#BTC crashing?

TLDR: Short term pain, but bull phase intact.

1. $GBTC premium is -12.95%: Bearish

2. TA (daily): $22K-$39K

3. 6/25 Options: Price>$40K, bullish; Otherwise, bearish

4. Futures: Neutral-bullish

5. On-chain: Bullish

6. TA (monthly): Target: $184K-$346K in Oct '21

TLDR: Short term pain, but bull phase intact.

1. $GBTC premium is -12.95%: Bearish

2. TA (daily): $22K-$39K

3. 6/25 Options: Price>$40K, bullish; Otherwise, bearish

4. Futures: Neutral-bullish

5. On-chain: Bullish

6. TA (monthly): Target: $184K-$346K in Oct '21

1/ $GBTC's premium is still double digit in the red amidst the unlock of 64M GBTC shares this month. This indicates the share unlock could contribute to downward pressure on #BTC's price.

https://twitter.com/AllenAu11/status/1400067698512437251

2a/ As tweeted on 6/3/21, #BTC's price was forming a symmetrical🔺pattern. It broke out of the pattern to the downside yesterday & in the worst case, the target price is $22K.

It traded to $31K today & trend line #4 (cloned from #1) provided support & it bounced from that level.

It traded to $31K today & trend line #4 (cloned from #1) provided support & it bounced from that level.

2b/ If #BTC remains bearish and trades between trend lines:

#3 & #4: $28K on 6/19/21

#4 & #5: $24K on 6/19/21

#5 & #6: $22K on 6/19/21

#4 & #5: $22K on 6/29/21

* #3, #5 & #6 are cloned from #1

#3 & #4: $28K on 6/19/21

#4 & #5: $24K on 6/19/21

#5 & #6: $22K on 6/19/21

#4 & #5: $22K on 6/29/21

* #3, #5 & #6 are cloned from #1

2c/ If it is a bear trap and #BTC begins to trade between trend lines:

#2 & #3: $39K on 6/19/21

$37K on 6/29/21

#1 & #2: $48K on 6/19/21

$46K on 6/29/21

* #2 is cloned from #1

#2 & #3: $39K on 6/19/21

$37K on 6/29/21

#1 & #2: $48K on 6/19/21

$46K on 6/29/21

* #2 is cloned from #1

3/ Deribit's #BTC options expiring on 6/25/21 indicate that if BTC's price is <$40K, bears are in control and the support levels are:

$36K/$32K/$28K/$24K/$20K

If BTC's price is >$40K, the resistance levels are:

$44K/$48K/$50K/$52K

$36K/$32K/$28K/$24K/$20K

If BTC's price is >$40K, the resistance levels are:

$44K/$48K/$50K/$52K

4/ #BTC futures market isn't over-extended. It's net short as funding rates at major exchanges are negative. The futures OI has declined to levels seen in January 2021.

There's a slight uptick in OI indicating a neutral to bullish BTC price action. A short squeeze is possible.

There's a slight uptick in OI indicating a neutral to bullish BTC price action. A short squeeze is possible.

