#DiveIn: Collapse in Term Premium TP

▪️ TP negative again after being positive for most of 2021

▪️ Excess yield investors require/receive to commit to holding L/T bond instead of series of S/T bonds has turned negative

▪️ Investors now willing to pay extra to hold L/T bonds

1/10

▪️ TP negative again after being positive for most of 2021

▪️ Excess yield investors require/receive to commit to holding L/T bond instead of series of S/T bonds has turned negative

▪️ Investors now willing to pay extra to hold L/T bonds

1/10

With 10y UST yield at 1.18% & TP at -0.10% => 1y yield is expected to avg ~1.28% over next 10 yrs

Term Premium?

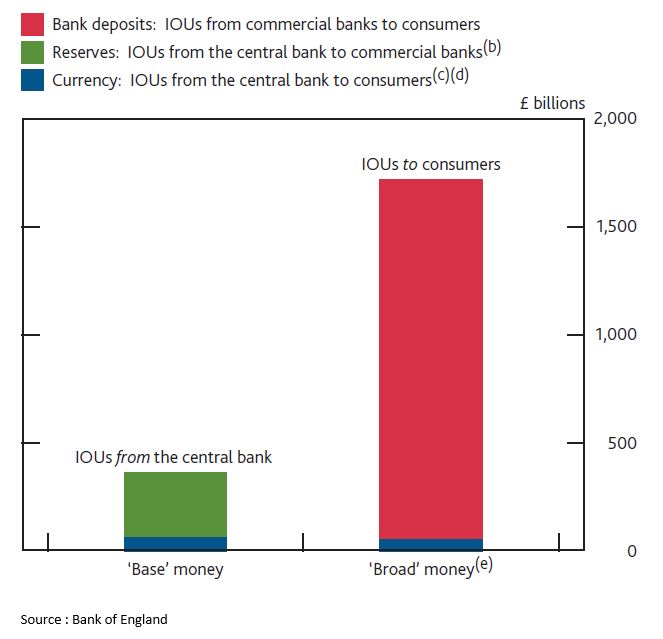

▪️ Compensation investors demand for risk that S/T yields do not evolve as expected

▪️ 10y Nominal = expected path of S/T yield over next 10 yrs + Term Premium TP

2/10

Term Premium?

▪️ Compensation investors demand for risk that S/T yields do not evolve as expected

▪️ 10y Nominal = expected path of S/T yield over next 10 yrs + Term Premium TP

2/10

▪️ Negative TP => investors willing to accept lower yield on L/T bond to avoid risks of rolling over their investments in series of S/T bonds with uncertain fluctuating interest rates

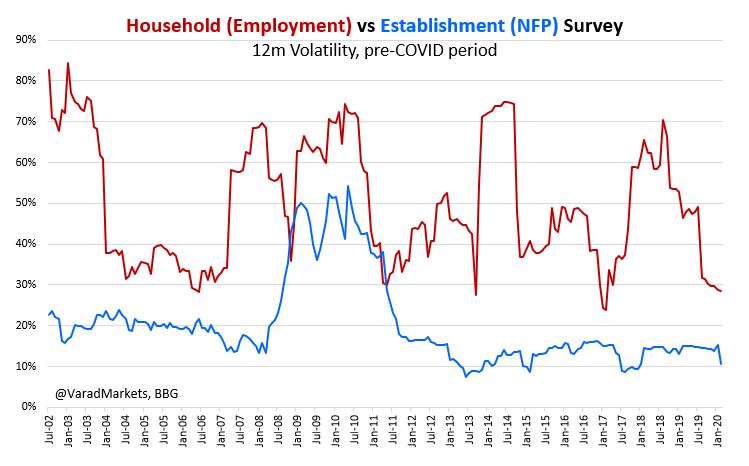

Thus higher Rates Volatility usually implies higher TP

Chart: ACM TP v/s MOVE Index

3/10

Thus higher Rates Volatility usually implies higher TP

Chart: ACM TP v/s MOVE Index

3/10

▪️ TP as compensation for possible deviation from "Expectations Hypothesis" that expected return from L/T bond until maturity equals expected return from rolling over series of S/T bonds

▪️ TP are highly correlated across countries but interest rate expectations are not

4/10

▪️ TP are highly correlated across countries but interest rate expectations are not

4/10

▪️ TP challenging to comprehend & difficult to measure as it requires estimation of investor expectations (not directly observable) of future course of S/T rates over lifetime of L/T Bonds

Any model is just useful simplifying tool; may not capture all real-life influences

5/10

Any model is just useful simplifying tool; may not capture all real-life influences

5/10

▪️ Fed’s popular ACM Model (Adrian Crump & Moench 2013)

- Five-factor no-arbitrage term structure statistical model

- Characterizes yields as linear function of pricing factors / principal components

▪️ KW Model (Kim & Wright) also includes survey data on interest rates

6/10

- Five-factor no-arbitrage term structure statistical model

- Characterizes yields as linear function of pricing factors / principal components

▪️ KW Model (Kim & Wright) also includes survey data on interest rates

6/10

Macro factors: TP can vary with:

🔹 Perceptions of uncertainty about inflation, real activity & monetary policy => recent TP collapse partly represents pricing of growth slowdown & virus resurgence

🔹 Business cycle as investors more risk-averse in recessions than in booms

7/10

🔹 Perceptions of uncertainty about inflation, real activity & monetary policy => recent TP collapse partly represents pricing of growth slowdown & virus resurgence

🔹 Business cycle as investors more risk-averse in recessions than in booms

7/10

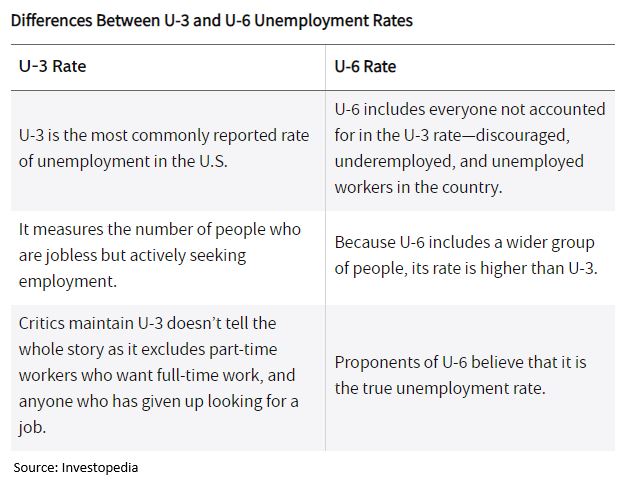

🔹 Liquidity factors & ‘safe haven’ demand esp ard geopolitical risk=>investors may be willing to hold bonds even with negative TP

Correlations (2018):

- Slope more affected by unemp gap

- Level of interest rate strongly correlated with level of inflation but not unemp gap

8/10

Correlations (2018):

- Slope more affected by unemp gap

- Level of interest rate strongly correlated with level of inflation but not unemp gap

8/10

🔹 Demand-supply mismatch (Treasury borrowing/supply v/s pension fund, insurance, Fed QE demand)

- Pension funds may consider L/T bonds less risky given their L/T liabilities while other investors may demand compensation

- Notable compression in TP since GFC

@HayekAndKeynes

9/10

- Pension funds may consider L/T bonds less risky given their L/T liabilities while other investors may demand compensation

- Notable compression in TP since GFC

@HayekAndKeynes

9/10

🔹 Normally Fed’s new uncertain AIT framework should have led investors to demand more compensation for risk of inflation (higher TP), but recent collapse in TP may partly highlight confidence that Fed will keep inflation & expectations well anchored around 2%

@INArteCarloDoss

@INArteCarloDoss

References:

BIS 2018 "Term premia: models and some stylised facts"

bis.org/publ/qtrpdf/r_…

IMF 2018 "Macroeconomic Approach to Term Premium"

imf.org/en/Publication…

BIS 2018 "Term premia: models and some stylised facts"

bis.org/publ/qtrpdf/r_…

IMF 2018 "Macroeconomic Approach to Term Premium"

imf.org/en/Publication…

• • •

Missing some Tweet in this thread? You can try to

force a refresh