The COVID-19 pandemic has had a significant adverse impact on football clubs, though it is important to distinguish between money that has been completely lost to the game and income that has simply been deferred. This thread will analyse what this means for the Premier League.

Many clubs have listed the revenue impact of COVID-19 in their accounts, while others have not quantified the amounts. In the latter case, I have made assumptions consistent with those clubs who have provided figures in order to estimate the impact.

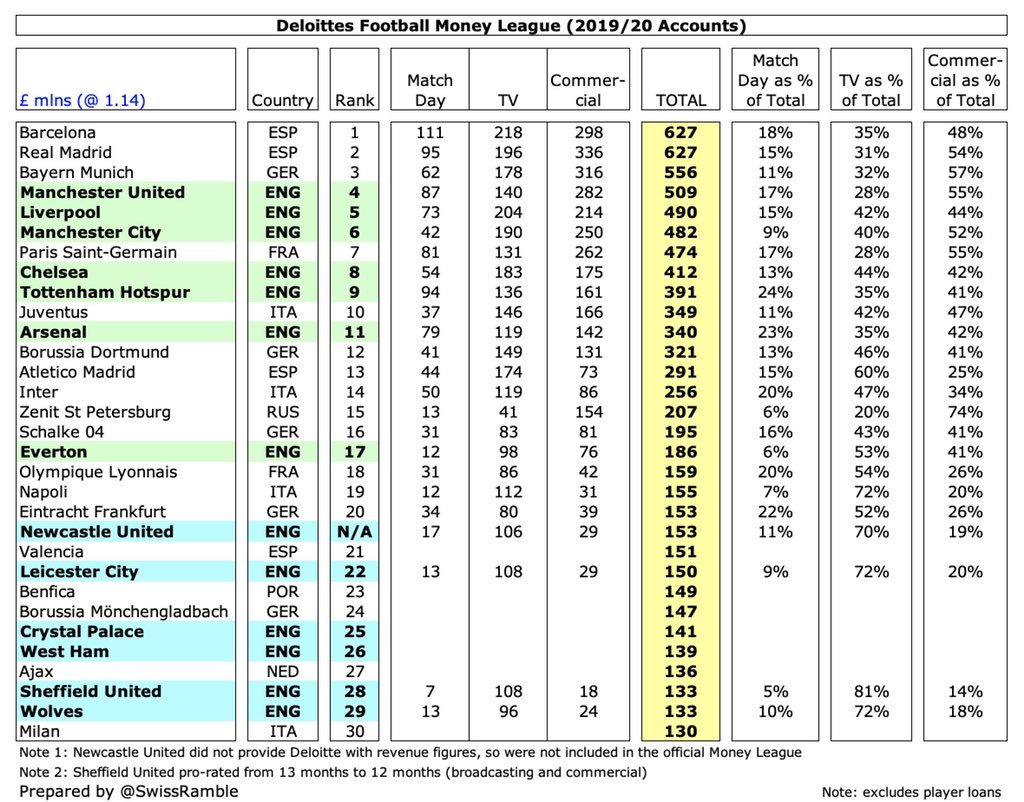

On the face of it, Premier League revenue held up quite well in 2019/20, though there were only 3 months impacted by the pandemic that season, as 4 clubs reported revenue above £400m (#MUFC £509m, #LFC £490m, #MCFC £478m & #CFC £407m), while all but one club was higher than £100m

Furthermore, there were no fewer than 7 English clubs in the top 20 (5 in the top 10) of the Deloitte Money League, which is a global ranking of revenue. In fact, there were 13 clubs in the top 30 (including #NUFC, who did not share figures with the consultancy).

