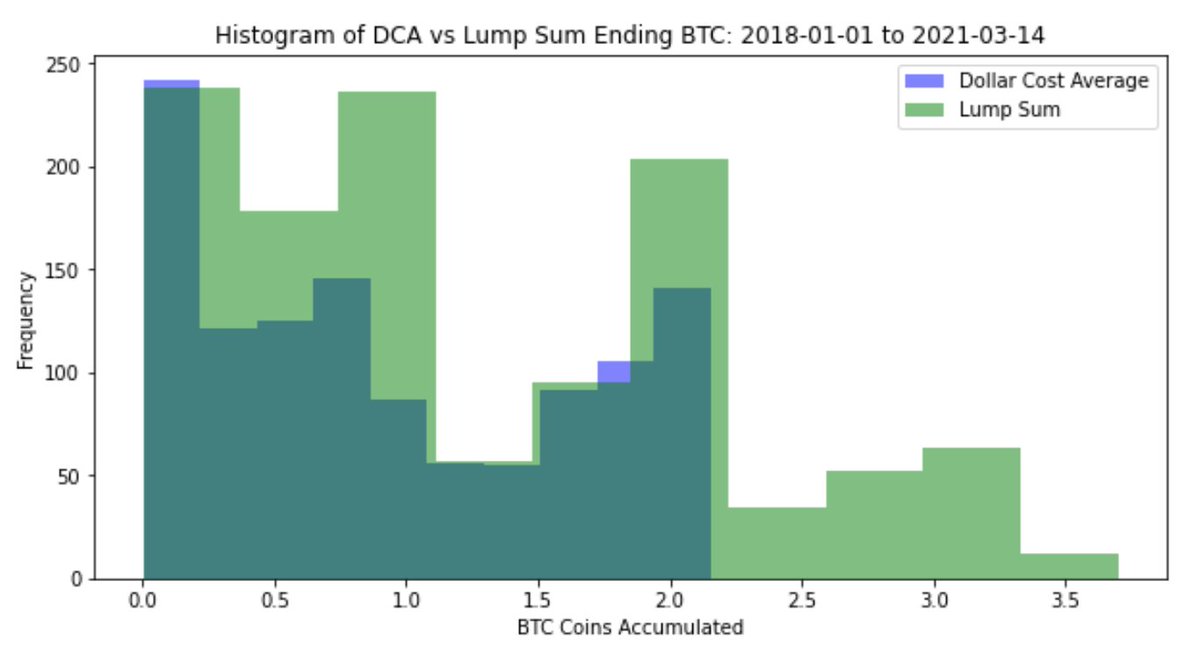

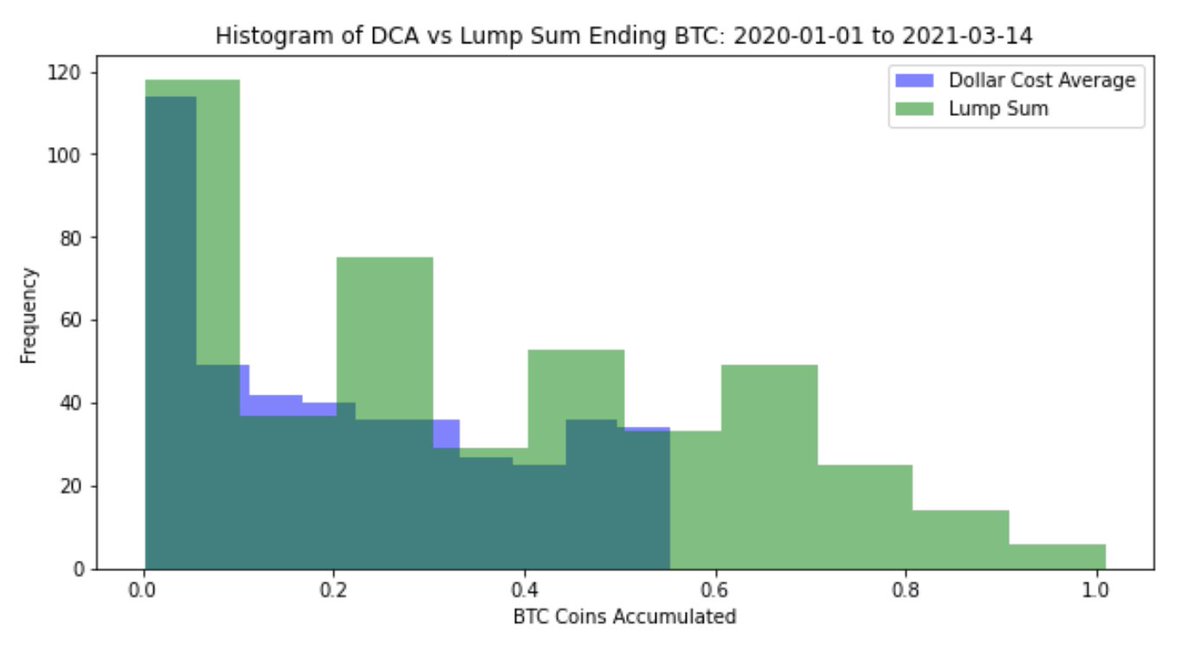

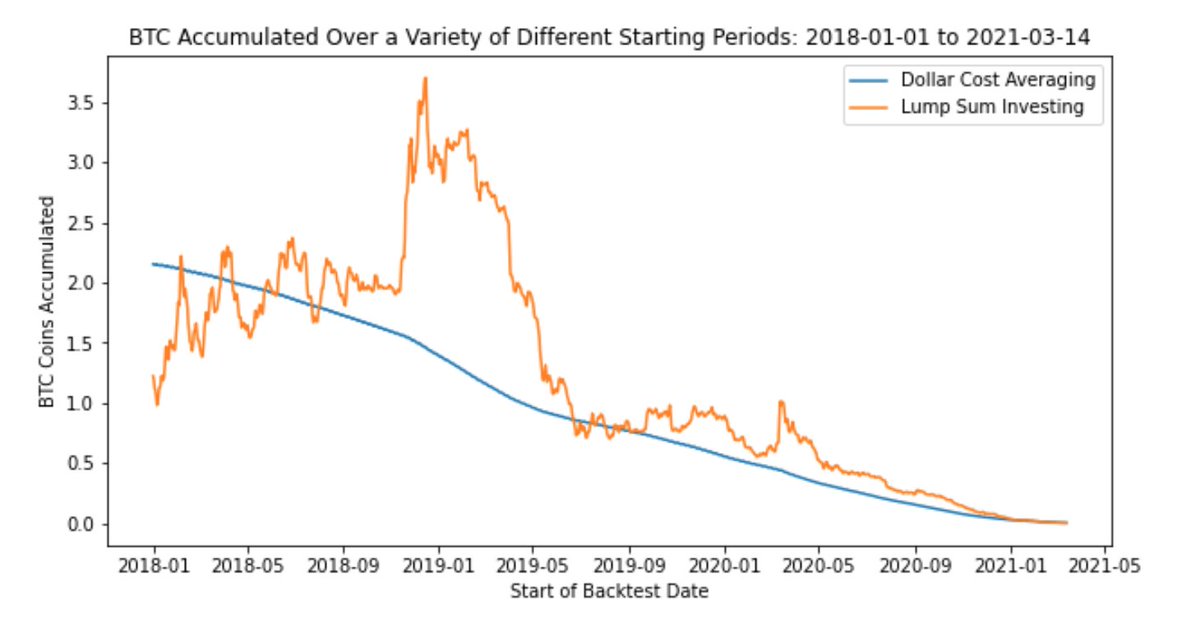

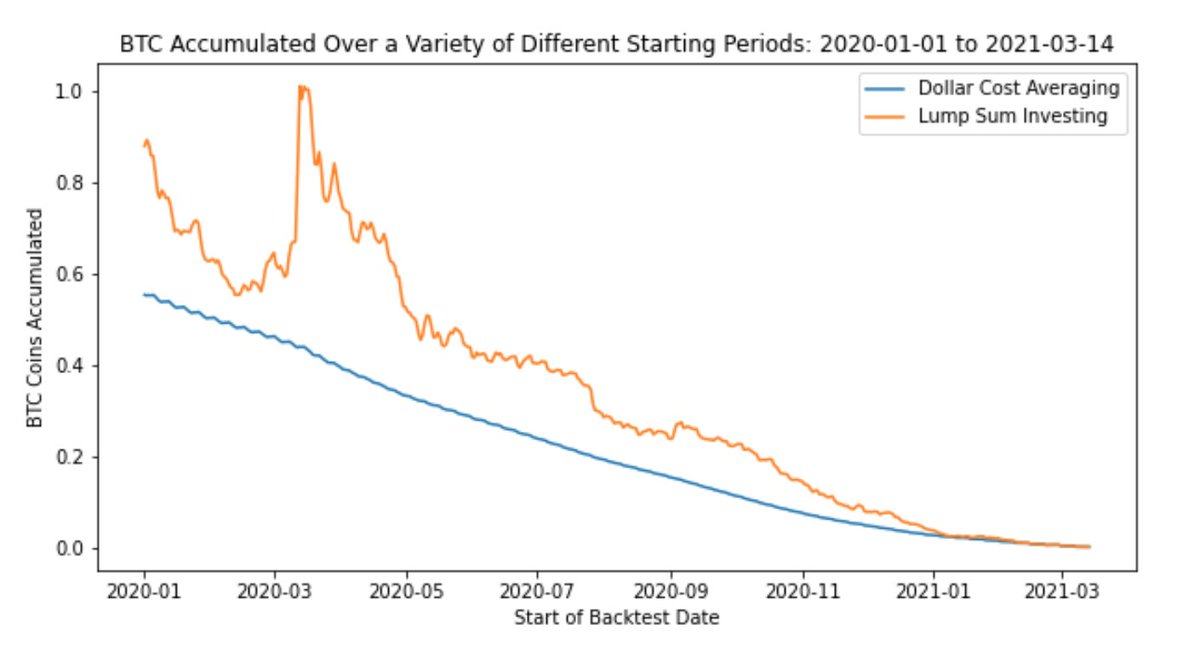

9. Running this analysis again but