#Dollar = '#Fiat' Money?

Article rightly highlights QE just as asset swap & that Money is created by Bank lending, not Fed, it also revives interesting debate arguing Dollar not Fiat but Credit money

What exactly is Fiat/Paper money? Two definitions:

1/7

ft.com/content/5e5b2a…

Article rightly highlights QE just as asset swap & that Money is created by Bank lending, not Fed, it also revives interesting debate arguing Dollar not Fiat but Credit money

What exactly is Fiat/Paper money? Two definitions:

1/7

ft.com/content/5e5b2a…

'Fiat' Money:

1⃣ Into existence because of authoritative decree/sanction/order; no Intrinsic value

2⃣ Not convertible to or backed by other asset or commodity (Nixon Gold Std 1971; Britain 1931)

1⃣ Decree:

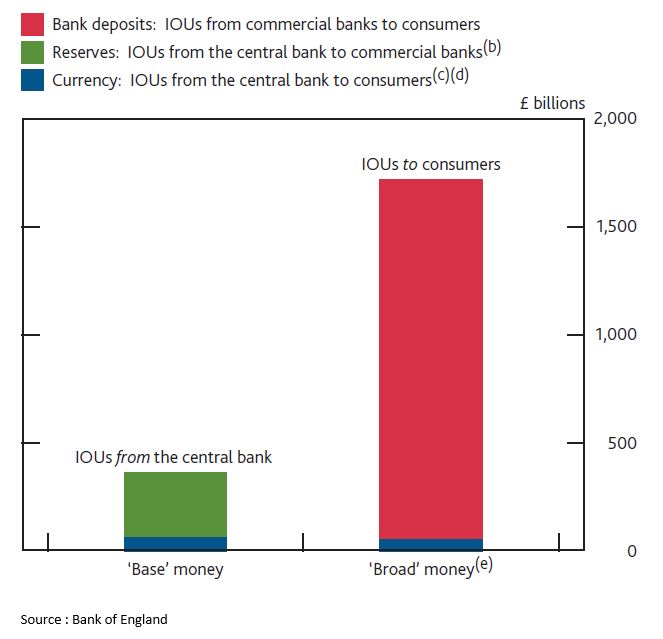

Dollars/Money = IOU 'I owe you' from Central Bank CB to Economy =

2/7

1⃣ Into existence because of authoritative decree/sanction/order; no Intrinsic value

2⃣ Not convertible to or backed by other asset or commodity (Nixon Gold Std 1971; Britain 1931)

1⃣ Decree:

Dollars/Money = IOU 'I owe you' from Central Bank CB to Economy =

2/7

=Liability of CB=>‘Credit’ Money

But Dollar/Money = special IOU that everyone in Economy trusts. So yes, we take credit risk on US Govt when we trust Dollar=>‘Credit’ Money

But while there may not be an authoritative decree behind Dollar (so not ‘Fiat’ from that angle)...

3/7

But Dollar/Money = special IOU that everyone in Economy trusts. So yes, we take credit risk on US Govt when we trust Dollar=>‘Credit’ Money

But while there may not be an authoritative decree behind Dollar (so not ‘Fiat’ from that angle)...

3/7

it is Govt authority which brings that trust in the first place, which makes Dollar universally accepted as medium of exchange

So it is NOT:

Authority => Decree/Order => Dollar/Money

BUT it is:

Authority => Trust => Dollar/Money

This Trust is where credit risk creeps in

4/7

So it is NOT:

Authority => Decree/Order => Dollar/Money

BUT it is:

Authority => Trust => Dollar/Money

This Trust is where credit risk creeps in

4/7

2⃣ Convertibility:

Arguments for Dollar not being Fiat using second definition are a bit hazy

If you lose faith in US Govt, can you convert your financial asset (Money/Dollar) into another non-fin goods/commodity. No

Article seems to suggest that we should be fine as...

5/7

Arguments for Dollar not being Fiat using second definition are a bit hazy

If you lose faith in US Govt, can you convert your financial asset (Money/Dollar) into another non-fin goods/commodity. No

Article seems to suggest that we should be fine as...

5/7

...this CB liability (Money/Dollars) is ultimately backed by assets "It’s all transactions on balance sheet, assets for liabilities"

But note that CB liability (Dollars) is backed by Assets (UST/Debt) which are also denominated in same Dollars

6/7

But note that CB liability (Dollars) is backed by Assets (UST/Debt) which are also denominated in same Dollars

6/7

CB can pay back its liability/debt only with more fiat money. You can get your old $100 bill replaced at bank with new $100 bill – but both are still Dollars

Hence:

🔹 Authoritative Decree angle: Dollar not 'Fiat' but 'Credit/Trust' Money

🔹 Convertibility angle: Dollar is Fiat

Hence:

🔹 Authoritative Decree angle: Dollar not 'Fiat' but 'Credit/Trust' Money

🔹 Convertibility angle: Dollar is Fiat

• • •

Missing some Tweet in this thread? You can try to

force a refresh