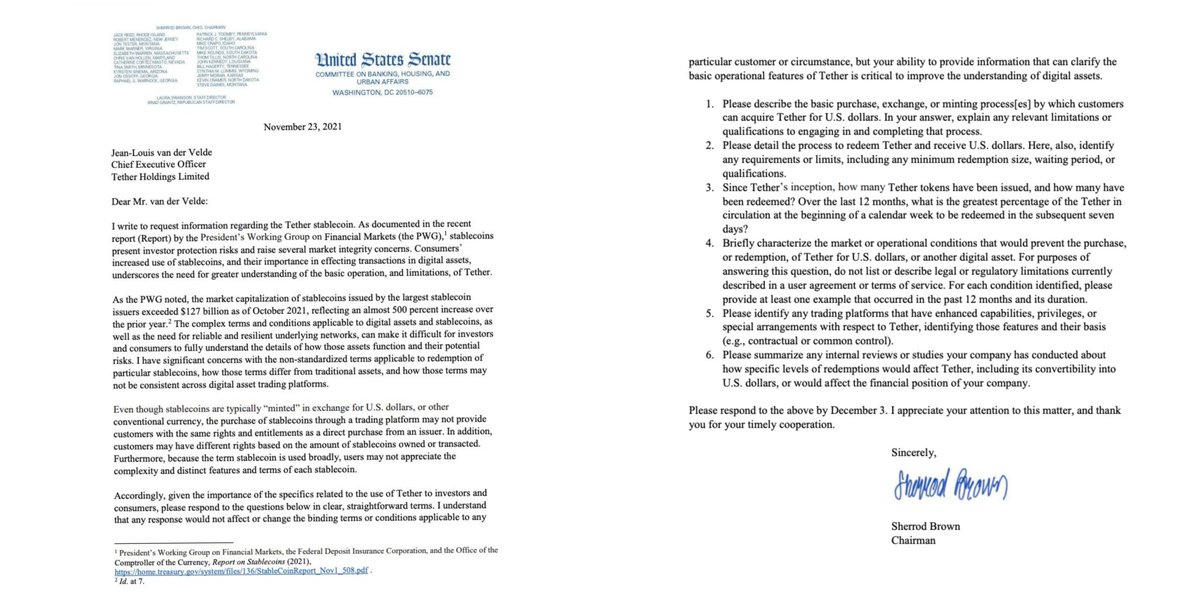

🚨 BREAKING: The U.S. Senate sent a letter requesting immediate information from #Tether about their reserves, redemption process, issuance, and activities due to "several market integrity concerns" as stated by the PWG.

Tether has been given 10 days to respond. #Retweet

Tether has been given 10 days to respond. #Retweet

Interesting Note: The letter is addressed to #Tether CEO Jean Louis van der Velde, who hasn't been seen/heard for quite time...

My guess is that #USDC probably received a similar letter. 🤔

Who is Senator Sherrod Brown? He is the Chair of the Senate Banking Committee.

Why is Senate Banking Committee important? It has jurisdiction over matters related to banks & banking, deposit insurance, federal monetary policy, issuance of redemption of notes, currency & coinage, etc.

This is the moment when #Tether is gonna lawyer up. Things are gonna get difficult for them. I don't expect them to respond on time. They will seek to postpone or not answer at all. This is a prelude to a potential Senate Hearing. They will not want stuff on paper...

🚨 CONFIRMED: Sen. Brown sent a similar letter to #Circle that operates stablecoin #USDC. Brown also sent letters to cryptocurrency exchanges #Coinbase, #Gemini and #Binance, as well as #Paxos which operates Pax dollar stablecoin; TrustToken, which operates the #TUSD stablecoin..

IMPORTANT FACT: In March this year, Senator Sherrod Brown sent a letter to Fed, encouraging Fed to take a lead on CBDCs, and dissing #Bitcoin and Facebook's #Libra. In other words, Sen. Browns actions are in sync with PWG and other regulators...

🚨 CONFIRMED LETTER: This is the letter sent to #USDC. It is the same letter as the one sent to #Tether.

For all the messages that I am receiving that claim this is fake and just FUD, here is the link to the letter from the Senate Committee: banking.senate.gov/imo/media/doc/…

I expect a lot of ex-regulators who have started working for #crypto players as directors, consultants or lobbyists, to start resigning for "personal reasons".

• • •

Missing some Tweet in this thread? You can try to

force a refresh