now with data starting in 2018 and 2020 we can see the distribution of the DCA starts lining up with that of lump-sum investing.

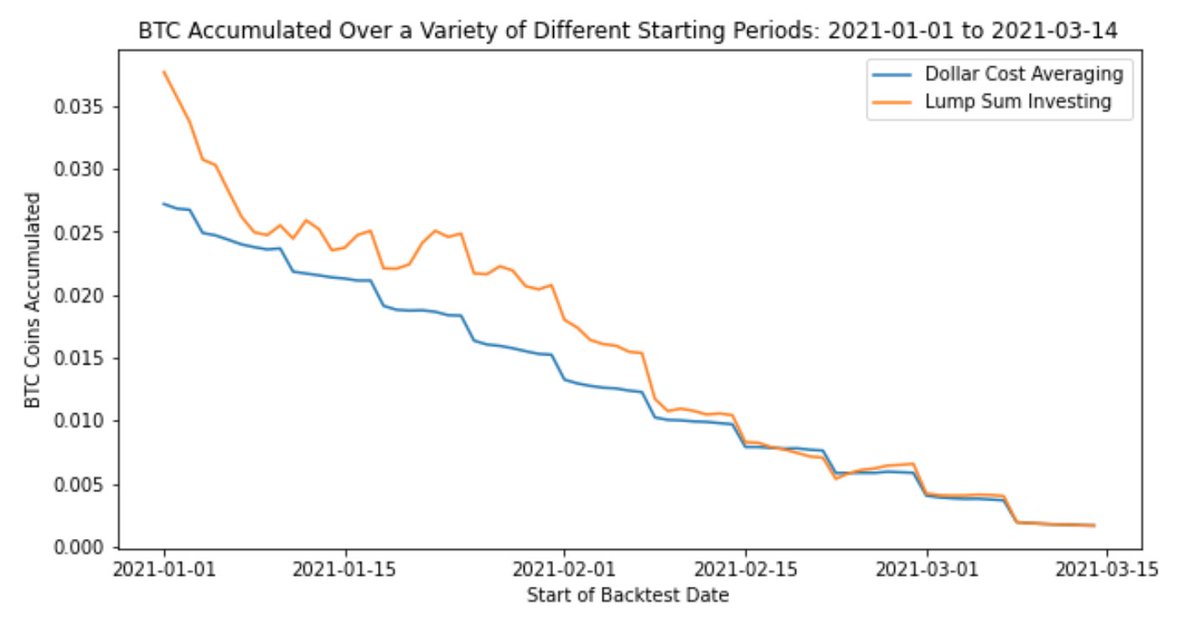

10. Over time the difference between the amount of BTC accumulated through DCA starts to get much closer to the lump-sum approach. In other words, the distributions become similar to one another as we start looking at more recent data.

