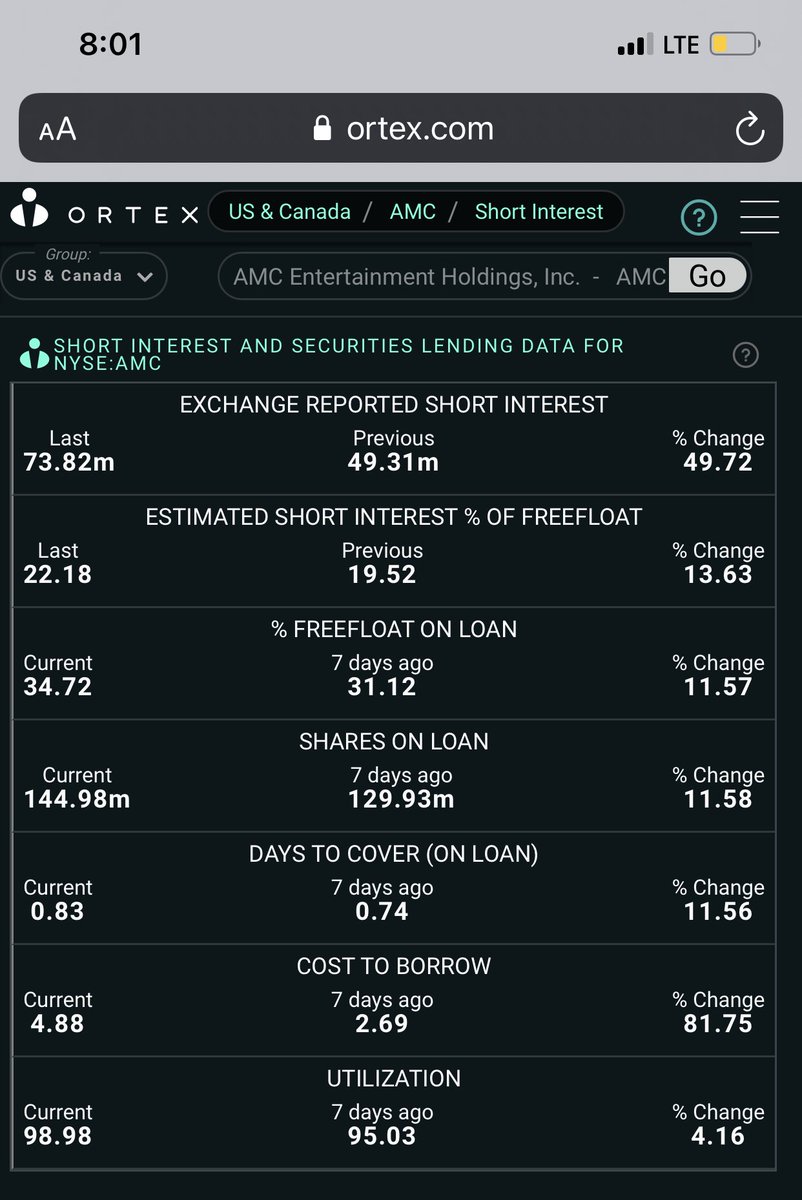

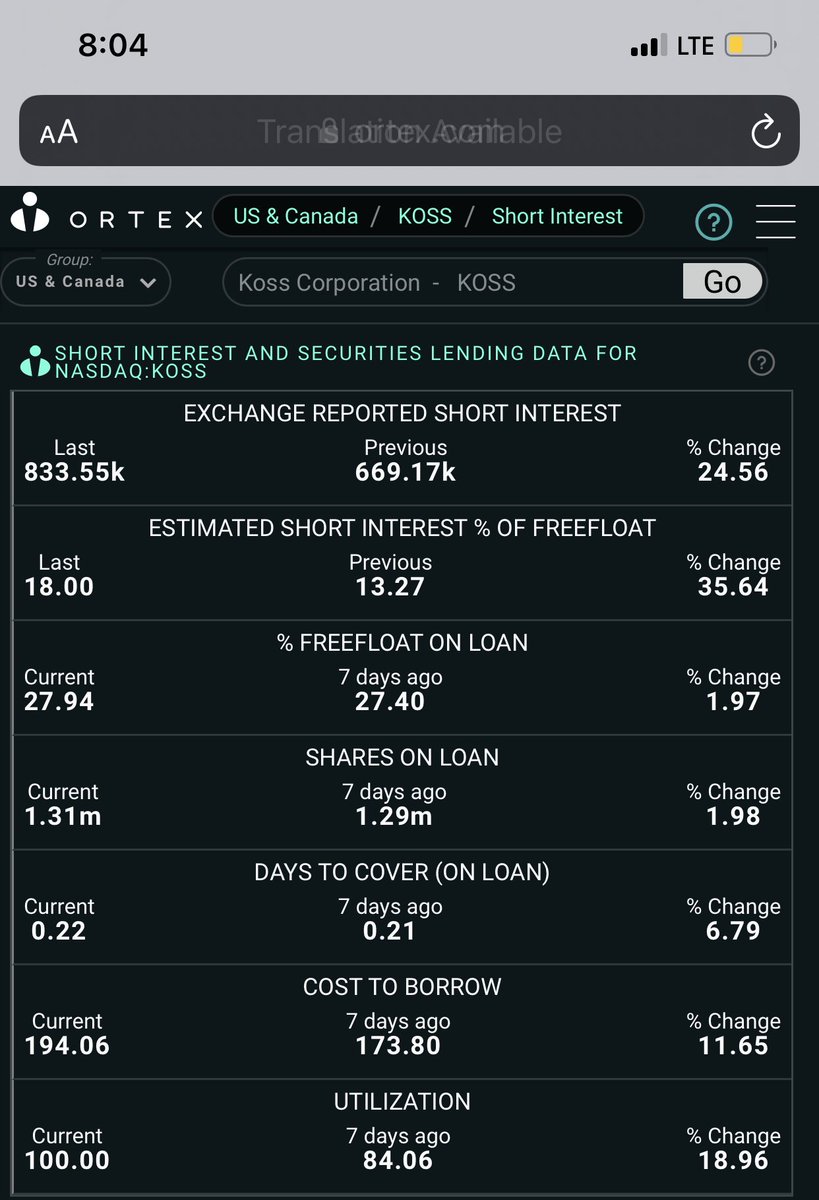

#AMC #GME #TSLA #KOSS now that I have a few moments let’s talk ortex. I’ll give you an update on the rules DD. Below is your ortex info. Biggest change is that AMC is at 99% utilized since yesterday. The breakdown is this when a stock gets closer to 100% of shares being utilized

The more likelihood short sellers will face a buy in if investors recall their loan shares meaning investors turn off their borrowing indicators and bring the shares back into their account and collect the interest payment from them being loaned out. Now if we get to 100% of the

Shares being loaned out that means every share humanly possibly available to borrow is already out on loan taking away HF ability to short the stock without having to buy back the shares sold short. Once this avenue is used HF and MM will automatically moved to selling calls

Short remember skin in the game. They sell calls short collect the money immediately and then try to buy them back at a lower price point. They have no intention on collecting or buying back. This is why utilization is important higher utilization means less weapons available to

HF that must find borrowable shares when their are none left they move on to naked calls aka short selling calls that are not covered. Check out the ortex in below. I’m still working on Stepping into the light I was waiting to publish to see if I could get some inside info

Or listen to opening arguments as this is going to completely destroy the ATS systems and move it into 1 system who puts retail first and greed second. Enjoy folks... I’ll be with you shortly

• • •

Missing some Tweet in this thread? You can try to

force a refresh