🇺🇸 #Macro Update (1) | Latest data confirmed that growth will accelerate in 4Q as the latest wave of Covid-19 reached a peak in mid-Sep.

*Oct. figures suggest that households started using accumulated excess savings (since Feb. 2020).

*Oct. figures suggest that households started using accumulated excess savings (since Feb. 2020).

🇺🇸 #Macro Update (2) | Hurricane Ida hit the U.S. in late Aug./beginning of Sep. and affected activity in 3Q.

*Therefore, a positive normalization is expected in 4Q as suggested by the rebound in Industrial Production (especially the Mining component).

*Chart from Bloomberg ⬇

*Therefore, a positive normalization is expected in 4Q as suggested by the rebound in Industrial Production (especially the Mining component).

*Chart from Bloomberg ⬇

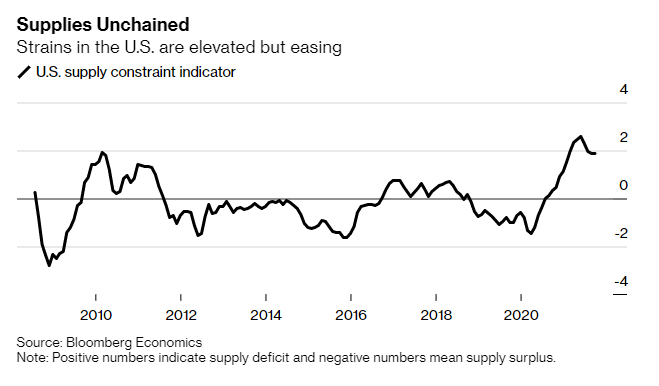

🇺🇸 #Macro Update (3) | Supply chain disruptions have eased a bit since the beginning of 4Q.

*On Tuesday, President Joe Biden said that bottlenecks in the U.S. supply chain are seeing relief.

*It was coherent with the recent retracement of Bloomberg "Supply Constraint Indicator".

*On Tuesday, President Joe Biden said that bottlenecks in the U.S. supply chain are seeing relief.

*It was coherent with the recent retracement of Bloomberg "Supply Constraint Indicator".

🇺🇸 #Macro Update (4) | Comments and data from the auto industry (sales, production) also improved as chip shortage eased slightly.

https://twitter.com/jc_econ/status/1460613734552981504?s=20

🇺🇸 #Macro Update (5) | Yesterday, trade balance (goods) and wholesale inventories came largely above expectations forcing economists to revise upward their 4Q GDP estimates.

https://twitter.com/calculatedrisk/status/1463656380519227395?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh