#BTC #bulls have a much stronger thesis than the #BTC #bears. Bulls have solid data driven analysis confirming trends in real time. Bears are using technical charts that ignore Onchain conditions with little to no acknowledgement of what’s happening on the network.

THREAD TIME:

THREAD TIME:

I would like to make it clear, I acknowledge the #BTC #bear case, and it’s possible, but the current #bullish trending Onchain data, fundamental strength, and improving technicals make the bear case weak and less likely to occur.

The bears calling for a bull trap have almost no data driven analysis to back up their claims. Long term holders and entities holding older coins (which is majority of supply) are not selling, but are accumulating and holding. Yes they can sell, but we aren’t seeing that.

For the bears to be validated, we have to see long term holders, entities holding older coins, and large miners start dumping massive amounts of #BTC at once and start a selling trend Onchain.

This is not happening, as all these cohorts continue to #HODL and accumulate dips. The UTXO Age Distribution metric confirmed older coins were not sold during the 53k to 42.8k pullback. Instead, 3 to 6 month cohorts who bought between 50k to 64.8k panic sold the lows.

The problem with the bear thesis is the technical charts used mostly captured bull traps during bear markets where long term holders were dumping on rallies, forming lower highs and rejections at key resistance levels. Additionally aSOPR and LTH SOPR were below 1 (at loss).

During the May 2021 liquidation event where #BTC fell 55%, LTH SOPR remained above 1 the entire time, another data point showing this is not a bear market. @gaah_im

As @WClementeIII repeatedly mentions, this is known as whale exit liquidity, where whales holding older coins dump massive amounts of #BTC during bear market rallies causing Spent Output Age Bands spiking and forming a trending of selling.

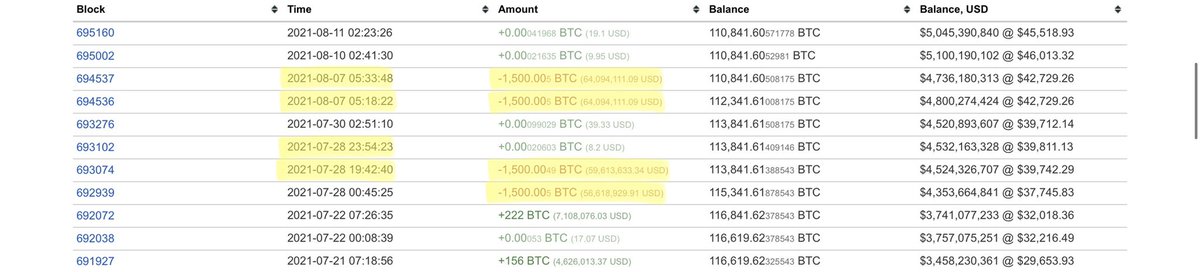

Although there was a recent spike in Spent Output Age Bands, it never turned into a trend, and fell back down. This directly correlates with older coins recently taking minor profit between 42k and 50k, then going back to accumulation.

This 19% has not impacted older coins and long term holders, they simply bought the dip while weak hands sold.

As of now, the Onchain data strongly suggests there are no signs of whale exit liquidity. Miners holding 1.84 million #BTC, LTHs, and older coins continue to hold (these entities hold majority of total #BTC supply).

I will not always be correct. I am open to having my #bull thesis invalidated only if the data confirms a bearish trend Onchain is forming, and technicals reach an invalidation point.

My #bull case will be invalidated if long term holders, large entities holding older coins, and large miners all sell at the same time forming a bearish Onchain trend of selling, along with price falling back below the 30k to 40k trading range.

This is possible and I remain open to this scenario as there is no 100% certainty in the markets.

I remain #bullish as long as the fundamentals, technicals, Onchain metrics, and momentum continue to show a #bullish trend for #BTC.

Trying to keep this thread quick and to the point: the #bull case is much strong than the #bear case simply because the Onchain data continues to show a bullish trend.

If all cohorts are in strong accumulation, Spot Exchange reserves are at multi year lows, and the majority of supply is held by entities who don’t want to sell at current prices, when the next wave of demand comes, price is likely to rise significantly.

Regardless of this pullback, I remain #bullish on #BTC and strongly believe, based on the data that #BTC remains in a #bull market, and this is just a shake out on the way to new all times highs.

• • •

Missing some Tweet in this thread? You can try to

force a refresh