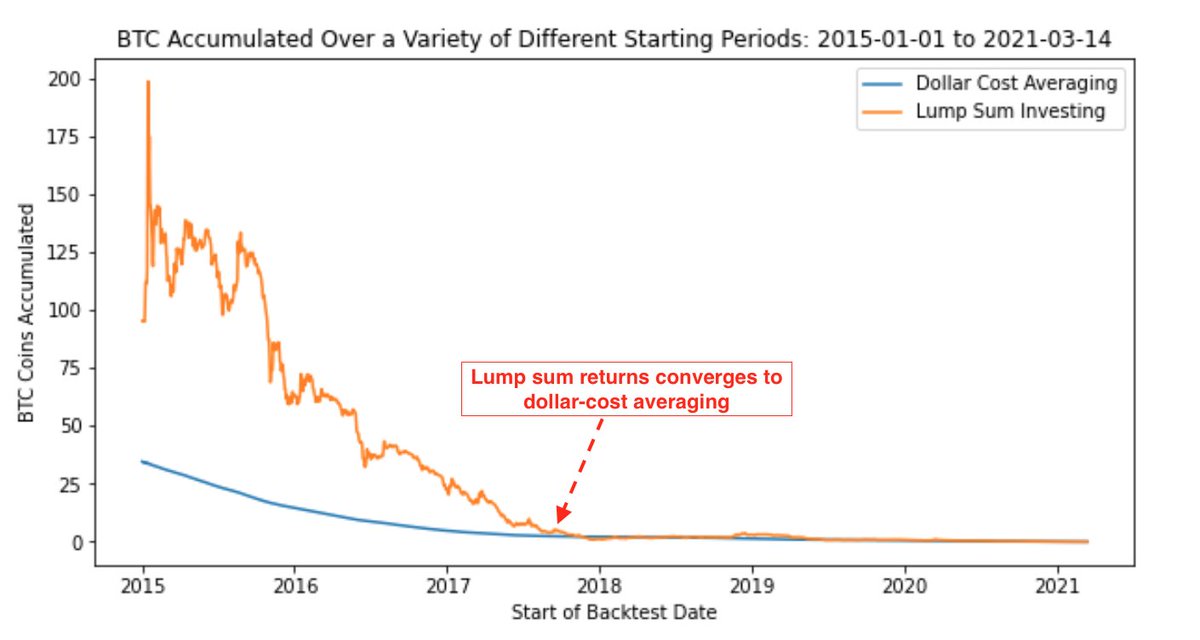

11. This chart shows the number of BTC accumulated with DCA and lump sum investing if we were to start the backtest on any particular day. For example, the data points on 2015-01-01 represent the total BTC accumulated from 2015-01-01 to 2021-03-14 for the DCA and lump-sum method.

12. As another example, the data point on 2020-04-23 represents the total BTC accumulated if we ran the backtest from 2020-04-23 to 2021-03-14. We can clearly see the early years of BTC favoured lump sum investing, however, in recent years the trend has shifted.

13. Zooming into the post 2017 era, we can see the convergence between the amount of BTC we collect with the DCA and lump-sum approach (notably in 2021). This begs the question - today is it better to go all in on BTC at once or spread out the position over time?

14. Given BTC is now a macro asset, I’d bet it’s more feasible to DCA this for accumulation into a long-term portfolio. However, for high conviction bets that are still early, lump-sum investing may be a better approach rather than accumulating over a multi-year period.

15. Has BTC become institutionalized enough such that DCA is now the best way to accumulate for the long-term? Is there any better way to for institutions/individuals to accumulate for the long-term?

@cryptarbitrage @PelionCap @AviFelman

@gross_bit @fb_gravitysucks @RaoulGMI

@cryptarbitrage @PelionCap @AviFelman

@gross_bit @fb_gravitysucks @RaoulGMI

• • •

Missing some Tweet in this thread? You can try to

force a refresh