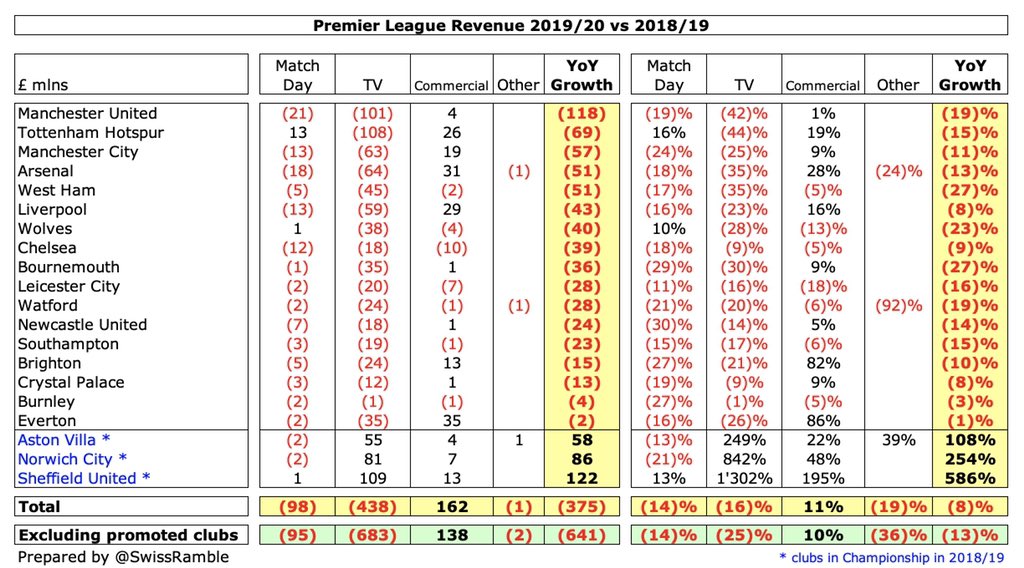

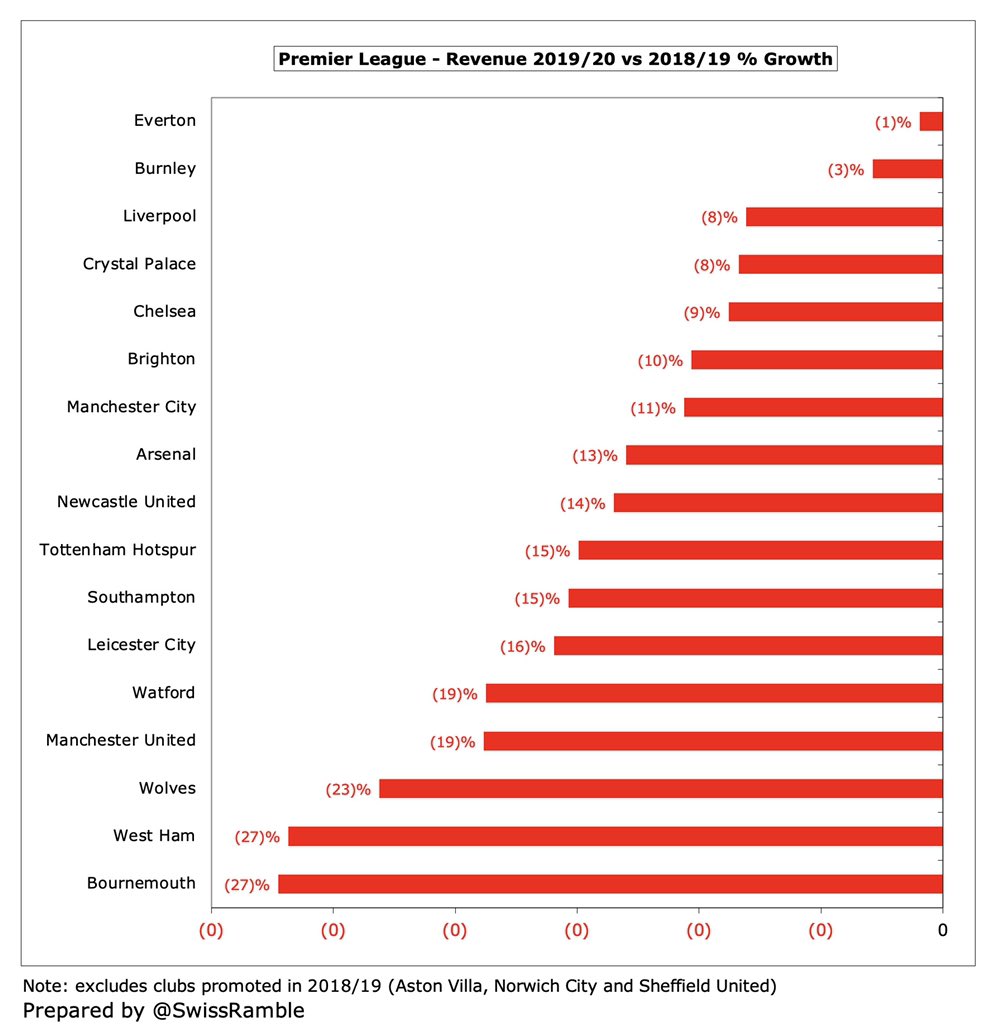

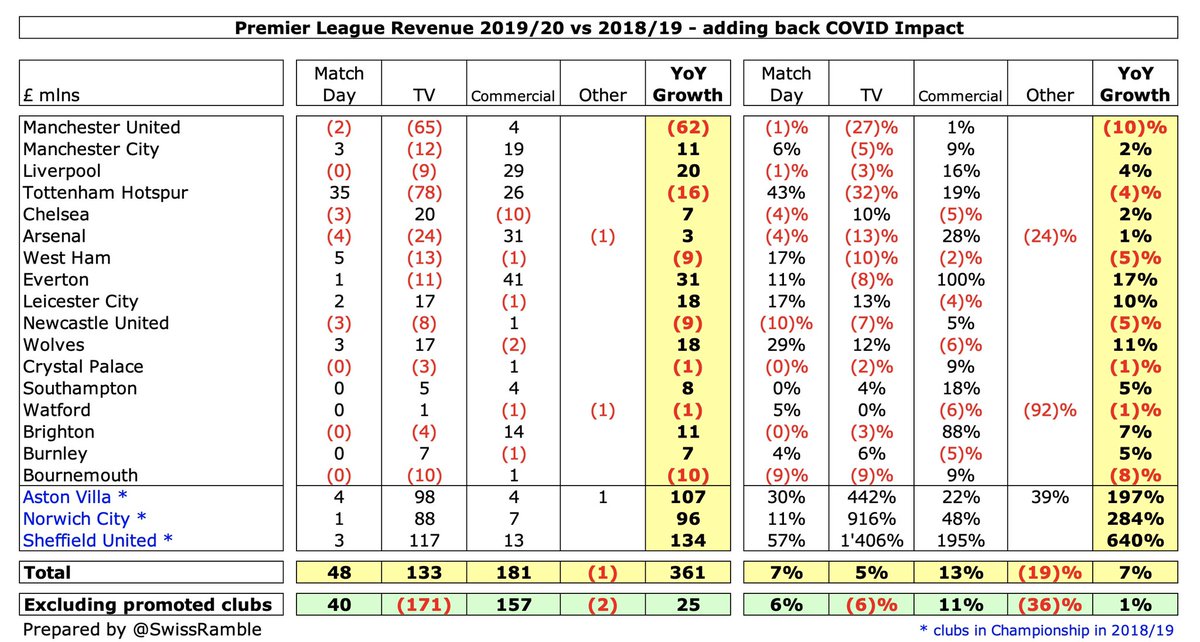

However, that disguises the fact that all Premier League clubs experienced a decrease in their revenue in 2019/20 – except the 3 clubs that were promoted from the Championship, who were boosted by the lucrative TV deal in the top flight (#AVFC, #NCFC and #SUFC).

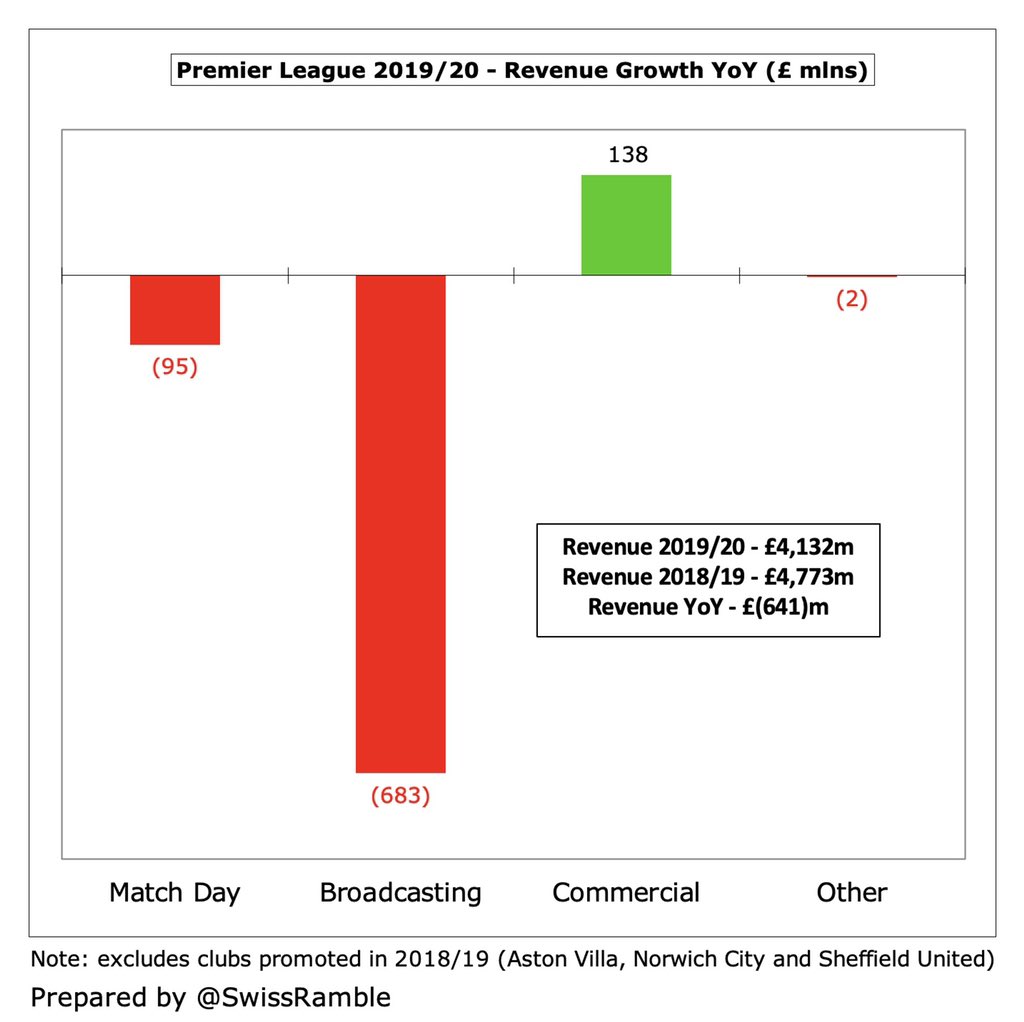

Excluding those 3 promoted clubs, revenue for the other 17 clubs dropped £641m (13%) from £4,773m to £4,132m, mainly due to broadcasting, down £683m (25%) to £2,045m, though match day also fell £95m (14%) to £563m. Partly offset by commercial growing £138m (10%) to £1,520m.

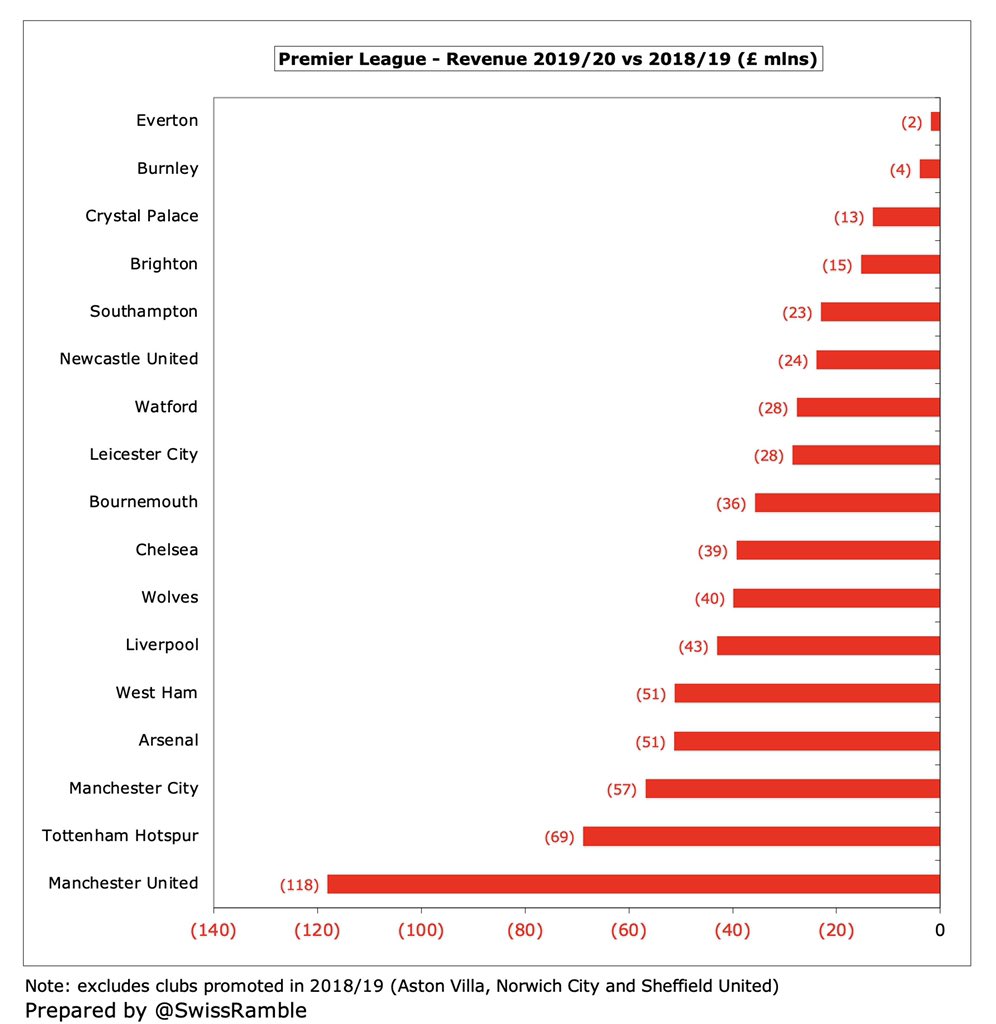

The largest revenue decreases in 2019/20 came at #MUFC £118m and #THFC £69m, both of whom were impacted by worse performance in European competitions, followed by #MCFC £57m, #AFC £51m and #WHUFC £51m. In contrast, there were very small falls at #EFC £2m and #BurnleyFC £4m.

Clearly, it is likely that the largest revenue impact in absolute terms would be at the bigger clubs, on account of their higher revenue base. However, in percentage terms, others suffered more, e.g. #AFCB 27%, #WHUFC 27% and #WWFC 19%. Average decline was 13%.

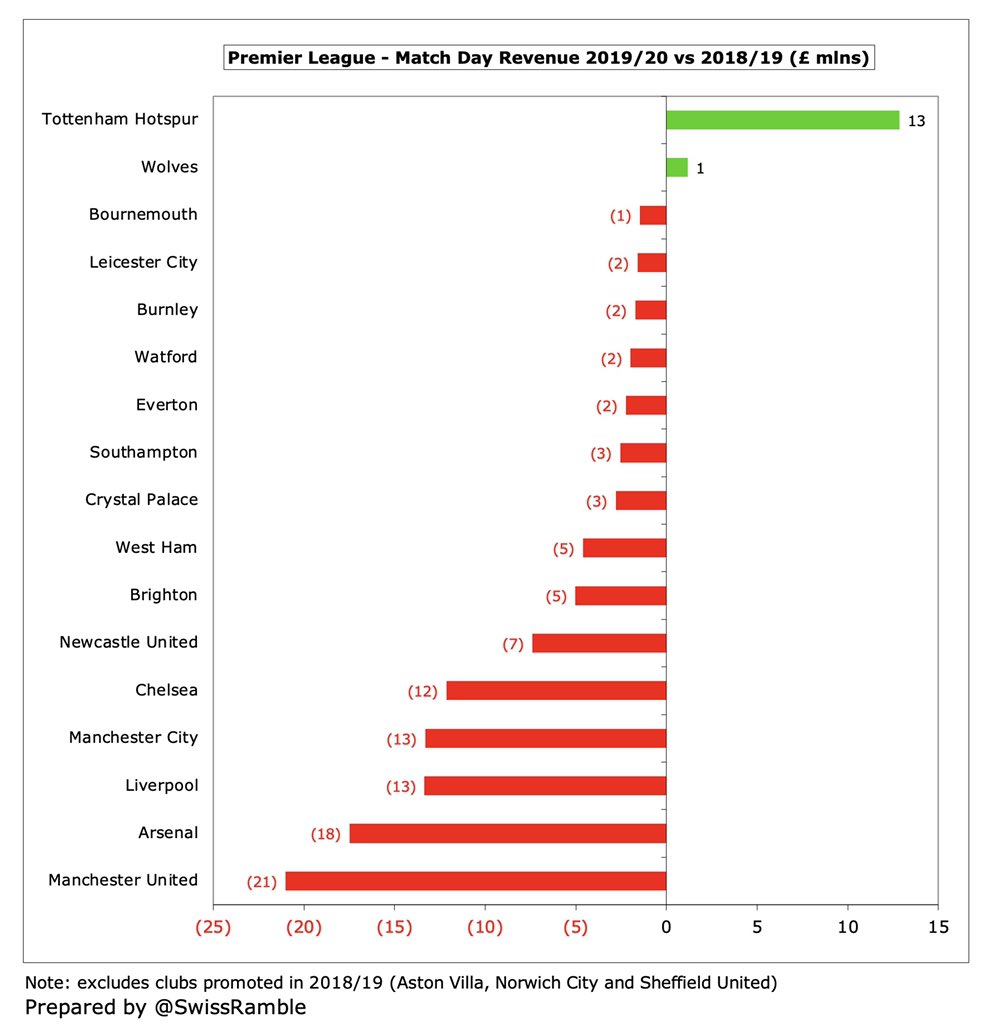

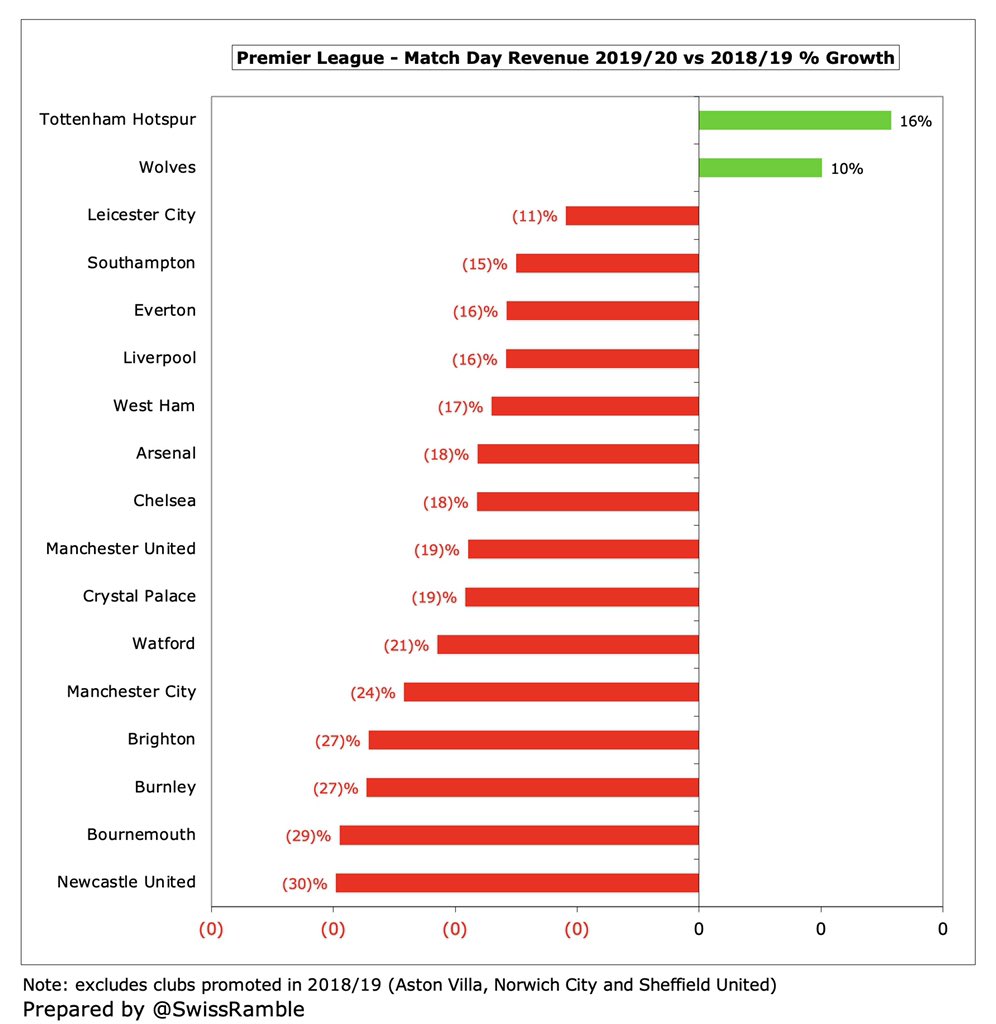

Match day income fell at almost all Premier League clubs, mainly due to playing games behind closed doors from March onwards, with the largest decreases at #MUFC £21m and #AFC £18m. Only 2 clubs saw growth here: #THFC (new stadium boost) and #WWFC (ticket price increase).

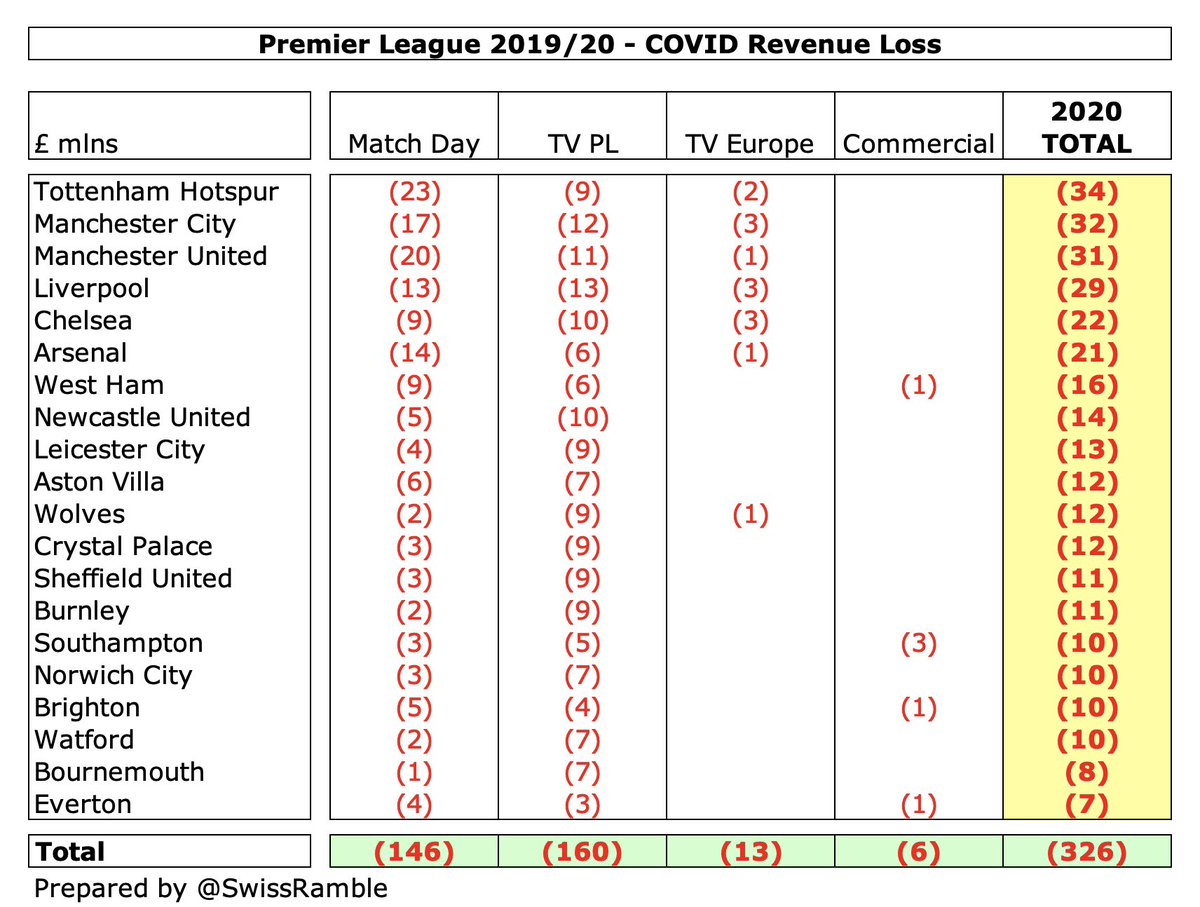

The COVID impact on match day income produced £146m lost revenue with the most at #THFC £23m, #MUFC £20m, #MCFC £17m, #AFC £14m and #LFC £13m. Where no figures available in accounts, calculated as revenue divided by games played with fans multiplied by games behind closed doors.

