#Macroscope: Weekly Snapshot

1⃣ Tapering: Divergent views

- Bullard wants taper to start in fall/Sep21, end by Q1’22, Delta temporary

- Brainard, possible Fed Chair, wants to see Sept jobs data (out on 8 Oct) to judge progress

- Overall Dec’21 announcement remains base case

1/10

1⃣ Tapering: Divergent views

- Bullard wants taper to start in fall/Sep21, end by Q1’22, Delta temporary

- Brainard, possible Fed Chair, wants to see Sept jobs data (out on 8 Oct) to judge progress

- Overall Dec’21 announcement remains base case

1/10

2⃣ Virus

▪️ US cases further up; Delta now >80% of cases but more localized where vaccination remains low

▪️ "experts don't expect Delta to cause nationwide surge like winter wave"

▪️ To watch school re-opening

▪️ Herd immunity threshold probably pushed up, vaccination key

2/10

▪️ US cases further up; Delta now >80% of cases but more localized where vaccination remains low

▪️ "experts don't expect Delta to cause nationwide surge like winter wave"

▪️ To watch school re-opening

▪️ Herd immunity threshold probably pushed up, vaccination key

2/10

▪️ Drop in UK cases encouraging

▪️ China virus situation worst since Wuhan last yr; while absolute number still small, worth monitoring

▪️ Israel with 57% vaccination seeing rising "hospitalized cases but more serious condition significantly delayed"

3/10

scmp.com/news/china/pol…

▪️ China virus situation worst since Wuhan last yr; while absolute number still small, worth monitoring

▪️ Israel with 57% vaccination seeing rising "hospitalized cases but more serious condition significantly delayed"

3/10

scmp.com/news/china/pol…

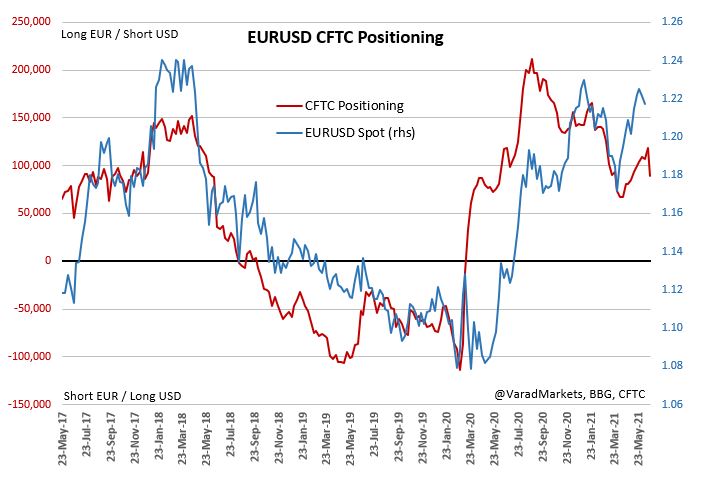

3⃣ CFTC COT FX Positioning:

▪️ 6th consecutive week of reduction in long EUR position (since Jun FOMC)

▪️ Short AUD added ahead of RBA tomorrow

▪️ Long CAD further reduced - close to neutral now

▪️ Short JPY now stands out as largest Long USD equivalent followed by short AUD

4/10

▪️ 6th consecutive week of reduction in long EUR position (since Jun FOMC)

▪️ Short AUD added ahead of RBA tomorrow

▪️ Long CAD further reduced - close to neutral now

▪️ Short JPY now stands out as largest Long USD equivalent followed by short AUD

4/10

4⃣ #Australia RBA MPC 3 Aug

▪️ NSW & Victoria represent bulk of new cases, forced into lockdown

▪️ QE A$ 5bn/wk to 4bn/wk till Nov – mkt already pricing chance tapering would be deferred

▪️ If looks beyond recent lockdowns, sticks to taper timeline=>AUDXXX can retrace higher

5/10

▪️ NSW & Victoria represent bulk of new cases, forced into lockdown

▪️ QE A$ 5bn/wk to 4bn/wk till Nov – mkt already pricing chance tapering would be deferred

▪️ If looks beyond recent lockdowns, sticks to taper timeline=>AUDXXX can retrace higher

5/10

5⃣ #China slowdown theme continues

▪️ Enough discussed about recent regulatory crackdown & few mkt calming comments from authorities

▪️ Both Official (50.4) & Caixin Mfg (50.3) PMI continued to ease off, lower than expectations, barely in expansion zone

6/10

▪️ Enough discussed about recent regulatory crackdown & few mkt calming comments from authorities

▪️ Both Official (50.4) & Caixin Mfg (50.3) PMI continued to ease off, lower than expectations, barely in expansion zone

6/10

6⃣ #FX last week

▪️ DXY -0.5% but reasonable divergence within FX

▪️ JPY best (+0.65%), EUR, GBP, CAD also up

▪️ AUD worst (-0.55%), NZD, NOK also in red

▪️ Non-Asia EM did well: ZAR, TRY, COP, HUF, CZK +>1.0% v/s USD

▪️ TWD, PHP best in Asia, CNH again failed above 6.5000

7/10

▪️ DXY -0.5% but reasonable divergence within FX

▪️ JPY best (+0.65%), EUR, GBP, CAD also up

▪️ AUD worst (-0.55%), NZD, NOK also in red

▪️ Non-Asia EM did well: ZAR, TRY, COP, HUF, CZK +>1.0% v/s USD

▪️ TWD, PHP best in Asia, CNH again failed above 6.5000

7/10

#AUD, still in downtrend, interesting ahead of RBA in backdrop of China-driven nervousness

▪️ Dovish surprise=>could pierce thru 7300 support => would completely unwind reflation pricing since Nov'20

▪️ Should wait for >7415 for any clear sign of revival of reflation theme

8/10

▪️ Dovish surprise=>could pierce thru 7300 support => would completely unwind reflation pricing since Nov'20

▪️ Should wait for >7415 for any clear sign of revival of reflation theme

8/10

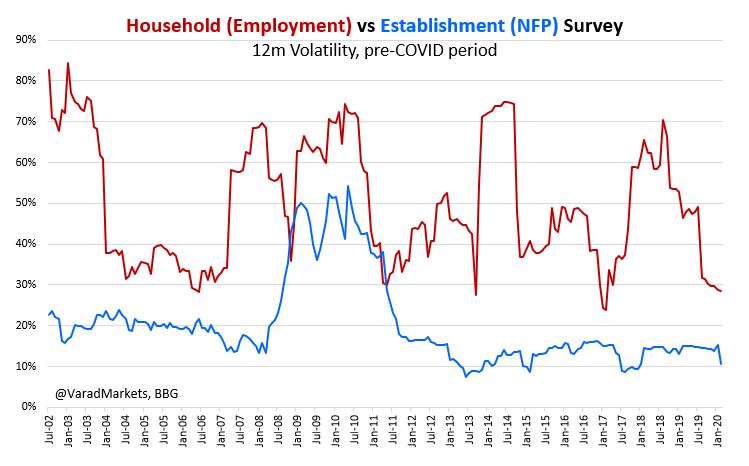

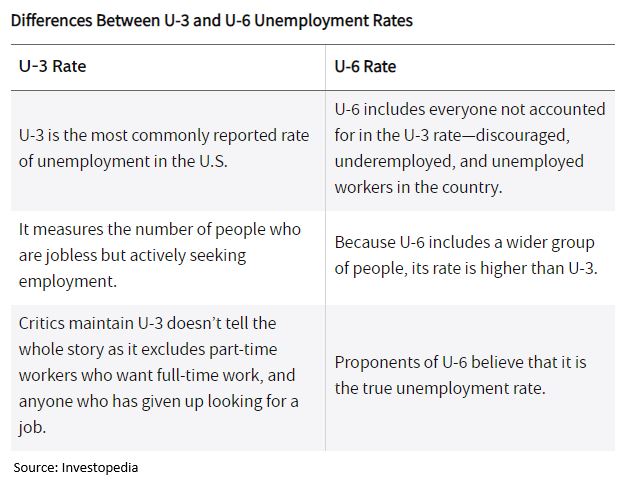

▪️ #Dollar had been disconnected with Equities & Real rates but few now looking for catch up of EUR & JPY with recent collapse in US real yields ▪️ A bumper Friday NFP (>1000k, BBG +900k) could put that off with renewed USD bid with calls for Sept tapering announcement

9/10

9/10

7⃣ $550 bipartisan Infrastructure Bill likely to be passed by Senate this wk but may be held back in House unless Budget Resolution ($3.5trn Dem-only) also cleared by Senate

Senate vote by itself not a massive market mover but worth watching this space

bloomberg.com/news/articles/…

Senate vote by itself not a massive market mover but worth watching this space

bloomberg.com/news/articles/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh