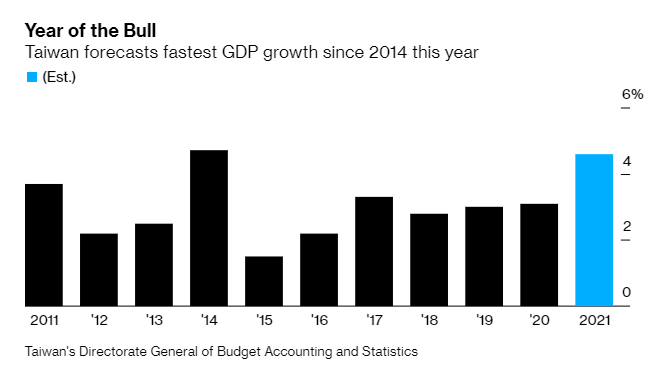

🌎 It's time to start a new tweetstorm to monitor global trade rebound, which should be larger than exp. in 2021.

*The drag from #Covid_19 restrictions in 🇺🇸 🇪🇺 will ease.

*Uncertainty linked to trade tensions ⬇.

*Leading sectors (semis and autos) already point to a sharp ⬆.

*The drag from #Covid_19 restrictions in 🇺🇸 🇪🇺 will ease.

*Uncertainty linked to trade tensions ⬇.

*Leading sectors (semis and autos) already point to a sharp ⬆.

🇯🇵 #Japan | In January, the value of overseas shipments climbed 6.4% YoY (fastest since Oct. 2018), rising for a second month and picking up from December’s 2% pace.

🇯🇵 #Japan's exports, machine orders pick up as global demand recovers - Reuters

reuters.com/article/us-jap…

reuters.com/article/us-jap…

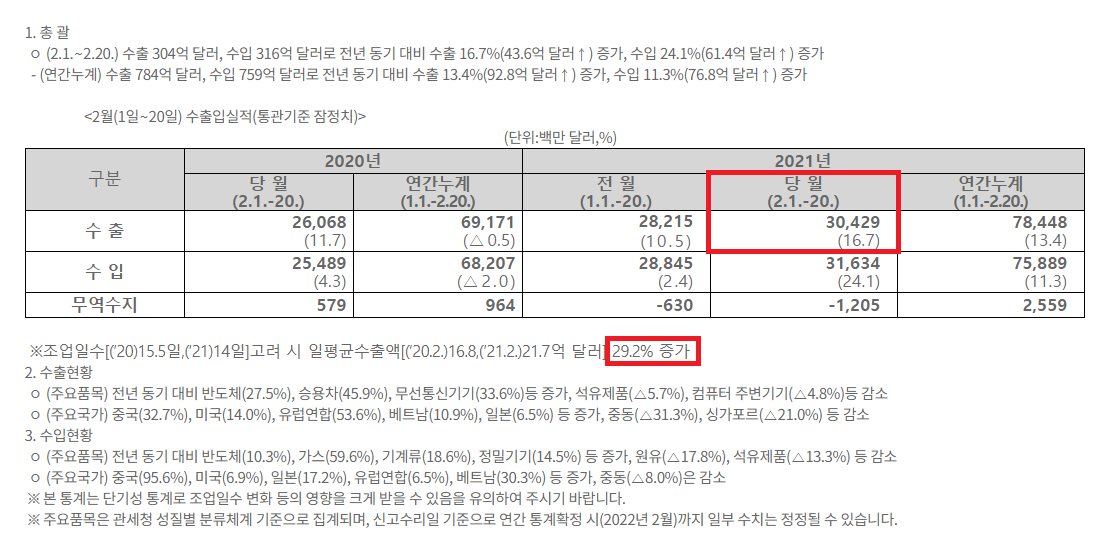

Earlier this week, 🇰🇷 figures for the first days of February (adjusted for calendar effects) were also encouraging.

https://twitter.com/C_Barraud/status/1361192862063484930

🇰🇷 #SouthKorea February 1-20 Exports Y/Y: +16.7% v +11.4% in January (full month)

*Average Daily Exports Y/Y: +29.2%❗ v +6.4% in January (full month)

➡ Link (Korean): bit.ly/3pBtWSU

*Average Daily Exports Y/Y: +29.2%❗ v +6.4% in January (full month)

➡ Link (Korean): bit.ly/3pBtWSU

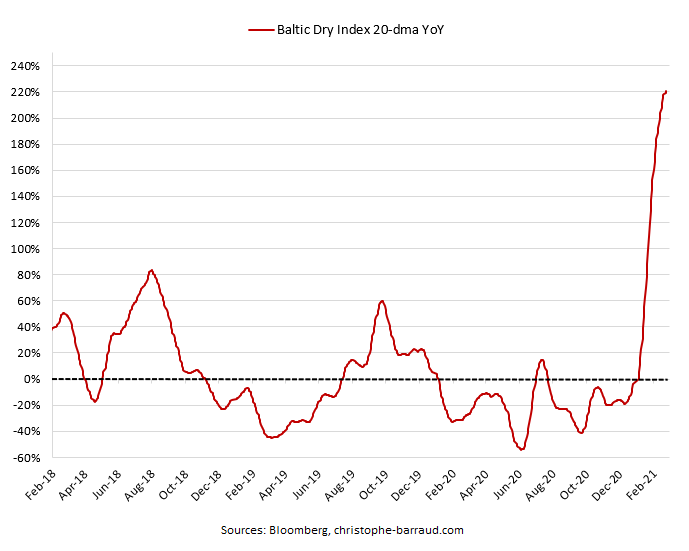

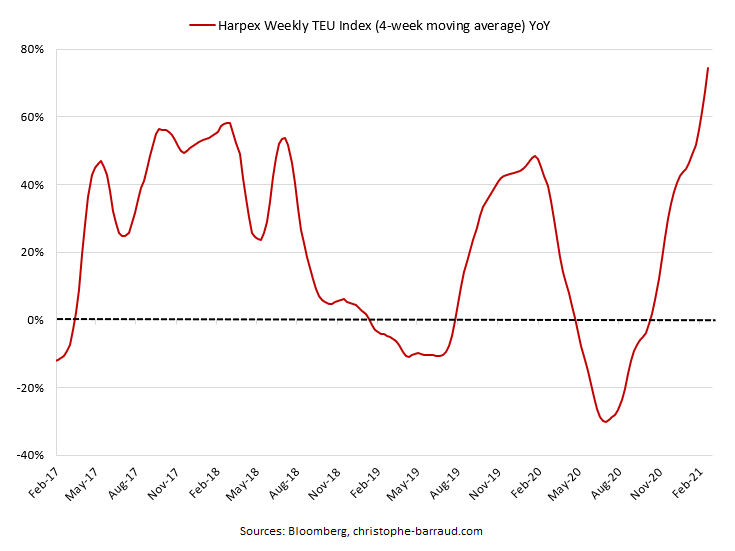

🌎 #Freight | #Shipping costs are rising very quickly and it's not only a problem of supply or base effect.

• • •

Missing some Tweet in this thread? You can try to

force a refresh