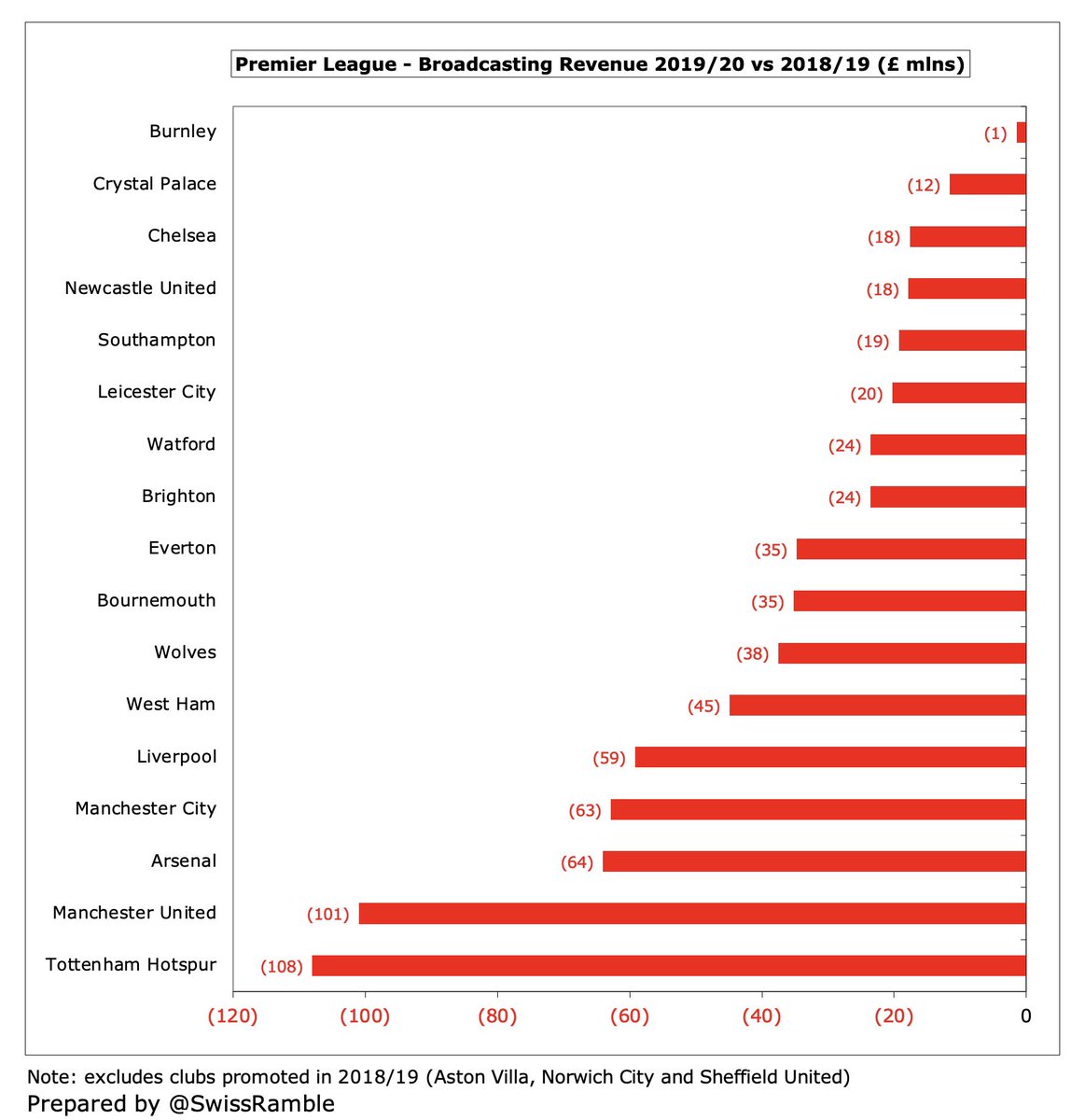

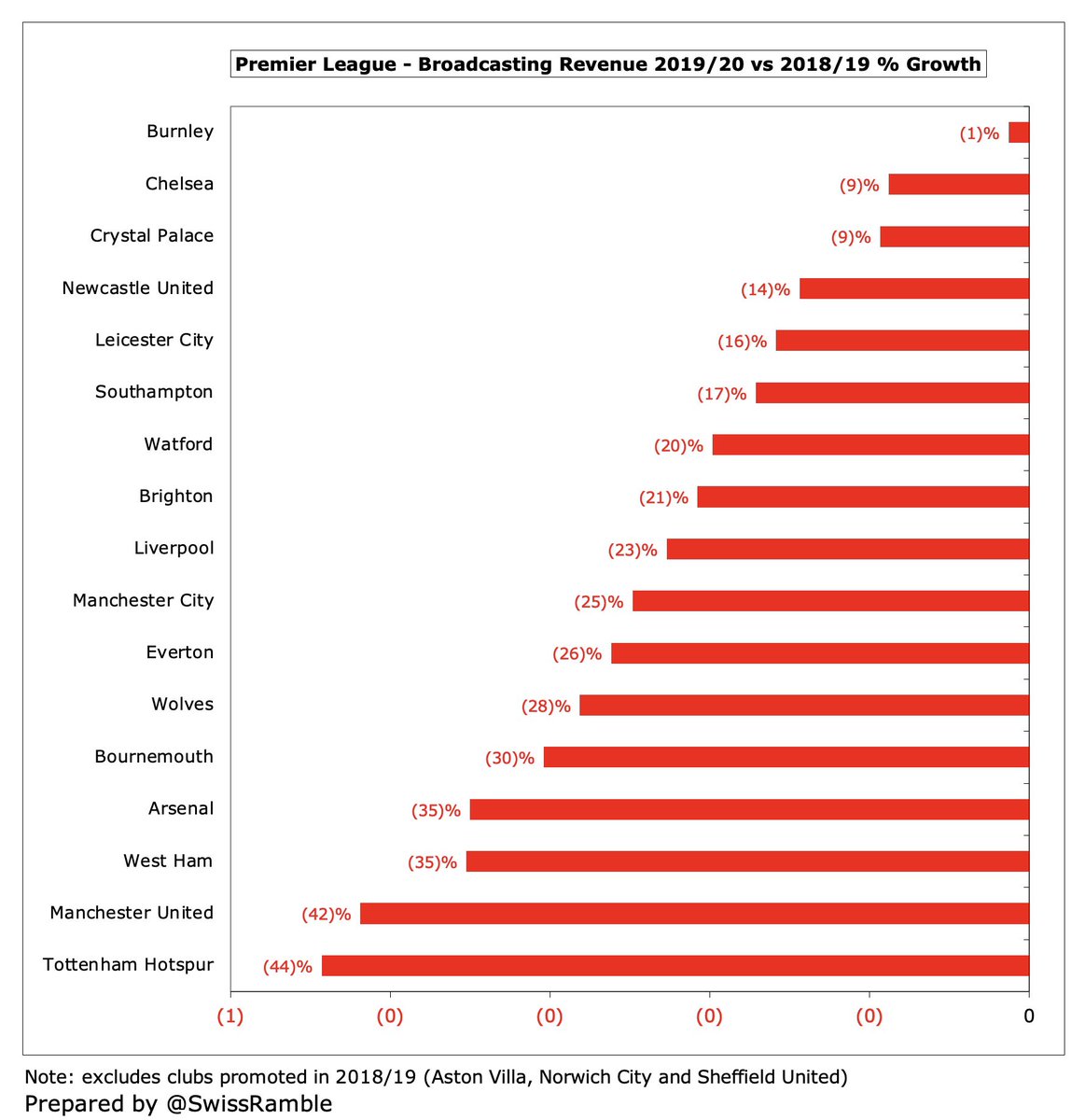

All clubs had lower broadcasting income in 2019/20, though there was a big difference in the size of the reductions. #THFC fell £108m (Champions League last 16 vs final), while #MUFC were down £101m (Europa League vs CL) and #AFC dropped £64m.

The 2019/20 reduction included a rebate to broadcasters, due to disruption to the schedules and an inferior product (no fans), amounting to £160m lost revenue. This was pro-rated based on gross receipts, so highest were at the top 4: #LFC £13m, #MCFC £12m, #MUFC £11m & #CFC £10m.

