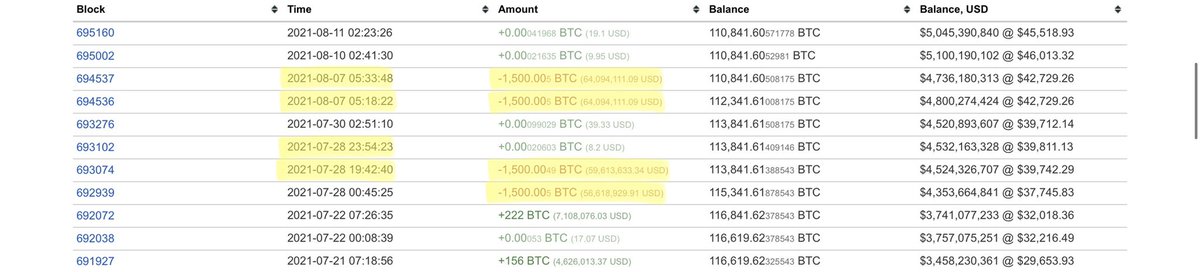

#BTC #bears can draw all the technical fractals they want. But one trend remains: LTHs are HODLing, Miners in aggregate continue to net accumulate, LTHs remain in profit, and cohorts older than 12 months have not sold this dip.

These cohorts all need to sell massive amounts of #BTC and start a trend of selling Onchain in order for BTC to start a bear market.

As of now, the trend shows continuing accumulation and HODLing.

As of now, the trend shows continuing accumulation and HODLing.

Yesterday #BTC miners sold 2833 BTC. This is nothing compared to the nearly 40,000 they sold in one day in late 2020. This entire year, miners reserves have been slowly trending higher. They hold 1.847 million BTC, the recent peak was 1.85 million.

• • •

Missing some Tweet in this thread? You can try to

force a refresh