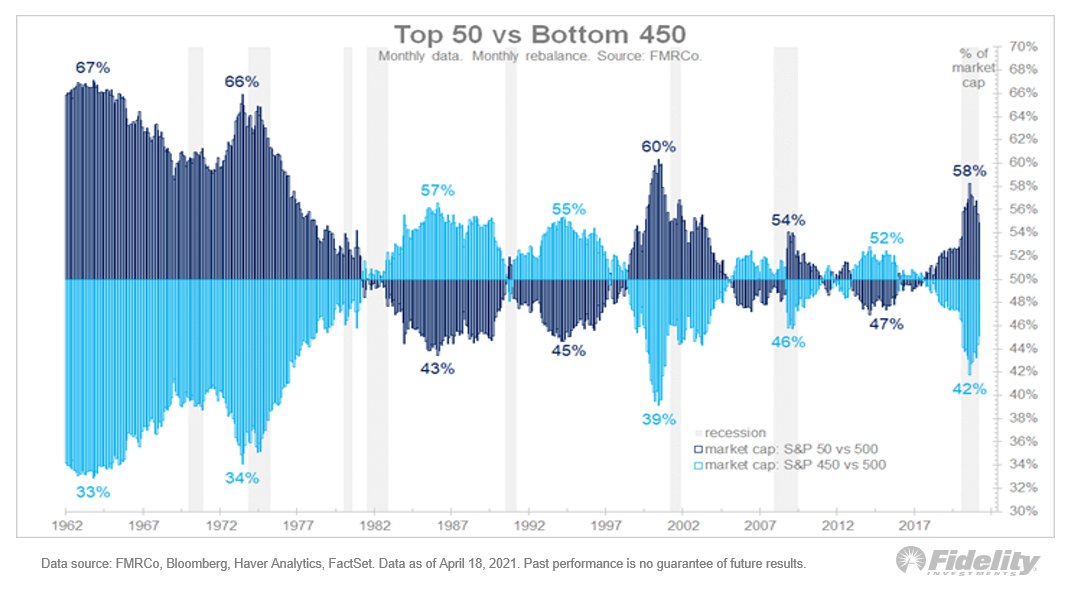

Large-cap growth stocks took the lead in recent weeks, propelling the S&P 500 to new highs. So let’s take a look at the “nifty fifty” largest stocks. Here, the relative return of the 50 largest vs. the next 450 (monthly data) since 1962. (THREAD/1)

Over the very long term, mega caps tend to lag the market, presumably because they tend to be rather boring quality stocks with high P/Es and steady but unexciting earnings growth. But, interspersed along that declining trendline are a few notable eras of mega-cap leadership. /2

The mega-cap growth period since 2014 is the 3rd such regime in six decades, with the previous two consisting of the original Nifty Fifty era of the early 1970s & the boom/bubble in tech stocks during the late 1990s. /3

In my view, the latest era has been driven by the need for free cash flow in a slow-growth world with low interest rates./4

This current era may or may not have come to an end following the presidential election. Why? The market understood that a new secular regime of coordinated fiscal and monetary policy was likely. /5

That, combined with the gradual reopening of the economy from pandemic-induced lockdown, quashed the relative return of mega caps. Since then, the top 50 stocks have underperformed the bottom 450 by 1455 basis points after having outperformed by 4865 bps since 2014. /6

As the next chart shows, at its peak, the nifty fifty comprised 58% of the market cap of the S&P 500. As of March it was 55%. That peak was just shy of the 60% in 2000 and well shy of the 66% in 1973. /7

At their peak, the "growthier" sectors made up 72% of the top 50, while they comprised only 30% of the bottom 450. As this next chart illustrates, those numbers are right in line with the 2000 extreme. /8

Meanwhile, the more value-oriented sectors comprised a mere 10% of the top 50, while making up 52% of the bottom 450, as this chart shows. /9

The current era looks a lot like the late 90s in terms of overall performance and sector composition. But: In 2000, the top 50 stocks traded at a P/E of 40.5x while the bottom 450 were 19.9x. That gap closed during the bear market that followed. /11

Today, as this next chart illustrates, the top 50 trade at a 32.9x multiple while the bottom 450 trade at 30.7x P/E. No huge gap this time around. /12

I think the out-performance of mega caps since 2014 has been justified by an (almost) equally strong gain in relative earnings. So unlike 1998-2000, the current mega-cap leadership is, in my view, likely more sustainable. /13

So, I don't see a valuation bubble. Even if there is a secular regime shift toward small caps and value (a distinct possibility based on history), it may not produce the catastrophic under-performance in mega cap growth names which occurred following the 2000 peak. /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh