1/ As Warren Buffet would say, for #Bitcoin our favourite holding period is forever.

But that doesn’t mean you have to wait an eternity to see gains.

So what should be your investment horizon?

Here is the breakdown 🧵

But that doesn’t mean you have to wait an eternity to see gains.

So what should be your investment horizon?

Here is the breakdown 🧵

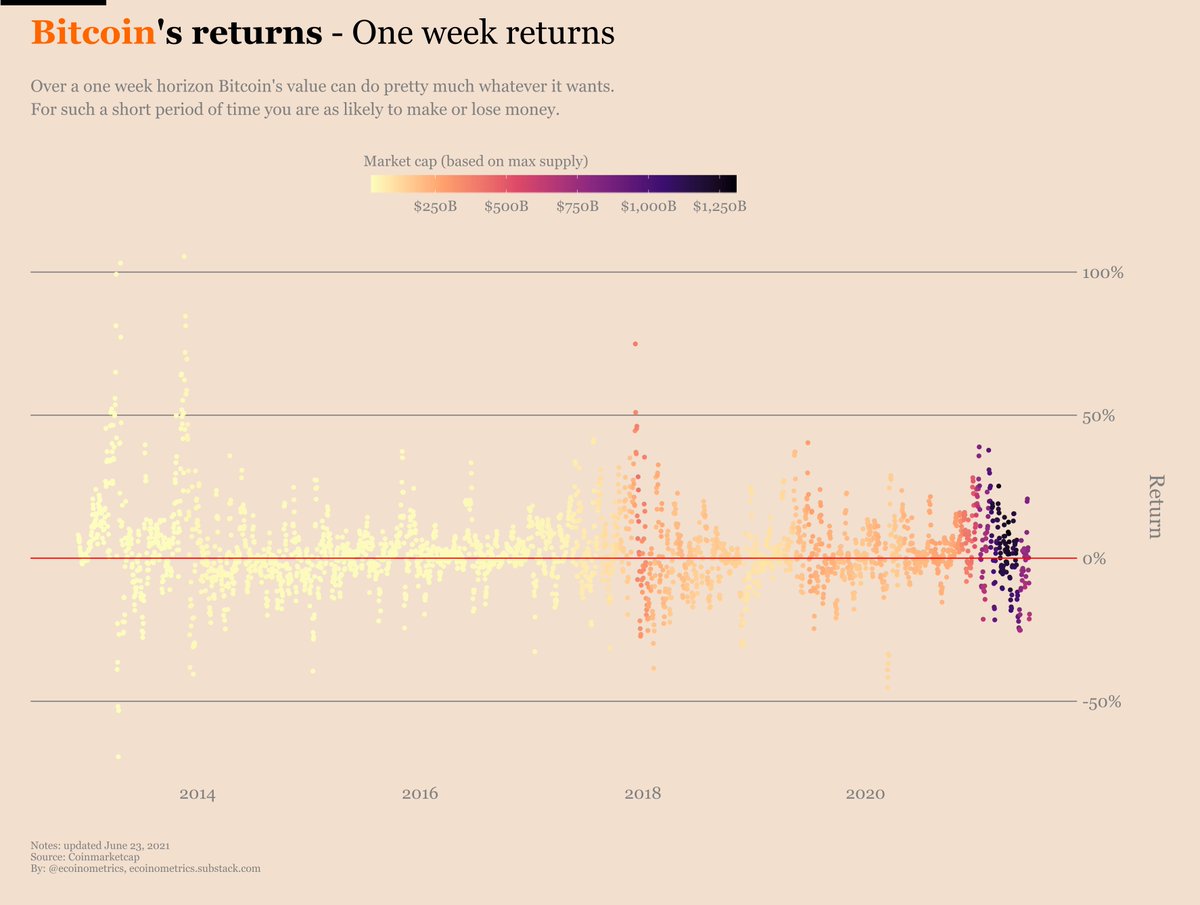

2/ Over short time frames anything can happen:

🟧@elonmusk can tweet.

🟧 FUD can grip the market.

🟧 You can get a good FOMO pump.

Really, anything goes… 📉📈🤷♂️

🟧@elonmusk can tweet.

🟧 FUD can grip the market.

🟧 You can get a good FOMO pump.

Really, anything goes… 📉📈🤷♂️

4/ If you hold Bitcoin for one month, it is still a coin toss to decide whether you are making money or not.❌

5/ If you hold Bitcoin for one year, things already start to look better. But you are not guaranteed to be in the green.✅

8/ So clearly longer investment horizons are better.

⬜️ Is it magical? No.

⬜️ Will this pattern continue forever? No.

🟧 Will this pattern continue in the near future? Probably yes.

⬜️ Is it magical? No.

⬜️ Will this pattern continue forever? No.

🟧 Will this pattern continue in the near future? Probably yes.

9/ First of all, it works because the main driver for #Bitcoin’s growth is adoption. But adoption takes time.

That’s why the longer your investment horizon, the better. You need to give it time.

That’s why the longer your investment horizon, the better. You need to give it time.

10/ At some point in the future diminishing returns will start to be a problem. #Bitcoin’s market cap cannot grow exponentially forever.

So, bar an hyperinflation event, #BTC will become more stable in US$ terms.

But there are reasons to think we aren’t there yet...

So, bar an hyperinflation event, #BTC will become more stable in US$ terms.

But there are reasons to think we aren’t there yet...

11/ First, if you believe in the “Bitcoin is digital gold” narrative, then #BTC is still small compared to both financial gold and physical gold.

