For everyone wading into the global tax overhaul as G7 ministers meet today — hi, welcome, glad you could make it.

Let’s break down where we are, what are the sticking points, and what may — and may not — be accounced in coming days.

<cue thread>>

Let’s break down where we are, what are the sticking points, and what may — and may not — be accounced in coming days.

<cue thread>>

OK, first things, first. This is not about tax. At its core are unanswered questions over which govts have the right to tell large (digital) companies what they can and can not do within their jurisdictions.

In short, it's a power play (but I would say that, as a POLITICO hack)

In short, it's a power play (but I would say that, as a POLITICO hack)

Countries like France & Italy see the likes of @Facebook & @Google making lots of ad revenue within their countries and legitimately question: why is that cash going to Ireland/US and not staying with us? How's that fair?

It comes down to the fact that the current global tax system really isn't set up to deal with complex international companies (both digital and non-digital) that are able to pick and choose where they want to pay tax. In short, the system is broken

Enter the @OECD. The Paris-based group of mostly-rich countries did a pretty good job on overhauling offshore tax rules (known as BEPs) and so was given the task of trying to do the same thing with the wider global tax regime. This dude is leading the show politico.eu/article/digita…

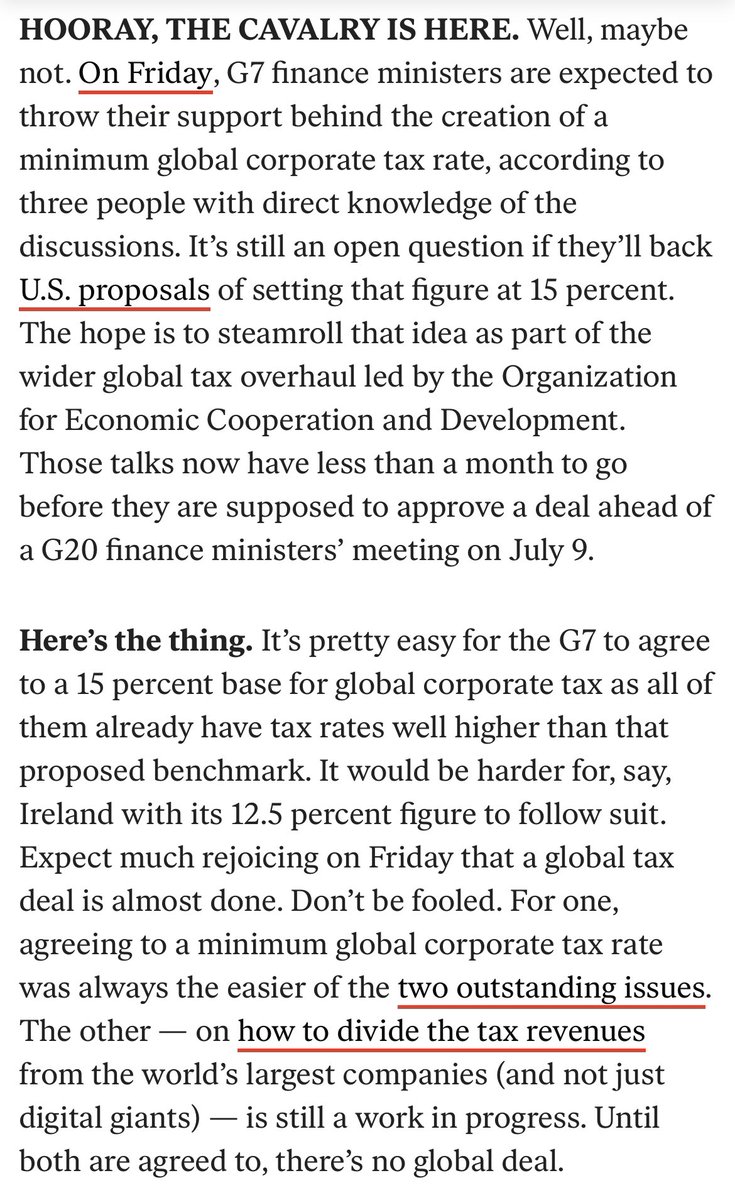

We're dealing with two core issues. 1) How best to divvy up tax revenue from (digital) companies that may have large presences in specific countries but pay little or no tax there. 2) Create a minimum corporate tax benchmark to stop companies from tax-shopping for the best deal

These talks have been going on for years (trust me, I've been covering them). And during the Trump administration, American negotiators were deeply involved in hammering out a deal...

... all while US officials/politicians in DC were categoric in rejecting any global tax overhaul that allowed others to tax Big Tech, and not the IRS. It's an odd one in which despite the 'techlash' in the US, Washington has been very pro-tech in this regard

Why? Well, the cynic in me thinks it comes down to wanting to keep all that tax revenue for the US and the US alone, but hey ho.

Fast forward late 2020, the OECD had missed its deadline to get a global digital tax deal and everyone was waiting for Biden to take over to reset the agenda. Biggest problem: no one on Capitol Hill supported global tax reforms that only focused on tech

So when Biden dropped brand new proposals in April that suggested focusing on the world's top 100 countries (both tech and non-tech), it caught many by surprise -- but also created expectations of getting a deal done politico.eu/article/washin…

The US quickly followed up with separate, but linked, proposals to create a minimum global corporate tax benchmark of 15%. Again, that was a surprise but was (mostly) well-received.

So that's where we are right now. A deal that would include tech & non-tech, and potentially set a minimum global tax threshold of 15% worldwide. Expect G7 ministers to back the minimum threshold (but unlikely name-check the 15% -- that's my personal opinion)

On how to share tax revenue from the top 100 countries, that's still a work in progress. And the OECD negotiations now have less than a month to hammer something out before G20 ministers meet on July 9 to approve the entire deal

Warning: you can't have a minimum corporate tax benchmark w/o agreeing on how to tax the top 100 countries in the world. They are directly linked and the OECD process has said you can't have one without the other.

So don't believe the G7 when they are "close to a deal" if they don't say anything about dividing up tax revenue.

Saying otherwise is just smoke and mirrors.

Saying otherwise is just smoke and mirrors.

So don't believe the G7 when they are "close to a deal" if they don't say anything about dividing up tax revenue.

Saying otherwise is just smoke and mirrors.

Saying otherwise is just smoke and mirrors.

So what happens next? OECD negotiators will take on the G7 ideas and trying to get something done (mostly likely a top-line political agreement) by the end of the month, and then give themselves more time to figure out the technical parts.

Two major sticking points: 1) Countries have already passed their own unilateral digital taxes, and said they will collect that cash if a global deal isn't done. Fun fact: UK's regime will start officially collecting money from Big Tech in Sept, awks

Even this week, the USTR said it would slap retaliatory tariffs on billions of dollars of other countries' goods in response to these taxes. Sure, they postponed that tariffs for 6 months, but the warning is there: don't go it alone or else.

2) Congress. No one of Capitol Hill is eager for either a digital-focused tax regime or allowing other countries to collect money without the US being able to tax foreign companies like German automakers or French luxury goods companies.

And — breaking out my old Civics classes — any OECD deal must get approved by Congress, so again, nothing is done until it's done in DC.

US politicians have welcomed the current (US-led) proposals. But that doesn't mean they'll accept the final outcome of these talks.

US politicians have welcomed the current (US-led) proposals. But that doesn't mean they'll accept the final outcome of these talks.

Phew, ok that's a crash course of where we are, what's at stake and what has to happen now.

There's a lot going on here. But reminder: this is not about tax. It's about global power.

There's a lot going on here. But reminder: this is not about tax. It's about global power.

Rant over. Thoughts appreciated.

PS: UK offers update on G7 finance talks (they’re hosting). A lot of waffle, IMO, from UK finance minister. Talks finish tomorrow.

For folk watching the G7 tax stuff this evening, pls keep this in mind politico.eu/newsletter/dig…

Doh, this is supposed to be companies, NOT countries 🤦

https://twitter.com/markscott82/status/1400740554112221185

G7 reach global agreement on (digital) taxes. Now this needs to be approved by @oecd

https://twitter.com/rishisunak/status/1401133898847948803

Details👇 The profit allocation via Pillar One, imo, is most interesting part. That means countries will be required to divvy up tax revenue from world’s largest companies w/ others govts worldwide. As with everything, though, devil is in the detail

So based on companies only being w/ at least 10% profit margin to be included in new tax regime, @amazon would not make the cut.👇 Excellent. Excellent.

• • •

Missing some Tweet in this thread? You can try to

force a refresh