So look. I think there are great things happening in #crypto.I think we have ways to go in terms of growth. I am not Bearish on this industry.

But when I look at all indicators I track, it seems pretty likely that we‘ll see a full on leverage flush sooner than later. Not advice.

But when I look at all indicators I track, it seems pretty likely that we‘ll see a full on leverage flush sooner than later. Not advice.

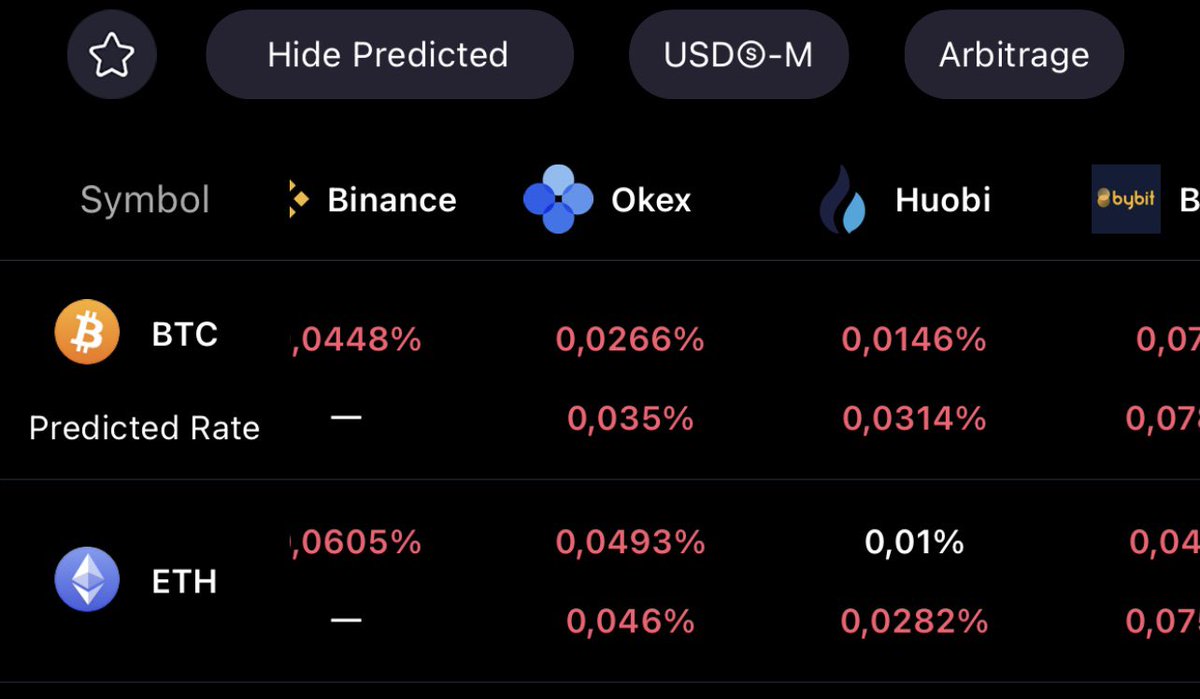

A) Leverage premium both in coin and $USDT margined futures is high

B) Funding (a result of A) is downright scary for some coins like $SOL and nowhere near neutral for any of them

C) $BTC Futures open interest was up the most in any 30 day rolling period before,then remained high

B) Funding (a result of A) is downright scary for some coins like $SOL and nowhere near neutral for any of them

C) $BTC Futures open interest was up the most in any 30 day rolling period before,then remained high

D) A lot of non-crypto people are talking to me about $SHIB and $DOGE again

So what that tells me is: people are euphoric about crypto and just buy everything with leverage.

People even bought the dip with leverage. That is generally not a reason to be negative on price.

So what that tells me is: people are euphoric about crypto and just buy everything with leverage.

People even bought the dip with leverage. That is generally not a reason to be negative on price.

But that alone is a reason to be cautious and avoid leverage.

Now add to this that we made ATHs in a lot of coins and all of them re-tested their old ATHs from above and it did not act as support. That isn‘t the sign of a market that is just before price discovery.

Now add to this that we made ATHs in a lot of coins and all of them re-tested their old ATHs from above and it did not act as support. That isn‘t the sign of a market that is just before price discovery.

It is a sign the market needs time to digest the recent massive rally. I can totally see a grind higher or some volatile push to new ATH that each don‘t last long like Feb-Apr this yr.

I have a hard time though to see a massive upmove that leaves all else in the dust right now.

I have a hard time though to see a massive upmove that leaves all else in the dust right now.

The best and healthiest thing for this market would be a leverage liquidation cascade to get rid of the excess baggage and get the dog coins back to normal. Then it would be a perfect set up to me.

Grind higher is fine too, just not something I‘d do with leverage. Not advice.

Grind higher is fine too, just not something I‘d do with leverage. Not advice.

The most successful $BTC bot sees what I see apparently

https://twitter.com/thepsychobot/status/1452243759136186369

• • •

Missing some Tweet in this thread? You can try to

force a refresh