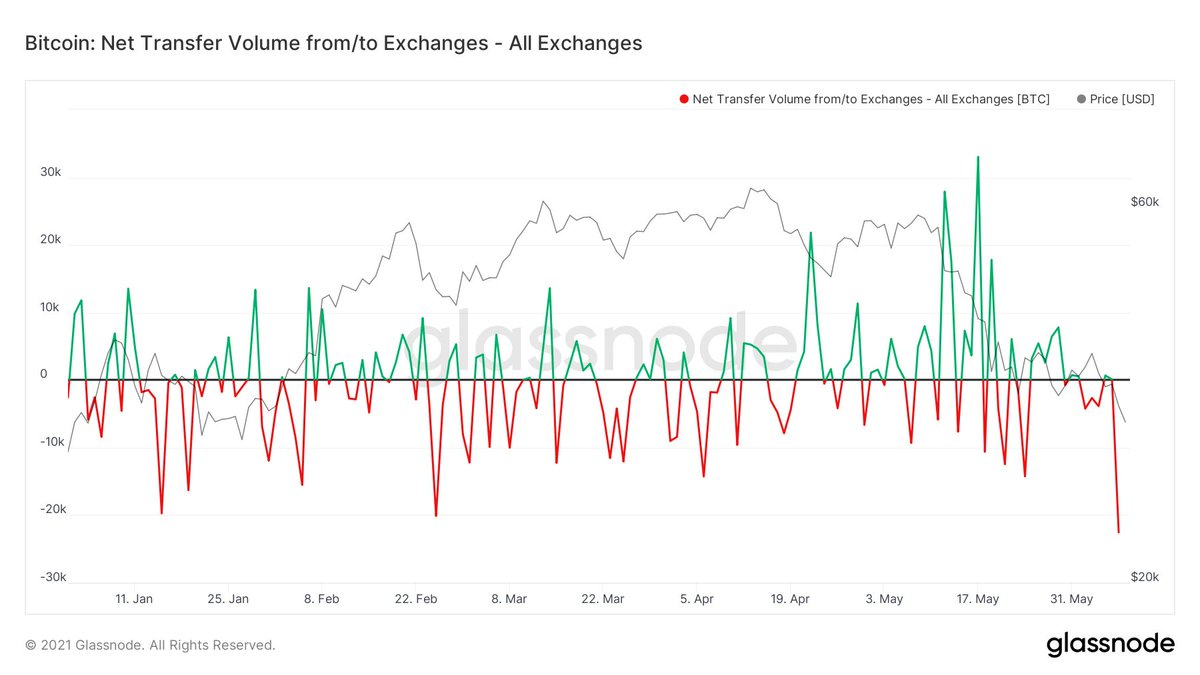

5/ Recent #BTC on-chain metrics are not bearish.

i. Exchange net flow volume had the highest YTD outflow on 6/7/21 (22.5K BTC). Institutions bought up BTC and sent them to cold storage. Majority came from Kraken ($600M).

i. Exchange net flow volume had the highest YTD outflow on 6/7/21 (22.5K BTC). Institutions bought up BTC and sent them to cold storage. Majority came from Kraken ($600M).

5 ii. LT HODLers net #BTC position change has turned positive, indicating they are accumulating BTC has BTC's price corrects from its ATH.

aSPOR shows BTC's price is favorable for buying the dip and this explains why LT HODLers are buying BTC.

aSPOR shows BTC's price is favorable for buying the dip and this explains why LT HODLers are buying BTC.

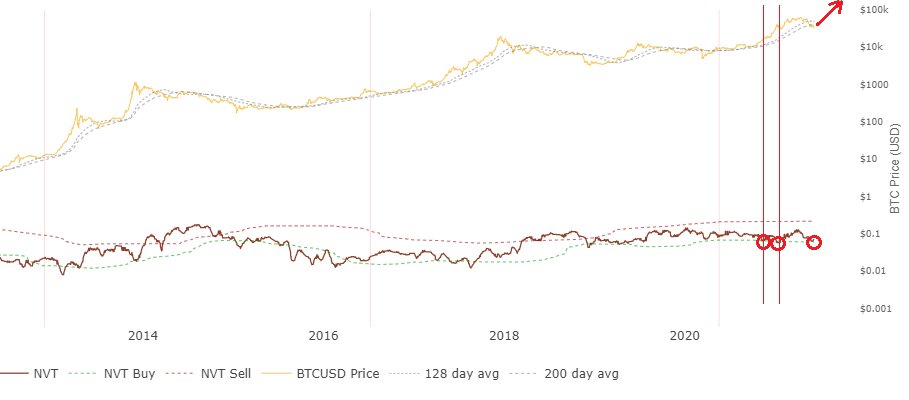

5 iii. Willy Woo's NVT indicator shows that #BTC has reached the NVT buy zone. Every time, BTC hits the NVT buy line (green), it rallies. This may happen soon if this plays out.

5 iv. Miners are selling because of the China crackdown on #BTC mining, but the 2013 fractal could be at play -- Miners selling around mid-cycle dip and then reaccumulate before selling as BTC peaks.

6/ Seems #BTC is trading like its 2013 bull phase. 2 mo. red candles & a lower low followed by a rally to the peak. If so, BTC will correct 30% from the May low to $21K & then rally to the top.

If the peak is between that of 2013 & 2017, the price is $184K-$346K in Oct.

If the peak is between that of 2013 & 2017, the price is $184K-$346K in Oct.

• • •

Missing some Tweet in this thread? You can try to

force a refresh