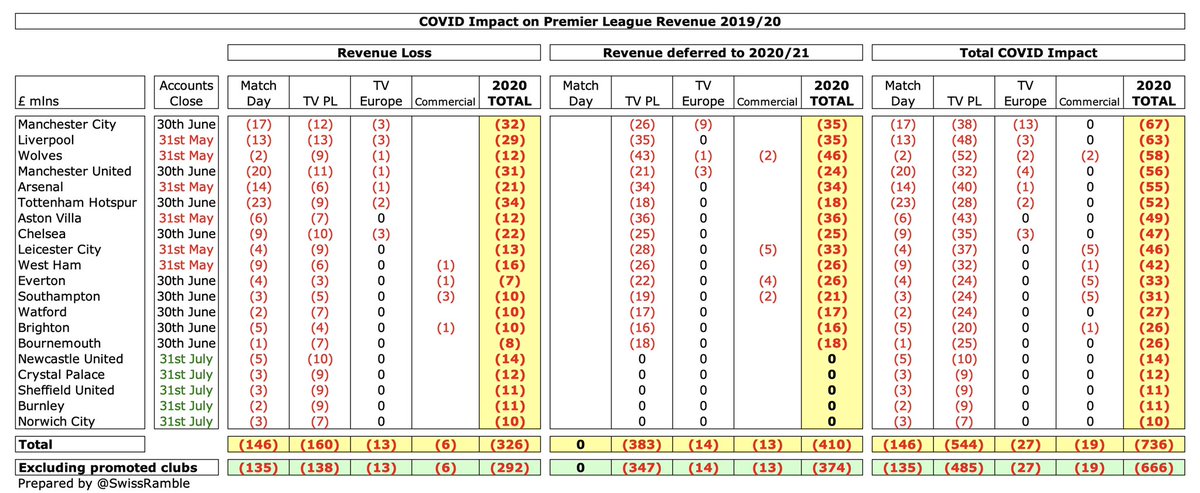

However, the larger impact on broadcasting income was the deferral of £383m to 2020/21 accounts, as revenue for games played after a club’s accounting close could not be booked in the 2019/20 season. However, clubs have different accounting dates, so the impact was not the same.

Clubs whose accounts closed on 31st May had the largest revenue deferrals, e.g. #WWFC £43m, #AVFC £36m, #LFC £35m and #AFC £34m. In contrast, clubs with 31st July year-end could book all revenue in 2019/20, so nothing has been deferred to 2020/21.

This makes revenue comparisons between Premier League clubs quite tricky, as the figures for clubs with 31st July year-end looked better in 2019/20, while others saw reductions. On the other hand, it will be a different story in 2020/21, when those clubs will see a boost.

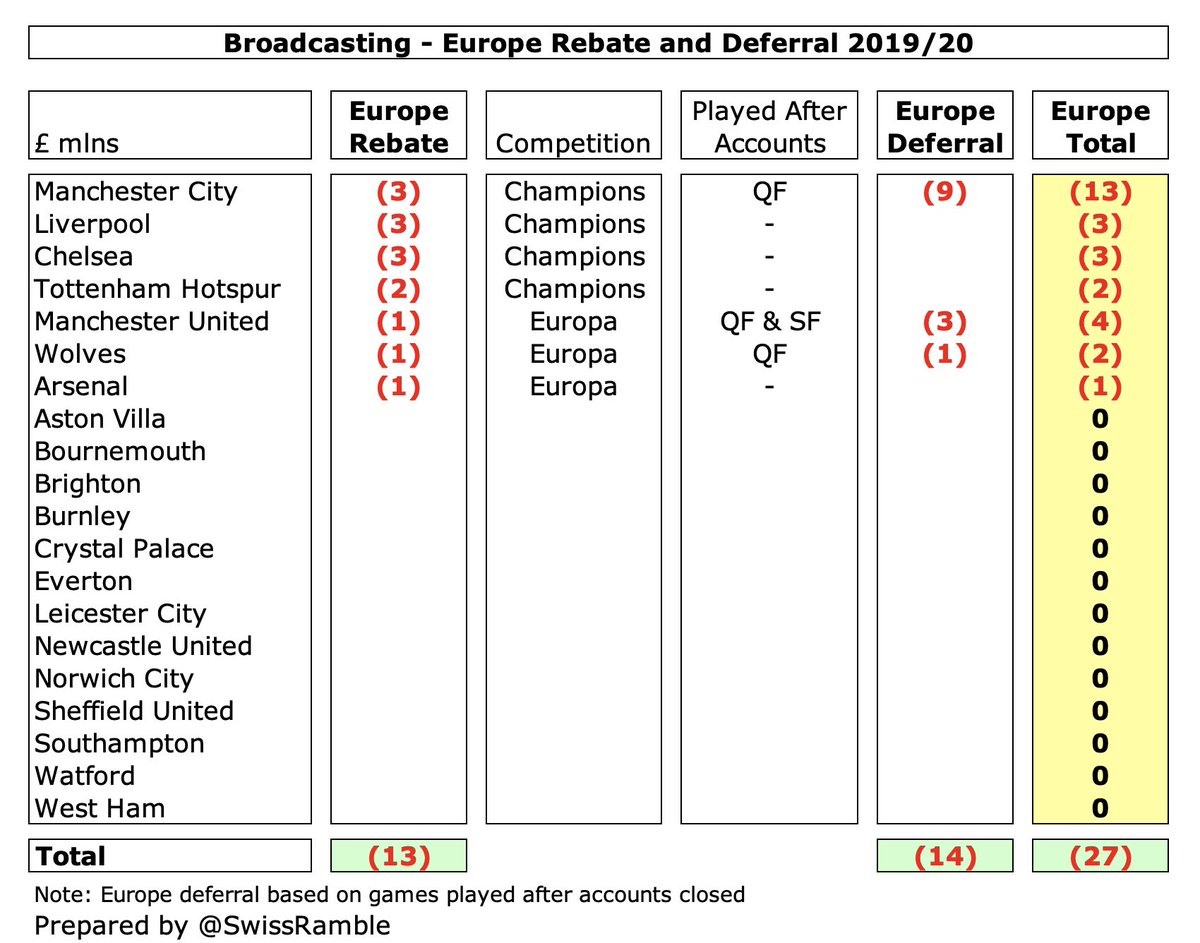

In addition, clubs that qualified for Europe had a reduction in TV money. There was a rebate of around 3% to broadcasters, while revenue for games played after the accounting close was deferred to 2020/21. In this way #MCFC had a £3m rebate with £9m revenue slipped to 2020/21.

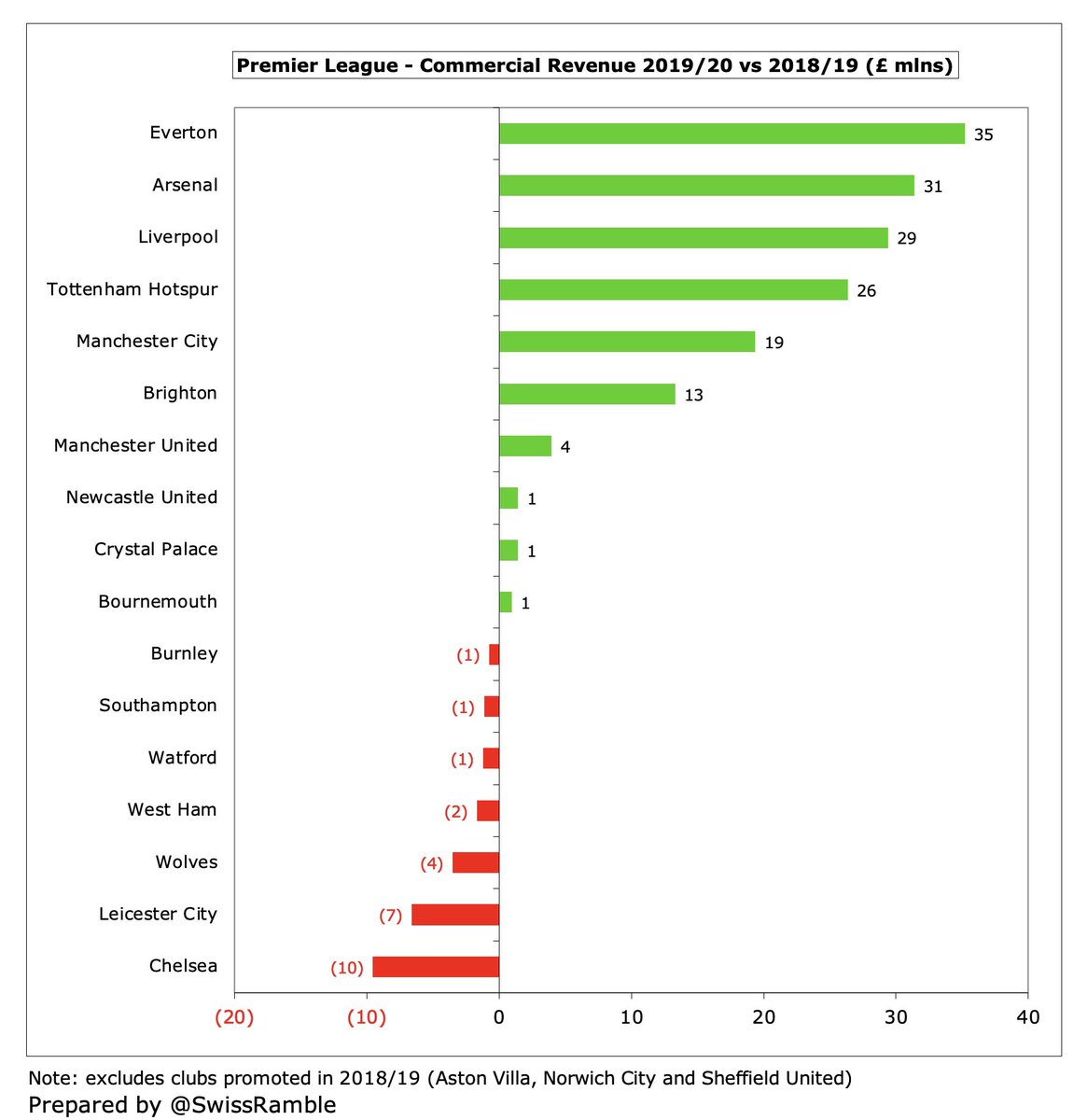

Commercial revenue increased at 10 Premier League clubs, led by #EFC £35m (once-off £30m USM payment for stadium naming rights option), #AFC £31m (new deals with Emirates and Adidas), #LFC £29m (sponsorship and merchandising uplift) and #THFC £26m (new stadium).

