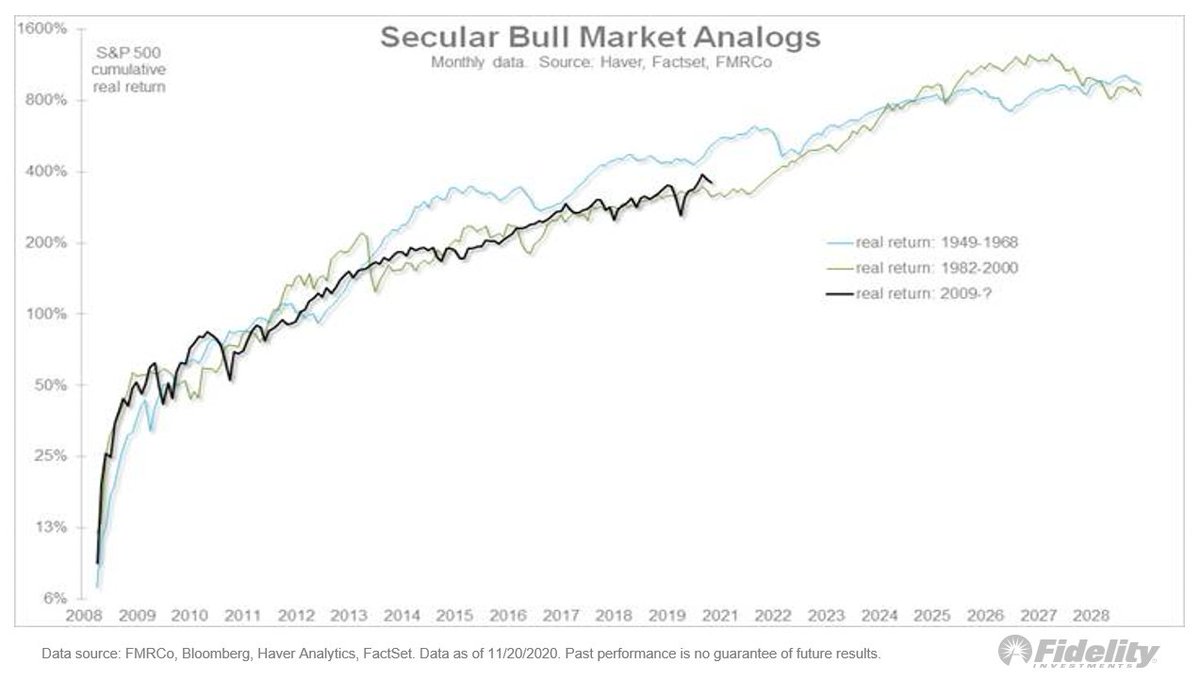

Let’s compare two important historical market regimes to the post-GFC era. Here, I isolate the era of financial repression from 1942-51, and the secular rise in inflation from the early 1960s to the early 1980s. (THREAD /1)

I am showing these charts as a scatter plot of nominal returns (x) and real returns (y). It’s an unusual format (without the time scale) but it shows the trends clearly. /2

The financial repression era started in 1942 w/ the buildup to WWII & ended when the Fed gained independence in 1951. The federal debt tripled & the Fed monetized it all while pushing real rates firmly negative via rate caps. That same conversation appears to be happening now. /3

The secular inflation era started when inflation and bond yields ended their “low-for-long” period in the early/mid 1960s and started rising, slowly at first, then all at once. /4

As inflation and rates rose, and the secular bull market matured and eventually peaked (with a speculative frenzy in 1968), the stock/bond correlation went from steeply negative in 1960, to flat in 1964, to positive during the 70s and 80s. /5

Now, let’s take a closer look at these analogs. We already know that both the 1940s and the late 60s-70s produced bouts of inflation. It’s pretty clear that value stocks and especially small cap value were outstanding inflation hedges. /6

Left behind were large cap growth stocks. That couldn’t be more different from the post-GFC era, although value and small caps have been catching up quickly since last fall. /7

If the current financial repression era has further to go and ends up producing structural inflation, then one look at the chart above tells you that the rotation from growth to value, and from large to small, could end up being secular rather than cyclical. /8

How did bonds and commodities behave during these regimes, compared to the current cycle? This chart shows long-term bonds and high-yield, commodities, and gold and silver. /9

The middle of the chart shows what you would expect, knowing what interest rates, inflation and gold did during the 70s. That huge spike in silver? The Hunt Brothers episode in 1980. The large decline in the blue lines shows the effects of interest rates soaring. /10

The cluster on the left seems counterintuitive, knowing that inflation spiked several times during the 1940s. But with the Fed monetizing the war debt and capping short rates at 3.8% and long yields at 2.5%, there was no return and no volatility to be had in the bond market. /11

Gold was fixed at around $35 during the 40s, so there was no return or volatility to be had there. But even the CRB did poorly during that time, which is a bit surprising. Stocks were the only game in town, nominal or real. /12

Moving to the upper right side of the above chart, we see the post-GFC monetary inflation era. Commodities have performed poorly, and basically nothing has been able to keep up with equities (much like the 1940s, but unlike the 1970s). /13

See that pink line going straight up past the SPX? I indexed #bitcoin to the price of gold as of March 2020, which is when bitcoin’s latest rise began. This shows what might have happened to the price of gold, had it been the only game in town as a monetary inflation hedge. /14

In short, during past eras of financial repression & rising inflation, value beat growth, small beat large, stocks beat both bonds & commodities, but commodities were better than bonds. Something to remember in case the current era of monetary inflation lasts a while longer. /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh