1. Huge thanks to @BrandonRochon_ for teaching me how to use @Covalent_HQ's powerful API. We were able to pull some data on the recently issued @SushiSwap call options built on @UMAprotocol and analyzed some cool stuff by looking at on-chain greeks.

2. Disclosure: @ledger_prime is an investor in Covalent. This is not financial advice.

3. Recently I’ve been spending a decent amount of time pricing OTC alt-coin options which led me to explore whether we can use DeFi options as a way to hedge our exposures. Let’s briefly discuss some ideas on hedging before moving to the actual analysis.

4. In an options book, the delta (underlying exposure to asset) usually causes the most PNL fluctuations and MMs will generally not want to take on this type of risk. MMs are here to collect the bid/ask spread and don’t speculate (too much) on price.

5. A trader can hedge their delta risk using spot/futures but the issue is they have to rely on a model to produce a theoretical greek. This can be dangerous when one makes faulty assumptions (ie: LTCM). Choosing the wrong parameters can over/undershoot the correct exposure.

6. I remember a section in @nntaleb's book on dynamic hedging where he suggested it's good to hedge options with options. If done right, hedging an option with an option can eliminate tail risk for MMs and reduce dependency on theoretical models.

7. This makes the most sense for short-dated maturities (ie: < 7 day options) where the greeks become quite unstable. In these cases, it's better to spread risk with other options rather than trying to hedge to some theoretical delta.

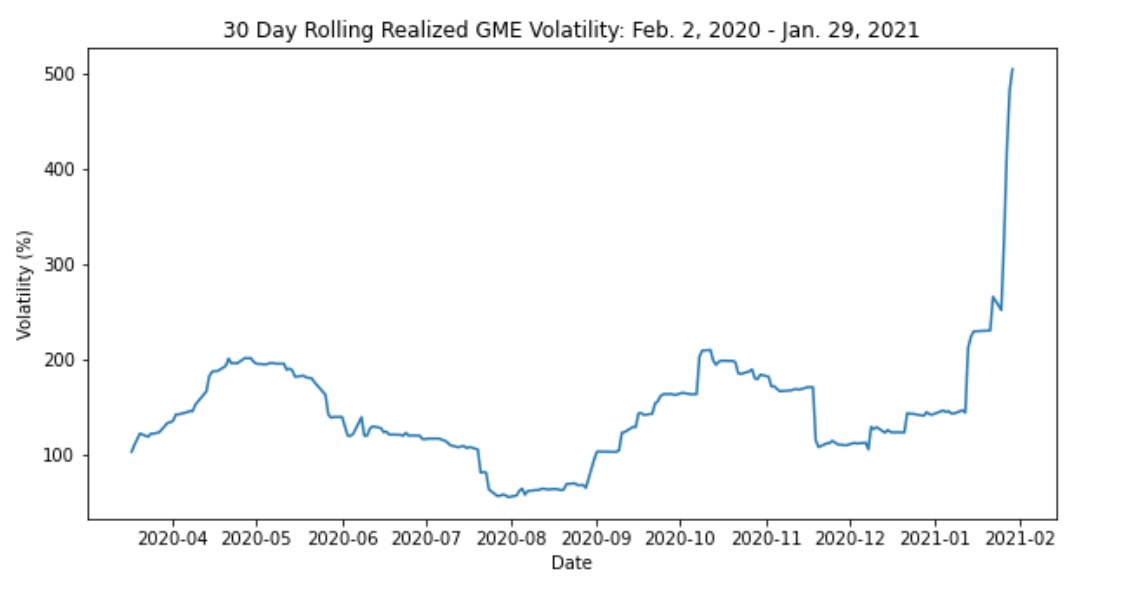

8. Now let's move to the actual analysis. Overall, we can see 30/60 day realized vol for SUSHI has been declining since the start of this year. This is similar to BTC/ETH realized vols - it’s been a constant grind downwards throughout this rally thanks to the institutional bid.

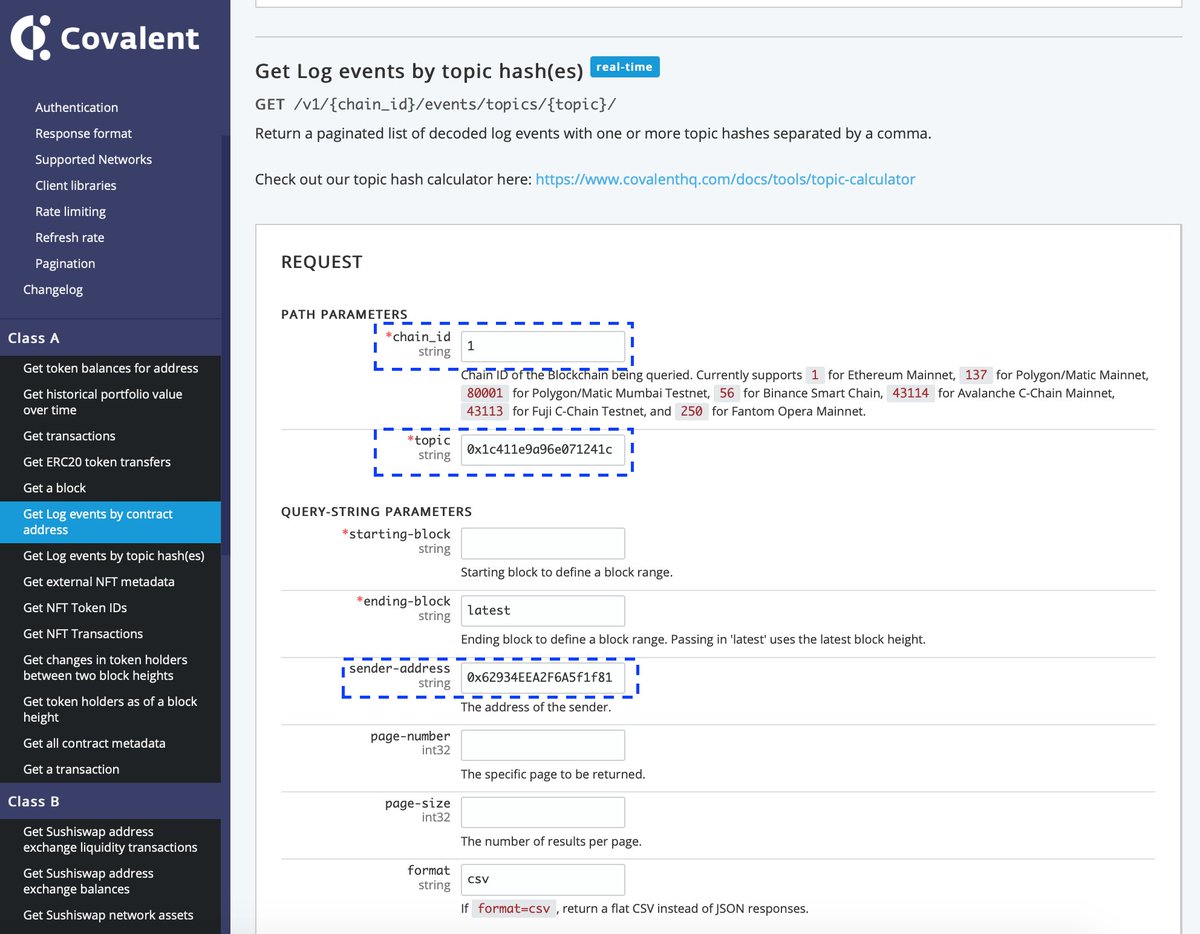

9. Using the @Covalent_HQ's API we’re able to retrieve the AMM pool reserve balances for the xSUSHI-XSUc25-0531 pair on @SushiSwap. It was pretty neat to use a quick API call and retrieve time-series indexed prices for such a niche market. Here's a screenshot of how we did it.

10. From here we convert the option prices to USD and compute the IV on the date of each option transaction (there were around 40 swaps since the launch of the option). The IV was resampled on a daily basis and linearly interpolated to smooth out the curve.

11. The IV was trading at a steep discount to 60 day RV at the beginning of the trade but later jumped higher. This can serve as a starting point to think about vol trading this option but that’s for another day! As of now the IV is trading at a premium of ~10 vol points to RV.