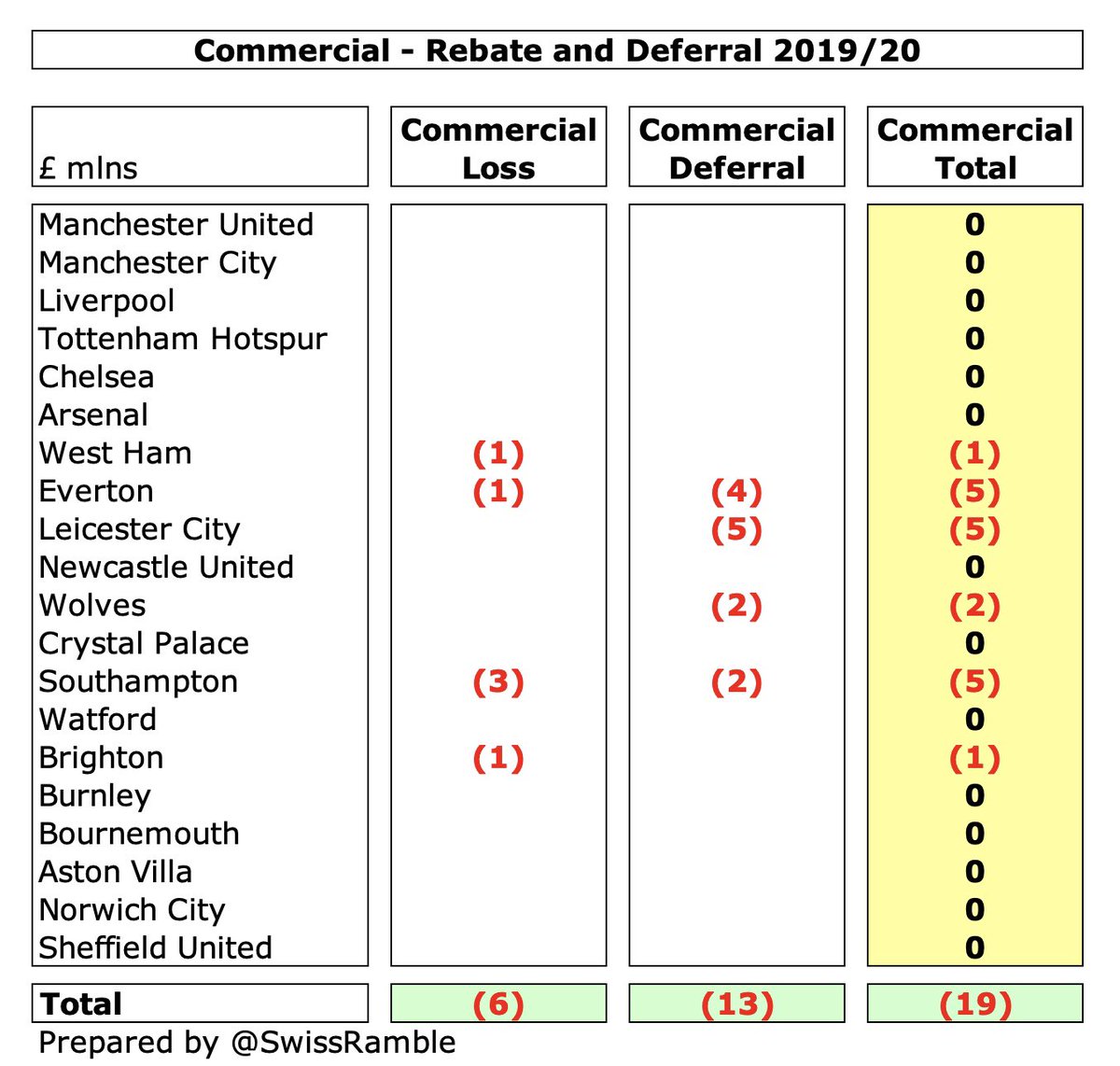

There was little COVID impact on commercial income in 2019/20, thanks to existing contractual arrangements, only amounting to £6m lost and £13m deferred. The effect is likely to have been much higher in the 2020/21 season, as sponsors also struggled in the pandemic.

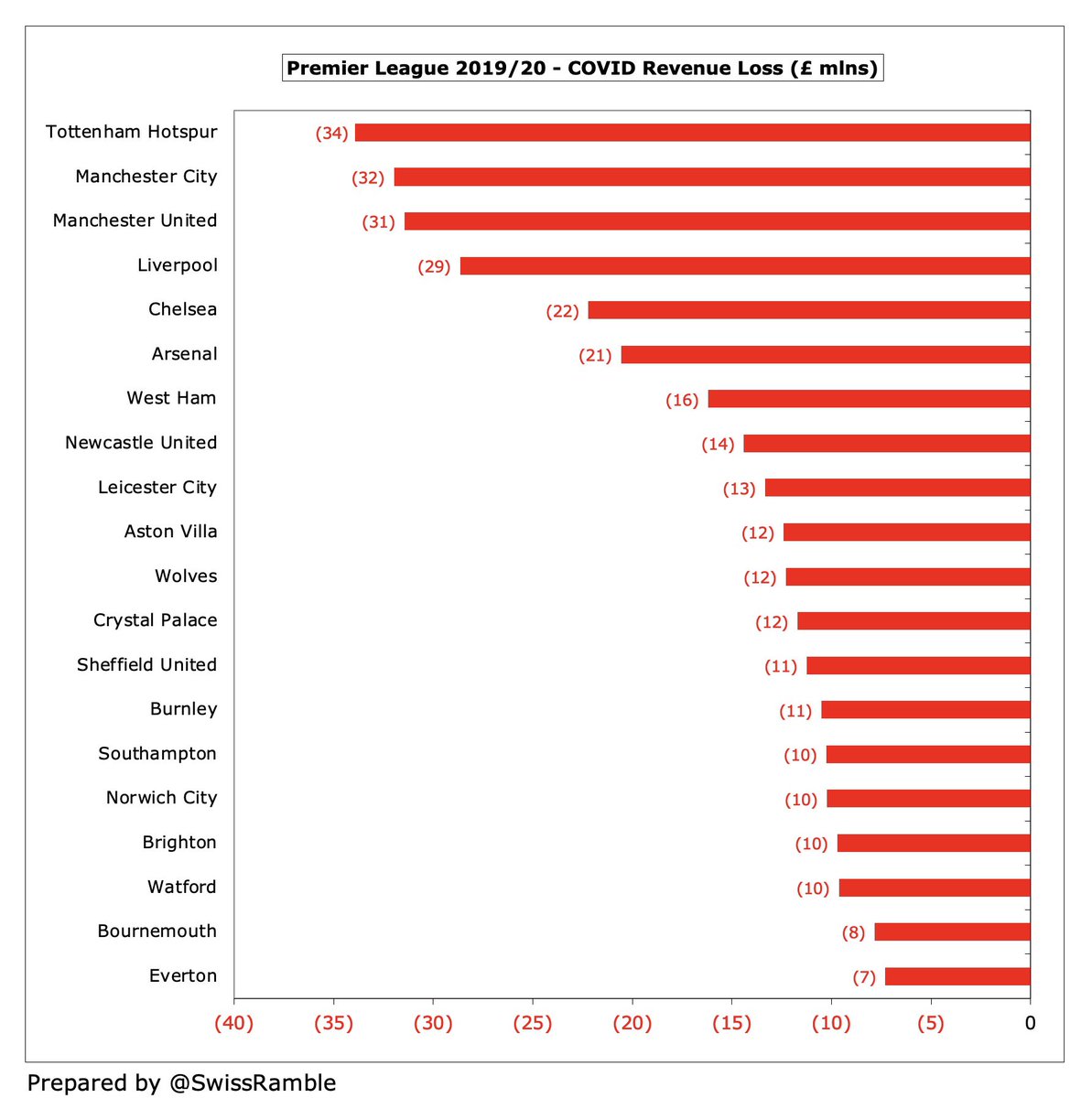

In total, I estimate that Premier League clubs lost £326m revenue due to COVID in 2019/20, split broadcasting PL £160m, match day £146m, TV Europe £13m and commercial £6m. Largest revenue losses were at #THFC £34m, #MCFC £32m, #MUFC £31m, #LFC £29m, #CFC £22m and #AFC £21m.

In addition, £410m of revenue has been deferred from 2019/20 to 2020/21 accounts. Six clubs will be boosted by more than £30m: #WWFC £46m, #AVFC £36m, #MCFC £35m, #LFC £35m, #AFC £34m and #LCFC £33m. However, 5 clubs have no deferred revenue, including #NUFC, #CPFC & #BurnleyFC.

