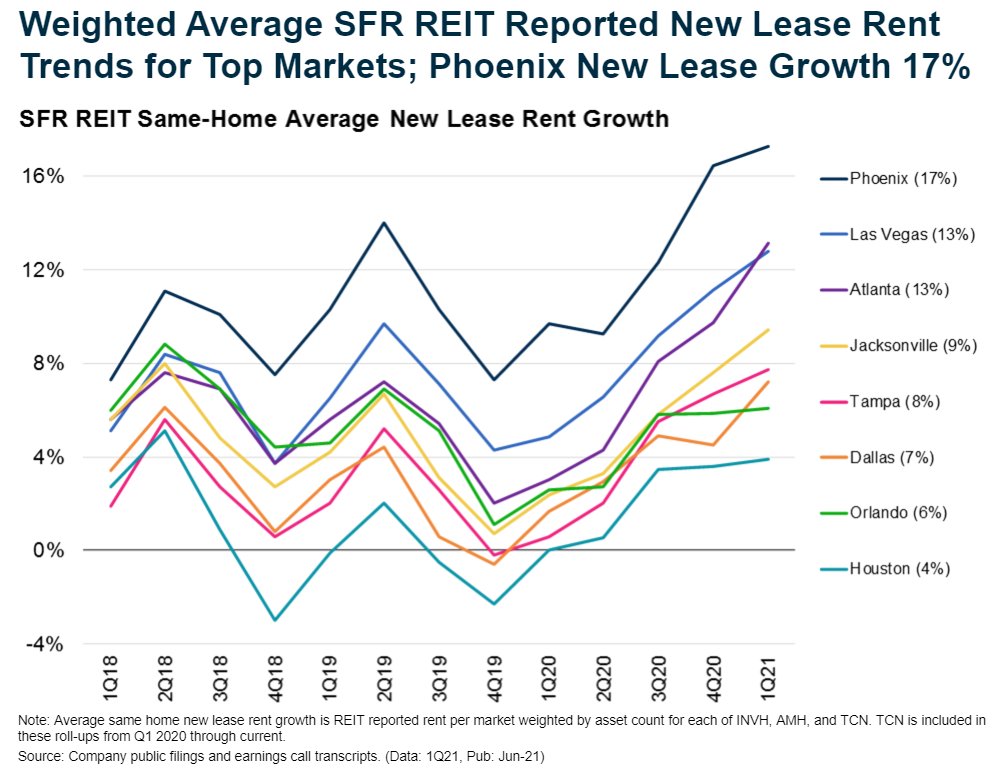

Single-family rent growth on new leases shooting higher. Rollup for REITs across top markets below. #Phoenix +17%! #LasVegas & #Atlanta not too far behind at +13%.

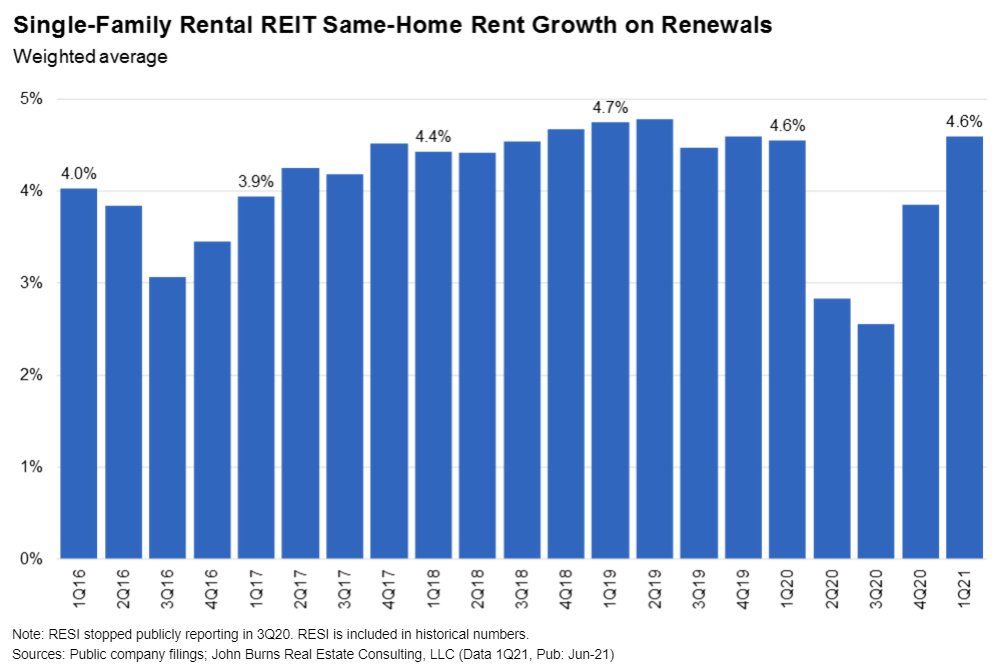

Here's new lease growth rolled up for the single-family rental REITs from 1Q16 through 1Q21. Running at 9% currently, well beyond pre-COVID levels.

• • •

Missing some Tweet in this thread? You can try to

force a refresh