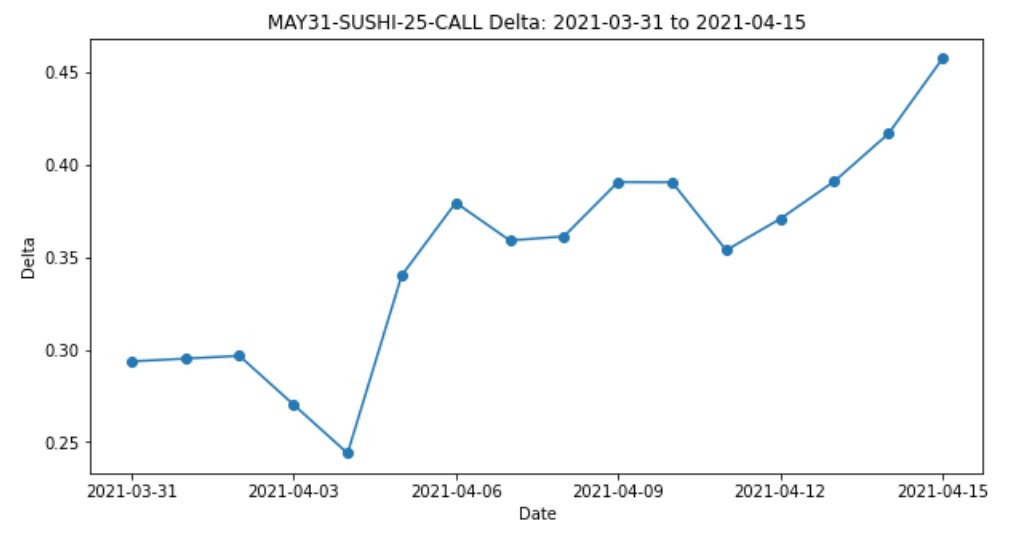

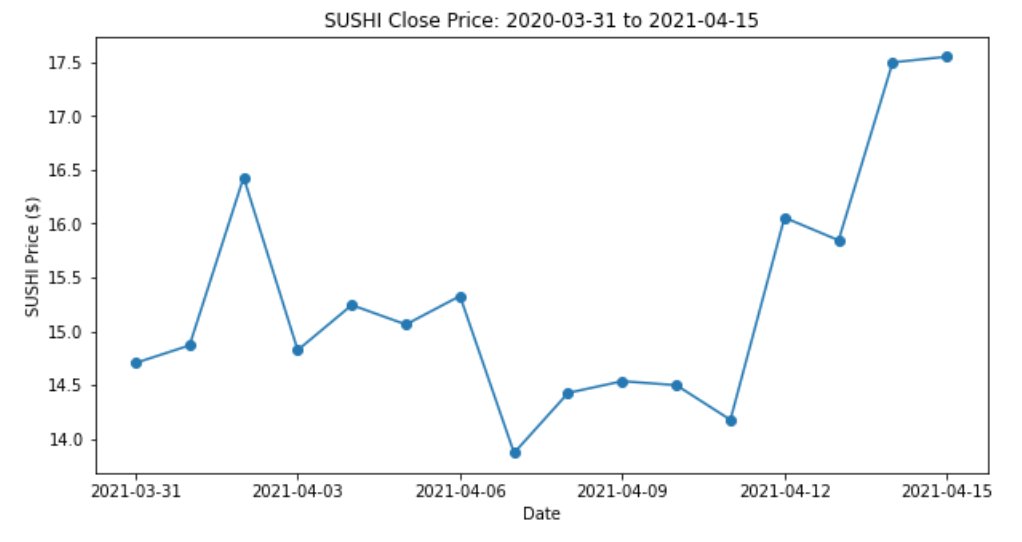

12. Currently the delta is nearly 0.50 which implies the market believes SUSHI has a ~50% chance of reaching ITM at expiry (ie: SUSHI >= $25 by May 31, 2021). Notice how the delta gradually rises as SUSHI also goes up - this is what we’d expect.

13. Vega for options is highest near ATM so as SUSHI goes to its ATM strike price of $25 we’d expect vega to also increase as shown below.

14. Although gamma is also highest near ATM, higher IV over the past few days has caused gamma to fall. This is because when IV rises the market expects turbulent times ahead, therefore, larger changes in delta are already expected and priced in.

15. It’s important to note these greek calculations are highly sensitive to the underlying behaviour in the market. Individual players have the ability to materially move prices in DeFi options given the limited liquidity. I expect this to change as more MMs enter this space.

Any thoughts on this? How would you vol-trade or speculate on alt-coin options either OTC or through DeFi? @ConvexMonster @OrthoTrading @fb_gravitysucks @JSterz

• • •

Missing some Tweet in this thread? You can try to

force a refresh