With #DeFi heating up, more and more people are beginning to use #DEXs over traditional #CEXs🙌

However, some people are still confused about what a #DEX is and the different types that exist!

Here's a summary👇 #Thread

However, some people are still confused about what a #DEX is and the different types that exist!

Here's a summary👇 #Thread

#CEXs are often the place users go to buy their first #cryptocurrency 🪙

However, in order to use them, you must create an account on their website and send your money to them trusting that they will (hopefully🤞) send it back when you’re finished 😅

However, in order to use them, you must create an account on their website and send your money to them trusting that they will (hopefully🤞) send it back when you’re finished 😅

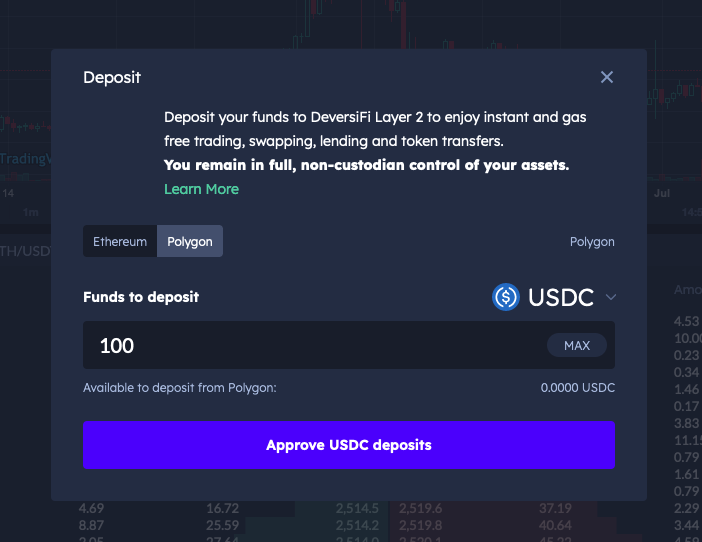

#DEXs exist on multiple blockchains, but the most popular ones are built on #Ethereum. Instead of creating an account to use them, you connect existing Ethereum wallets (such as @MetaMask) and then start making trades! 🙌

There are several different types of #DEX, which all work based on slightly different principles.

At their core, most DEXs are built with #smartcontracts, which ensure that trades take place only at the agreed price between the buyer and seller 💱

At their core, most DEXs are built with #smartcontracts, which ensure that trades take place only at the agreed price between the buyer and seller 💱

The three main types of #DEX are:

➡️ Automated-market-makers (#AMMs)

➡️ Order-books

➡️ Over-the-counter

➡️ Automated-market-makers (#AMMs)

➡️ Order-books

➡️ Over-the-counter

#AMMs are some of the easiest #DEXs to use and often have a wide range of #tokens available to trade 🚀

With AMMs, you are always able to make a trade, even if there is nobody who wants to make the opposite trade to you!

With AMMs, you are always able to make a trade, even if there is nobody who wants to make the opposite trade to you!

This is possible because there is a pool of funds that are always available within the protocol with the price set on basic supply and demand!

Each time someone sells some of token X, the price goes down 📉and equally, if they buy, the price goes up 📈

Each time someone sells some of token X, the price goes down 📉and equally, if they buy, the price goes up 📈

An order-book DEX instead contains many orders from different users all over the world. Each time someone wants to buy or sell a #cryptocurrency, their intent is added to a list, and if two people want to make opposing trades, they are matched together 🤝

Over-the-counter #DEXs are typically used for people who want to trade high-value assets and have already found someone else that they want to trade with 🚀

Both parties send their assets to the escrow agent & once the escrow has received both, they release the traded assets

Both parties send their assets to the escrow agent & once the escrow has received both, they release the traded assets

An over-the-counter DEX, therefore, automates the role of the escrow agent, only releasing the assets if both sides have provided them 🤝

Interested in the benefits of using a #DEX? Check out our latest blog post here👇

blog.deversifi.com/what-is-a-dex/

Interested in the benefits of using a #DEX? Check out our latest blog post here👇

blog.deversifi.com/what-is-a-dex/

• • •

Missing some Tweet in this thread? You can try to

force a refresh