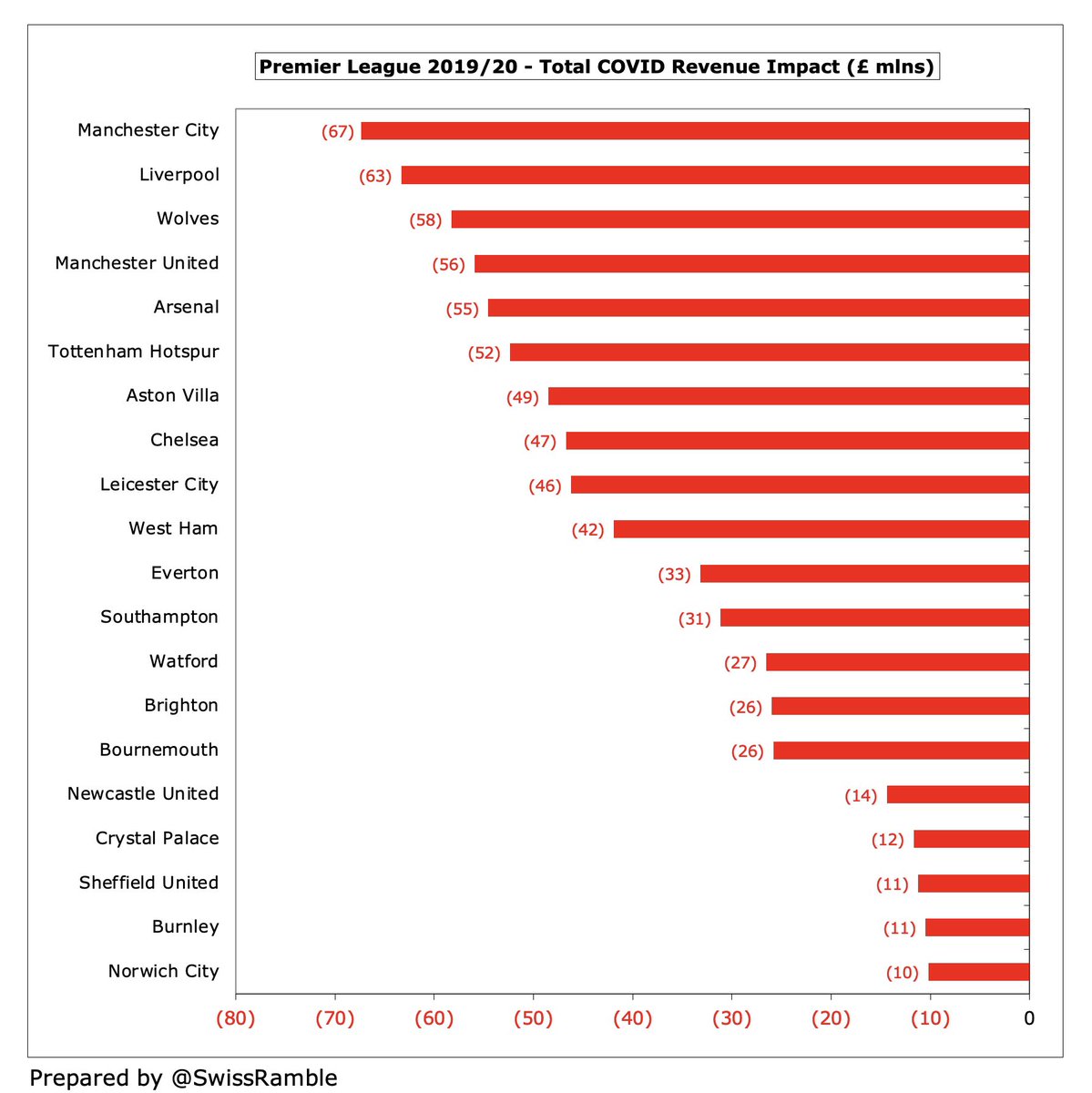

So the total revenue reduction from COVID in 2019/20 Premier League was £736m, split between £326m lost and £410m deferred to 2020/21. Six clubs saw their 2019/20 revenue reduce by more than £50m: #MCFC £67m, #LFC £63m, #WWFC £58m, #MUFC £56m, #AFC £55m and #THFC £52m.

If we add back the COVID impact, the 2019/20 revenue would increase £736m from £4,507m to £5,243m. Excluding the 3 promoted clubs, it would increase by £666m from £4,132m to £4,798m with 10 of the 17 clubs having year-on-year revenue growth.

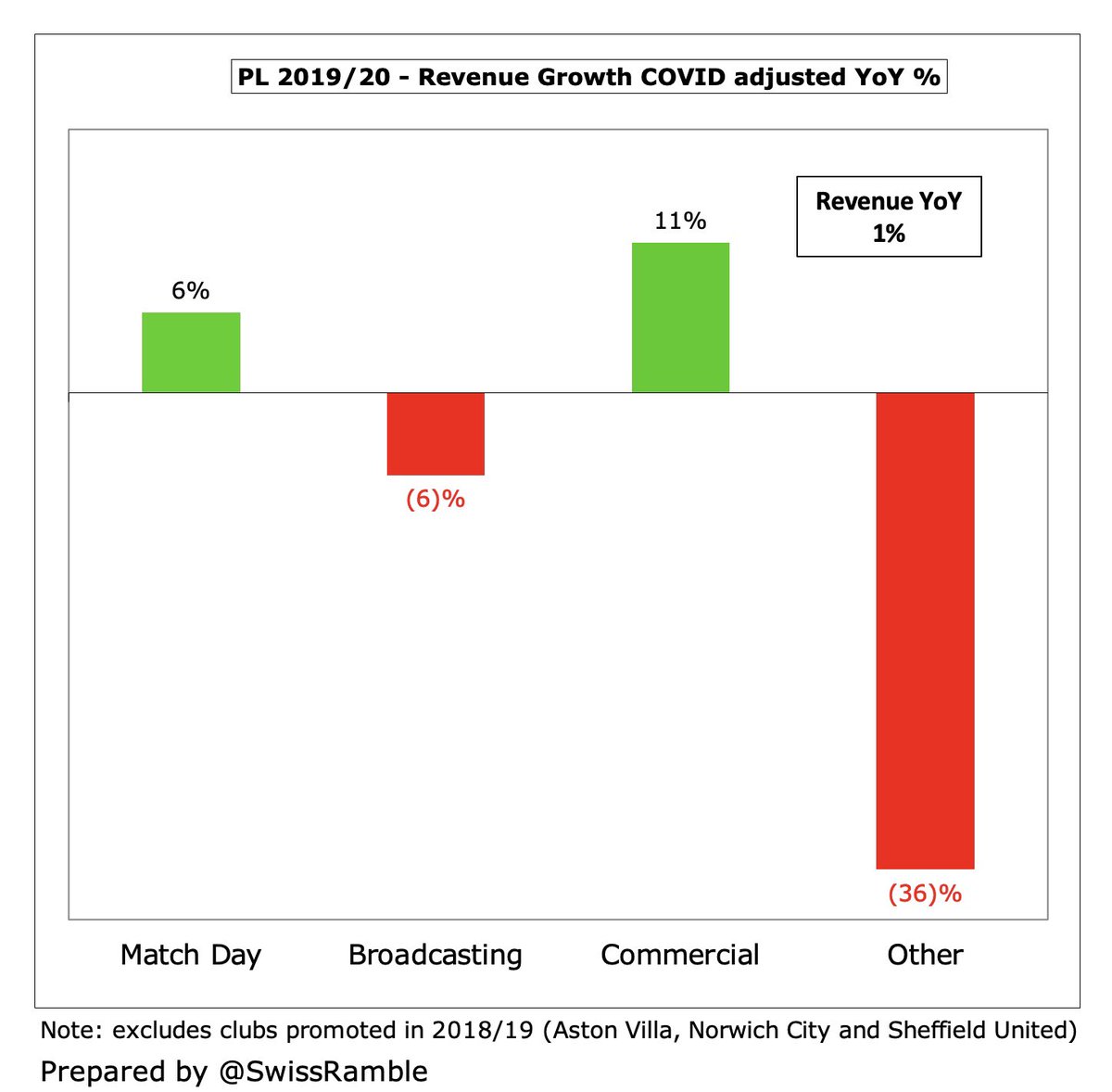

Excluding COVID, 2019/20 revenue would have grown £25m (1%) from £4,773m to £4,798m. Both commercial and match day rose, by £157m (11%) and £40m (6%) respectively, though broadcasting was down £171m (6%).

