Three largest Asians may end up with early tightness:

▪️ #China: Never went too accommodative to start with + credit tightening

▪️ #India: Inflation surge may force RBI's hands

▪️ #Korea: BoK increasingly hawkish

KRW 2y IRS +17bp since May MPC

INR 5y NDOIS +11bp post CPI yday

▪️ #China: Never went too accommodative to start with + credit tightening

▪️ #India: Inflation surge may force RBI's hands

▪️ #Korea: BoK increasingly hawkish

KRW 2y IRS +17bp since May MPC

INR 5y NDOIS +11bp post CPI yday

BoK's recent hawkishness => rates sell off (higher yld) v/s Received rates positioning:

🔹 'Normalization should not be put off too much'

🔹 'Rapid debt rise may hurt consumption'

🔹 'Should secure policy room for future issues'

🔹 'Inflation may accelerate faster than expected'

🔹 'Normalization should not be put off too much'

🔹 'Rapid debt rise may hurt consumption'

🔹 'Should secure policy room for future issues'

🔹 'Inflation may accelerate faster than expected'

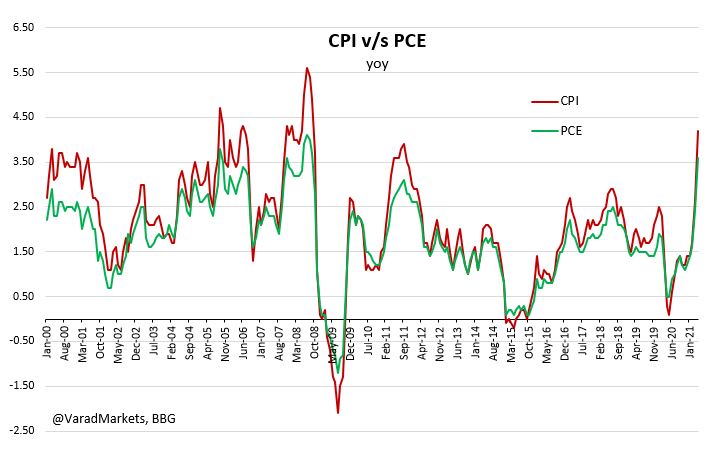

India: Inflation surge

Key to see how RBI interprets the CPI data - transitory or persistent?

Key to see how RBI interprets the CPI data - transitory or persistent?

https://twitter.com/VaradMarkets/status/1404461038087467012?s=20

China: Credit tightening

https://twitter.com/VaradMarkets/status/1404004165097906180?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh