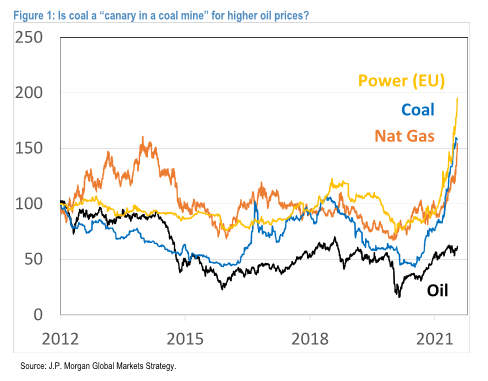

1) "Buy the dip (ex high-multiple tech), markets would be fine with $130 #oil and 250bp yields, #coal: canary in a coal mine?" Marko Kolanovic (JPM)

- adjusting for inflation etc. we think even with oil at $130 or $150 equity markets and ...

$SPY $QQQ $TLT $GDX #Commodities

- adjusting for inflation etc. we think even with oil at $130 or $150 equity markets and ...

$SPY $QQQ $TLT $GDX #Commodities

2) - we think markets can absorb higher rates, and we don’t expect a broad market selloff unless yields were to rise above 250-300 bps (US 10y), which we don’t foresee in the near term

Who am I do comment but bursting of the dotcom bubble was preceded by 6.8% 10Y, GFC was ...

Who am I do comment but bursting of the dotcom bubble was preceded by 6.8% 10Y, GFC was ...

3) preceded by 5.3%, and 3.2% caused a short but sharp bear market Q4 '18 (Powell panicked in just a few months).

Given leverage, duration, sensitivity to equities and populism today vs even a few years ago, not sure the box within which the Fed is "trapped" is as big as 2.5%.

Given leverage, duration, sensitivity to equities and populism today vs even a few years ago, not sure the box within which the Fed is "trapped" is as big as 2.5%.

• • •

Missing some Tweet in this thread? You can try to

force a refresh