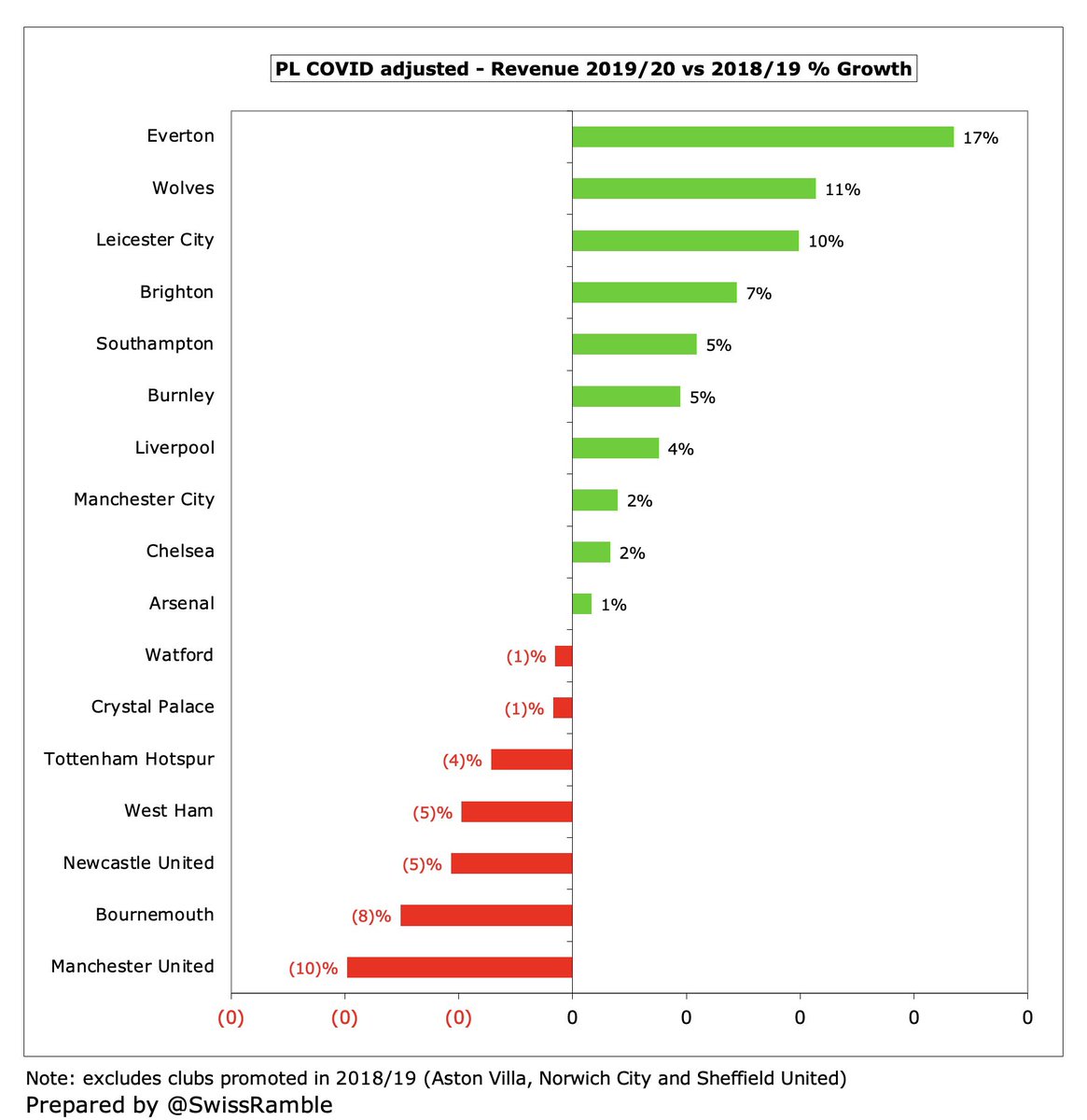

Without COVID, the highest year-on-year revenue growth was #EFC £31m (17%), followed by #LFC £20m (4%), #WWFC £18m (11%) and #LCFC £18m (10%). On the other hand, #MUFC would still have dropped £62m (10%), reflecting Europa League participation.

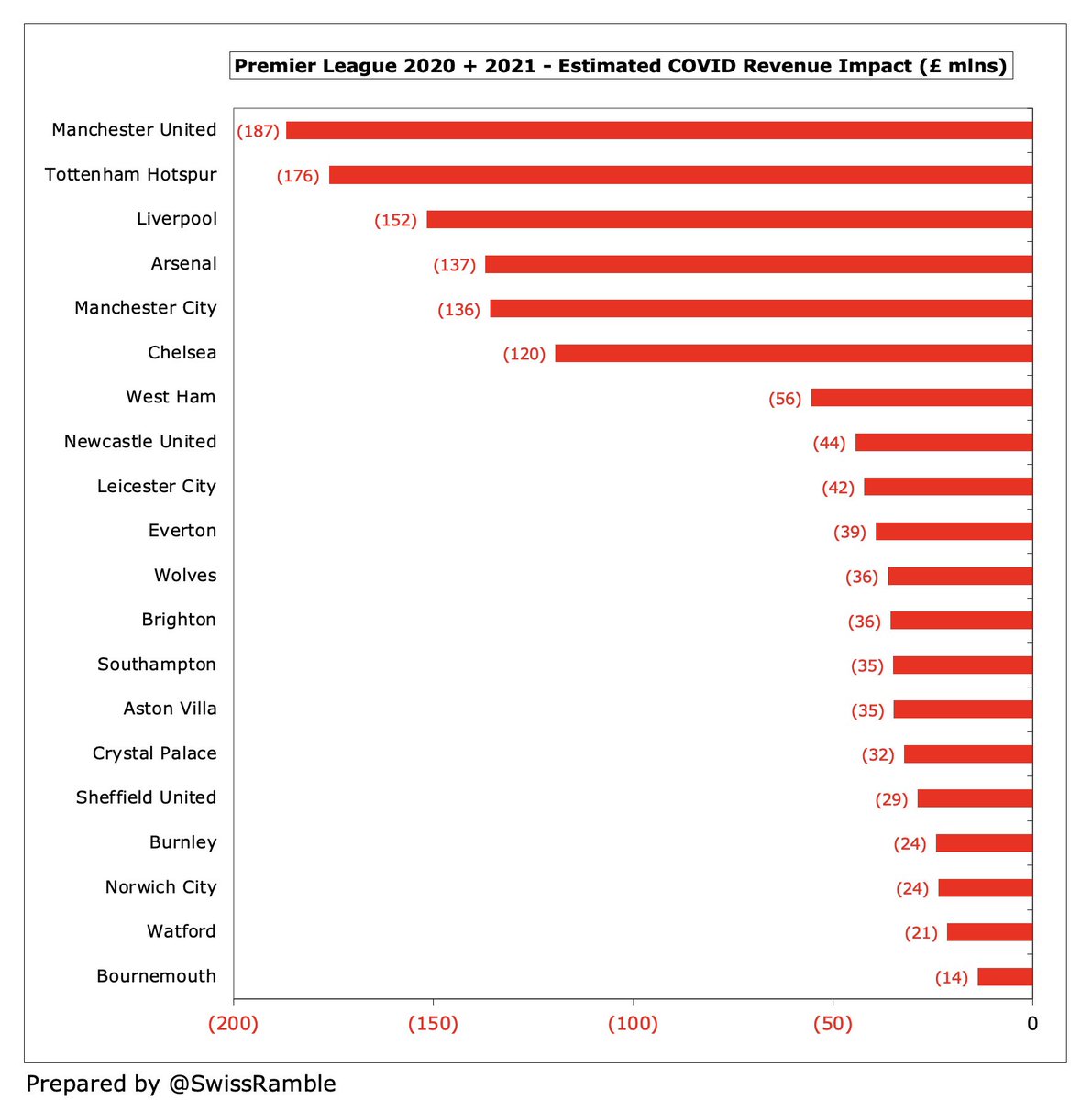

Of course, the COVID impact will have been much larger in 2020/21, as almost all games were played without fans. I have estimated £1,049m: (a) match day £698m (95% loss); (b) Premier League rebate £97m (media reports); (c) Europe TV £14m (rebate); commercial £240m (15% decrease).

Based on this model, 5 Premier League clubs will have lost more than £100m revenue due to COVID in 2020/21: #MUFC £155m, #THFC £142m, #LFC £123m, #AFC £116m and #MCFC £104m, with #CFC not far behind at £97m. Then, there is a big drop to #WHUFC £39m.

Much of 2020/21 COVID impact is driven by match day, as virtually the whole season was played behind closed doors, so clubs earning a lot from this revenue stream miss out the most, e.g. #THFC £111m (following move to new stadium), #MUFC £104m, #AFC £88m and #LFC £80m.

Similarly, the assumption that 15% of commercial revenue will have been lost in 2020/21 also means that clubs with high sponsorship, advertising and merchandising will lose more from COVID, e.g. #MUFC £42m and #MCFC £37m. In reality, impact likely to vary between clubs.

Part of the total £330m PL rebate to broadcasters was paid in 2019/20 with balance due to be split between 2020/21 and 2021/22. Estimate for 2020/21 is based on media reports with the amount of the rebate depending on league position. Highest are #LFC and #MCFC with £8m each.

UEFA TV money also impacted by COVID rebate to broadcasters, as matches were delayed and only one leg played in 2019/20 quarter-finals and semi-finals. This was 3.4% for the Champions League and 3.0% for the Europa League, so assumed same for 2020/21. Highest #CFC & #MCFC £4m.

Based on these assumptions, Premier League clubs will have lost £1.4 bln over past 2 seasons (2019/20 £326m, 2020/21 £1,049m), split between match day £844m, broadcasting £284m & commercial £246m. Excludes £410m revenue deferred from 2019/20, as this is only a timing difference.

Over the past 2 seasons, the largest estimated COVID loss was £187m at #MUFC; followed by #THFC £176m, #LFC £152m, #AFC £137m, #MCFC £136m and #CFC £120m. Maybe something for fans to consider when they agitate for their club to splash the cash to sign new players.

There is no doubt that COVID has had a major negative impact on revenue, though accounting technicalities (i.e. different year-ends) mean that clubs were affected to a greater or lesser extent in 2019/20 figures. In many cases, deferred revenue will enhance 2020/21 financials.

That said, the size of the PL losses really should give pause for thought, so I’ll say it again: £1.4 bln over the past two seasons. In that period, 6 clubs have lost more than £120m, Although losses are smaller outside the Big Six, they are still significant in percentage terms.

• • •

Missing some Tweet in this thread? You can try to

force a refresh