𝗖𝗧𝗠 #𝗕𝗧𝗖 𝗢𝗻-𝗖𝗵𝗮𝗶𝗻 𝗠𝗲𝘁𝗿𝗶𝗰 𝗗𝗮𝘀𝗵𝗯𝗼𝗮𝗿𝗱: 𝗪𝗲𝗲𝗸 𝟮𝟮 𝟮𝟬𝟮𝟭

𝗕𝗧𝗖 𝗣𝗲𝗮𝗸 𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿𝘀

TLDR: All 7 indicators show that BTC has neither peaked nor is in its bear phase

Note #3, #4 & #7 indicate that BTC could be in its mid-cycle correction*

𝗕𝗧𝗖 𝗣𝗲𝗮𝗸 𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿𝘀

TLDR: All 7 indicators show that BTC has neither peaked nor is in its bear phase

Note #3, #4 & #7 indicate that BTC could be in its mid-cycle correction*

* #4 & #7 show that BTC is behaving like its price action 6 days before the final dip in the mid-cycle correction in 2013.

If this plays out, we could see the low of the mid-cycle correction in 2021 around 6/12/21.👀

HODL #BTC!

If this plays out, we could see the low of the mid-cycle correction in 2021 around 6/12/21.👀

HODL #BTC!

𝟭. 𝗠𝗩𝗥𝗩-𝗭 𝗦𝗰𝗼𝗿𝗲 (>𝟳.𝟱): 𝗡𝗼

6/6/21 Value: 1.63

For #BTC to enter its bear phase, MVRV-Z Score will go to the pink zone first and then trend downward. This hasn't happened yet.

6/6/21 Value: 1.63

For #BTC to enter its bear phase, MVRV-Z Score will go to the pink zone first and then trend downward. This hasn't happened yet.

𝟯. 𝗥𝗲𝘀𝗲𝗿𝘃𝗲 𝗥𝗶𝘀𝗸 (>𝟬.𝟬𝟮): 𝗡𝗼

6/6/21 Value: 0.004*

*This is similar to that in the mid-cycle correction in 2017.

For #BTC to enter its bear phase, Reserve Risk will go to the pink zone first and then trend downward. This hasn't happened yet.

6/6/21 Value: 0.004*

*This is similar to that in the mid-cycle correction in 2017.

For #BTC to enter its bear phase, Reserve Risk will go to the pink zone first and then trend downward. This hasn't happened yet.

𝟰. 𝗥𝗲𝗮𝗹𝗶𝘇𝗲𝗱 𝗛𝗢𝗗𝗟 𝗥𝗮𝘁𝗶𝗼 (𝗥𝗛𝗥) (>𝟰𝟬𝗞): 𝗡𝗼

6/6/21 Value: 6,321*

*This is similar to that in the mid-cycle correction in 2013 and 2017.

For #BTC to enter its bear phase, RHR will go to the pink zone first & then trend downward. This hasn't occurred yet.

6/6/21 Value: 6,321*

*This is similar to that in the mid-cycle correction in 2013 and 2017.

For #BTC to enter its bear phase, RHR will go to the pink zone first & then trend downward. This hasn't occurred yet.

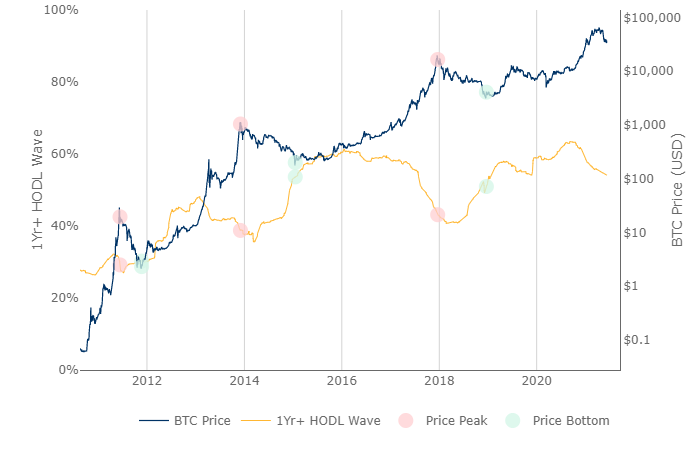

𝟱. 𝗥𝗲𝗮𝗹𝗶𝘇𝗲𝗱 𝗖𝗮𝗽 𝗛𝗢𝗗𝗟 𝗪𝗮𝘃𝗲𝘀 (𝟯𝗿𝗱 𝗪𝗮𝘃𝗲):

𝗪𝗮𝘃𝗲 𝟭

For #BTC to enter its bear phase, Realized Cap HODL Waves will have to go through a 3-wave pattern. This hasn't happened yet.

𝗪𝗮𝘃𝗲 𝟭

For #BTC to enter its bear phase, Realized Cap HODL Waves will have to go through a 3-wave pattern. This hasn't happened yet.

𝟲. 𝗣𝘂𝗲𝗹𝗹 𝗠𝘂𝘁𝗶𝗽𝗹𝗲 (>𝟰): 𝗡𝗼

6/6/21 Value: 1.33

For #BTC to enter its bear phase, Puell Multiple will go to the pink zone first and then trend downward. This hasn't happened yet.

6/6/21 Value: 1.33

For #BTC to enter its bear phase, Puell Multiple will go to the pink zone first and then trend downward. This hasn't happened yet.

𝟳. 𝗡𝗨𝗣𝗟 (𝗕𝗹𝘂𝗲): 𝗡𝗼 𝗘𝘂𝗽𝗵𝗼𝗿𝗶𝗮

6/6/21 Value: 0.43 (Yellow)*

* This is similar to that in the mid-cycle correction in 2013.

For #BTC to enter its bear phase, NUPL will be in Euphoria first. This hasn't happened yet.

6/6/21 Value: 0.43 (Yellow)*

* This is similar to that in the mid-cycle correction in 2013.

For #BTC to enter its bear phase, NUPL will be in Euphoria first. This hasn't happened yet.

• • •

Missing some Tweet in this thread? You can try to

force a refresh