So the Newcastle United takeover saga has finally reached a conclusion, as the club has been bought by a consortium (with Saudi Arabia's Public Investment Fund owning 80%), but what do the new investors get for their £305m? #NUFC

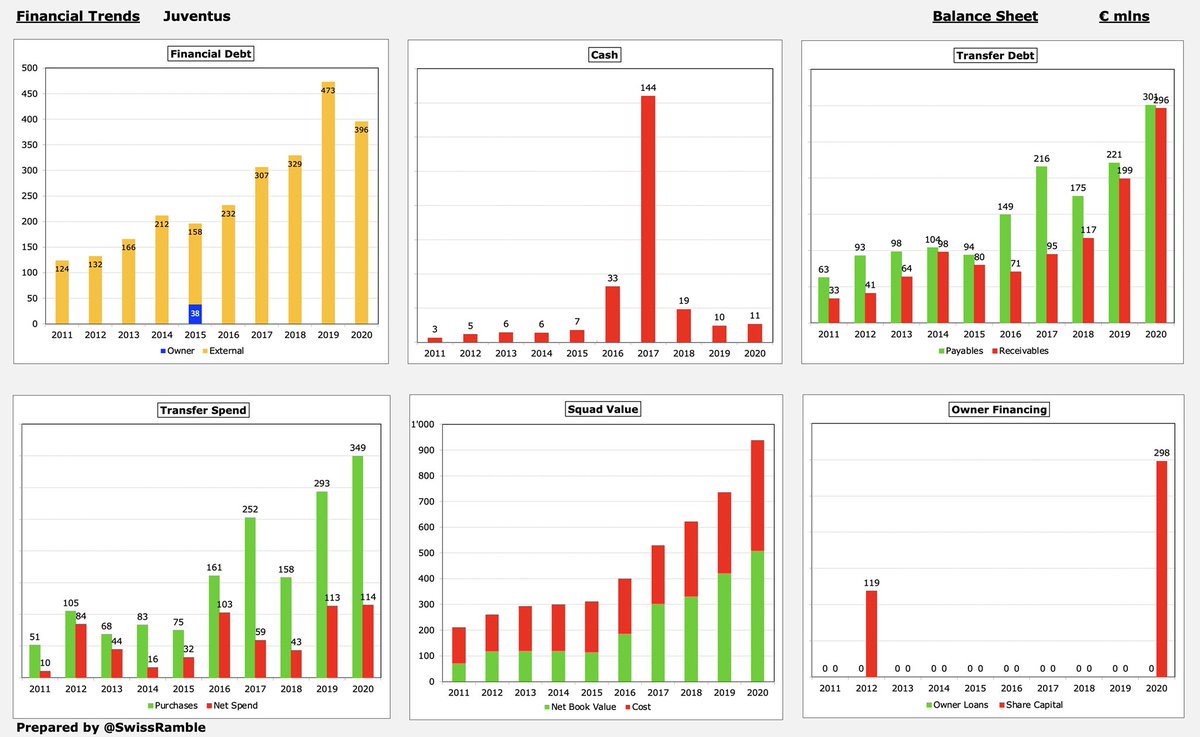

This #NUFC 10-year overview up to 2020 shows a profitable club. The only losses came in 2017 (after relegation to the Championship) and 2020 (COVID impacted). Relatively low profit from player sales for a club in the Premier League.

#NUFC revenue growth has been driven by central broadcasting deals. In contrast, match day has declined, while there has been virtually no commercial growth in the last few years. As a result, broadcasting accounts for 70% of total revenue.

#NUFC wage bill has been very low by Premier League standards. The 2020 increase was partly due to the accounting period being extended to 13 months. Player values were reduced in 2020 by £11m impairment. Very little interest paid as Ashley's loans are interest-free.

#NUFC financial debt only £108m, almost all owed to Ashley, while transfer debt was cleared. Low transfer spend (just £165m in 10 years). Lowest owner financing in Premier League since 2010. High £63m cash balance is misleading, as it includes advance payment of PL TV money.

Obviously the figures will look a bit different for 2021, as virtually all games were played behind closed doors, but these figures do highlight the #NUFC financial situation.

• • •

Missing some Tweet in this thread? You can try to

force a refresh