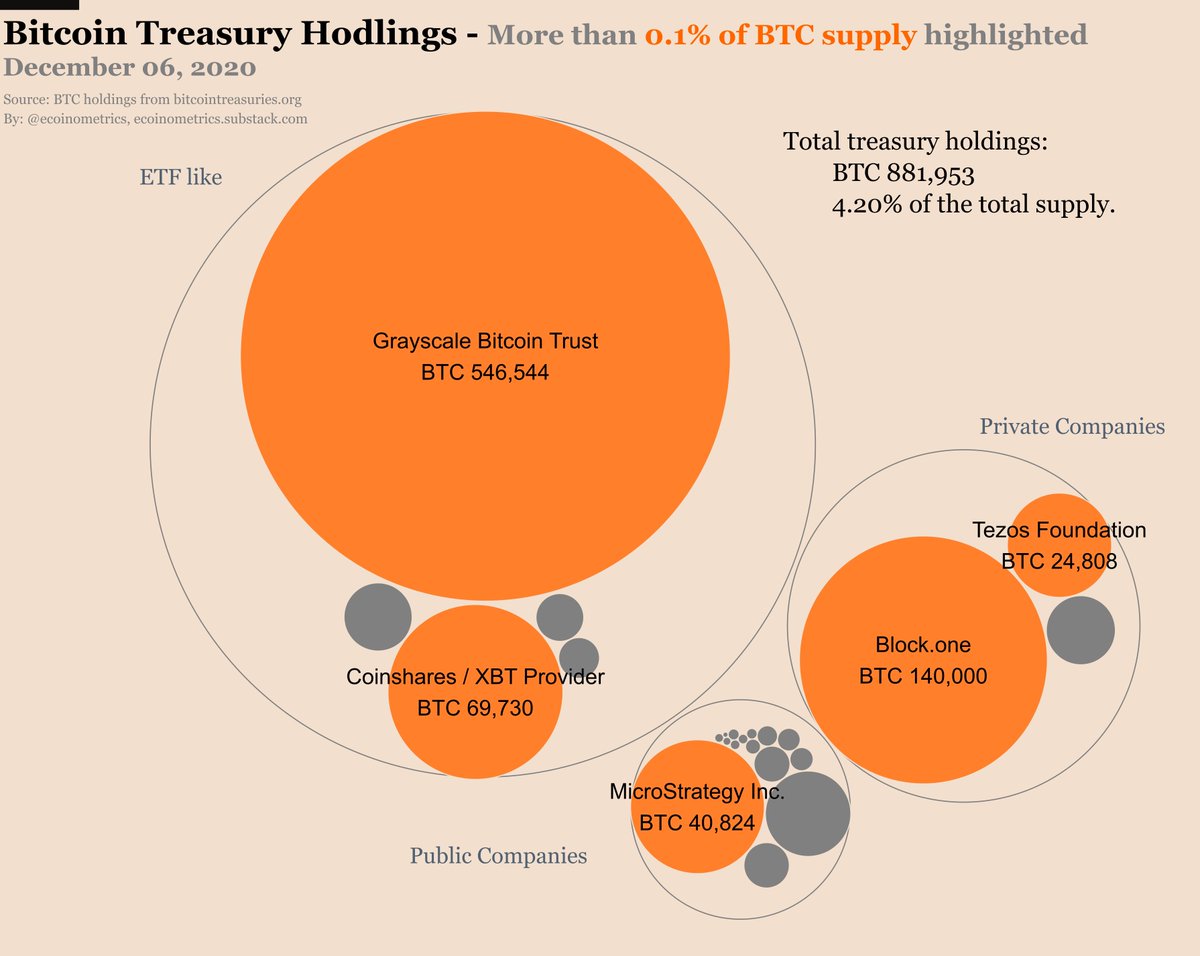

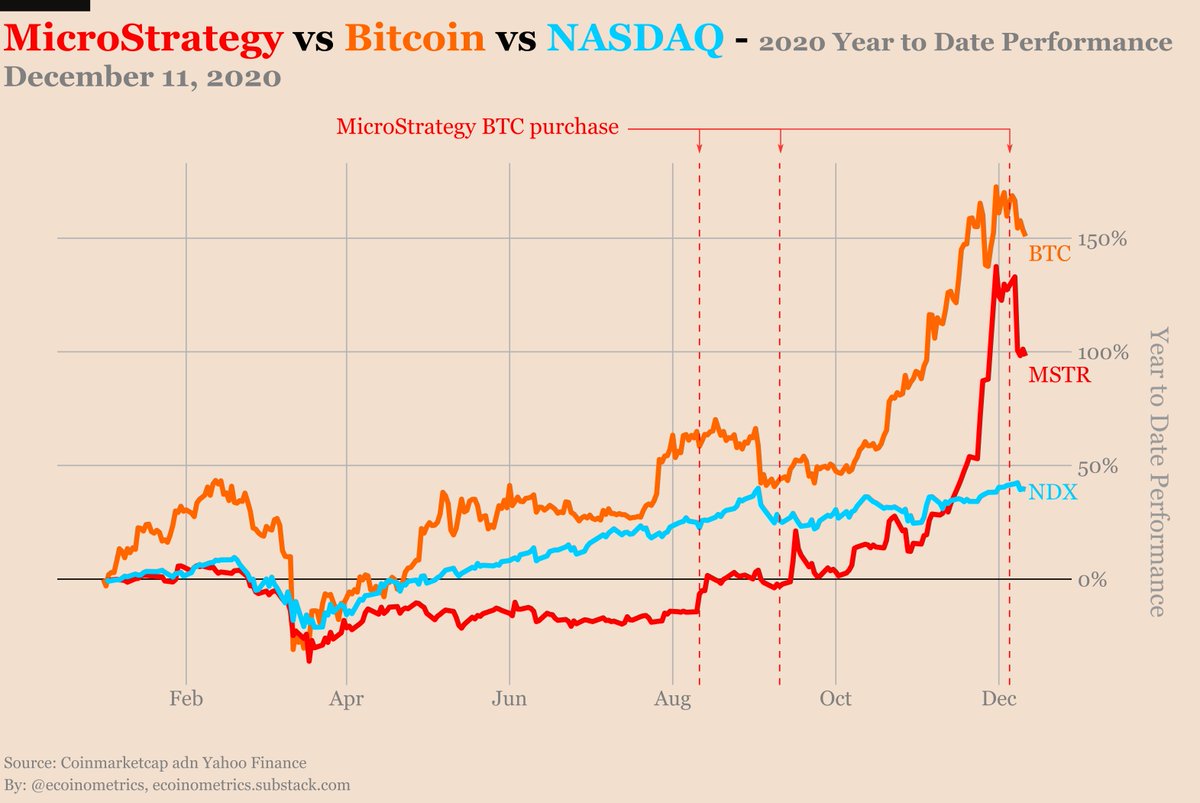

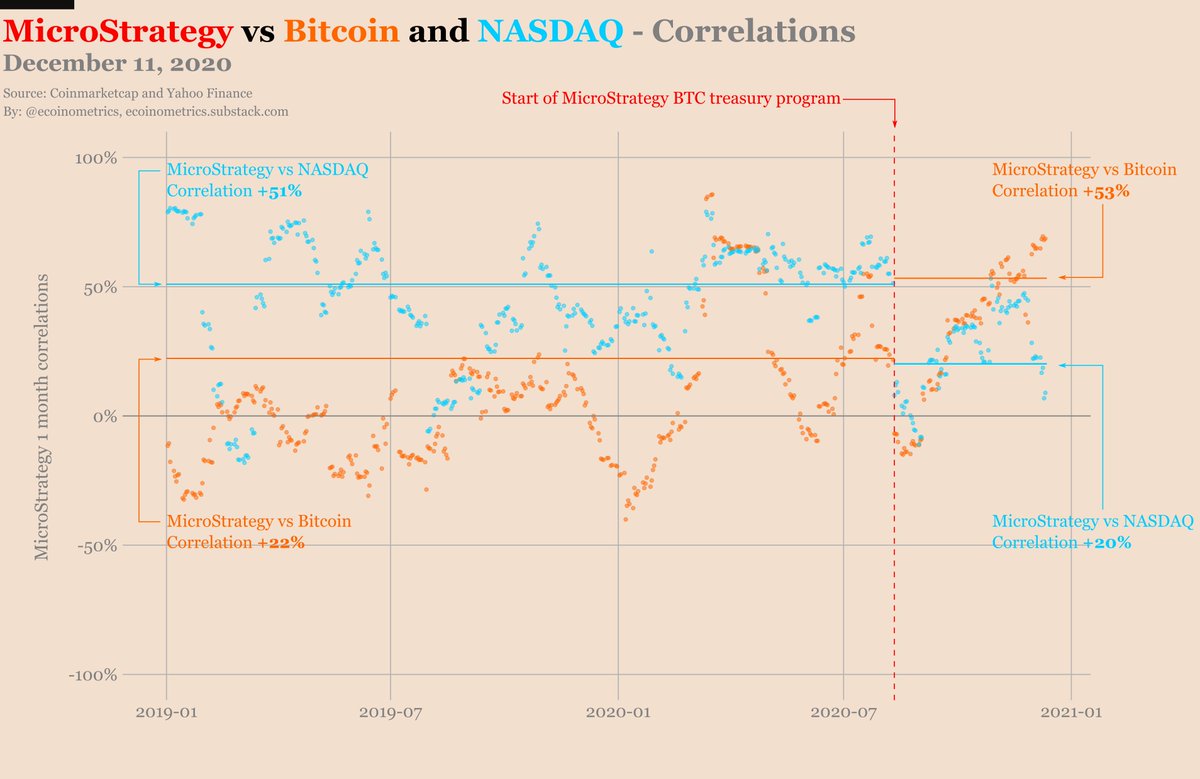

12/ Second institutional money is just starting to enter the market.

We don’t even have a US #Bitcoin ETF… there is a lot of inflow still to come from there.

We don’t even have a US #Bitcoin ETF… there is a lot of inflow still to come from there.

13/ Finally demographic changes mean that the digital assets transformation is just getting started.

It will take 10-15 years to see it play out but this is a major force for any macro trend.

#Bitcoin can only benefit from it.

More on that here.👇

ecoinometrics.substack.com/p/ecoinometric…

It will take 10-15 years to see it play out but this is a major force for any macro trend.

#Bitcoin can only benefit from it.

More on that here.👇

ecoinometrics.substack.com/p/ecoinometric…

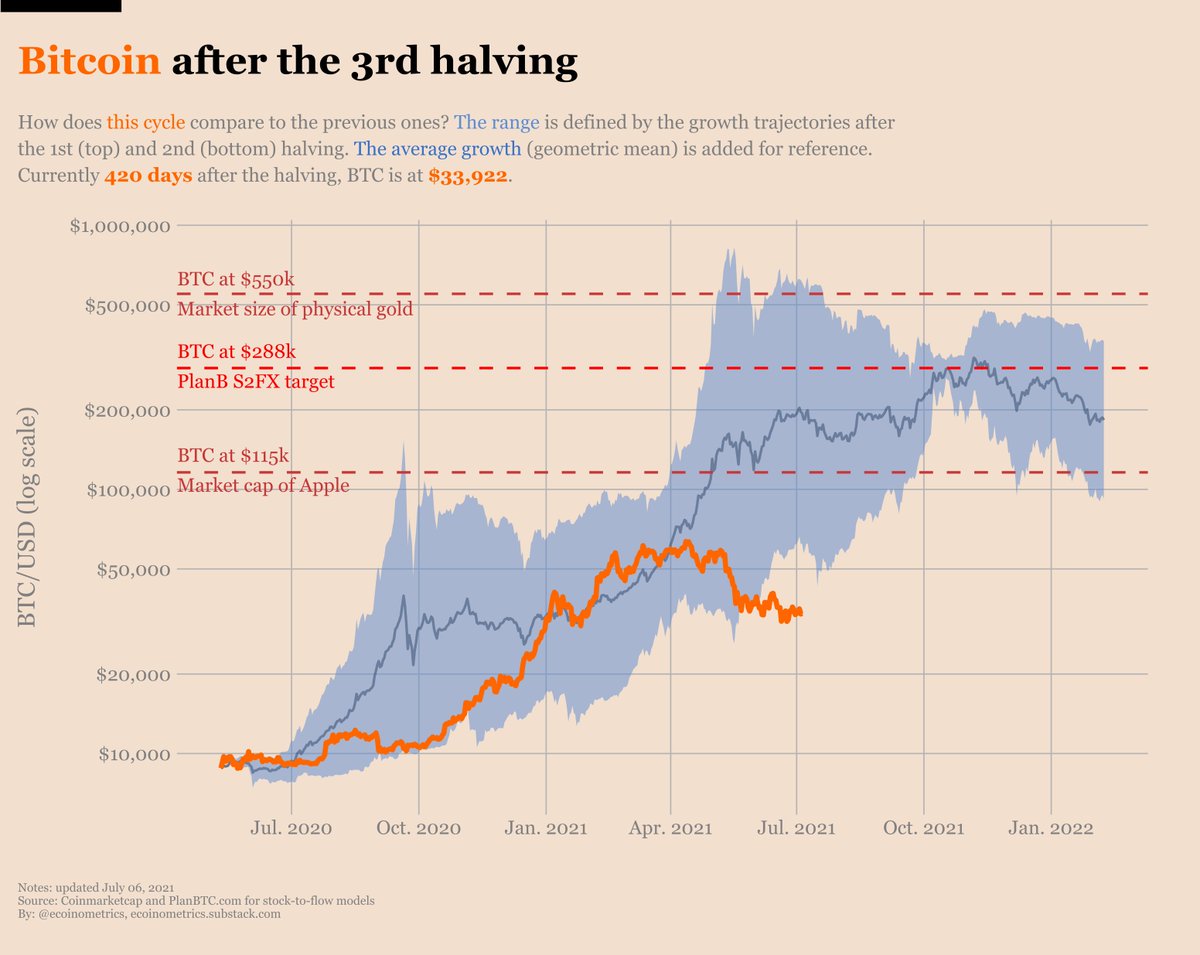

14/ Right now, the short term price action has seen #Bitcoin dip below the trajectory of its previous cycles.

But nothing has changed when it comes to the long term game.

Conclusion, this big drawdown is a buying opportunity for long term hodlers.

But nothing has changed when it comes to the long term game.

Conclusion, this big drawdown is a buying opportunity for long term hodlers.

15/ So that's it. Pretty straightforward: buy #Bitcoin now and let the long term trend play out.

Want to know more?

Go checkout the Ecoinometrics newsletter and subscribe to get weekly research updates directly in your inbox.

ecoinometrics.substack.com

Want to know more?

Go checkout the Ecoinometrics newsletter and subscribe to get weekly research updates directly in your inbox.

ecoinometrics.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh