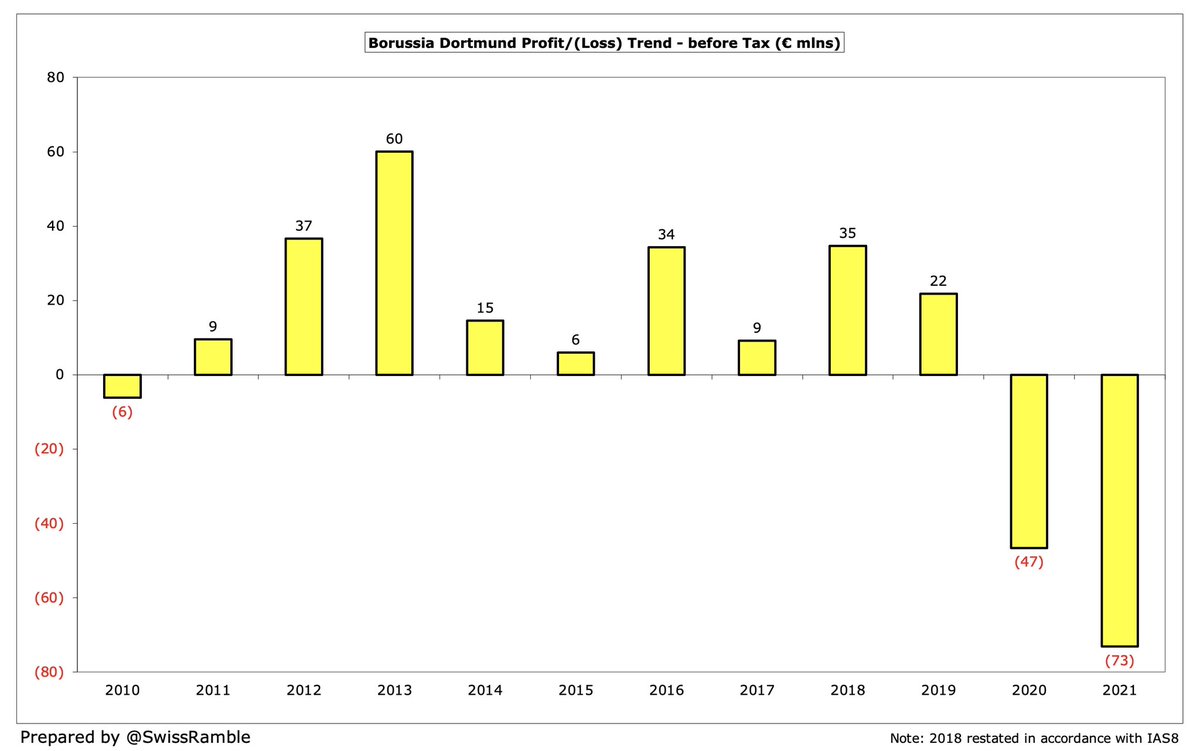

Borussia Dortmund 2020/21 accounts cover a season seriously impacted by COVID, when they finished third in the Bundesliga, won the DFB Cup and reached the Champions League quarter-finals. Head coach Lucien Favre was replaced by Marco Rose for 2021/22. Some thoughts follow #BVB

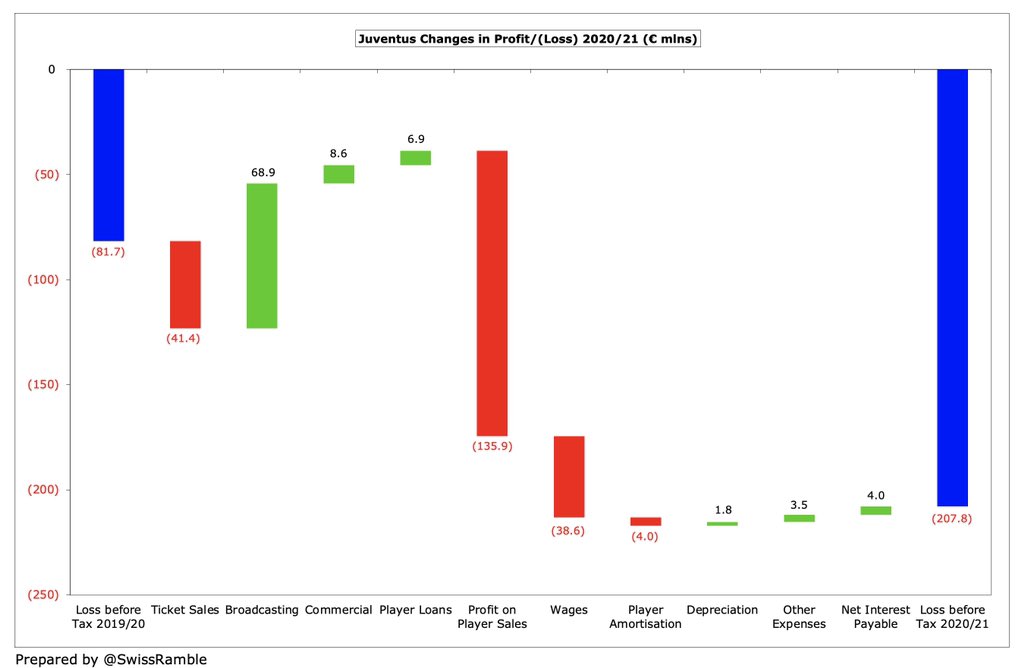

#BVB pre-tax loss widened from €47m to €73m, as revenue dropped €35m (9%) from €379m to €345m and profit on player sales fell €25m from €40m to €15m, partly offset by cutting operating expenses by €31m and net interest payable decreasing €2m.

#BVB €35m revenue fall was due to COVID driven reductions in match operations, down €32m (98%) to €1m, and commercial, down €21m (12%) to €147m. On the other hand, broadcasting rose €17m (10%) to €187m, mainly Champions League money, while other income was up €1m to €10m

As a technical aside, #BVB definition of operating proceeds, which includes €24m from player sales, but excludes €10m other operating income, fell a hefty €128m (26%) from €487m to €359m.

#BVB wage bill increased slightly by €1m to €216m, while player amortisation (including impairment) rose €5m (6%) to €97m. However, other expenses fell €36m (25%) to €105m, due to reduced match day & catering costs, plus lower commission from Sportfive marketing agreement.

#BVB €73m pre-tax loss is the highest in Germany, though it should be emphasised that these accounts are the first published for the 2020/21 season, so the only ones that include a full year of the pandemic. In 2019/20 eight of the 18 clubs lost more than €20m.

Clearly COVID has had a significant effect on #BVB finances. I estimate the revenue loss in 2020/21 to be around €64m (match day €32m, catering & hospitality €29m and UEFA TV rebate €3m). Without this impact, the revenue would have been €408m, a club record.

Although #BVB €73m loss is obviously not great, it is by no means the worst reported in the COVID impacted 2020/21 season, as it is “beaten” by many other leading European clubs, including Barcelona €481m, Inter €246m, Juventus €210m, #MUFC €105m and Milan €96m.

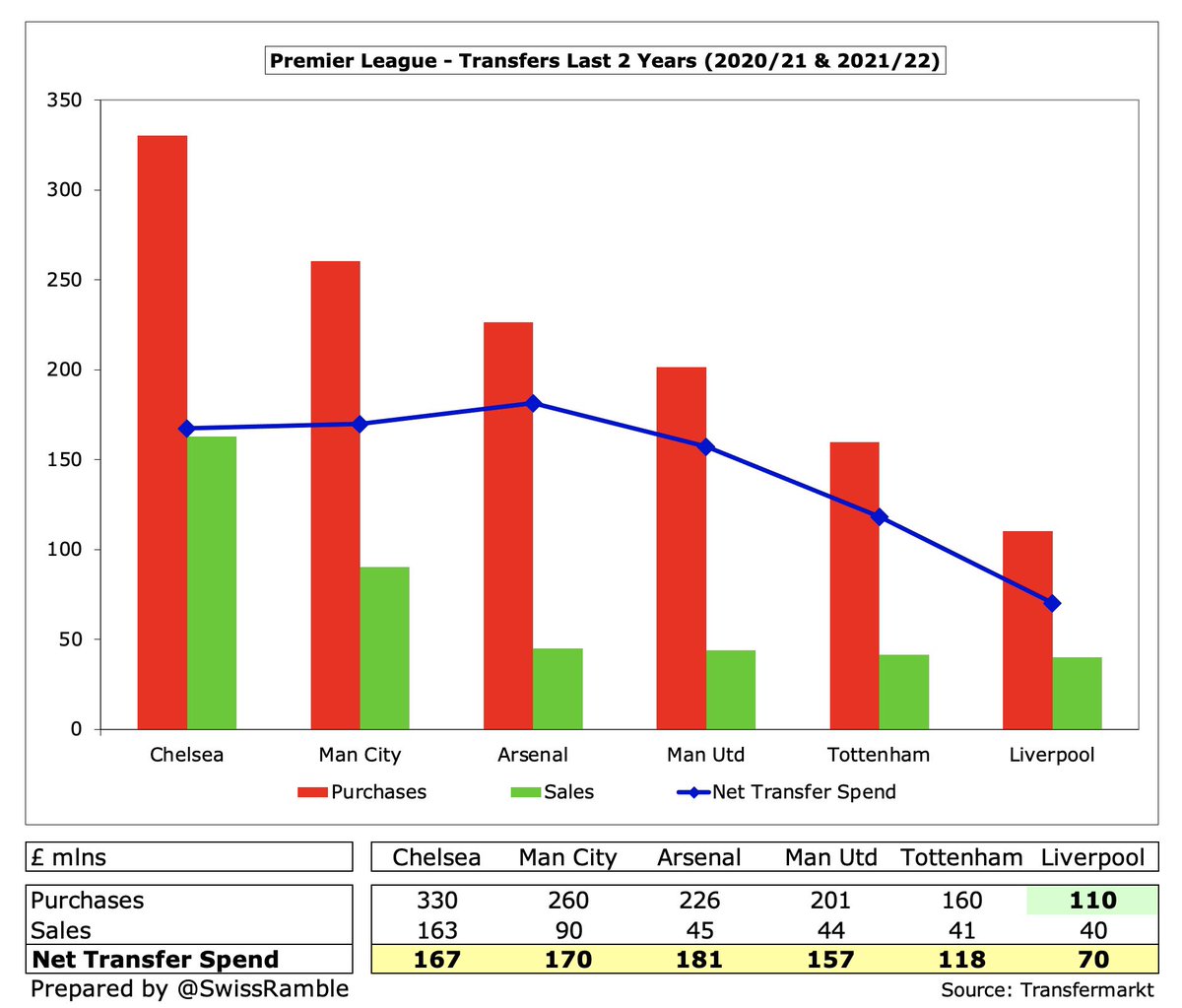

#BVB profit on player sales fell €25m from €40m to €15m with the only sizeable sale being Toprak to Werder Bremen. Jadon Sancho’s big money move to #MUFC cane after these accounts. Profits from this activity fairly low in last 2 seasons, e.g. Juve €167m & #CFC €163m in 2020.

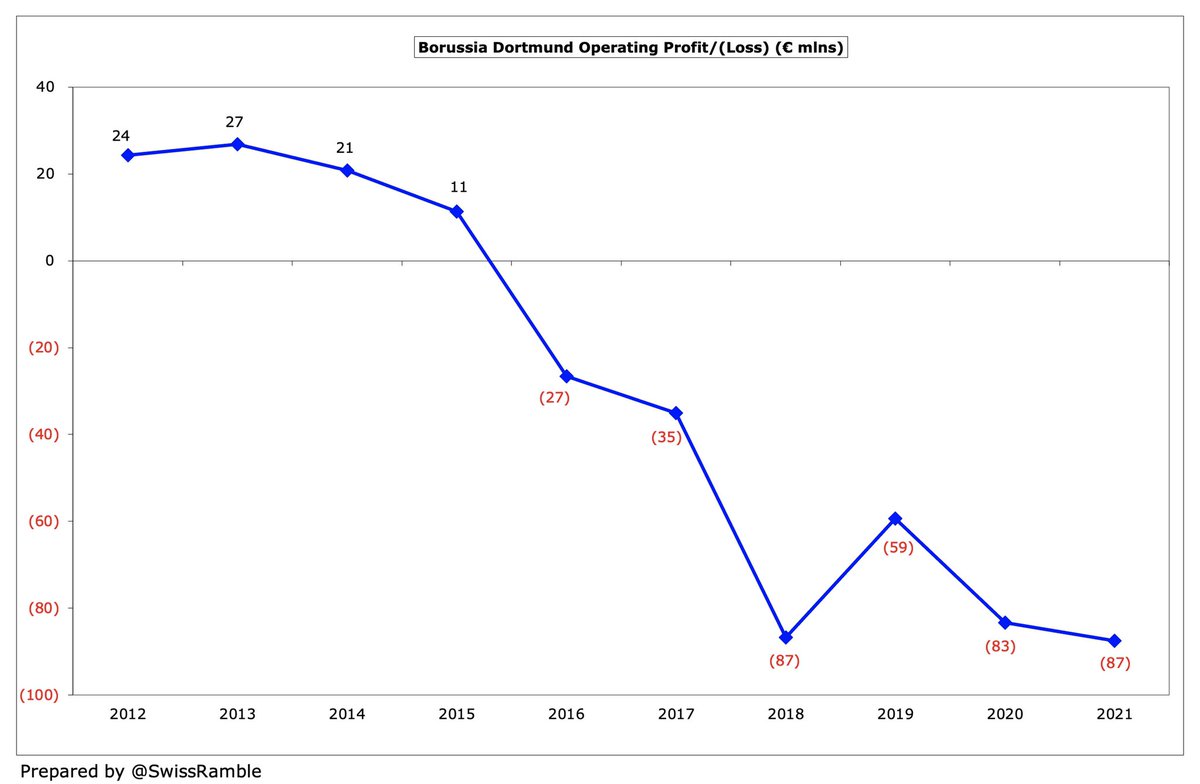

After nine consecutive years of profits, which generated €227m between 2011 and 2019, #BVB have now posted losses in each of the last two years, amounting to €120m. The board expects another net loss in 2021/22, albeit much lower (between €12m and €17m).

Despite the slowdown in 2021, transfer deals have become an important part of the #BVB strategy with €358m player trading profit in the 5 years up to 2020, one of the highest in Europe. COVID will “temporarily reduce transfer fees”, though Haaland would attract a decent offer.

#BVB EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), a measure of underlying profitability, rose slightly to €24m, which is on the low side for a leading European club. Including player sales, this has slumped from the €137m peak three years ago to €39m.

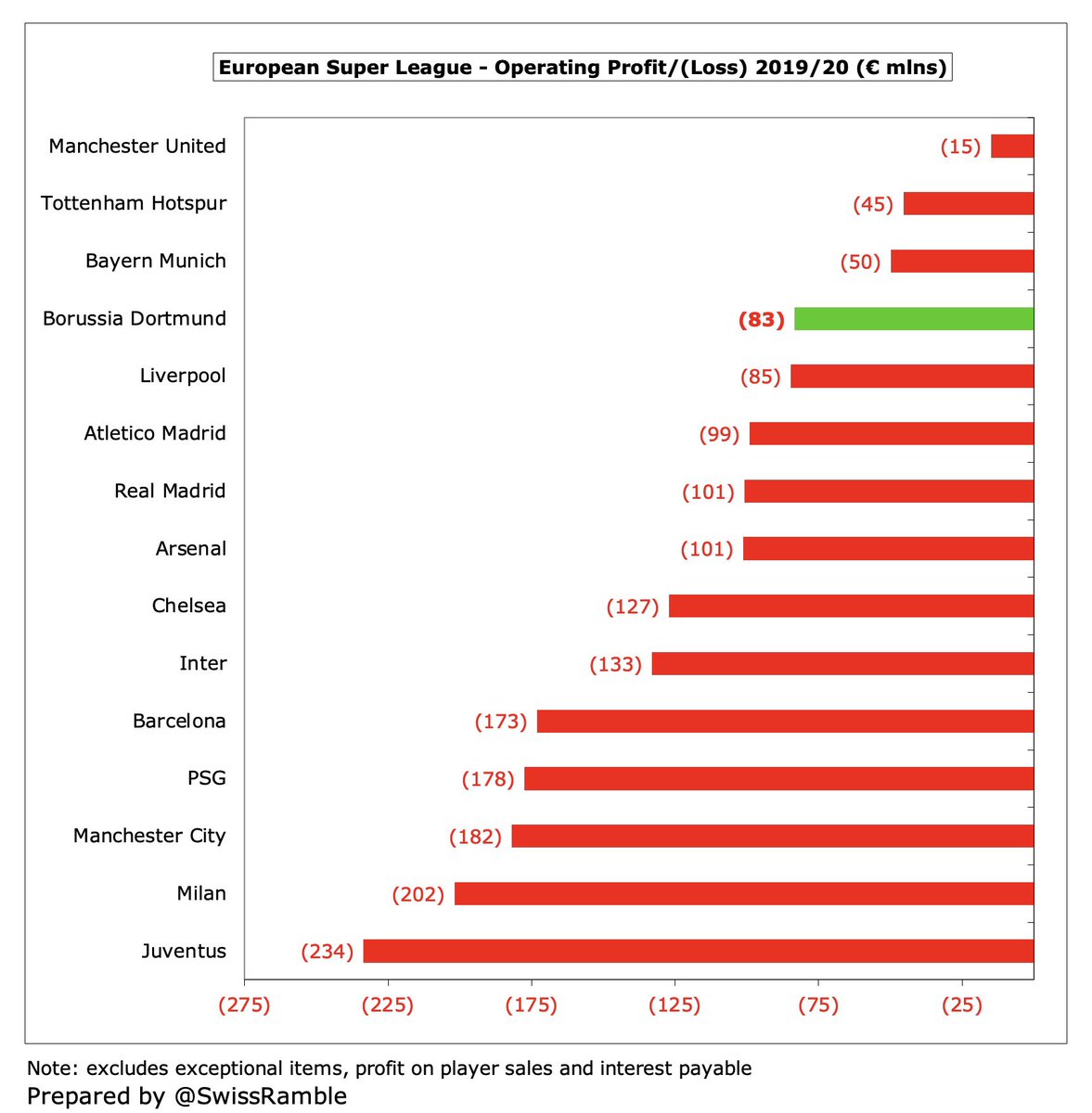

#BVB operating loss has been on a downward trend, falling to €87m in 2020, compared to €27m profit in 2013. That said, their €83m loss in 2019/20 was one of the smallest among the European elite, much better than the likes of Juventus €234m, Milan €202m and #MCFC €182m.

#BVB ongoing revenue has fallen by €33m (9%) in the last two years from €378m to €345m, very largely driven by match day, down to less than 1% of total revenue. The club definition of operating proceeds, including transfer income, has dropped €131m (27%) in this period.

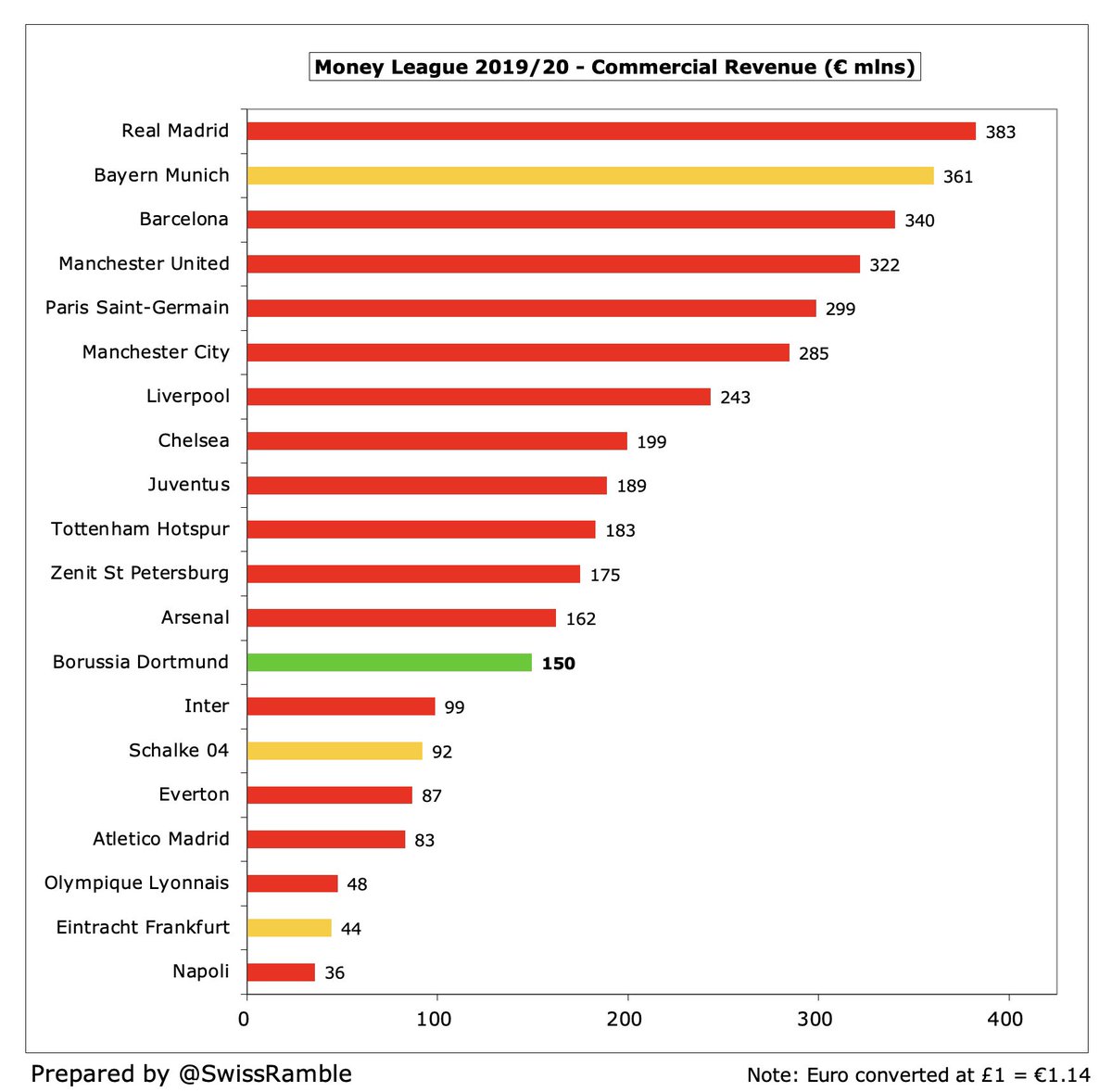

The revenue gap between #BVB and #FCBayern has narrowed in recent years, but was still €268m in 2020. Put another way, Bayern’s €634m revenue was 73% higher than Dortmund’s €366m (Money League figures), which is a huge difference between the first and second ranked clubs.

The Bundesliga releases figures for gross profit, which represents revenue (including transfer income) less cost of materials. This gives us some idea of the relative financial power of clubs with Bayern Munich leading the way €665m, followed by BVB €474m and RB Leipzig €325m.

For the 4th year in a row #BVB retained 12th place in the Deloitte Money League, based on €366m revenue in 2019/20, sandwiched between #AFC & Atletico Madrid. Four other German clubs in top 30: Bayern €634m, Schalke €223m, Eintracht Frankfurt €174m and Mönchengladbach €168m.

However, it should be noted that German clubs benefited from the Bundesliga completing its 2019/20 season before end-June, so all TV payments were booked in that season, while others (Premier League, Serie A & La Liga) had to recognise revenue over two seasons.

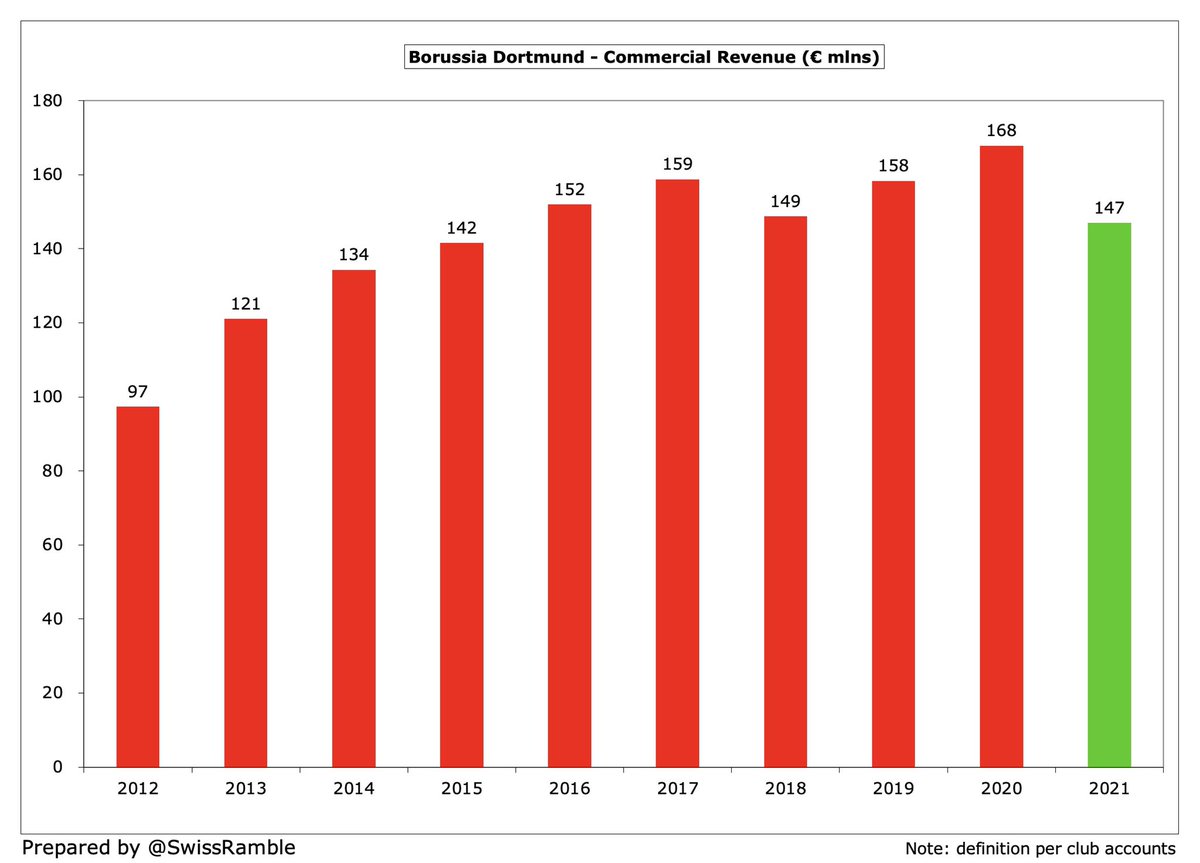

#BVB commercial income fell €21m (12%) from €168m to €147m, the lowest since 2015, due to COVID restrictions on advertising, hospitality, conference & catering, partly offset by higher sponsorship deals. Dortmund relatively low in Europe, more than €200m less than Bayern.

In 2020/21 #BVB shirt sponsorship increased from €20m to combined €35m up to 2025 (1&1 – Bundesliga; Evonik – Europe and DFB Cup), while Puma kit deal was extended to 2028 at €31m (triple previous €10m). Also €9m Opel sleeve sponsor & €6m Signal Iduna stadium naming rights.

#BVB broadcasting revenue rose €17m (10%) from €170m to €187m, a club record for this revenue stream, mainly due to UEFA TV money, up €11m to €79m, and DFB Cup, up €5m to €10m. Bundesliga income flat at €98m. In top 10 in Europe in 2020, but €33m lower than Bayern €203m

Bundesliga TV money distribution uses 4 criteria: 5-year league performance ranking (70%); 5-year ranking for both divisions (23%); 20-year ranking (5%); and playing time of Germany U23s (2%). In 2020/21 #BVB received €95m per media reports, second only to Bayern €105m.

The new Bundesliga domestic 4-year TV deal from 2021/22 will be 5% lower than current deal, though BVB said this represented a good outcome in the circumstances. Total €1.4 bln still third best in Europe, though a long way below Premier League €3.6 bln and La Liga €2.0 bln

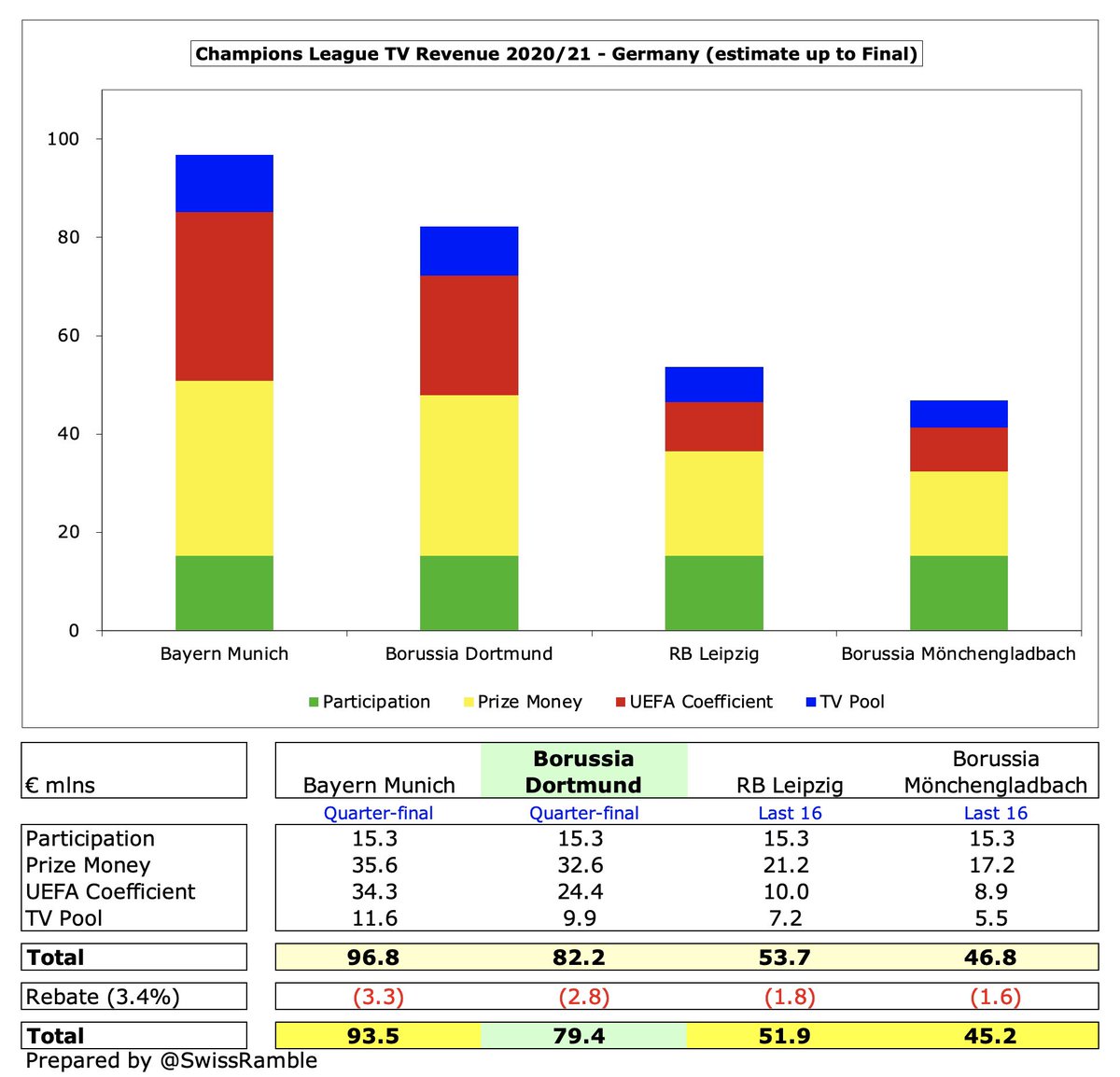

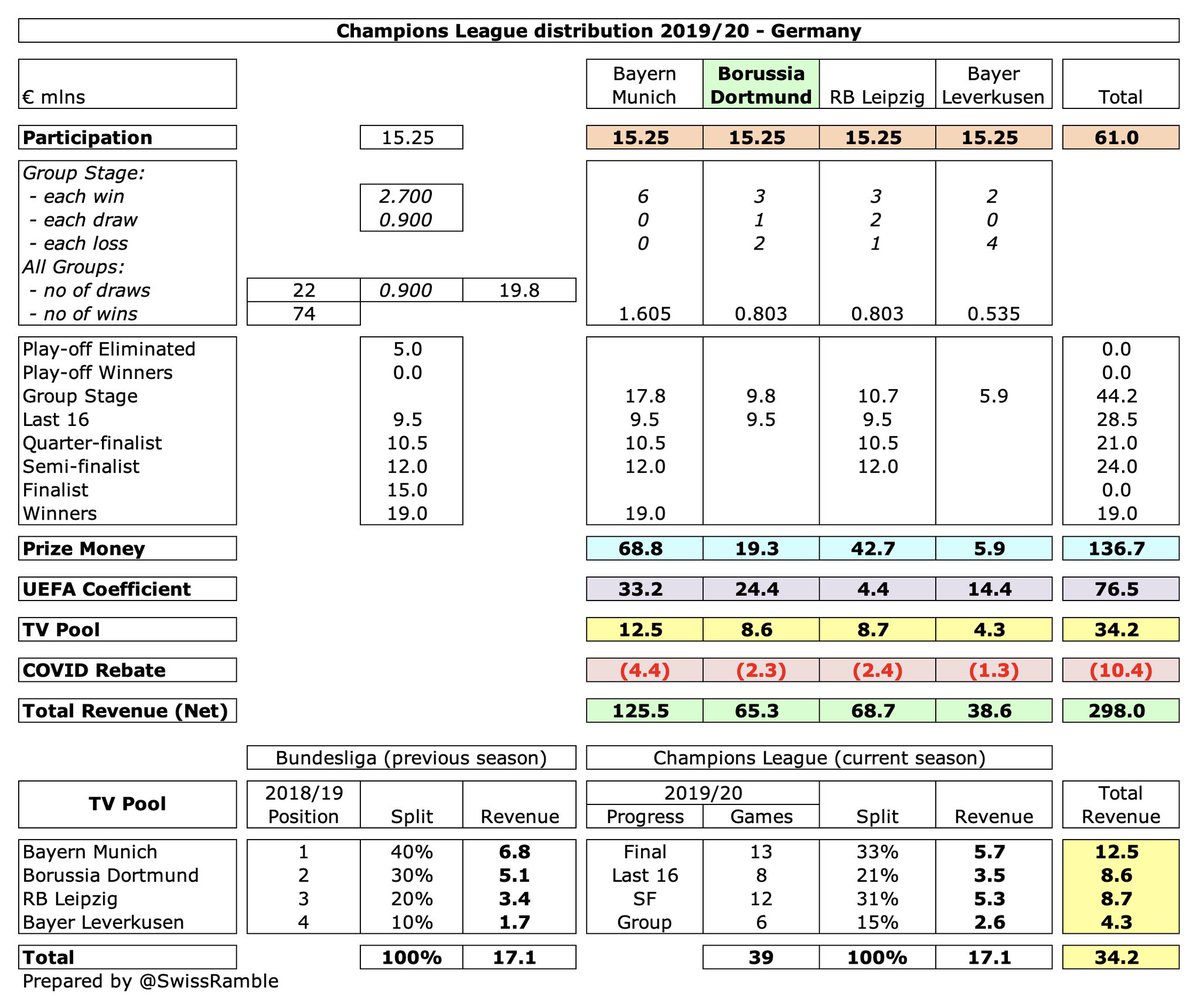

Based on my estimate, #BVB earned €79m from the Champions League after reaching the quarter-finals, €14m more than prior season’s €65m (for last 16). Below Bayern’s €93m, but ahead of RB Leipzig €52m and Mönchengladbach €45m. Figures are net of 3.4% COVID rebate.

Worth noting the influence on Champions League money of UEFA coefficient payment (based on performances over 10 years), where #BVB had 11th highest ranking of clubs competing last season, giving them €24m (Bayern €34m, Leipzig €10m and Mönchengladbach €9m).

#BVB have earned a hefty €294m from European competition in the last 5 years, much less than Bayern Munich €427m, but a fair way above RB Leipzig €171m, Leverkusen €111m and Mönchengladbach €86m. From 2021/22 the German TV rights will be 70% higher (DAZN, Amazon & ZDF).

#BVB match operations income fell €32m (98%) to less than €1m, as all home games were played behind closed doors (except three with significantly restricted crowds). This revenue stream was as high as €45m two years ago pre-COVID.

Based on Deloitte’s definition of match day revenue, #BVB had the 13th highest revenue in the Money League with €46m in 2019/20, a fair way below Bayern Munich €70m, but ahead of Eintracht Frankfurt €39m and Schalke 04 €36m.

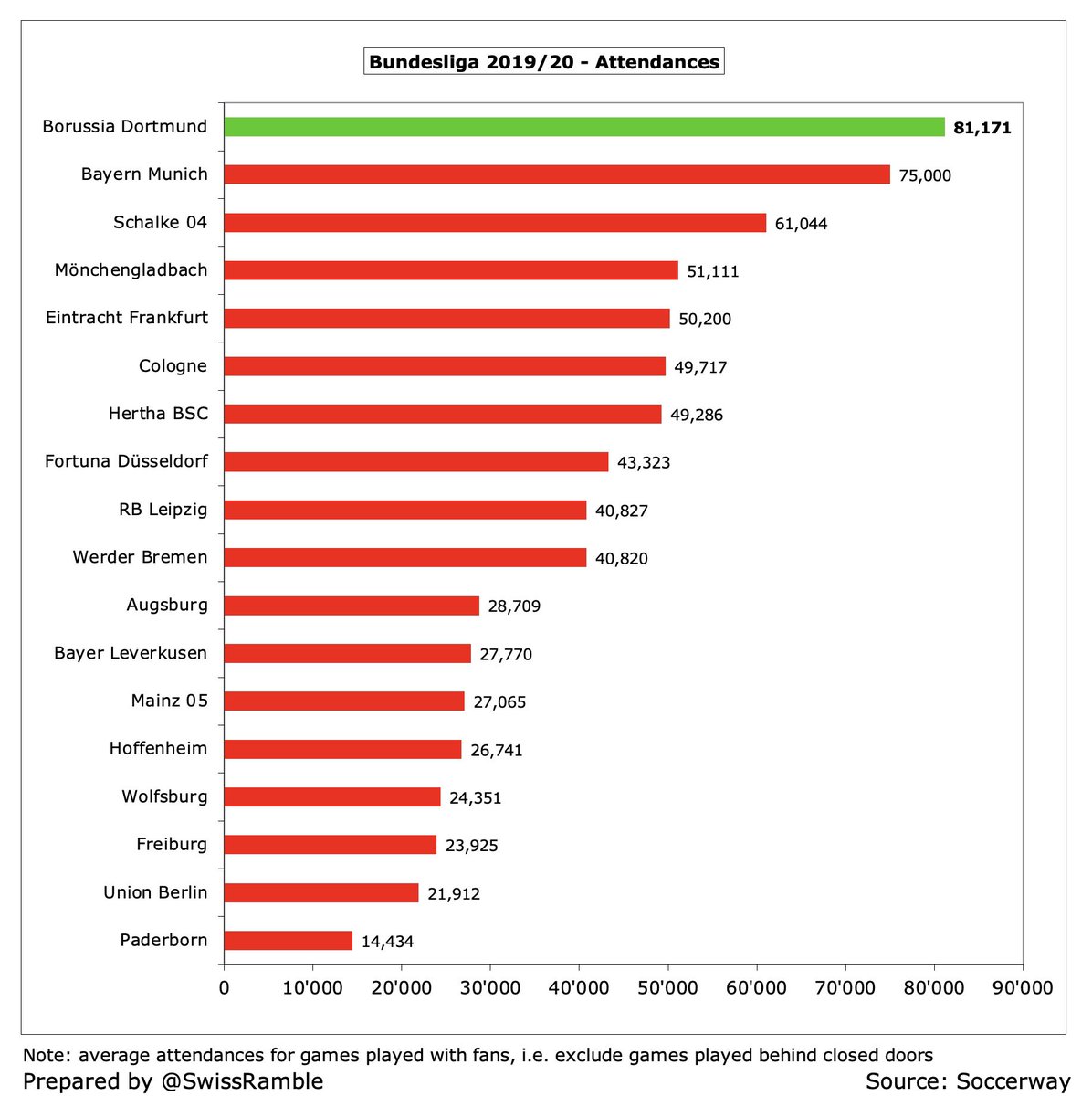

#BVB have the highest crowds in Germany (81,000), so will be happy that stadiums have re-opened this season, initially at 50% capacity (capped at 25,000), but from 1st October Dortmund will be allowed 67,028 fans (100% of 52,692 seats plus 50% of 28,673 standing places).

#BVB wage bill increased slightly by €1m to €216m, which is the club’s highest ever, despite some salary cuts due to COVID. Wages have grown by almost €100m since €118m in 2015, though the gap to Bayern Munich (€340m) was still a substantial €125m in 2020.

That said, #BVB €216m wage bill is significantly higher than the rest of the Bundesliga with the closest clubs being nearly €70m lower: RB Leipzig €147m, & Bayer Leverkusen €140m. However, a fair bit less than European peers, e.g. Barcelona €443m, PSG €414m & #MCFC €401m.

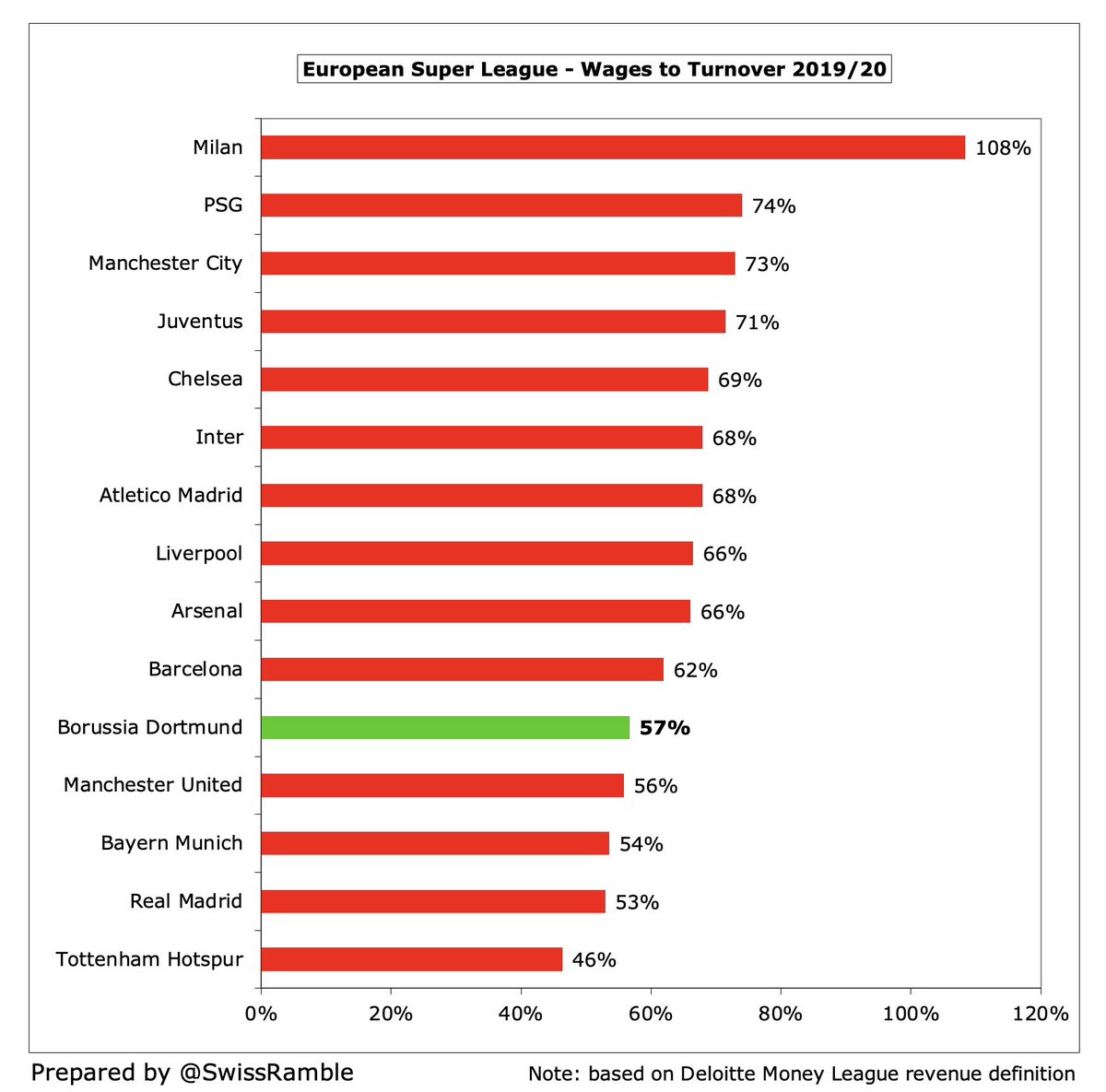

#BVB wages to turnover ratio increased from 57% to 63%, obviously impacted by COVID revenue losses. In a normal year Dortmund’s ratio would be one of the lowest (best) in Europe, e.g. in 2019/20 this metric was about the same as #MUFC.

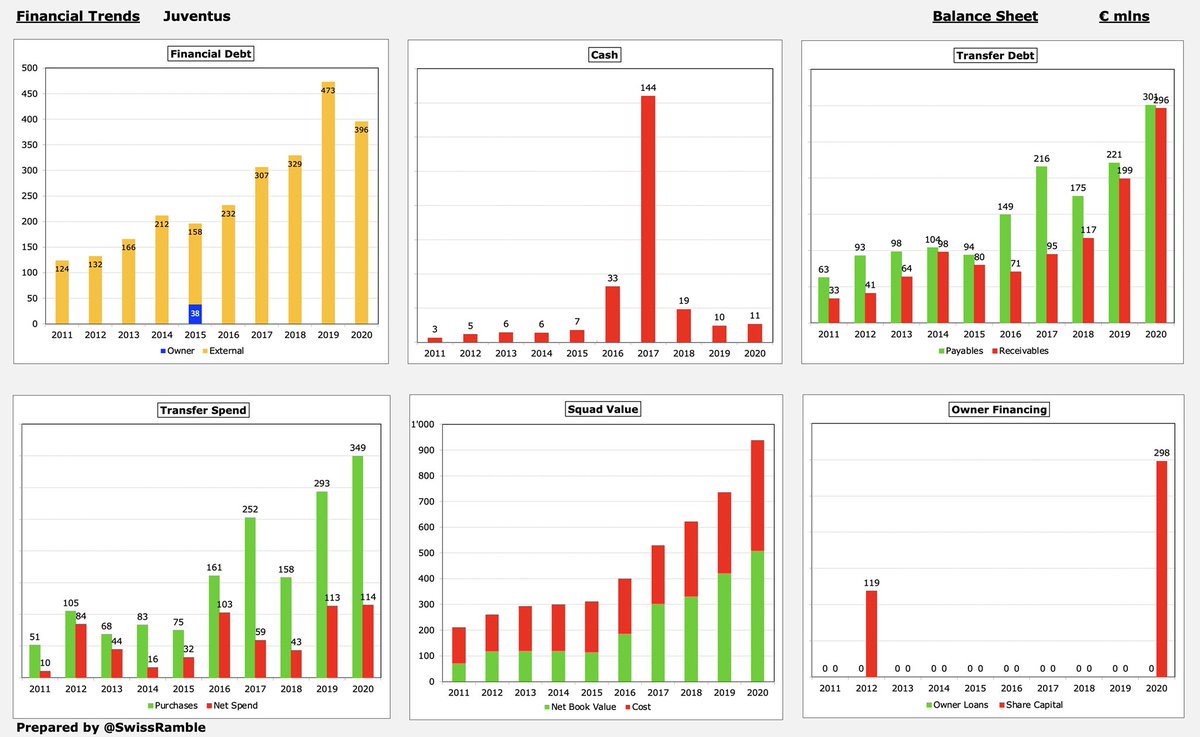

#BVB player amortisation, the annual cost of writing-off transfer fees, rose €4m (5%) to €93m, while the club also booked €5m player impairment. In fact, this (non-cash) expense has nearly tripled from €32m in 2016, reflecting the significant investment in the squad.

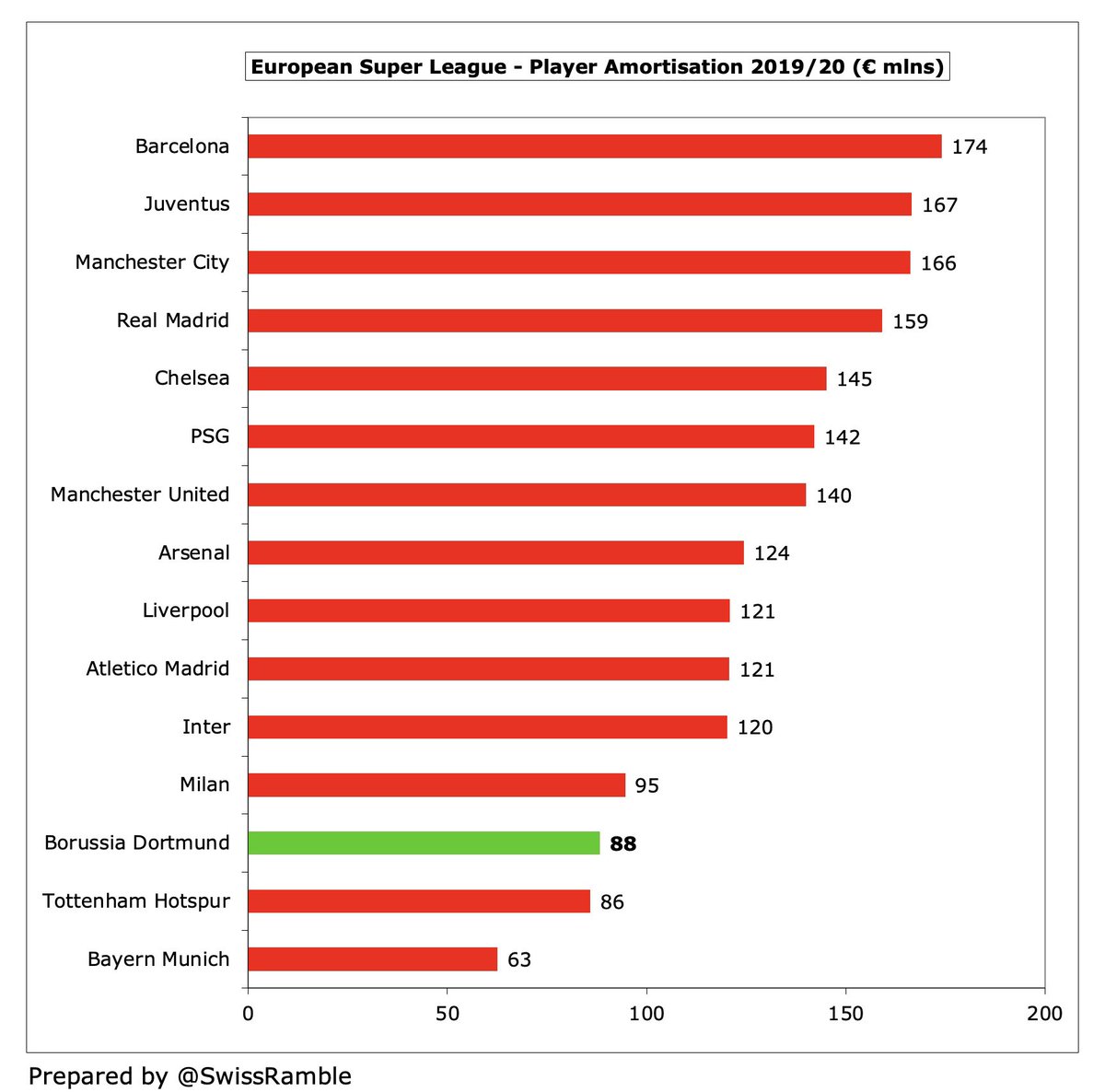

#BVB €111m for combined player amortisation and depreciation is highest in Germany, ahead of Bayern €91m & RB Leipzig €76m. However, for more perspective, big spending European clubs are much more for player amortisation alone: Barcelona €174m, Juventus €167m & #MCFC €166m.

#BVB are currently following “a rather passive transfer policy” due to COVID, hence a fall in player purchases to only €59m in 2021. However, their gross spend in last 5 years was €681m, significantly more than €195m in preceding 5-year period. Net spend 2017-21 was €251m.

Based on Transfermarkt, #BVB player sales proceeds in last decade have added up to €870m with half coming from just 6 transfers: Dembélé to Barcelona €135m, Sancho to #MUFC €85m, Pulisic to #CFC €64m, Aubameyang to #AFC €64m, Mkhitaryan to #MUFC €42m & Götze to Bayern €37m

As a result, #BVB had the highest net sales in the Bundesliga over the last five seasons with €181m in contrast to Bayern €193m net spend, though they did have the highest gross spend of €442m, ahead of Bayern €386m and RB Leipzig €371m.

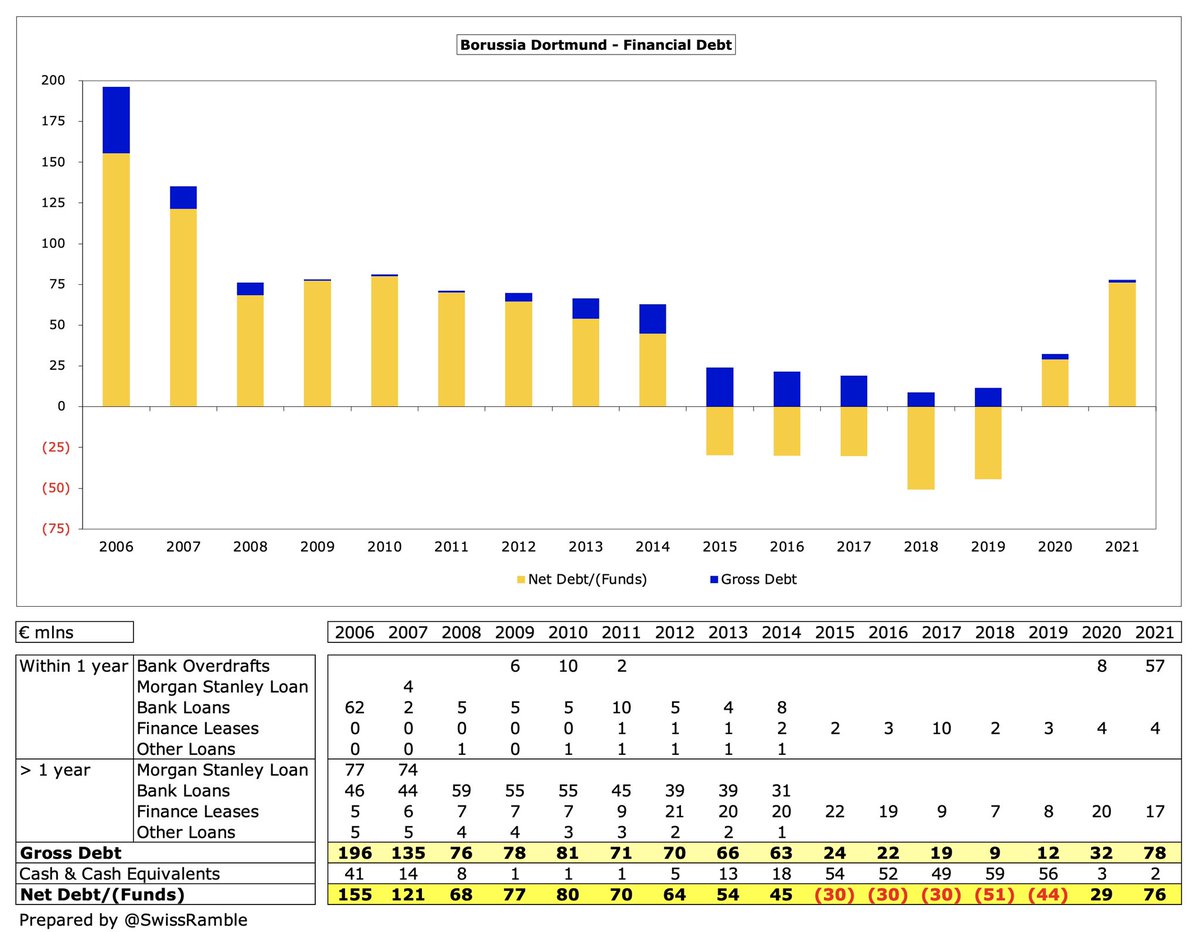

#BVB financial debt rose €46m to €78m, comprising €57m bank overdraft and €21m finance leases. However, Dortmund have done very well to reduce their gross debt from €196m in 2006.

In the prior season #BVB debt of €32m was one of the lowest in all of Europe, miles below other leading European clubs, e.g. #THFC €947m, #MUFC €599m, Barcelona €480m and Inter €411m. As CEO Watzke said, “This shows that BVB has great economic strength and is very stable.”

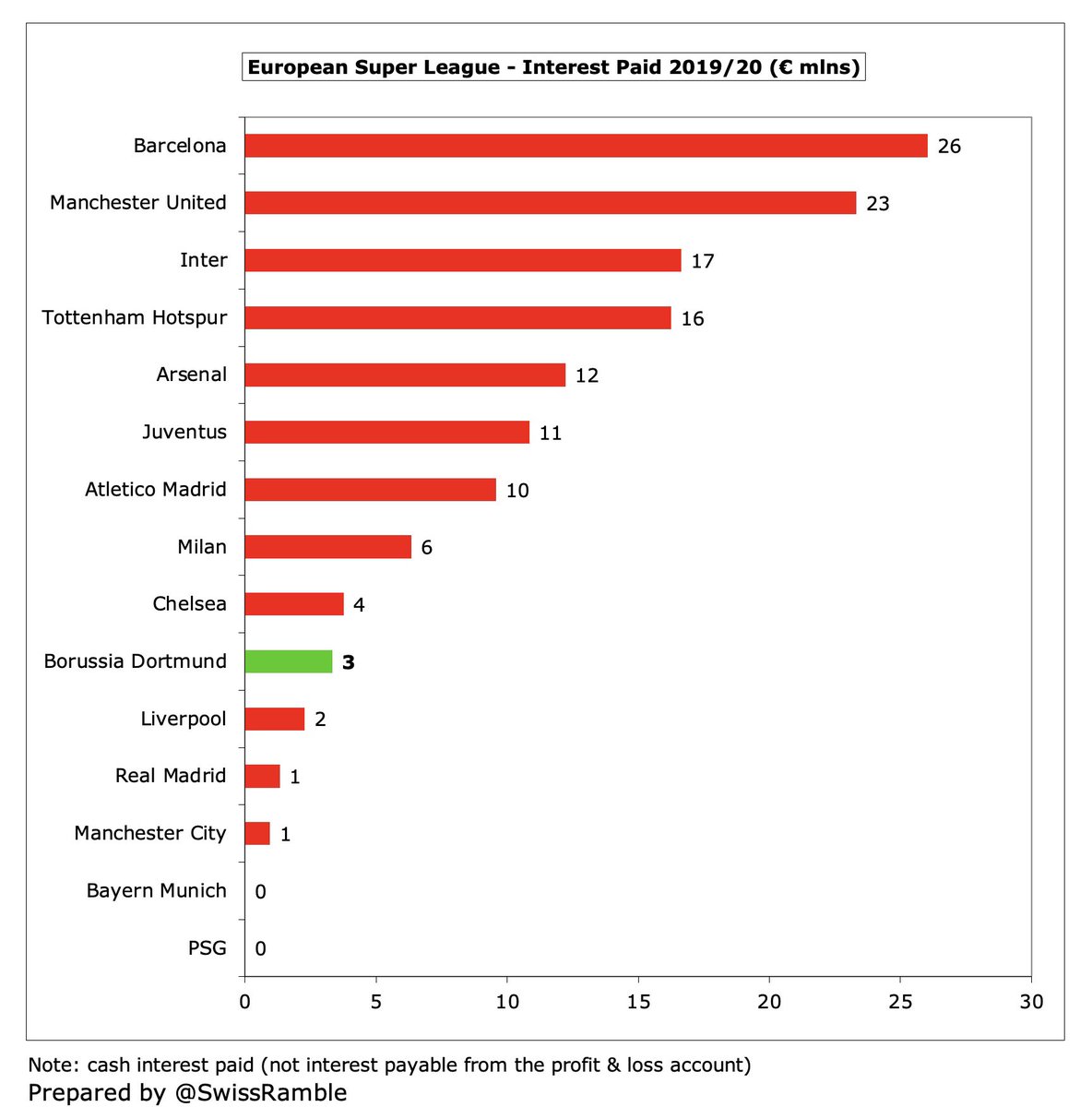

#BVB interest paid has been cut from €7.4m in 2015 to only €1.4m, down from €3.3m in 2019/20. In stark contrast to Dortmund, some clubs had much higher payments: Barcelona €26m, #MUFC €23m, Inter €17m, #THFC €16m, #AFC €12m and Juventus €11m.

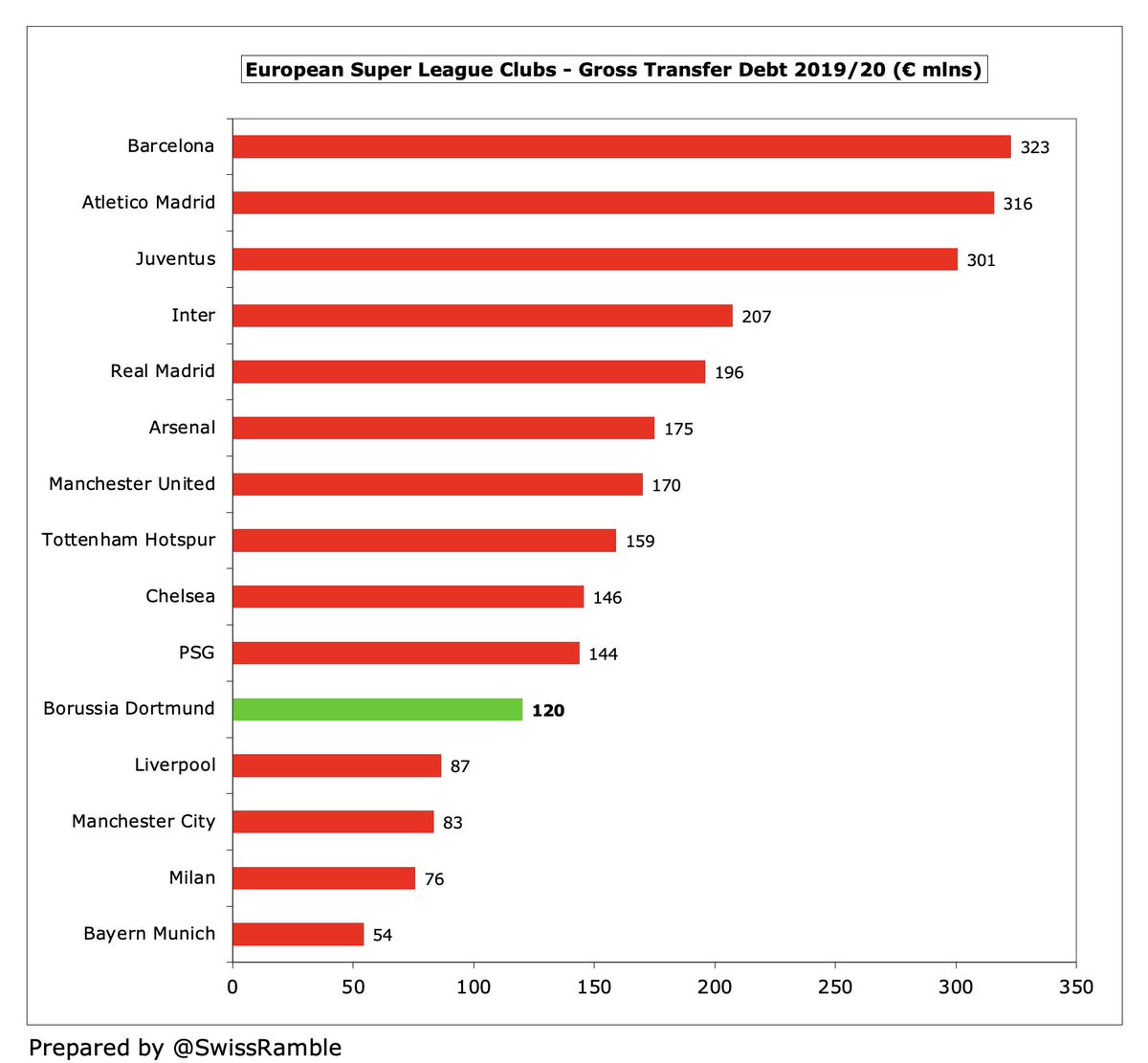

#BVB did reduce transfer debt from €120m to €88m, though this is still their second highest ever. That said, still pretty low by European standards, e.g. Barcelona, Atleti and Juventus are all above €300m. On a net basis, Dortmund owe €65m, as other clubs owe them €22m.

#BVB €209m total debt was also one of the lowest in Europe in 2019/20, significantly lower than the likes of #THFC €1.3 bln and Barcelona €1.2 bln. Note: total debt is defined as bank debt, transfer debt, tax liabilities, trade creditors and staff debt.

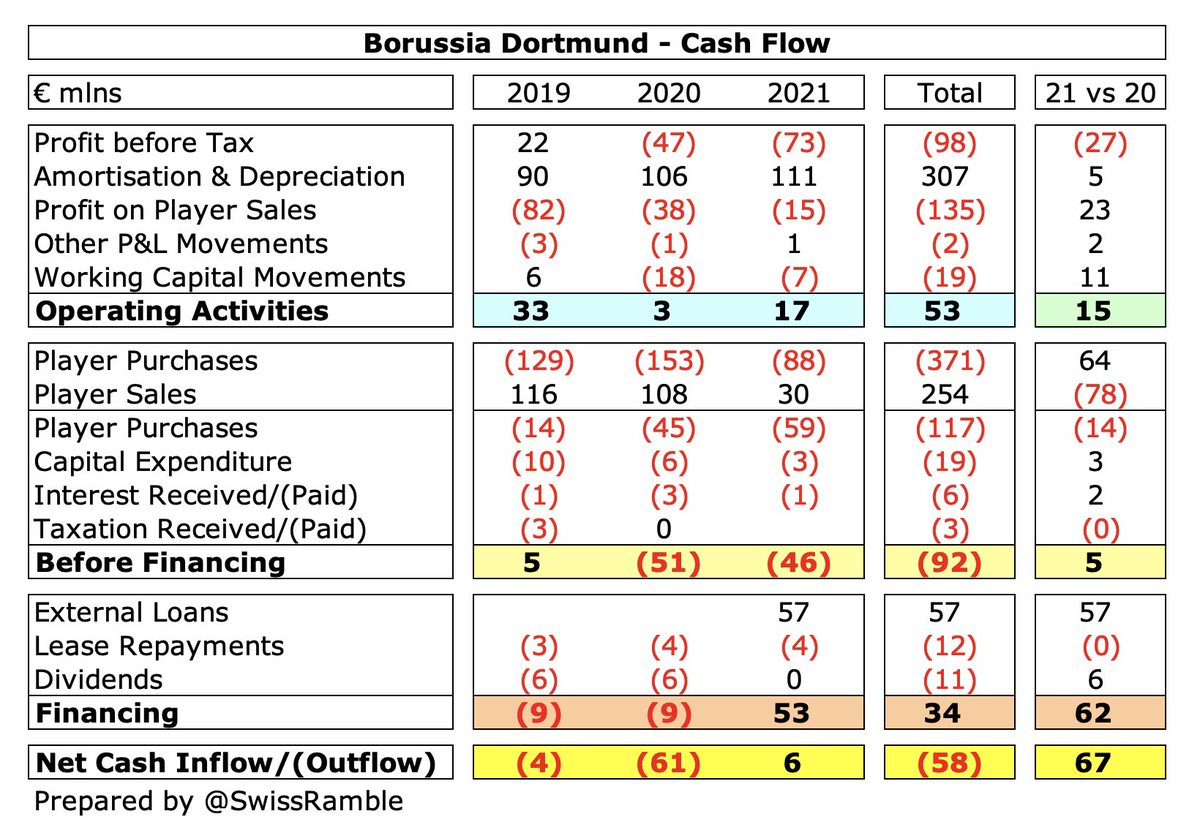

After adding back €111m non-cash items to £87m operating loss, offset by €11m working capital moves, #BVB had €17m cash flow in 2021, but spent net €59m on players (purchases €88m, sales €33m) , €3m capex and €1m interest. Funded by €53m external loans for £6m net inflow

Due to the net loss, #BVB did not make any dividend distribution in 2020/21, though they have paid out a total of €43m dividends to shareholders in the 8 years up to 2019/20.

Interestingly, #BVB shareholders include three of their most important sponsors, namely Evonik (though they reduced stake from 14.78% to 9.83% in 2020), Signal Iduna (5.43%) and Puma (4.99%). This is similar to Bayern, whose owners include Adidas, Audi and Allianz.

Since these accounts were published, #BVB have raised €86.5m via an increase in share capital. According to Watzke, this will be used “primarily to repay financial liabilities and to compensate for potential further COVID losses.”

The pandemic means #BVB expect “further severe adverse effects” on earnings in 2021/22, though the club said it will “persevere through these still difficult times thanks to the economically sound foundation it has built up and the specific countermeasures it has taken.”

Furthermore, when the transfer market returns to normality, #BVB expect “some very lucrative deals” that will boost transfer income. It does not take a genius to work out that their young talent like Haaland, Bellingham and Reyna could be sold for a lot of money at some stage.

• • •

Missing some Tweet in this thread? You can try to

force a refresh